The grocery sector has witnessed a uniquely fascinating period with early COVID concerns driving huge traffic surges to supermarkets, while the recovery period has seen uneven returns for different brands. And the questions are growing. Can the sector turn it’s COVID status into long term strength? Will the rising excitement around restaurants cut into their success?

We dove into the latest grocery data to find out.

The Expected Winners Still Winning

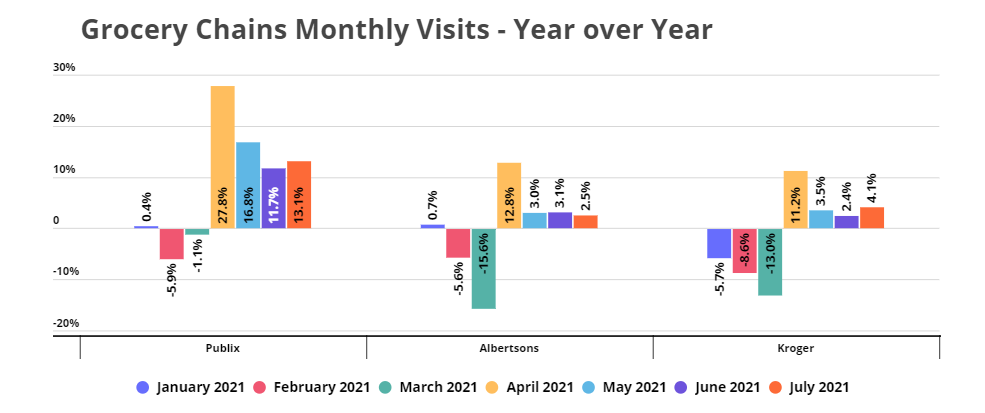

The rise of traditional, one-stop-shop grocers during the pandemic was a key trend where brands that were well aligned with providing value alongside mission-driven shopping were uniquely positioned. Players like Publix, Albertsons and Kroger saw significant strength during the pandemic – and there were indications that this was just the beginning. Essentially, the feeling was that the extended nature of COVID would sustain wider concerns around economic uncertainty, at-home cooking would retain a significant piece of the pie, and the ability to win over customers during the pandemic would drive ongoing loyalty.

And it does appear that these same brands successfully turned their COVID opportunity into long term strength. Looking at monthly visit data year-over-year shows that Publix averaged a massive visit jump of 17.3% for April, May, June and July when compared to the same months in 2020. Albertsons and Kroger also saw impressive average monthly jumps of 5.4% and 5.3% respectively. The ability of these brands to turn effective alignment with short-term trends into a foundation for extended success is a huge testament to their current strength and continued potential.

The Recoveries

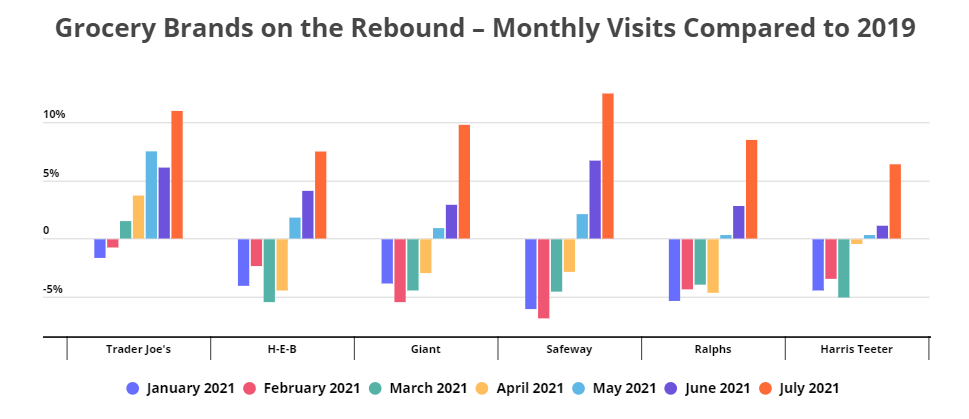

While some brands outperformed throughout the pandemic, others saw more uneven results. Yet, for many of these, the turnaround is underway. Grocery leaders across the spectrum like Trader Joe’s, H-E-B, Ralphs, and Harris Teeter have all seen significant and marked recoveries in recent months. H-E-B saw visits down 4.0% on average the first four months of 2021 when compared to the equivalent months in 2019, yet for May, June and July that average monthly change turned around to 4.5% growth. Trader Joe’s saw visits up 11.0% in July 2021 when compared to July 2019 after seeing January and February visits down 1.6% and 0.7% respectively compared to their 2019 equivalents.

