Introduction: Rapid Rent Growth in 2021

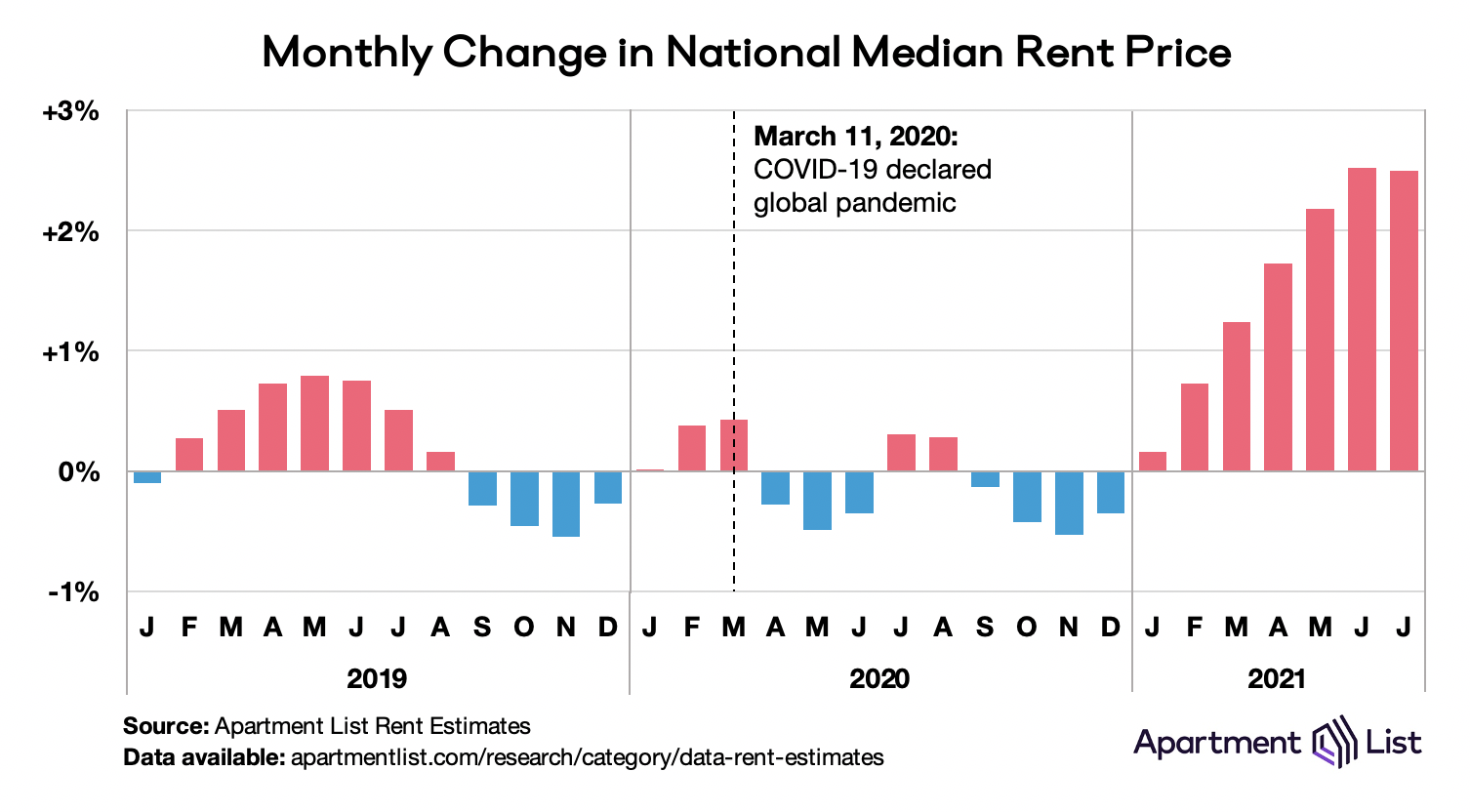

In a year when people have yearned for a return to normal, the rental market has been anything but. Not only are rent prices rising, they are rising tremendously fast and rising virtually everywhere. According to our national rent estimates, prices jumped over 11 percent in the first half of 2021, more than doubling the rate of inflation and more than tripling the typical rent growth we measured in the several years preceding the pandemic. Today, 87 of the nation’s 100 largest cities have fully rebounded to pre-pandemic rent prices, and in smaller cities like Boise, ID; Bend, OR; and Spokane, WA; rents are up more than 30 percent since last March.

