Luxury sales are all about brands – aspiration for different labels to signal a level of taste and fashion. But . . . what if they’re not? Recently, a number of new players specializing in multibrand luxury have entered the space to give shoppers the ability to shop luxury brands side-by-side as they look to purchase the latest trends. In today’s Insight Flash, see how these merchants are faring in both the US and UK markets.

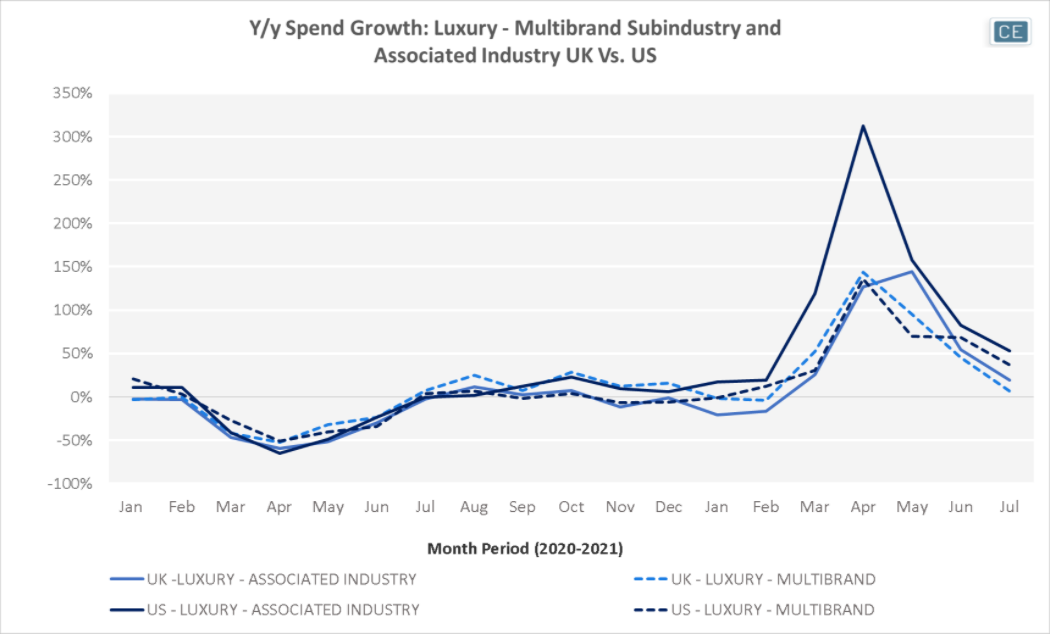

Trends at the beginning of the year were very different across each side of the Atlantic. In the US, the overall Luxury industry (which includes the DTC sales of individual brands) was growing much faster than the Multibrand Luxury subindustry, while in the UK Multibrand spend was higher y/y. However, in the last three months spend growth has surged for the overall Luxury industry in the UK, and it has now joined the industry in the US in outperforming Multibrand Luxury growth.

