ATTOM’s newly released Q2 2021 U.S. Residential Property Mortgage Origination Report revealed that the number of mortgages secured by residential property originated in Q2 2021 in the U.S. was up 29 percent from Q2 2020, but down 3 percent from Q1 2021.

According to ATTOM’s latest residential property mortgage origination analysis, the quarterly decline in overall mortgage lending in the U.S. marked the first decrease since early in 2020, as well as the first time that happened from a Q1 to a Q2 period since 2011.

The Q2 2021 report noted that lenders issued $1.18 trillion worth of mortgages in the second quarter, also up annually by 39 percent, but down quarterly by 1 percent. ATTOM’s new report also noted that rare quarterly drop-off came as a decrease in refinance activity canceled out a rise in home-purchase and home-equity lending.

ATTOM’s Q2 2021 mortgage origination analysis found that lenders refinanced 2.23 million home loans in Q2 2021, up 26 percent from Q2 2020, but down 15 percent from Q1 2021. The report noted the last quarterly decrease in refinancing activity came in early 2020, while the last time the number dropped from a Q1 to a Q2 period was in 2017. The Q2 dollar volume of refinance loans rose annually, by 26 percent, but went down quarterly, by 15 percent, to $674.7 billion.

However, refinance mortgages still accounted for a majority of all home-lending activity in Q2 2021, but the portion dipped from 67 percent to 59 percent, the biggest downward change in four years.

The Q2 report stated that purchase mortgages in Q2 2021 were up 22.4 percent from Q1 2021 and 52.4 percent from Q2 2020. The dollar volume of purchase loans in the second quarter was also up 30.9 percent from Q1 2021 and up 77 percent from Q2 2020.

According to the analysis, residential purchase-mortgage originations increased from Q1 to Q2 2021 in 90.4 percent of the metro areas included in the report, with the largest quarterly increases in Virginia Beach, VA (up 103.9 percent); Peoria, IL (up 90.9 percent); Champaign, IL (up 75.4 percent); Erie, PA (up 71.5 percent) and Fargo, ND (up 70.4 percent).

Aside from Virginia Beach, the report noted that among metros with a population of at least 1 million, those with the biggest quarterly increases in purchase originations in Q2 2021 were Raleigh, NC (up 61.8 percent); Oklahoma City, OK (up 60.2 percent); Birmingham, AL (up 59.7 percent) and Richmond, VA (up 58.4 percent).

The report also noted that among metros with a population of at least 1 million, those where purchase loans represented the largest portion of all mortgages in Q2 2021 included Oklahoma City, OK (48.8 percent of all mortgages); Miami, FL (46.8 percent); Las Vegas, NV (46.5 percent); Orlando, FL (42.8 percent) and Jacksonville, FL (42.5 percent).

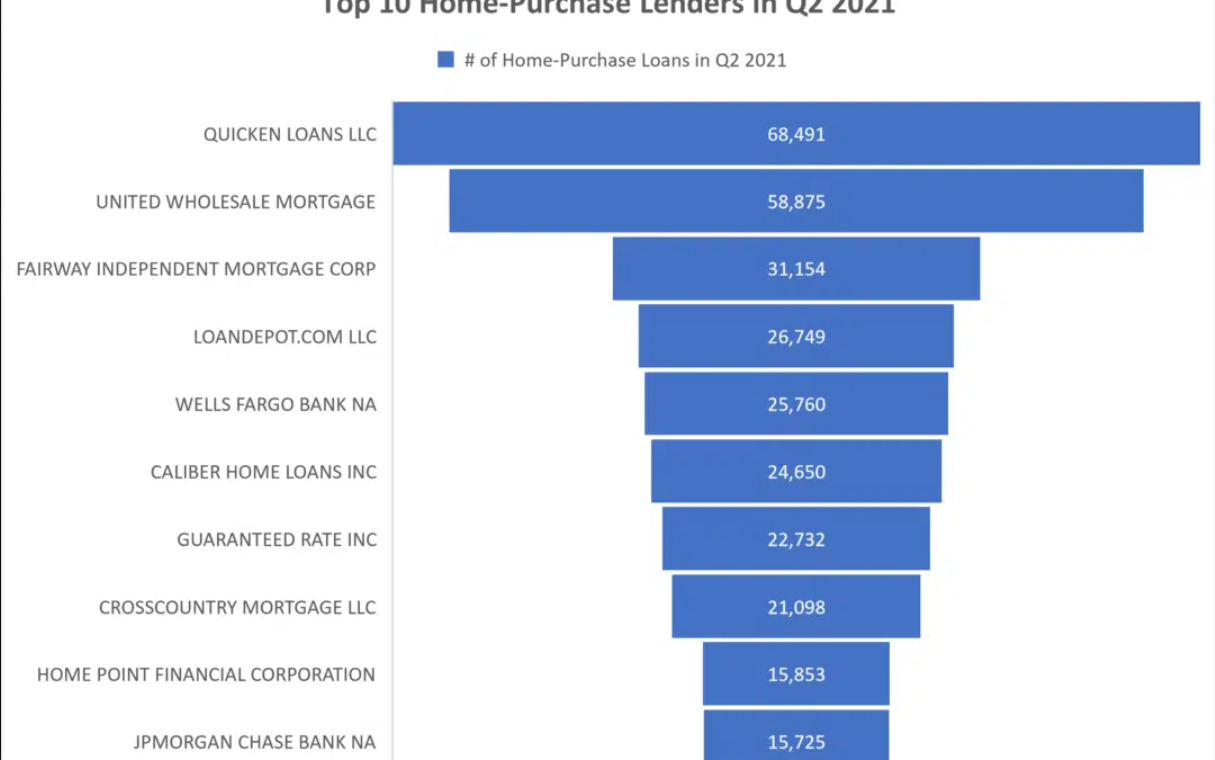

In this post, we take a deep dive into the data behind ATTOM’s Q2 2021 U.S. Residential Property Mortgage Origination Report to uncover the top 10 home-purchase mortgage lenders in Q2 2021 by lending volume. Those lenders include: QUICKEN LOANS LLC (68,491 home-purchase loans originated in Q2 2021); UNITED WHOLESALE MORTGAGE (58,875 home-purchase loans); FAIRWAY INDEPENDENT MORTGAGE CORP (31,154 home-purchase loans); LOANDEPOT.COM LLC (26,749 home-purchase loans); WELLS FARGO BANK NA (25,760 home-purchase loans); CALIBER HOME LOANS INC (24,650 home-purchase loans); GUARANTEED RATE INC (22,732 home-purchase loans); CROSSCOUNTRY MORTGAGE LLC (21,098 home-purchase loans); HOME POINT FINANCIAL CORPORATION (15,853 home-purchase loans); and JPMORGAN CHASE BANK NA (15,725 home-purchase loans).

ATTOM’s Q2 2021 mortgage origination report also stated there were a total of 225,240 home-equity lines of credit (HELOCs) were originated on residential properties in the second quarter, down 18.4 percent from Q2 2020, but up 17.6 percent from Q1 2021. That increase marked the first quarterly gain since Q3 2019, while the dollar volume of HELOC loans went up 15.7 percent from the last quarter, although still down 16.8 percent from last year.

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.