Key takeaways

Amazon recently surged ahead of Walmart and became the largest retailer in the world outside of China. In the pet sector, investors will be keen to see the Q2 results for Chewy (CHWY), Amazon’s strongest competitor. The September 1st Q2 CHWY earnings report and investment analysis will indicate if the online pet retailer can build on the solid upward momentum accelerated by the pet-buying spree during the pandemic last year.

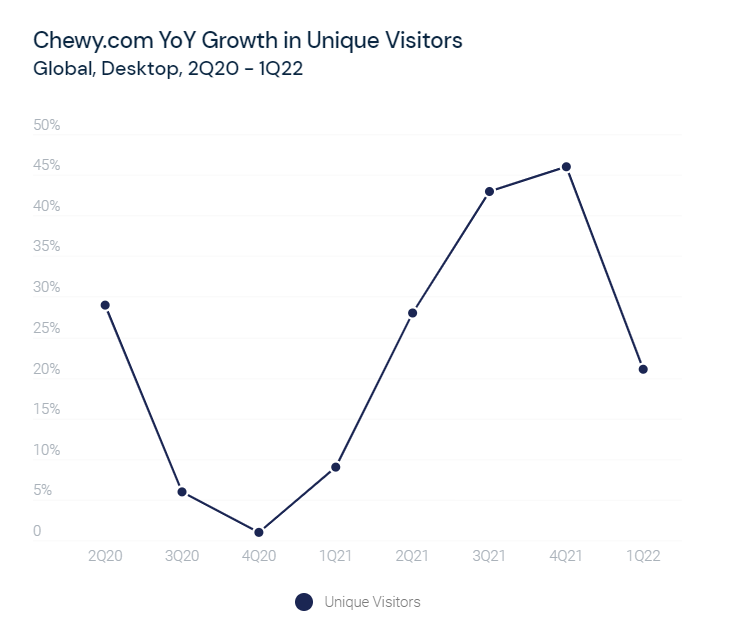

Chewy is coming out of an exceptionally strong Q1 propelled by strong tailwinds, namely growth in pet ownership and mass migration to online shopping which has accelerated during the pandemic. Growth of desktop unique visitor traffic to chewy.com, our key indicator for active customers remains strong, although it decelerated in Q2. With investor expectations high, Chewy will need to deliver dazzling results to meet or beat market expectations.

However, with the growth rate in unique visits starting to cool-off, our data suggests that the growth rate in active customers will likely decline.

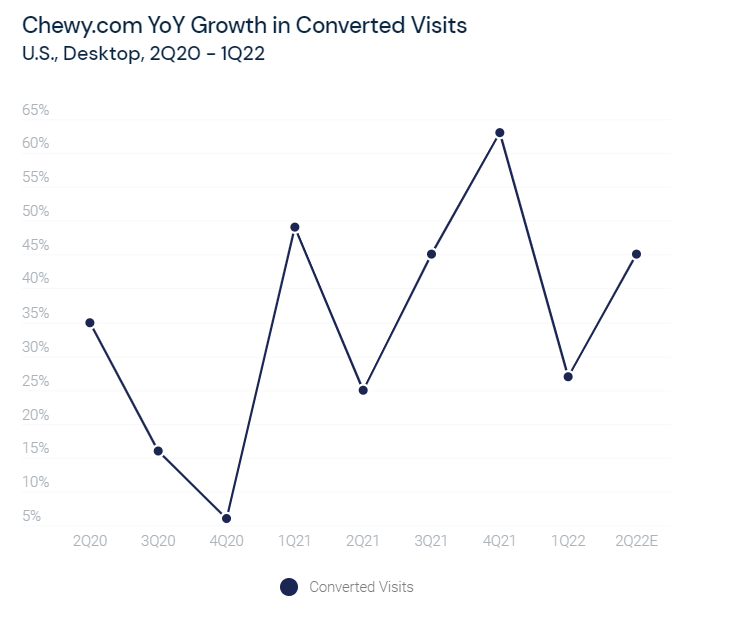

Despite a potential cooling-off in growth, our data indicates that Chewy is strengthening its ability to turn web browsers into paying customers based on a correlation between non-Autoship revenues and our estimates of converted visits.

A global crisis (and pet-mania that followed)

COVID-19 may have been a crisis for much of the U.S. economy and certainly a tragedy for millions of families across the globe. But in tough times, Americans stuck indoors brought home furry companions in record numbers, and Chewy was merely a few mouse clicks away to help.