Industry Trends

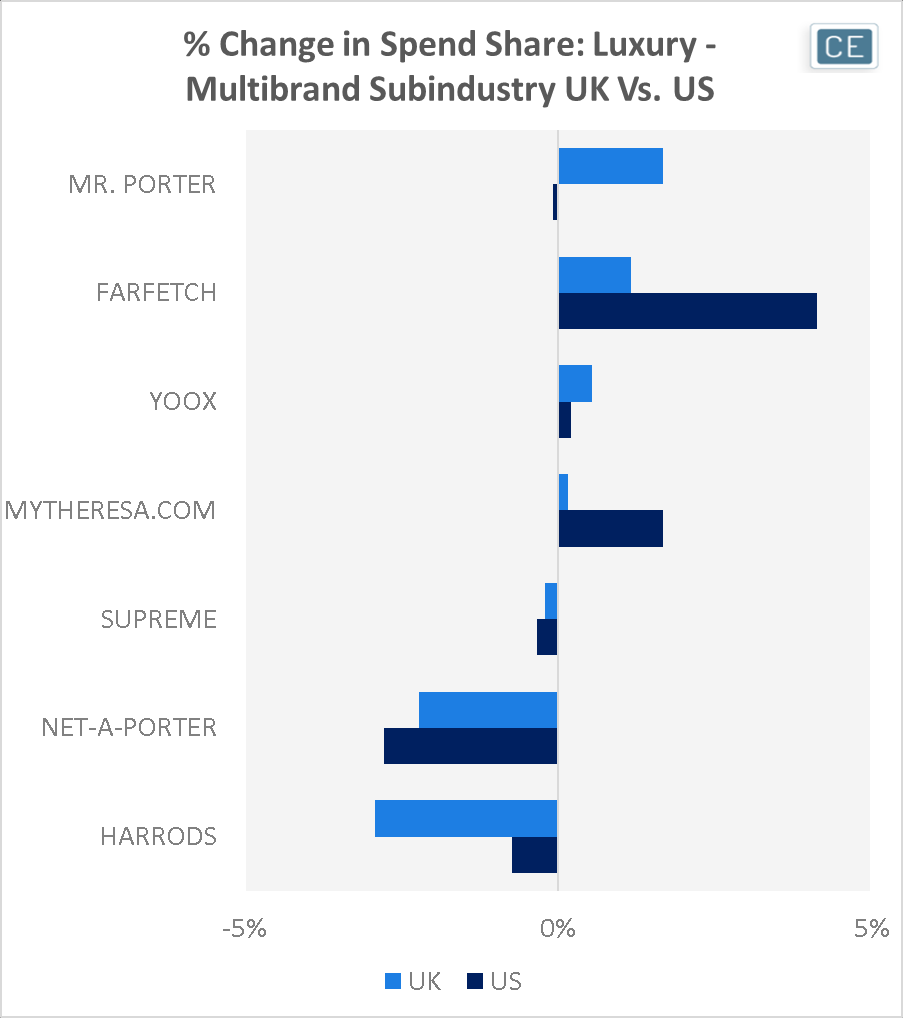

Preferences for Multibrand merchants are different on both sides of the pond as well. Farfetch has shown gains in spend share in both geographies this year versus last year, up by a delta of 4.1% in the US and 1.2% in the UK. However, Mr. Porter has shown the largest share gains of 1.7% in the UK, while it has actually lost share in the US. And Mytheresa.com, which has the second-strongest share gain of 1.7% in the US, only gained 0.2% share in the UK.

Multibrand Market Share

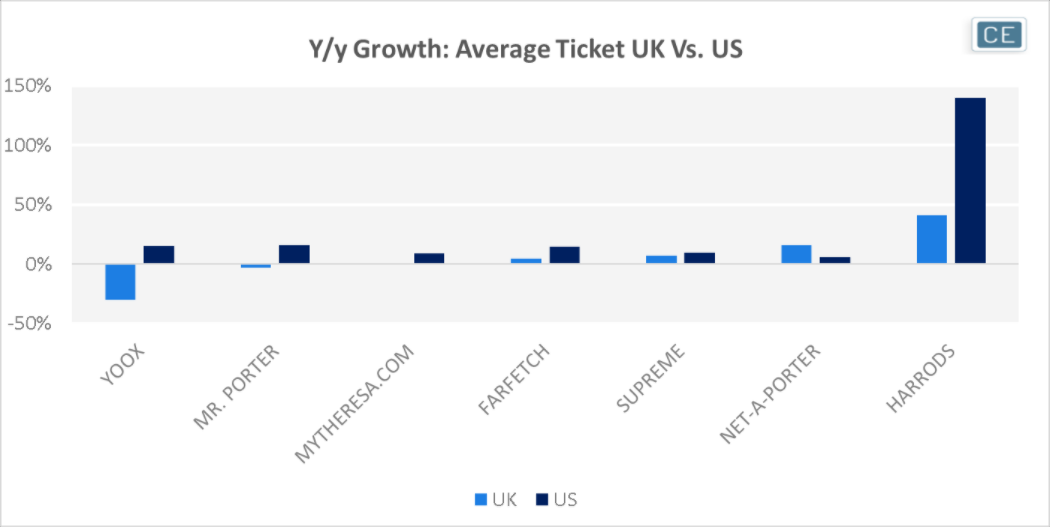

One bright spot for Multibrand Luxury that is consistent across geographies is growth in the average transaction size. Harrods is seeing the biggest gains in both markets, although its basket is growing much faster in the US where it is a new fascination than it is in the UK where it has such a deep history. Net-a-Porter, Supreme, Farfetch, and Mytheresa.com are also all seeing growth in both markets. Among these, Net-a-Porter is the only brand where UK average ticket is growing faster than US average ticket – the other three are all seeing US ticket growing faster. Indeed, even Mr. Porter and Yoox, which are seeing declines in average ticket in the UK y/y, are seeing it grow 15% in the US.

Basket Size

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.