Introduction

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through May 2021.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

“The rise in home prices has built a substantial home equity cushion for homeowners with a mortgage, reducing the risk of a foreclosure. The CoreLogic Home Price Index recorded an annual increase of 17% in June. This price rise builds home equity. For most borrowers in forbearance, the equity gain means they’ll still have some remaining — even if missed payments are added to their loan balance.”

– Dr. Frank Nothaft

Chief Economist for CoreLogic

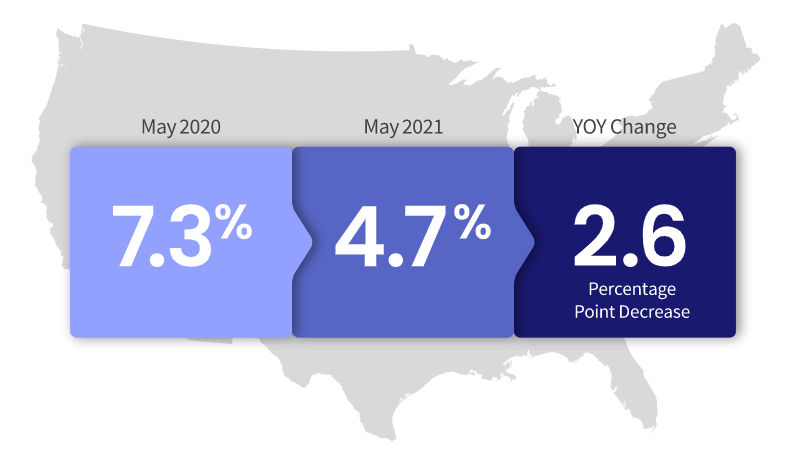

30 Days or More Delinquent – National

In April 2021, 4.7% of mortgages were delinquent by at least 30 days or more including those in foreclosure.

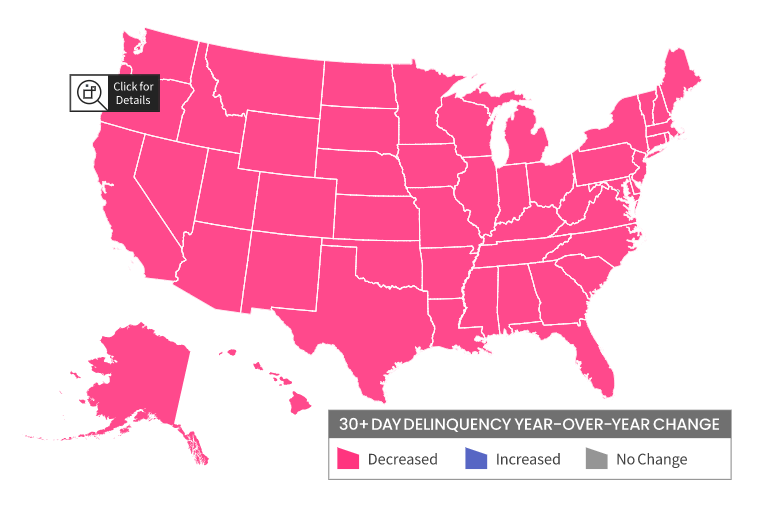

This represents a 2.6-percentage point decrease in the overall delinquency rate compared with May 2020.

Helpful Home Equity

Many are concerned about a pending foreclosure crisis when government provisions lift. Fortunately, the average homeowner in forbearance has sizeable equity in their home, which has helped create an additional financial buffer for those struggling to make mortgage payments. Thanks to these strong equity gains, and the availability of loan modifications and federal resources, we expect most borrowers have had enough support to stave off a foreclosure wave. Additionally, a recent CoreLogic survey of mortgage holders reports 85% of respondents said they maintained employment through the pandemic, which has helped many homeowners avoid delinquency and prevented a broad-scale mortgage crisis.

“The pandemic has created many challenges but, in the case of delinquencies, the impacts have been relatively muted thanks to numerous government support programs and the sharp snapback in economic activity over the past several quarters. Looking forward, we expect a robust economy and near-zero interest rates to hold delinquency levels at reasonable levels.”

– Frank Martell

President and CEO of CoreLogic

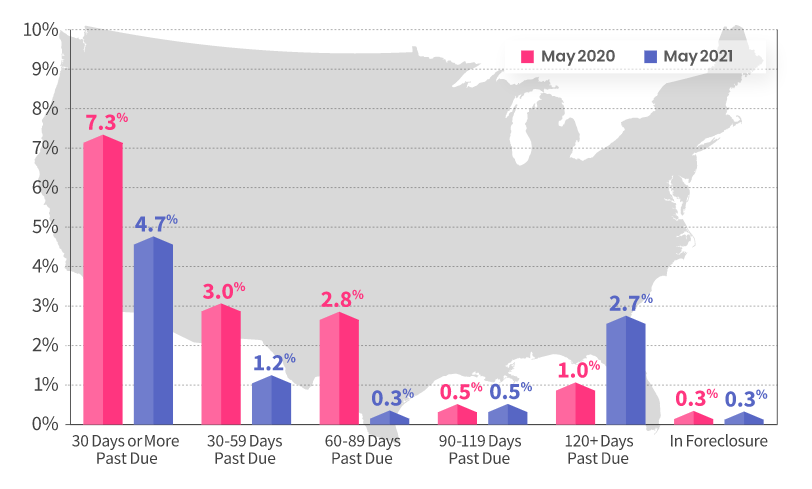

Loan Performance – National

CoreLogic examines all stages of delinquency to more comprehensively monitor mortgage performance.

