If the chicken wars of summer 2019 taught us anything, it’s that a healthy chicken sandwich obsession is warranted. The rise experienced by Popeyes was so significant that it catapulted the chain into visit levels that reset the standard for the brand.

So, using the launch of Popeyes’s new chicken nugget offering as an excuse, we dove back into the data from some of the chicken wars’ primary protagonists.

Popeyes Continues to Thrive

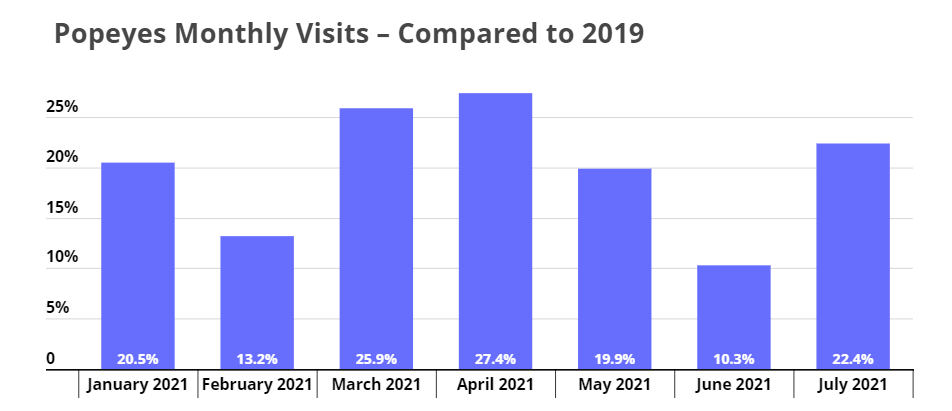

Looking at visits for Popeyes in 2021 compared to 2019 shows a clear and consistent trend of growth – even during months when visits to most QSR leaders were still limited by the pandemic’s effect. During the first seven months of 2021, Popeyes averaged 19.9% visit growth compared to the equivalent months in 2019, with July showing a 22.4% increase.

Popeyes’ Big Test Coming Up

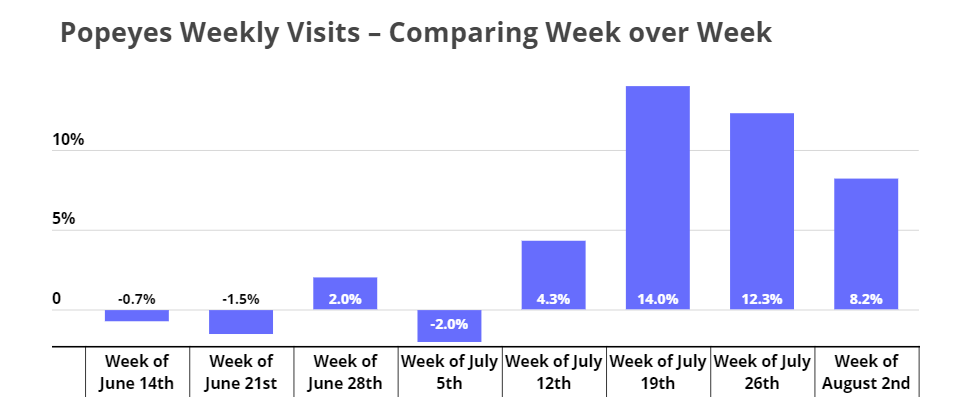

Yet, the biggest test is coming in August – the month in 2019 that marked the initial launch. The standard set in that month will likely push Popeyes into a visit decline compared to its 2019 equivalent for the first time in 2019 – not because of any weakness for the brand but simply due to the unique heights hit following the chicken sandwich launch. This is a reality even in spite of significant weekly visits growth compared to 2019 equivalents.

The expected ‘decline’ will need to be understood within the same frame of reference as the year over year drops from home improvement leaders Home Depot and Lowe’s, where the initial surge was so significant that it created a boost that pushed the brands higher than years prior.

And, interesting product launches like the chicken nuggets may not be enough to stem this shift. Visits the week of the launch were up 12.3% compared to the equivalent week in 2019, but this was in line with visit growth seen the week prior, indicating that the period was more responsible for the jumps than the new offering. However, should Popeyes prove capable of driving growth in August, or even a limited decline, the result will be truly impressive

The Wider QSR Surge

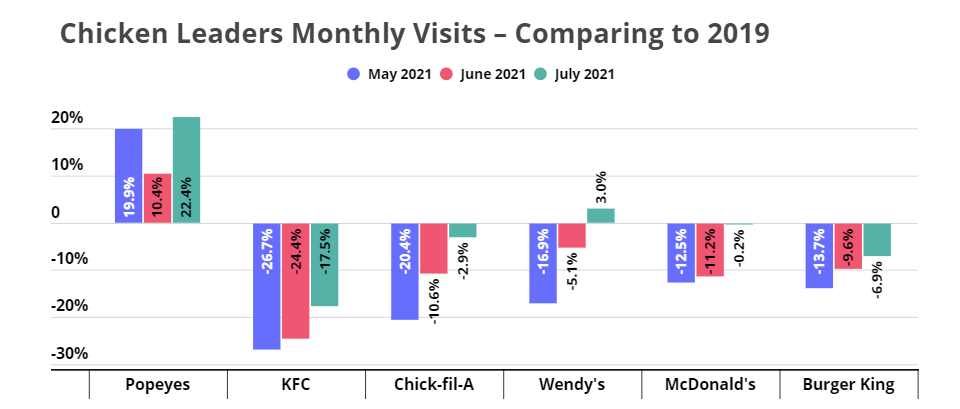

Popeyes’s success is not happening in a vacuum. Looking at other QSR leaders with an emphasis on those who played key roles in the initial Chicken Wars or have had more recent entries, the strength seems well spread. All the brands analyzed have seen significant reductions in their visit gaps compared to 2019 with July marking a high point across the board.

While this success does mirror the strength seen in other dining segments, there is a key caveat when analyzing QSR leaders – they are less dependent on actual visits. Top QSR players have proven to be incredibly adaptive with their multi-channel reach across drive-thru, delivery and takeaway. This leads to two key takeaways that speak to the high potential for this sector in the short and long term.

In the short term, wider concerns that rising COVID cases could lead to renewed restrictions may not negatively impact these brands, as they can adjust to a greater emphasis on other distribution channels during those periods. In the longer term, the strong recovery of in-location visits speaks to the strong pull these brands create at branches showing a wider ability to drive interest and demand across channels.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.