In the latest sign of their Brick-and-Mortar retail dominance, both Walmart and Target appear to be headed into an exceptionally strong Back-to-School season.

Leaving 2020 Behind

Both Walmart and Target were positioned relatively well during the early pandemic restrictions because of their essential retail status. And they both proved equally well positioned for the mission-driven shopping trend that privileged their one-stop-shop orientation, leading to a recovery period that showed comparable strength.

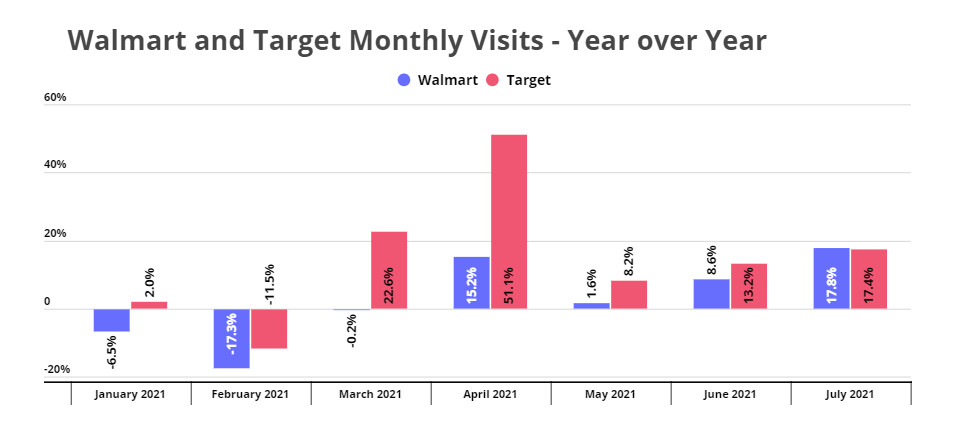

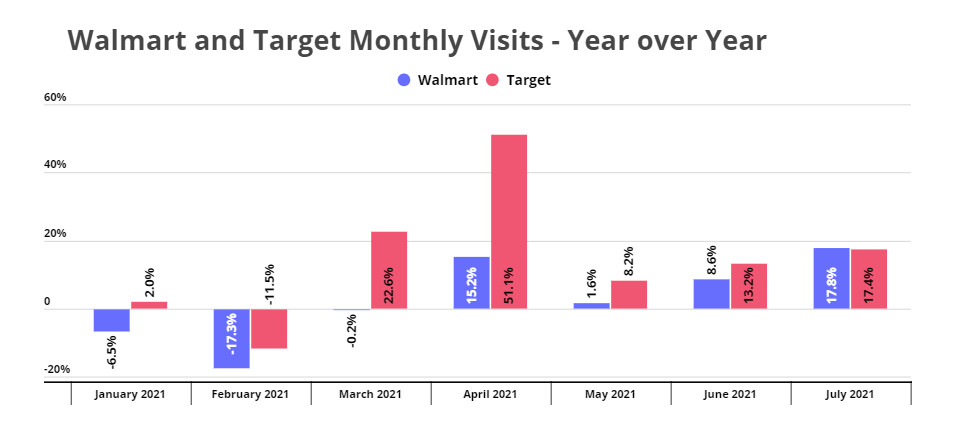

The result was a relatively strong 2020 for both in terms of offline retail, a reality that makes their year-over-year strength all the more impressive. Walmart saw year-over-year visit increases of 1.6%, 8.6%, and 17.8% in May, June and July respectively, showing strong signs of a big Back-to-School season. Target’s visits were equally, if not more, impressive, showing year-over-year growth of 8.2%, 13.2%, and 17.4% for those same months.

Comparing to a Huge 2019

But while the year-over-year comparison is diluted by the comparisons to COVID impacts, year-over-two-year is even more challenging because of the comparison to an especially strong 2019 Back-to-School season.

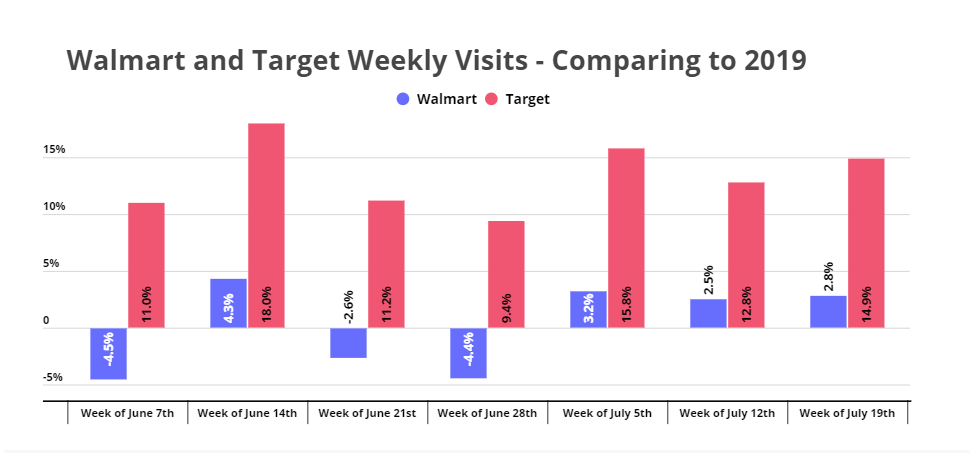

Yet, both brands are showing significant strength. Comparing to the equivalent months in 2019 shows Walmart returning to visit growth for the first time in 2021, with July visits jumping 2.9% compared to July 2019. And the visit surge that Target has been enjoying all year continued with visits in May, June and July up 7.7%, 11.4%, and 15.9% over the equivalent months in 2019.

Target and Walmart Stronger than Ever

The weekly visits numbers only reinforce the strength of these retail giants – even when comparing to the peaks of 2019’s Back-to-School season. Visits for the weeks beginning July 5th, 12th and 19th were up 2.8% on average for Walmart, while Target saw a massive 14.5% visit increase on those same weeks compared to 2019.

The clear takeaway is that both Walmart and Target have fully returned with early data indicating that the 2021 Back-to-School season could surpass even the lofty standards of 2019. And even with the growing uncertainty around rising COVID cases, both brands have proven capable of weathering the storm and leveraging their multichannel approach to drive value for customers.

In short, Walmart and Target may be proving that they possess the combination of brand strength, omnichannel breadth, and strategic agility necessary to thrive under almost any condition – even offline retail’s most challenging.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.