For some school districts*, the back-to-school shopping season has arrived. Following a year of mostly remote learning and a resulting stunted 2020 school shopping period, we looked at our data to see if 2021 would be any different. Good news for retailers: a return to in-person classes and some extra cash from the first Child Tax Credit payment shows the retail tide may be turning.

Key Takeaways

See Earnest’s prior back-to-school analyses from 2020 (Part One and Part Two) and 2019.

Back to school spending growth from households that received the Child Tax Credit was 21% more than that of non-recipients

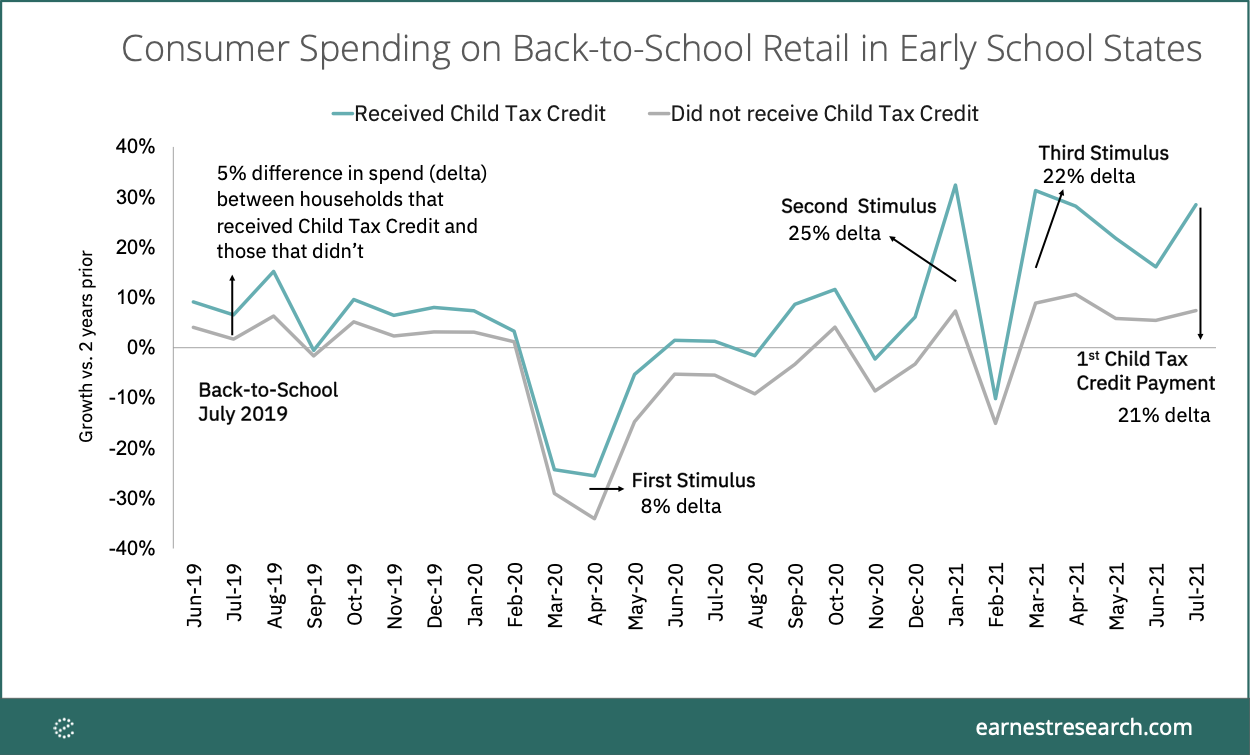

Earnest data shows that while all government payouts (stimulus payments and child tax credit) have spurred retail spending growth among recipients, households that received the Child Tax Credit spent a lot more than all other households (the credit reached roughly 70% of all households with children according to reported figures).

During the second and third rounds of stimulus payments, for households that also received the Child Tax Credit, their growth in spending was about 25% more than households that didn’t at popular back-to-school brands. While some of this discrepancy is expected – after all, larger families likely spend more than smaller households – 2021 was unique in just how much more households receiving the credit spent than usual. During the relatively normal 2019 early back-to-school season, for households who received the tax credit, their growth in spending was 5% more than their counterparts; in July 2021, that number was four times as much at 21%.