The nation’s overall delinquency rate for May was 4.7%. The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.2% in May 2021, down from 3% in May 2020. The share of mortgages 60 to 89 days past due was 0.3%, down from 2.8% in May 2020. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 3.2%, up from 1.5% in May 2020. While still high, this is the lowest serious delinquency rate since an initial jump during the pandemic in June 2020.

As of May 2021, the foreclosure inventory rate was 0.3%, unchanged from May 2020.

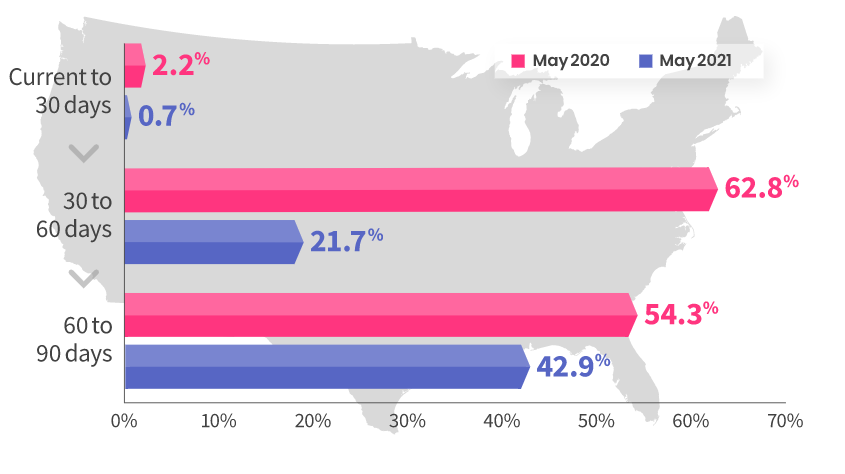

Transition Rates – National

CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The share of mortgages that transitioned from current to 30-days past due was 0.7%, down from 2.2% in May 2020.

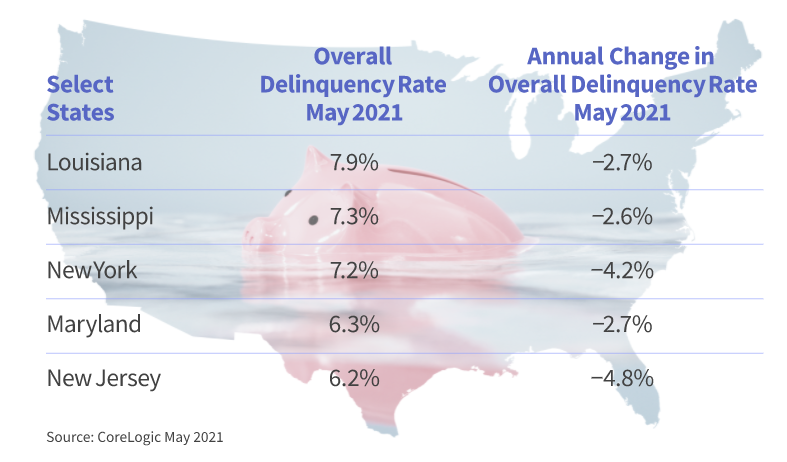

Overall Delinquency – State

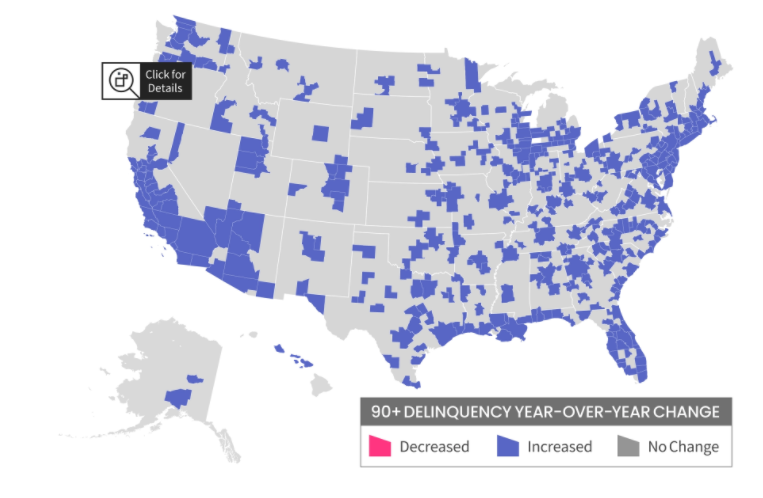

Serious Delinquency – Metropolitan Areas

Serious delinquency is defined as 90 days or more past due including loans in foreclosure.

There were 384 metropolitan areas where the Serious Delinquency Rate increased.

There were 0 metropolitan areas where the Serious Delinquency Rate remined the same or decreased.

Summary

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.