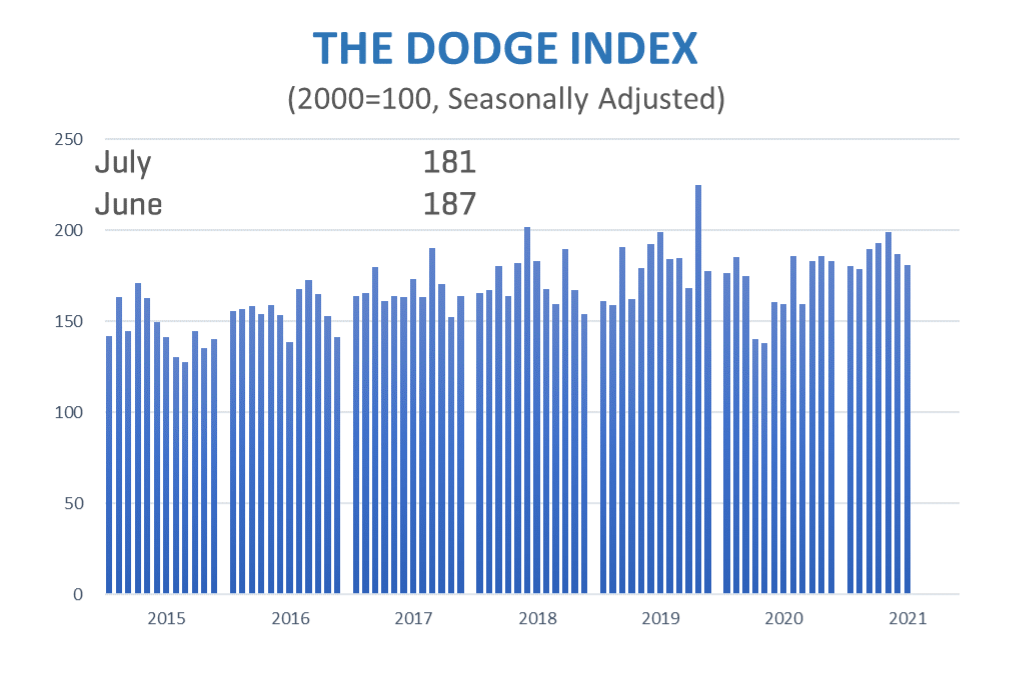

Total construction starts fell 3% in July to a seasonally adjusted annual rate of $854.8 billion, according to Dodge Data & Analytics. There were few bright spots during the month, with all three sectors (residential, nonresidential building and nonbuildings) moving lower in July.

“Construction material prices continue their march higher and are weighing heavily on construction starts,” stated Richard Branch, Chief Economist for Dodge Data & Analytics. “Lumber and copper prices have fallen in recent weeks; however, steel, plastic and other construction-related products are continuing their ascent. These increases will continue to impact construction starts over the coming months, somewhat muting the impact of stronger economic activity. A further risk to the sector is the rising number of COVID-19 cases due to the Delta variant. While we don’t expect significant business restrictions in response, it is a risk that can not be fully discounted. On the upside, projects entering the planning stage remain at levels not seen in several years and forward progress on an infrastructure program and the federal budget provides hope that brighter days are ahead.”

Below is the full breakdown:

For the 12 months ending July 2021, total nonbuilding starts were 2% lower than the 12 months ending July 2020. Environmental public works starts were 32% higher, while utility and gas plant starts were down 18%. Highway and bridge starts were up 1% and miscellaneous nonbuilding starts were 25% lower through the first seven months.

The largest nonbuilding projects to break ground in July were the $728 million I-6 project in Indianapolis, IN, the $315 million Kew Lake Water Supply project in Enid, OK, and the $300 million Cavalier Solar Farm in Surry County, VA.

For the 12 months ending July 2021, nonresidential building starts were 8% lower than the 12 months ending July 2020. Commercial starts were down 8%, while institutional starts fell 5%. Manufacturing starts dropped 26% in the 12 months ending July 2021.

The largest nonresidential building projects to break ground in July were the $1.5 billion JP Morgan Office Tower in New York, NY, the $1 billion Inglewood basketball arena in Los Angeles, CA, and the $825 million REG Geismar Biofuels Plant in Geismar, LA.

For the 12 months ending July 2021, total residential starts were 23% higher than the 12 months ending July 2020. Single family starts gained 29%, while multifamily starts were up 8% on a 12-month sum basis.

The largest multifamily structures to break ground in July were the $223 million second phase of the Sendero Verde project in New York, NY, the $203 million Chestnut Commons in Brooklyn, NY, and the $194 million 100 Flatbush mixed-use project in Brooklyn, NY.

Regionally, July’s starts rose in the Northeast, Southeast and Midwest regions, but fell in the South Atlantic and West regions.

JULY 2021 CONSTRUCTION STARTS

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.