Child Tax Credit recipients are fueling brick-and-mortar growth

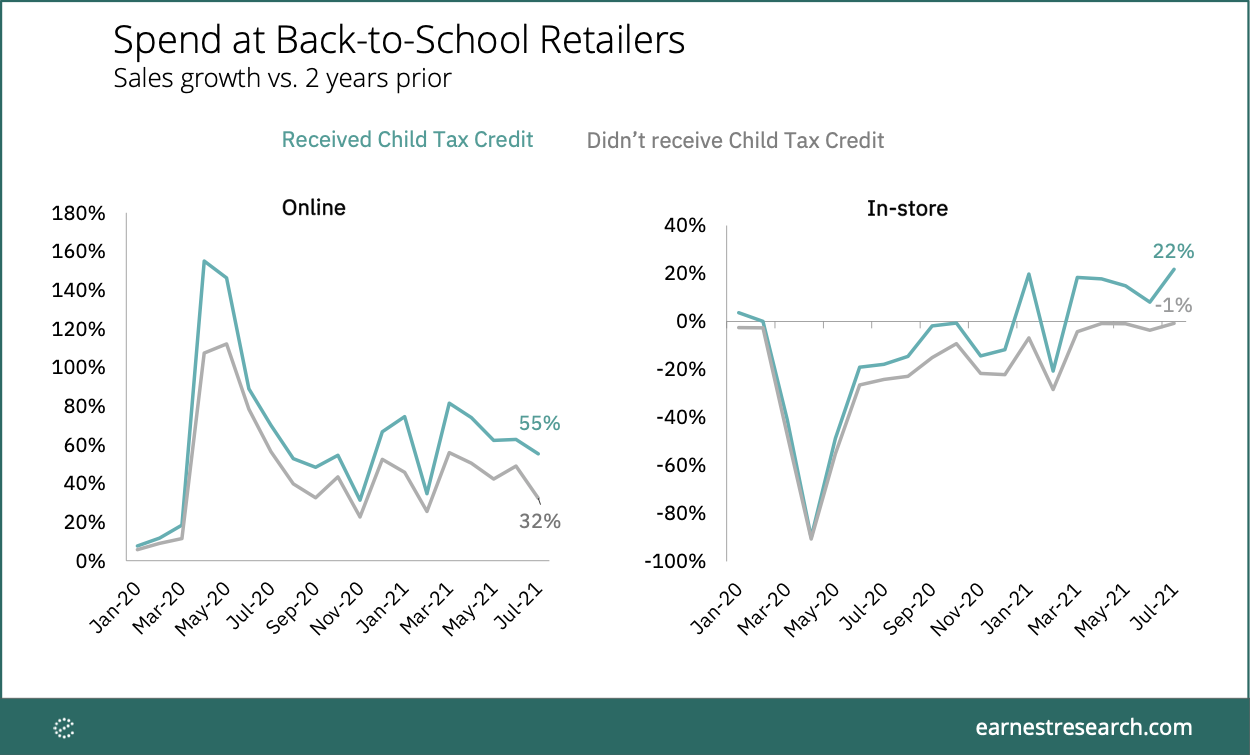

Some good news for brick and mortar establishments: more back-to-school shopping is happening in-store this year. Households receiving the Child Tax Credit spent 22% more in-store this July than two years prior, while households that did not receive the credit spent 1% less, proving that those with kids with some extra government cash may be spearheading the in-store revival.