What’s driving these dramatic rent spikes? In this report, we highlight five interconnected trends that help explain why rent increases are sweeping the nation. We do not intend for this to be a comprehensive list, nor do we suggest the relative weight of each individual factor on price changes. Instead, we hope to highlight ways in which the COVID-19 pandemic has exacerbated affordability concerns by disrupting supply and demand in both the rental and for-sale housing markets.

1. There are more households competing for homes than ever before

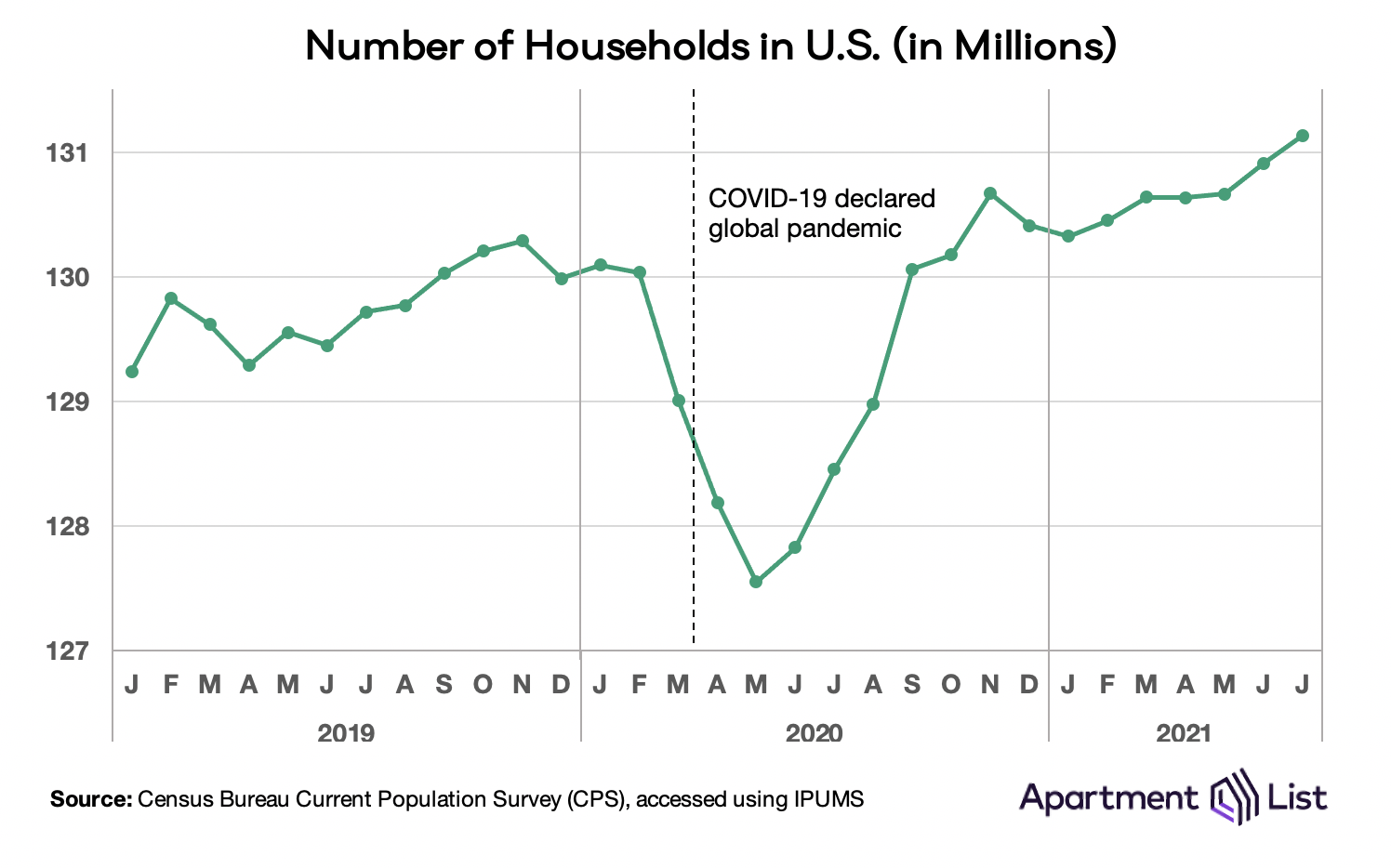

The early months of the pandemic saw rapid household consolidation: more people moving in together to living under fewer roofs. In just three months, the United States lost nearly 2.5 million households, and we can surmise that the vast majority were renters who had more flexibility to move on short notice. Much of this consolidation consisted of young adults – particularly those who had been living with roommates – giving up their leases and moving back in with family as they waited out the pandemic. From February through May, more than 20 percent of roommate households disappeared while the share of young adults living with parents spiked. This contributed to the dramatic rent drops that swept across the nation’s expensive cities last year.

