Ride-hailing giant Didi is at a critical crossroads — just a month into its June 30 blockbuster IPO in the US, only to be followed days later by a string of Chinese government regulatory-related problems. While the company mulls the plan of going private as a solution to its troubles, several securities fraud class action lawsuits were filed against Didi Global Inc. by its investors.

So what does the next few weeks, even days, look like for Didi? With its mobile apps for drivers and consumers ordered removed from app stores since July, any hope for growth seems bleak at the moment. Not to forget the ensuing financial disaster and loss behind its plummeting stock price that could adversely affect the company’s operations. Is going private a solution to all Didi’s woes? What does the company’s recent fundamentals tell us about Didi’s direction?

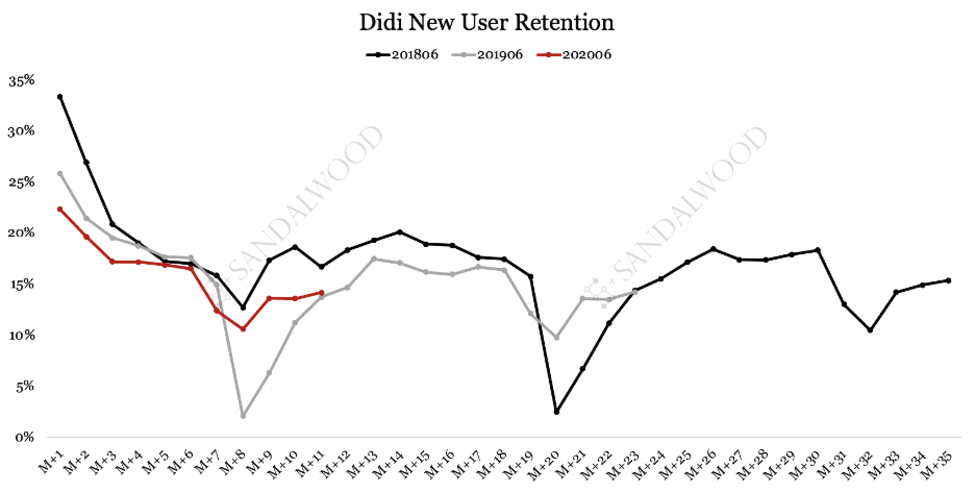

Sandalwood data shows that Didi’s new user retention rate is lower than the same cohort in the past two years, and generally stepping down to ~15% in the long run. Its new user purchase frequency is also lower than that of the past year.

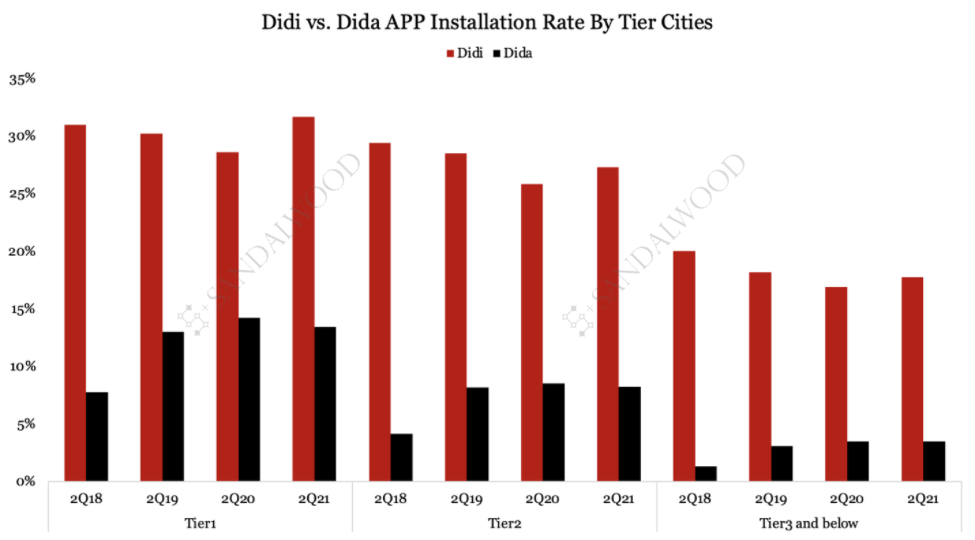

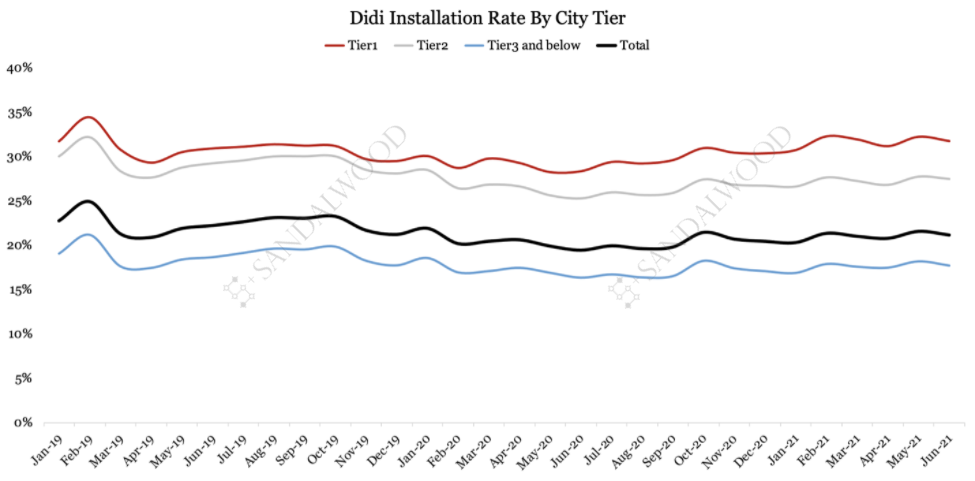

Didi’s App installment points to the fact that it has the highest penetration rate at 32% in Tier 1 cities as of 2Q21, which recovered faster than Tier 2 cities compared to a year ago. The company has been outperforming Dida, its major competitor, which also has the highest penetration rate in Tier 1 cities with 13% installation rate in 2Q21.

A further look at its user age group break down shows that the senior age group (age>45) installation growth has been ramping up – in fact, it accelerated the most as of 2Q21, while the younger age group (age<25) installation growth underperformed.

To learn more about the data behind this article and what Sandalwood has to offer, visit http://www.sandalwoodadvisors.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.