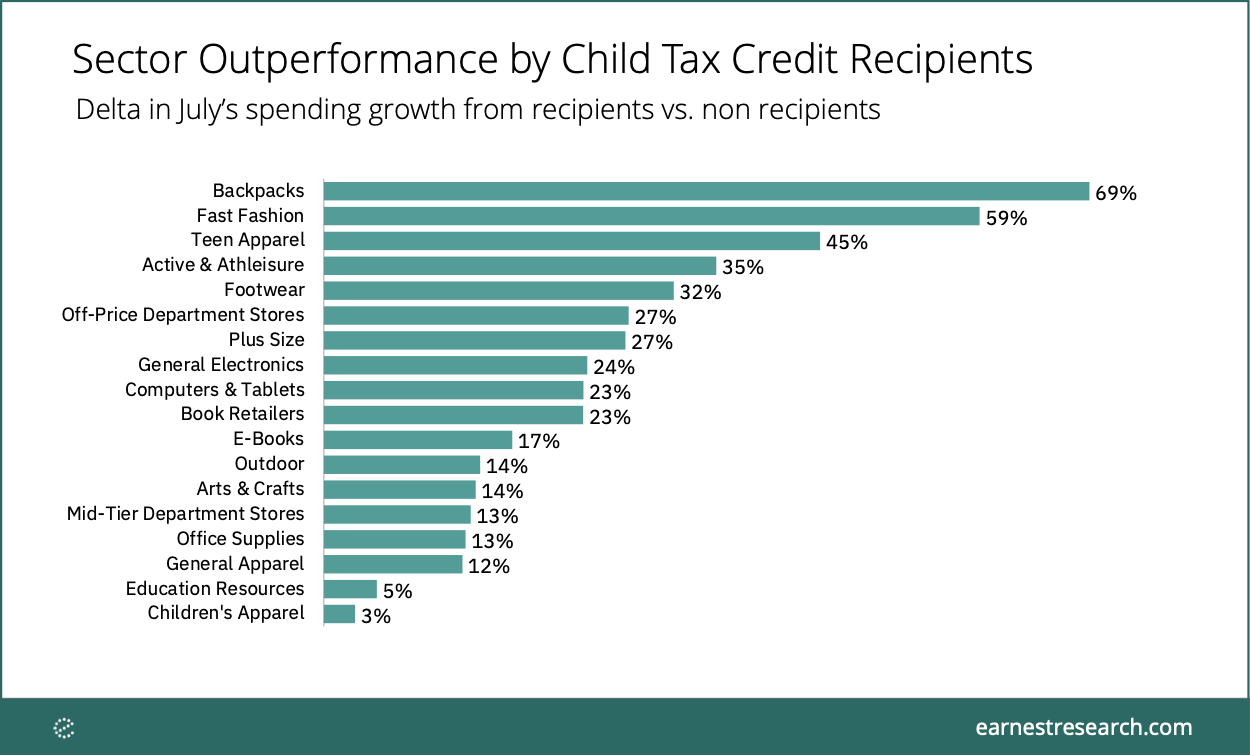

Backpacks, Fast Fashion, and Athleisure are winners of Child Tax Credit dollars

For recipients of the Child Tax Credit, backpack sales are a clear leader, with this group’s spending growth being 69% more at retailers like Jansport and Eagle Creek than families that did not receive the credit.

Interestingly, General Electronics and Computers companies like Newegg, Dell, and Best Buy saw close to a 25% increase in growth from recipients, suggesting families are perhaps preparing for the possibility of more remote learning.

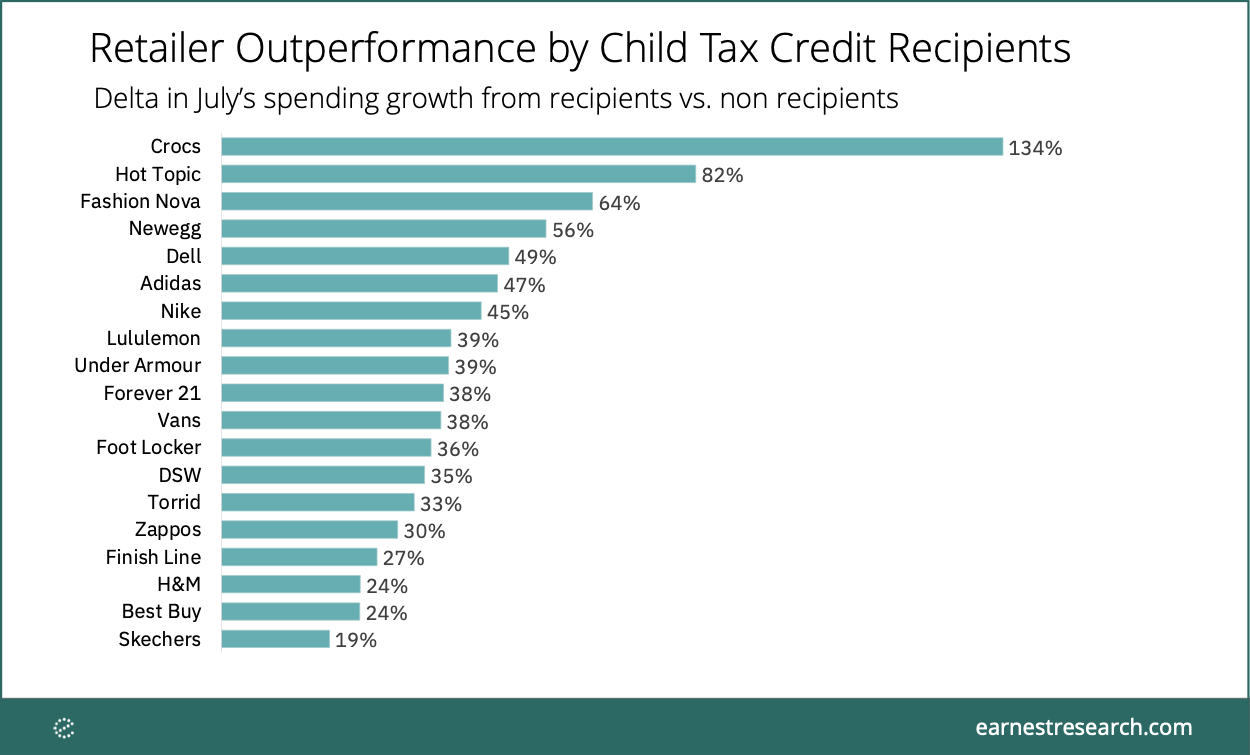

Government dollars are paying for…Crocs?

Which back-to-school retailers are seeing the biggest benefit from Child Tax Dollars? Topping the list with a monumental 134% of outperformance across households that got the Child Tax Credit vs. those that didn’t is Gen Z favorite Crocs—perhaps a nod to the clog company’s spike in Jibbitz charms sales and recent celebrity endorsements. Other fast fashion teen favorites Hot Topic and Fashion Nova followed at 82% and 64% outperformance. Given the Delta-driven possibility of remote learning this semester, it’s no surprise that Electronics’ retailers Newegg and Dell also topped the list.

Skechers, Best Buy, H&M, Finish Line, Famous Footwear, and Zappos, even at the relative bottom of this list, each still saw a healthy 20 – 30% of outperformance.

Will the remainder of the back-to-school period mirror these early trends? Will additional Child Tax Credits continue to fuel retail growth, or will a surge in the Delta variant curtail some of retail’s early wins?

Follow Earnest Insights to get the latest trends on the retail environment as we continue to track the consumer economy.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.