It’s been a wild ride for the travel industry as we try to enter post-pandemic territory. And we’re not there yet. While current COVID travel trends indicate that some areas have recovered, others have much further to go with a future that’s complicated by new variants.

Our industry consultant, Alisha Kapur, featured in Yahoo Finance, teamed up for a webinar with Tim Davis, the Managing Director of travel industry consulting group PACE Dimensions to give businesses insights using our travel intelligence tool on how you can prepare what’s next for the travel and tourism space.

Keep reading for the highlights.

Now vs. then: Travel sectors

Bookings climb higher

Worldwide data from our travel intelligence tool suggests that bookings have recovered but are far from pre-pandemic levels. Travelers made 106.7 million bookings globally Q1 2021, more than twice that of Q1 2020, when there were just 49.2 million bookings. This figure still significantly lags Q1 2019 level though, which stood tall at 159.8 million.

Online travel agencies (OTAs) make up for lost ground

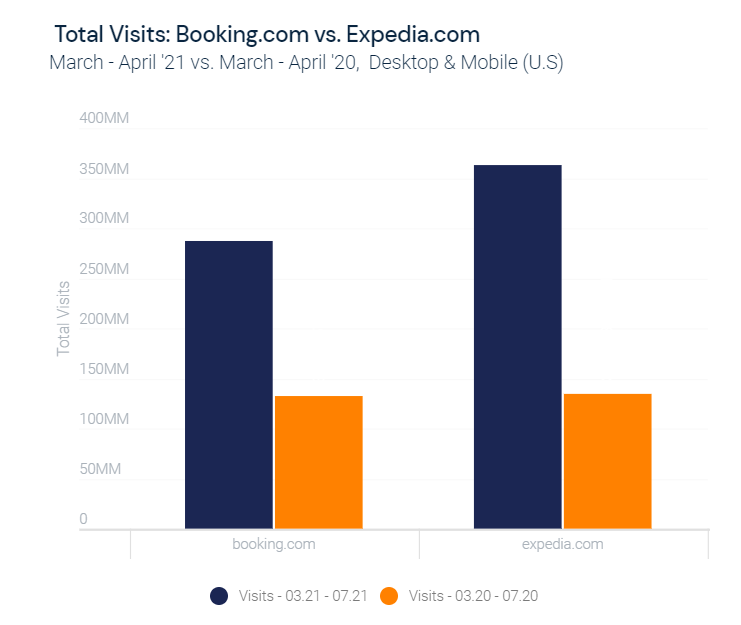

OTAs, which especially struggled during the pandemic have made up for lost ground since bottoming out March–April 2020 when traffic to expedia.com and booking.com crashed nearly 118%. In the first seven months of 2021 (Jan. – July), traffic to booking.com and expedia.com grew 114.8% and 98.4% respectively.

Accommodations – A+ recovery

Vacation rentals and hotels seem closest to making a full recovery, with unique visitors near pre-April 2020 levels. Despite rising summer COVID cases and the threats of variants, bookings in the U.S. reached 18.3 million in July which is nearly one million higher than bookings made July 2019, pre-pandemic (17.5 million). U.S. bookings had bottomed to 3.4 million in April 2020.

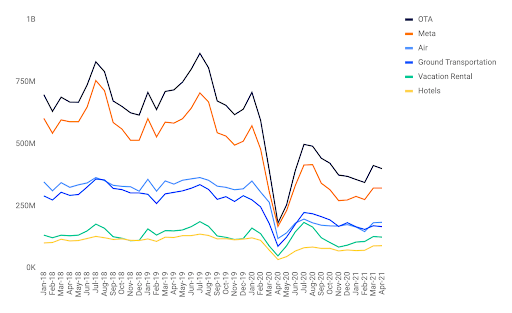

Unique Visitor Traffic to Top Travel Websites by Sector

Global, Desktop & Mobile (Jan. 18 – Apr. ’21)