Chewy’s Q1 net sales increased 32% to $2.14 billion and total active customers increased by 4.7 million or 31.6% to end the first quarter at 19.8 million. More importantly, average annual sales per active customer increased by 8.7% to reach $388.

And that’s just the start.

Chewy’s active customers typically spend more over time. As their active customer base grows, so too will future revenue momentum. Chewy active customers spend over $400 in their second year compared to approximately $700 in their fifth and almost $900 in their ninth year. Current Chewy active customers have been with the retailer for an average of 2 years. With investor expectations high, these numbers will be tough to beat.

Programs recently put in place to enhance customer experience and build on Chewy’s active customer base include fresh and prepared pet food as well as high-value health care services. Chewy pet health and wellness offerings read like a Blue Cross plan and encompass vet dietary advice, OTC medicines, pharmacy, and prescription fulfillment through ‘Petscriptions’ as well as tele-health.

Active customers are key to sustainable growth

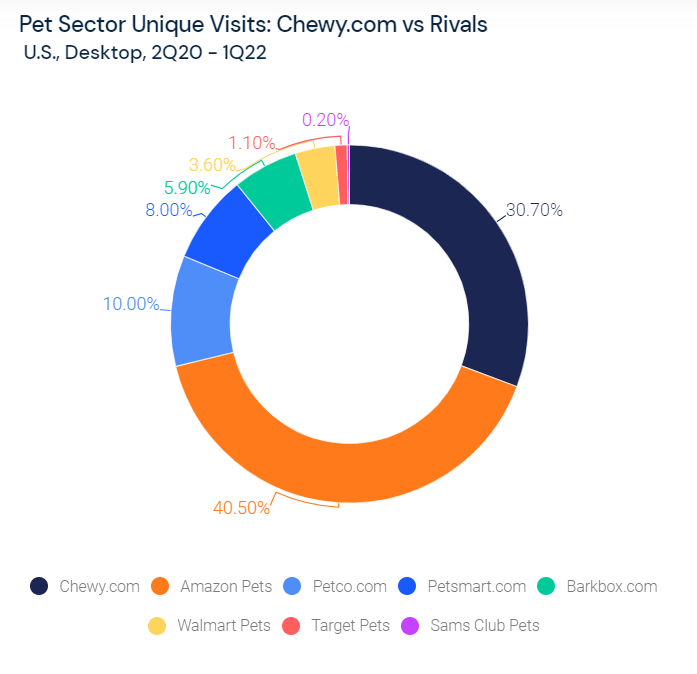

In short, Chewy’s active customer growth is the essential indicator of how sustainable long term growth will be for Chewy, who still ranks second in the online pet supply sector behind Amazon. Some skeptics may argue that the pet buying craze was a once-in-a-generation event due to the pandemic and will likely drop off in the next few quarters. A cooling off in the U.S. pet-adoration trend of recent months could significantly scale back expectations for future growth.

Despite some concerns about a slowing down in the buying craze, Chewy management certainly has solid grounds for their bullish expectations for strong growth in active customers. However, Similarweb web traffic data for chewy.com suggests active customer growth continues to cool off. While management stated the aggregate number of active customers has certainly increased, the share of active versus non-Autoship customers as well as the overall conversion rate suggests a slightly nuanced story.

Converted visits, or share of verified visits ending at the purchase confirmed or ‘thank you’ page on chewy.com, has continued to slide from a peak in 2Q20 of 63% down recently to 27%. However, Similarweb estimates that this rate will bounce up towards the 45% level for 2Q21.

As an indication in a possible cooling off cycle, the share of active customers year-over-year (YoY) has fallen from 46% in 4Q20 to 21% in 1Q21 with Similarweb estimates pointing to a further decline ahead.

While Similarweb data is signaling a decline in active customer growth, this deceleration is stabilizing. According to Chewy’s Chief Financial Officer, Mario Marte, the pet supply retailer expects solid double-digit growth across the board for Q2. Chewy sales are estimated to grow 26% to 28% YoY and hit between $2.15 billion and $2.17 billion for Q2. Full year 2021 net sales guidance is between $8.9 billion and $9.0 billion, representing 25% to 26% YoY growth.

Chewy will likely remain a second-place contender behind Amazon in the online pet sector. Nonetheless, Chewy will continue to significantly outperform its rivals in terms of web visits.

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.