The same pattern held true for Safeway, Ralphs, Giant and Harris Teeter – showing that while some grocers were negatively impacted by pandemic retail patterns, many possessed the brand relationship necessary to drive a strong recovery. The key factor appears to be success pre-pandemic along with activities to sustain brand loyalty even when the conditions were less ideal. The result has been a strong and steep recovery pattern that should position these chains well moving forward.

Expansion Leaders

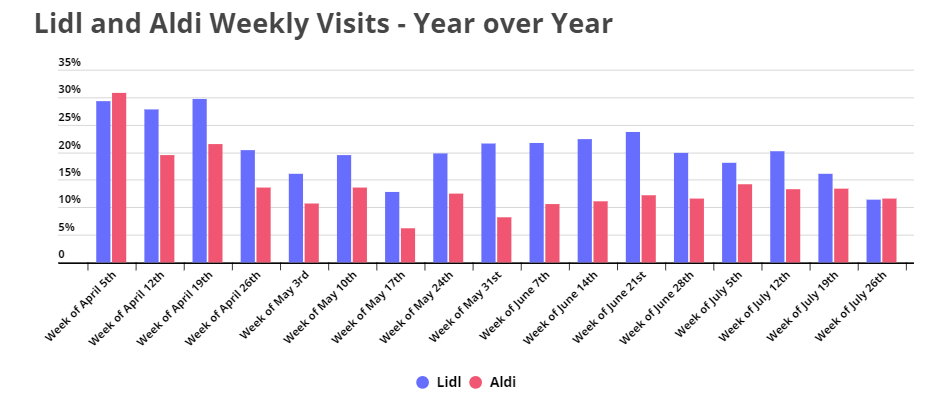

Two brands that are increasingly grabbing attention are Lidl and Aldi, both of whom have aggressively expanded their US footprint in recent years. And the expansions are delivering results on the visit front, with both seeing massive year-over-year gains in weekly visits nationwide. The big question, however, is how they will perform as expansion efforts slow down. Should they prove capable of maintaining some growth in visits as new store plans slow, hopes for even greater future success could increase accordingly.

The COVID Lift

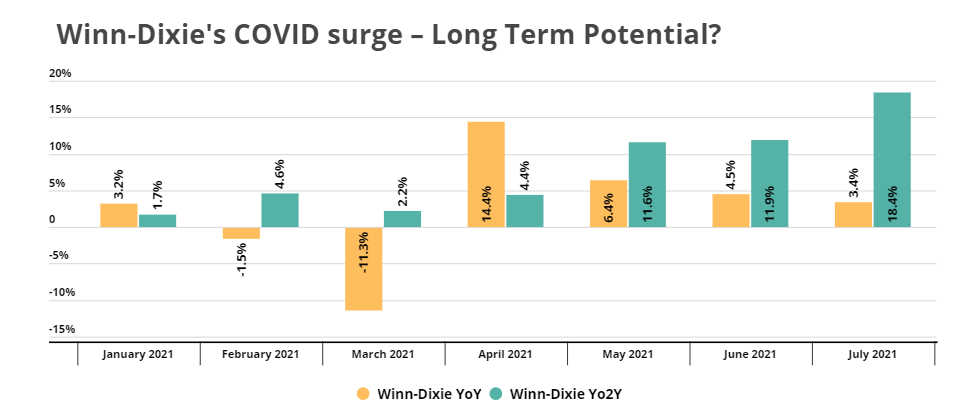

While some brands used pre-pandemic strength as a foundation for pandemic and recovery success, one brand that truly leveraged the pandemic to redefine its position is Winn-Dixie. The grocer had seen a very uneven period heading into early 2020, yet its focus on value, being a one-stop-shop, and proximity to audiences drove significant growth during COVID.

And looking at Winn-Dixie visits compared to both 2019 and 2020 levels shows that the brand seems to have successfully raised its profile. While year-over-year visits were down in March and have seen visit increases decreasing consistently month-over-month, the 2019 comparison is critical. While Winn-Dixie may not be seeing the same strength of surge as it did in 2020, it has clearly been pushed into a new level within the grocery landscape. While visits were only up 3.4% year-over-year in July, they are 18.4% higher than July 2019. This indicates that the brand could be oriented towards a much brighter trajectory as a result of its pandemic performance.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.