But dramatic household consolidation was only temporary. Households re-formed almost as quickly as they broke apart, and the total number of households in the U.S. has now surpassed its pre-pandemic peak and reached a new high of just over 131 million. Unfortunately, the same forces that disrupted household formation in 2020 also disrupted household construction. New starts fell dramatically last spring, and the industry’s rebound has been marred by uncertainty about materials and labor shortages. Today the National Association of Home Builders says that builder confidence is at its lowest point since July of last year. If new household formation continues to accelerate while new home construction sputters, the undersupply of housing could worsen and further drive up prices.

2. Homeownership is becoming prohibitively expensive

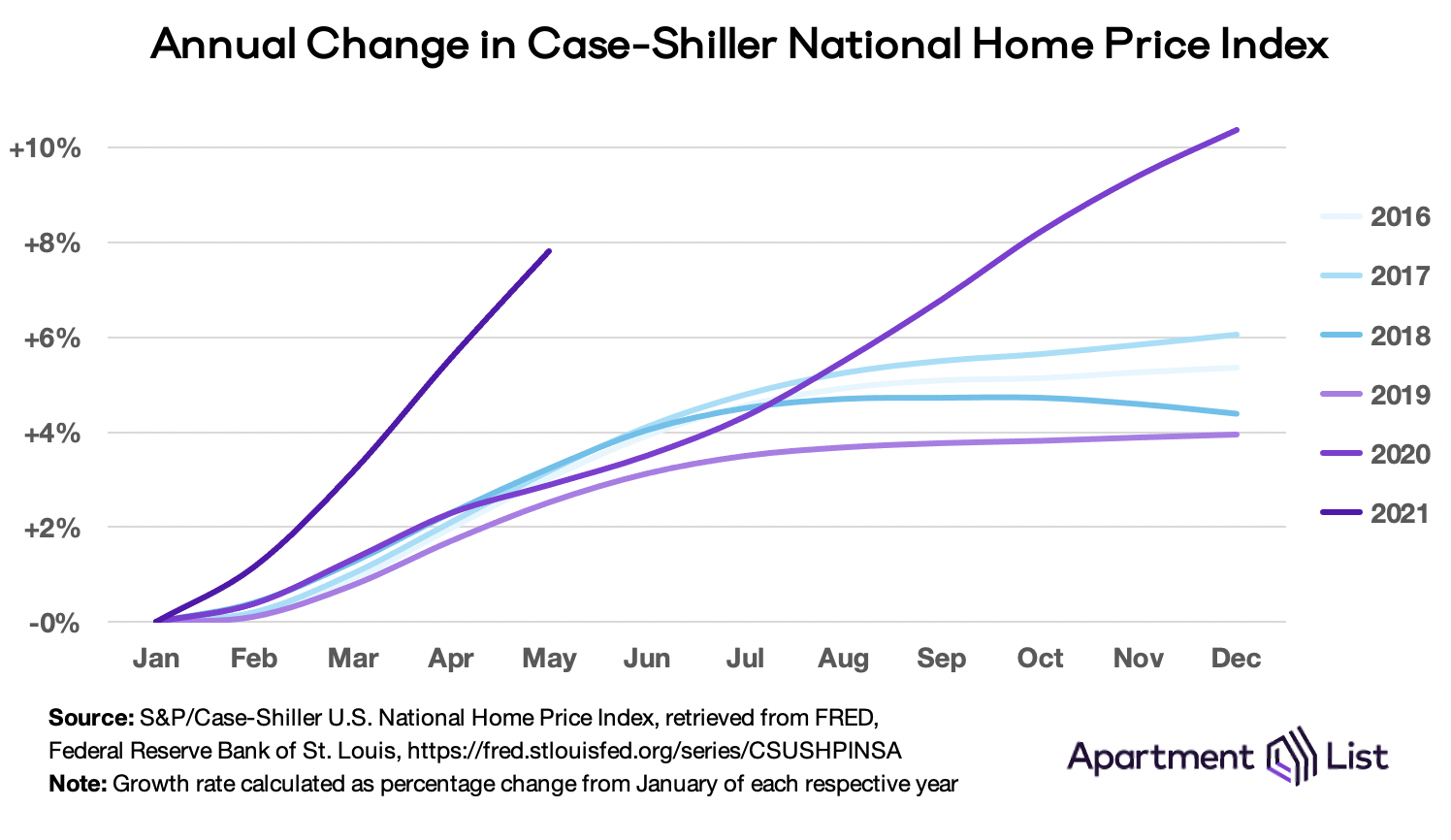

The vast majority of adults in the United States view renting as a stepping stone to homeownership. Therefore the availability of affordable homes in the for-sale market dictates how many compete for homes in the rental market. For-sale supply and affordability were both worsening in the years leading up to the pandemic, but conditions worsened rapidly in 2020 when new home construction slowed and wary sellers pulled off the market. In March 2021 there were fewer than 700,000 houses for sale across the country, a 48 percent drop in inventory compared to the year prior. In response, home prices have surged.

From 2016-2019, home prices appreciated between 4 and 6 percent annually. In 2020 they were on a similar trajectory pre-pandemic, but then accelerated and ended the year up more than 10 percent. Rapid growth has continued into 2021, with the Case Shiller home price index up nearly 8 percent through May. As supply shrinks and prices soar, more and more relatively high-income households are unable to find for-sale housing that meets their needs and preferences. These households therefore remain in the rental market, where they put additional pressure on affordability. A recent analysis of Apartment List migration data found that post-pandemic apartment hunters are searching with higher incomes and higher budgets, especially when moving to a new part of the country. These are the renters who, if not for prohibitively high prices, might otherwise buy homes and take some pressure off the rental market.