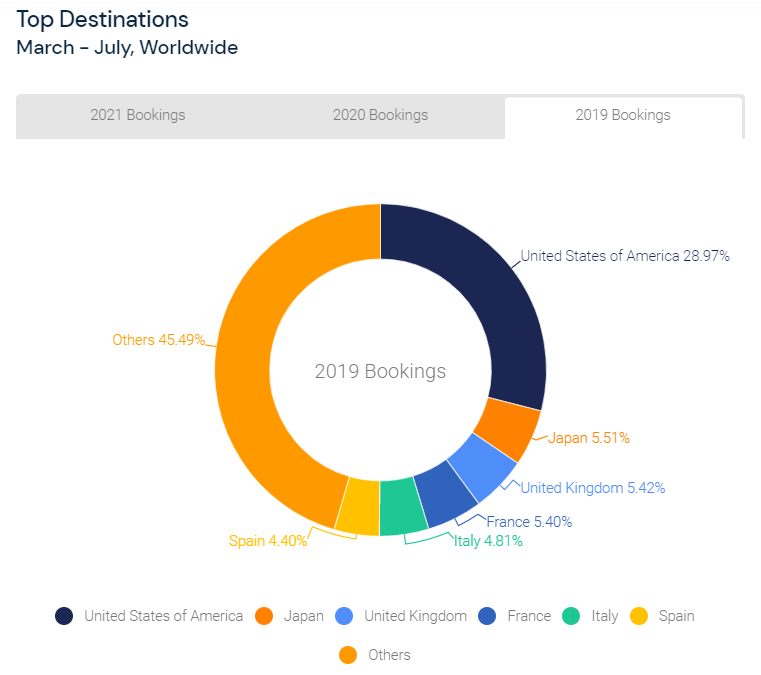

All roads lead to the USA

Factors influencing global travel seem to point travelers to America. This includes:

1. COVID recovery rollout attracts visits

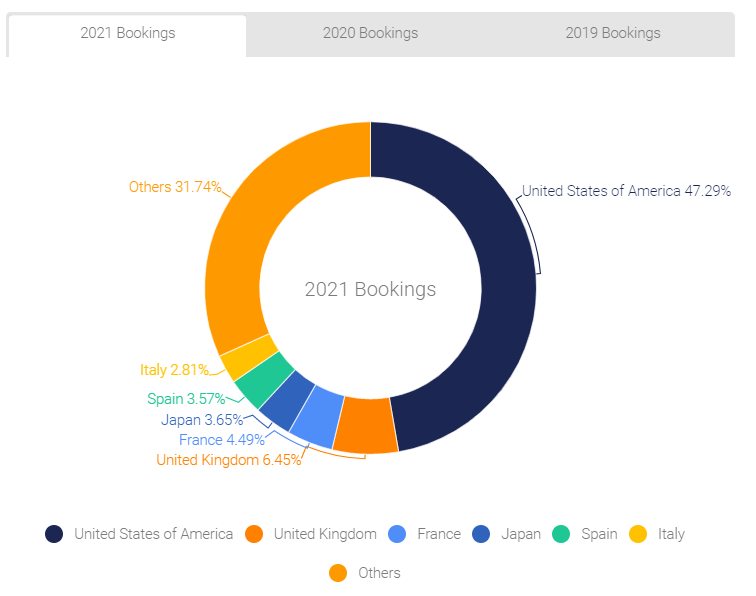

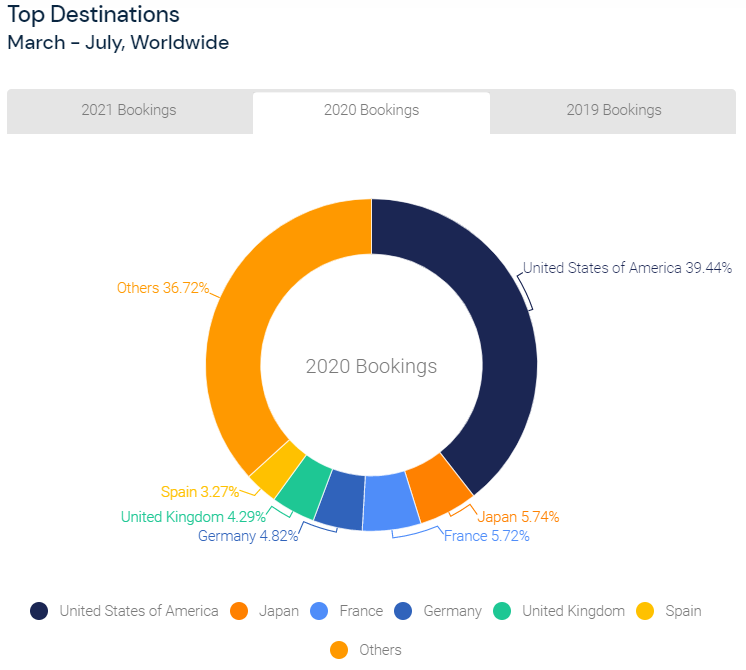

Not surprisingly, travelers prefer visiting locations where pandemic recovery is strongest. Therefore, the U.S, which has been among the fastest countries distributing vaccinations, has the strongest concentration of travelers globally – 48% head there March – July 2021, which is 19 ppts higher than 2019 and even higher than 2020

However, it’s key to note that 98% of travelers in the U.S. are American – 8 percentage points (ppts) more than pre-pandemic times (2019), signaling that fewer foreigners are traveling to the U.S. and more Americans are vacationing domestically. The percentage of U.S. travelers is down just 1 ppt from 2020 highs, indicating that despite vaccinations, some COVID travel trends at the height of the pandemic stay strong.

2. Gambling on indoor destinations

Last summer, travelers within the U.S. definitively preferred parks and wide-open spaces to help socially distance. National parks continue to be popular this year, however, travelers are more eager to explore cities and spend time indoors.

Searches for specific cities (e.g., “Los Angeles,” “Philadelphia,” and “Seattle“) rose in spring from the previous months, signaling urban reinvigoration.

Moreover, near opposite environments to national parks – casinos – are trending. Casino hotels composed eight of the top 10 hotels booked on OTA sites April–June 2021. The prior year, hotels near national parks like Yosemite in California and Utah took the four most-booked spots.

Trending keywords in June also indicate consumers going back to the gambling tables, throughout the U.S. “Borgata” (New Jersey), ranked second top trending search term followed by “Beau Rivage” (Mississippi), and “Bally’s Las Vegas.”

Large brands like Caesars and MGM own many of the top casinos on our lists.

Hotel vs. vacation rentals

Once at destinations, travelers are more willing to stay at hotels than they were one year ago. In fact, supply-driven areas of the travel industry (including hotels, as they “supply” bed and room types) are picking up traffic faster than other sectors.

In June 2021, hotel suppliers made up more than triple the market share as vacation rentals, a sharp contrast to last year. This indicates that safety concerns relating to hotels have been quelled from 2020 when traffic vacation rental providers, like AirBnB and VRBO skyrocketed due to fears of interacting with hotel guests on shared premises. Despite the Delta variant this year, travelers seem more comfortable staying on hotel properties.

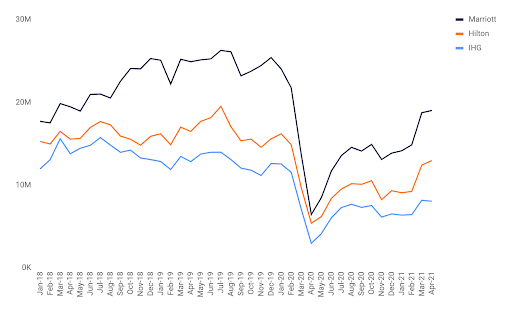

Bigger brands, bigger draw

Like consumers prefer Caesars and MGM for gambling, they also prefer large supplier hotel brands for general overnight stays. In fact, 7% of sites account for 87% of traffic in the travel industry, and Marriott and Hilton are pulling ahead of smaller brands like IHG. In April 2020, IHG was two million and three million unique visitors behind Hilton and Marriot respectively. In April 2021 the difference climbed to five million and 11 million.

Unique Visitor Traffic to Top Hotel Brands

Global, Desktop & Mobile (Jan. ’18 – Apr. ’21)

The takeaway

Large brands have both name recognition and strong loyalty programs to keep customers coming back. In order to effectively compete, hotel companies outside the top 7% need to offer similar benefits and get creative with their marketing programs.

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.