Financial Impact of the One-Way Road

It’s fair to say that the airline industry has never experienced a pandemic such as Covid-19, a near global lockdown, record industry losses, no clarity about reopening requirements and a nasty virus that has now reached a Delta variant…let’s hope it doesn’t get to a United variant!

In a bizarre way, Covid-19 has been both an interesting experiment and allowed airlines to transition with words such as “pivot” and “unprecedented” frequently used, and it has created some hopefully never to be repeated moments. One of those is the fact that US passport holders can currently travel to Europe and the UK but that no EU or UK passport holders can enter the US, except for a few exceptions. This kind of bi-lateral travel restriction flies against all the established principles of air services between countries but it looks like it may be here for a while. Against that backdrop we’ve taken an opportunity to highlight what this means and the likely financial impact across the transatlantic market.

US Area of Sale Dominates

Not surprisingly, the US area of sale dominates our analysis which has been based on July and August 2019 and whilst technically a booking could originate in the US or elsewhere with a ticket issued in the UK for instance, we have assumed that all the revenue assigned to each country have an origin point in that country. Not surprisingly the revenue picture at a country level is dominated by revenues generated in the US; with multiple revenue streams to all Western Europe markets it soon adds up!

During the peak two months of 2019, around US$ 6.1 billion of revenue was generated across the Atlantic of which 55% or some US$ 3.3 billion originated from the United States which may in part explain the willingness of Europe to welcome US passport holders back. The US market was worth some four and a half times more than the United Kingdom which in turn was three times larger than the German market. The combined US & UK area of sale revenues accounted for over two-thirds (US$ 4 billion) of all revenues generated, perhaps reaffirming the geographic advantage that the UK has in this market.

In total, transatlantic revenues were generated from some 146 countries in the two-month period and perhaps surprisingly markets such as India (US$ 86.3 million), Nigeria (US$33.2 million) and Saudi Arabia (US$20.2 million) generated more revenue than many European countries. In all cases historic travel patterns, expatriate holidays, multi stop visits to friends and families accounted for what many airlines view as valuable six freedom traffic flows; it is unlikely that those traffic flows will return in the short-term at least.

British Airways Has Most to Lose

Anyone who has ever prepared a SWOT analysis will know that strengths can also be strategic weaknesses and this analysis, highlights that precise issue for British Airways who would appear to be the most disadvantaged by the current one-way travel restriction. For many years the transatlantic market had been British Airways cash cow, with the only billion-dollar route operating between London Heathrow – New York JFK and had an extremely high proportion of corporate and premium traffic. All that business will hopefully return at some point but as the table below highlights the airline has historically generated some US$ 523 million in July and August of each year from other areas of sale, revenues that will not be anywhere near to being realised this year. British Airways US revenues will also have been impacted by the shortened booking windows that sudden reopenings have created around the globe; operating full flights with five days’ notice is not easy.

Table 1 – Top 10 Airline Transatlantic Revenues, July – August 2019

All the US majors operating across the Atlantic typically generate more than three quarters of their revenues from the US area of sale, partly reflecting the range of domestic points that they serve behind their respective hubs and perhaps the power of their frequent flyer programmes and credit cards. More importantly it means that for all three of those airlines although the loss of revenue from those overseas markets is significant at some US$ 350 million, their collective loss is less than two-thirds of BA’s total loss.

Only two European carriers traditionally earn more revenue from the US area of sale than their home markets: Aer Lingus who have a strong local affinity market and Turkish Airlines for whom most of Europe involves a lengthy backhaul via Istanbul and therefore the larger share of US generated revenues.

US Major Markets Largely Unaffected

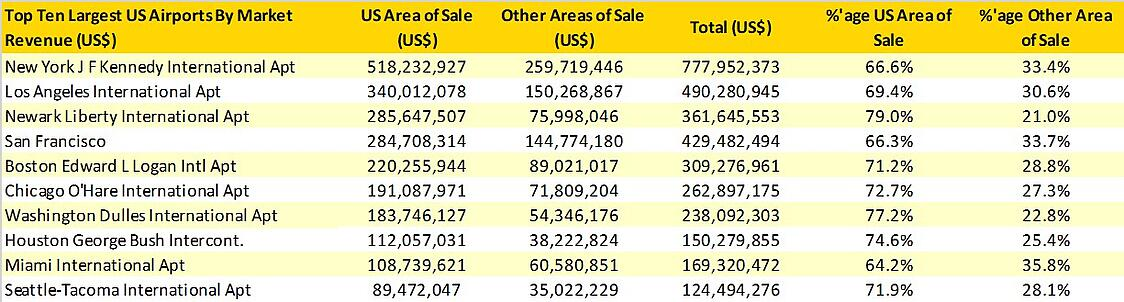

For the major US airports, most of their market revenues are generated from US areas of sale; typically, around 70% of the route revenues generated from their domestic market. The combined market value of the New York market is traditionally in the region of US$ 1.1 billion of which US$804 million (70%) has a US area of sale, suggesting that in relative terms the airline and indeed airport revenue streams are likely to be more protected than those of their European counterparts.

Table 2 – Top 10 US Airports Transatlantic Area of Sale Analysis, July – August 2019

Central to the relative strength of those markets is of course the respective hub positions that they all enjoy but they also perhaps have a better mix of traffic between leisure and corporate demand. From Europe to the United States there are certain US destinations that have a heavy reliance on inbound demand; markets such as Tampa, Orlando and Las Vegas are prime examples of normally stronger inbound demand; in the case of Las Vegas just some 30% of revenues are typically generated from US areas of sale.

Supporting this point further, in August 2019 some 44 US cities had direct air services from Western Europe and today only 24 have services; major markets not now served include Las Vegas, New Orleans and Austin. From a European perspective some 46 cities had direct services to the US in August 2019 and that is now down to 37 with markets such as Edinburgh, Stockholm, and Shannon yet to see services resumed.

Traffic Lights on a One-Way Road

However you interpret the data, the current situation heavily favours the three US based majors who essentially have around three quarters of the market to themselves, at least from a revenue perspective. For Europe’s airlines it seems the principles of reciprocity, enshrined in air services agreements for decades, are being ignored and of course now that US passport holders have access to Europe’s markets any negotiating position has been replaced by pleas for help from those carriers.

For some of those European airlines, the joint venture agreements that they have in place provide a degree of comfort but certainly not enough to cover the revenue loss they are currently experiencing. It certainly seems that this is an experiment that needs to stop and normal service be resumed; the US authorities need to reciprocate sooner rather than later.

To learn more about the data behind this article and what OAG has to offer, visit https://www.oag.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.