3. Search data suggest many renters are actively looking for a new home right now

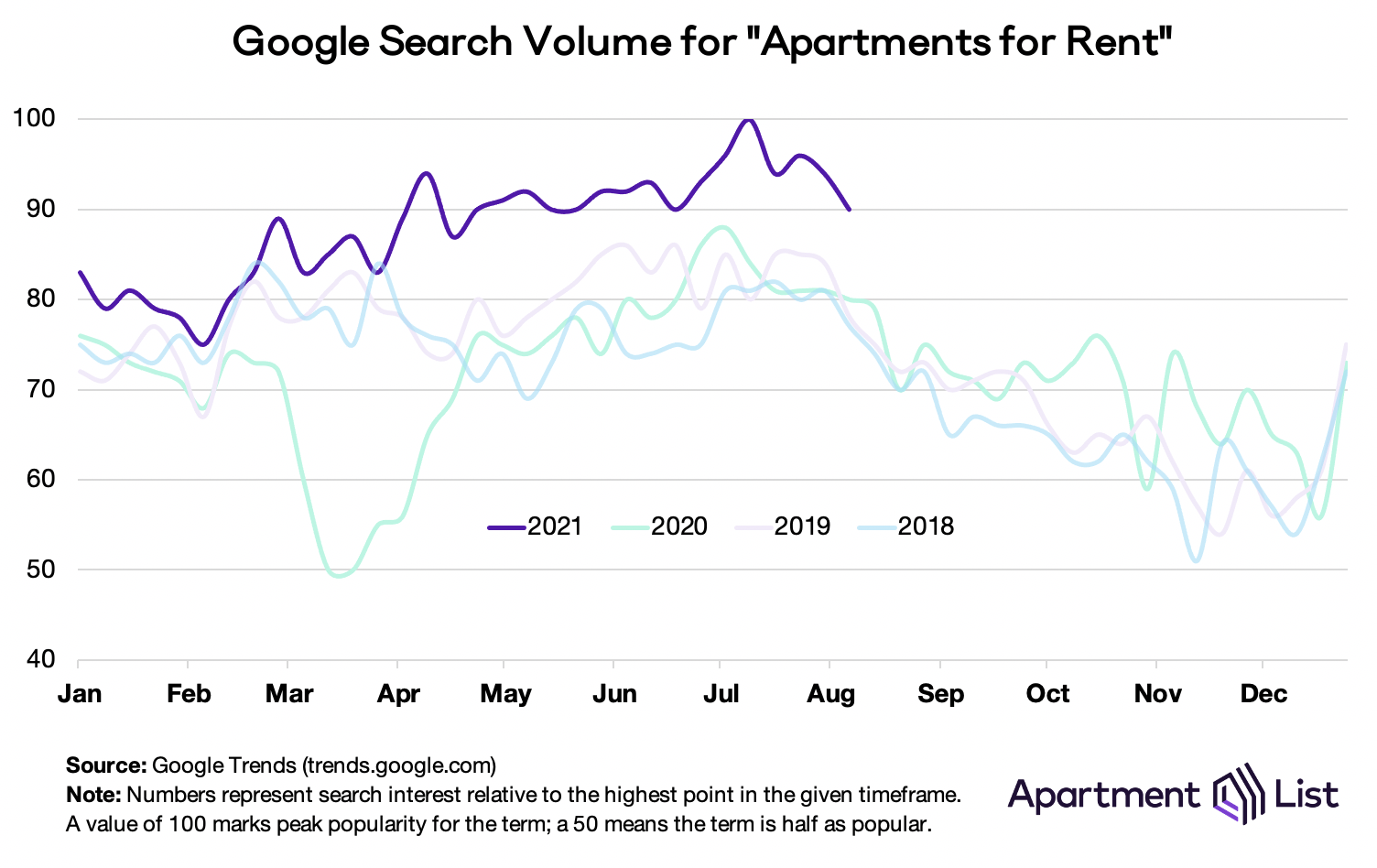

With a historically-high number of households and a historically-low number of homes for sale, the rental market is especially tight. And since most apartment searches take place online, we can visualize this record demand using Google Trends data. The chart below shows the popularity of the keyword “apartments for rent” over the past several years.

Since 2018 search volume has ebbed and flowed along a seasonal pattern – higher during the summers and lower during the winters – with two notable exceptions. The first is March 2020, when search interest collapsed as the nation sheltered-in-place and turned their online attention elsewhere. The second is this summer, when search volume has been consistently 10 percent higher than previous summers. Google Trends data stretches back to 2004 and the all-time peak for apartment hunting searches occurred just last month in July 2021.

4. Apartment hunters are searching with increased urgency

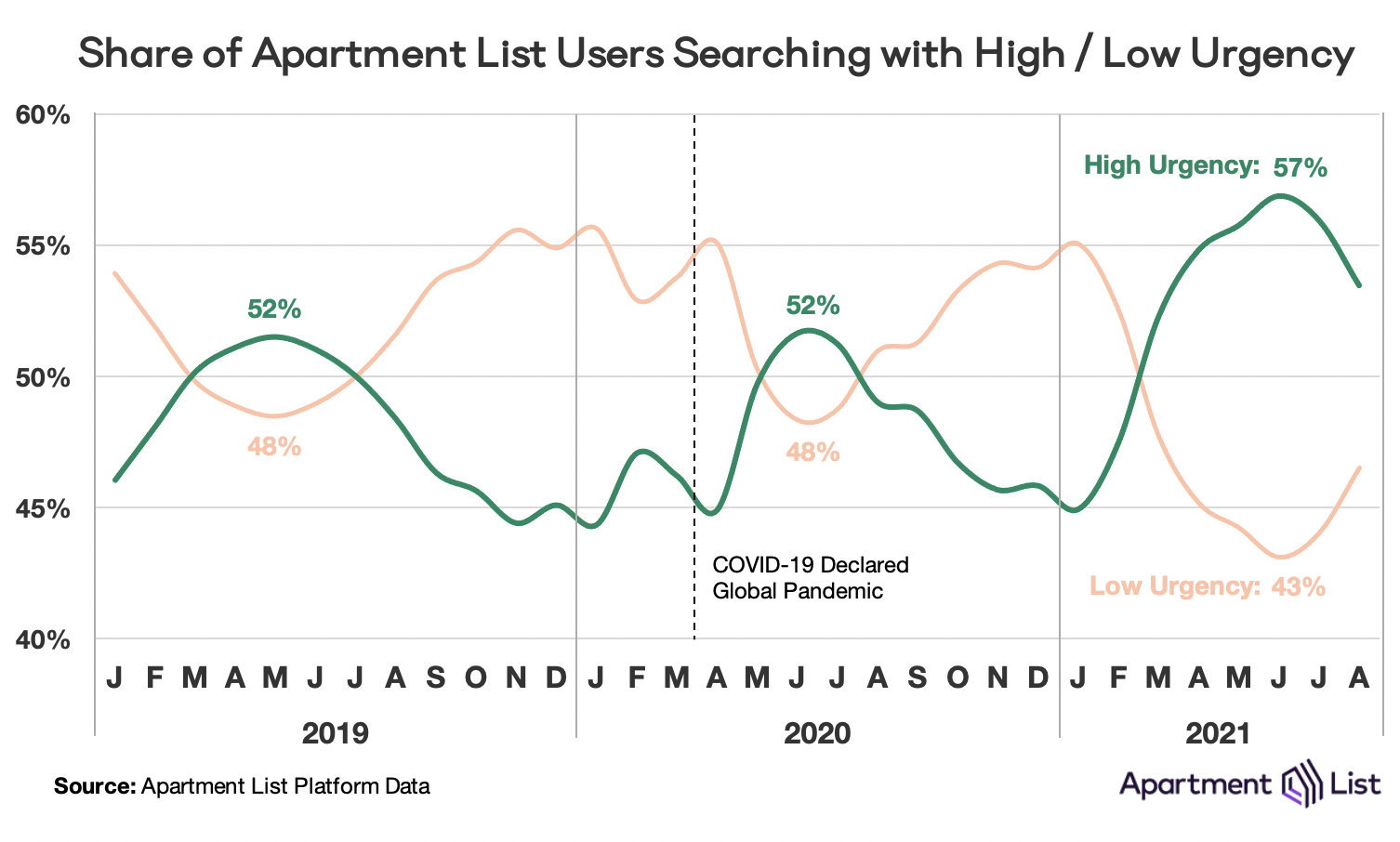

Facing a highly-competitive rental market this summer, renters are also searching with an increased sense of urgency. We measure urgency using data from the Apartment List registration flow; low-urgency movers say they are “just looking” or “in no hurry” to find their next home, while high-urgency movers say they “need to move” but have some flexibility or “gotta move” imminently. On average, high-urgency movers are searching for a new lease that starts in fewer than 30 days.

As with search volume, search urgency also follows a seasonal trend. A brief aberration towards the start of the pandemic has been followed by increased urgency in 2021, peaking at 57 percent of users this June, an all-time high. This urgency could be a result of several factors, including the expiration of year-long leases signed during the pandemic, moving back towards job centers now that offices and in-person activities are reopening, or moving away from job centers to take advantage of long-term flexible work arrangements. Whatever the reason, a larger and more-urgent pool of renters means a more-competitive market that drives up prices.

5. Apartment vacancy rates are historically low

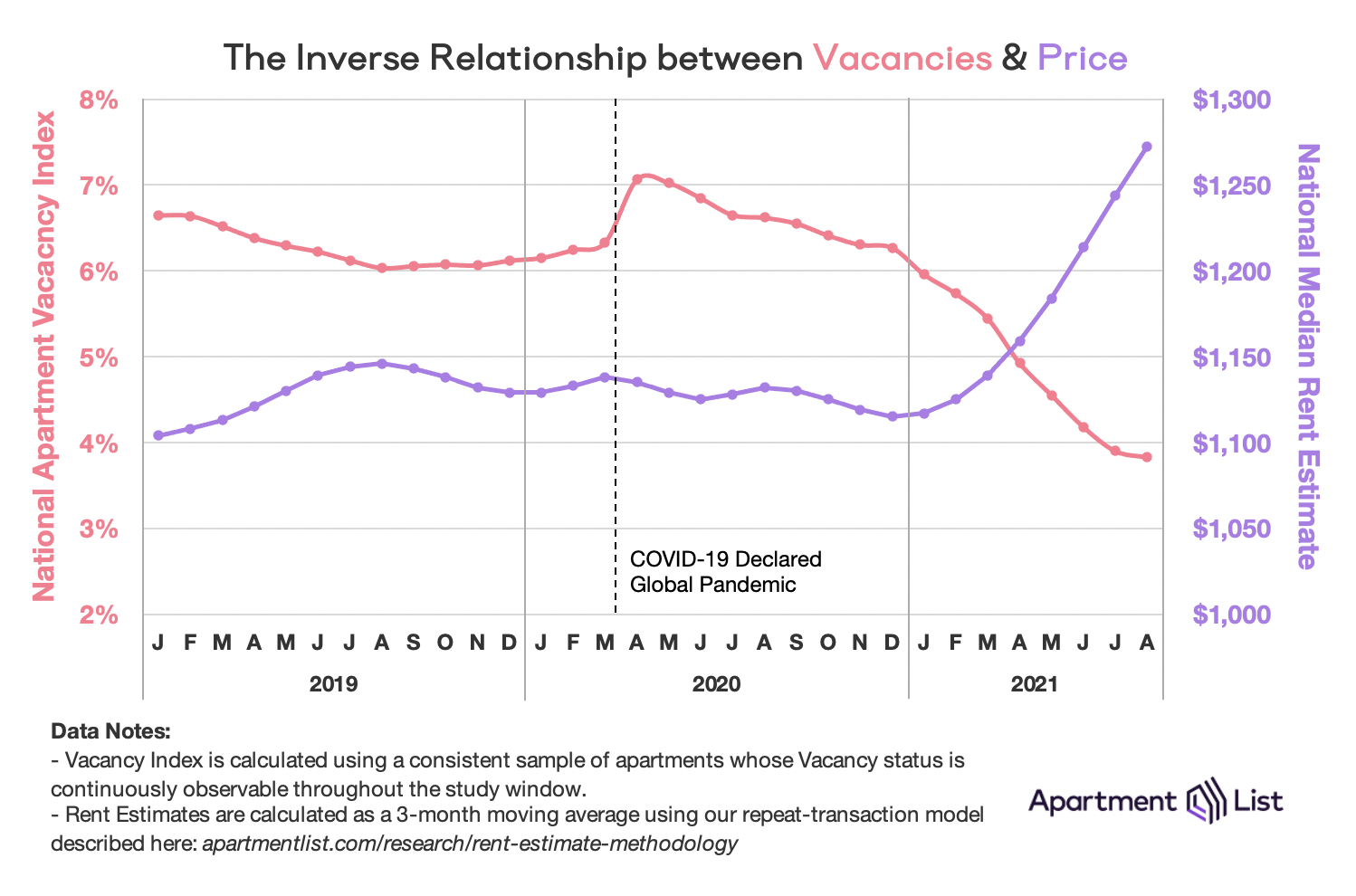

With a large, urgent group of renters looking to move right now, vacancies are disappearing and property managers are having little difficulty filling whatever empty apartments remain. The inverse relationship between occupancy and price was on display last summer, when elevated vacancy rates rapidly drove down prices in expensive urban centers. This summer the opposite is happening; a resurgence of rental demand has steadily reduced vacancies and provided landlords the opportunity to raise rents. Our national vacancy index and estimated national median rent are plotted below: while rents are up more than 11 percent in 2021, vacancies have shrunk by 36 percent. This month, only 3.8 percent of units in our sample sit vacant.

Last summer renters were offered steep discounts on new leases. Today’s low vacancy rate may reflect those who are staying put in order to hold onto those low rates. Other renters may be occupying units longer because of a patchwork of local and federal eviction moratoria that prevent landlords from evicting anyone who is not current on their payments. In any case, the rapid and inverse changes in these two metrics highlight how an under-supplied housing market quickly becomes an unaffordable one.

What Comes Next?

A few indicators signal that this summer’s rapid rent growth may be starting to cool off. For one, many seasonal trends remain seasonal; as we enter the fall, online search volume is slowing down and renters are becoming less urgent. Vacancy rates appear to be bottoming-out and while prices are still going up, the rate at which they are increasing is slowing. The resumption of evictions may further reduce price pressure by opening new vacancies, albeit at the risk of worsening economic and health consequences for those losing their housing.

But a brief cooling period this winter is unlikely to reverse much of the dramatic price gains we are witnessing this summer. Prices going into 2022 will assuredly be higher than they were going into 2021. One factor that remains undetermined is how residential construction will respond to this recession. In the decade following the 2008 recession, multi-family construction bounced back more quickly than that of single-family homes, spurring an apartment boom that centered in downtowns and central business districts. But the opposite appears to be true as we exit the COVID-19 recession. Construction – single-family and multi-family alike – is shifting towards the suburbs, and single-family is rebounding faster than multi-family.

Over the course of the pandemic, we have witnessed widespread economic hardship concentrated in the lowest income brackets, while at the same time, a growing embrace of remote work is shifting the location preferences of newly untethered Americans. These new trends are coinciding with millennials – the nation’s largest generation – aging into their prime homebuying years. The American housing market is currently undergoing a significant shakeup, and the long-term implications will play out over years, not months.

To learn more about the data behind this article and what Apartment List has to offer, visit https://www.apartmentlist.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.