Over the last two decades, we’ve seen several new business categories be born.

Without companies like Netflix, Uber, Apple and many more changing the status quo, this past year would have been completely different. They’ve changed everything from how we watch videos and listen to music to how we order takeout.

Consumer category creators are well known because they affect our everyday life. But behind the scenes, software category creators have been changing the way businesses run.

Software companies that invent their own categories tend to be more innovative—and are inherently digitally native.

We thought it would be interesting to see how category creators in the software industry advertise. Do they rely on digital advertising as other digital-native companies in the consumer sector do? Do they lean into traditional methods like other B2B companies? Or is there a mix of both?

Category Creators are Educators, But Are They Advertisers Too?

Category creators are typically thought of as companies that bring a new idea or product to market successfully. They identify needs or problems with the status quo and present new solutions.

Though these companies may get credit for dreaming up something entirely new, much of their inspiration usually draws on trends already going on within their industry. Very few companies go from no category to a completely new and revolutionary one.

“Category creation is an ongoing exercise in tenacity, perception and positioning,” writes Ryan Law, Director of Marketing at Animalz. “Our task is to identify a burgeoning trend and position ourselves at the front of the movement. This trend could be a latent frustration with the status quo (‘I’m so sick of cold emails’) or a changing social pattern (‘I don’t think I’ll ever want to work in an office again’).”

Thought leaders, Eddie Yoon, Christopher Lochhead and Nicolas Cole, at the Harvard Business Review (HBR) agree. Companies don’t have to be the first to market with a new service to be considered the category creator. It’s the companies that educate the market and create an effective flywheel that eventually win.

Take Tesla for example. Electric cars were first developed in 1832, before being disrupted by Ford. But nowadays, hardly anyone knows that. Tesla has succeeded in bringing electric vehicles back by combining hardware, software and services. The company hasn’t just created a new kind of car—it’s created a new business model in a legacy industry.

“Creating a new category is about educating the market about not only new solutions, but often new problems that are not top of mind,” explain the HBR authors. “This kind of education can’t be done merely with a great product or service or traditional marketing. This often needs to be experienced, which requires a breakthrough in the business model as well.”

Software companies that are considered category creators identify business trends and problems and create new solutions for those challenges. But they also create education efforts, innovative positioning and they try to offer new experiences for their target audiences.

Where does advertising fall in their education and positioning efforts?

MediaRadar Insights

We’ve looked at four software companies that are considered category creators and provided a quick look at their advertising spending.

1. Qualtrics

When Qualtrics was acquired by SAP, CEO Bill McDermott explained the deal saying, “when it comes to experience management, you’re going to hear plenty of noise out there who’d like to catch this wave. The question is who created the category? And the answer, of course, is Qualtrics, which is why we couldn’t be happier to have the SAP Global Distribution Channel behind their XM platform.”

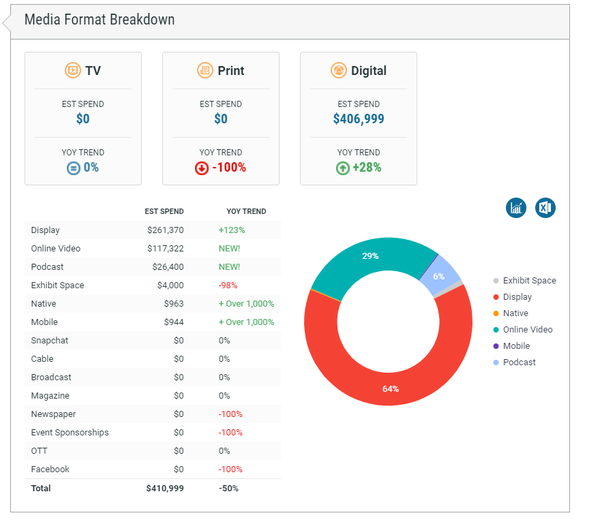

Looking at the experience management platform’s media format breakdown, we see the following spending:

Most of Qualtrics advertising spend (64%) goes to display. At the same time, they’ve been upping their native and mobile spending and adding online video and podcast formats to their mix. Without exhibits and events, it appears that Qualtrics is experiencing what most of the B2B sector is going through: more ad money is shifting into digital.

2. Hubspot

If category creators are exceptional educators, perhaps no company should get more credit for this than Hubspot. Hubspot pulled together different marketing ideas, trends and points of frustrations together to form the idea of “inbound marketing.” Through its use of educational content and ability to create content evangelists, Hubspot has effectively sold an idea in order to sell its software.

But does the king of inbound do outbound as well?

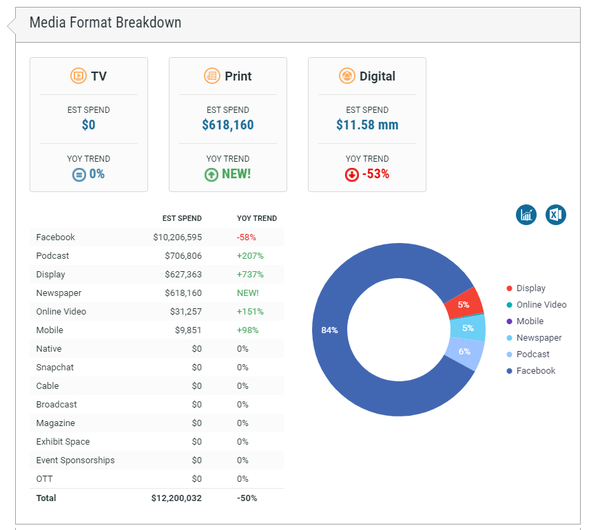

Hubspot devotes an overwhelming 84% of its budget to Facebook. This is not surprising because that’s where small business owners delivering their own content spend much of their attention.

But what is surprising is that the company’s Facebook spend is decreasing significantly, while they pour money into podcast, display and even newspaper for the first time.

3. Gong

Gong is considered the category creator of Revenue Intelligence platforms. With Gong, businesses can better understand customer interactions and tie customer communication to the business’s CRM.

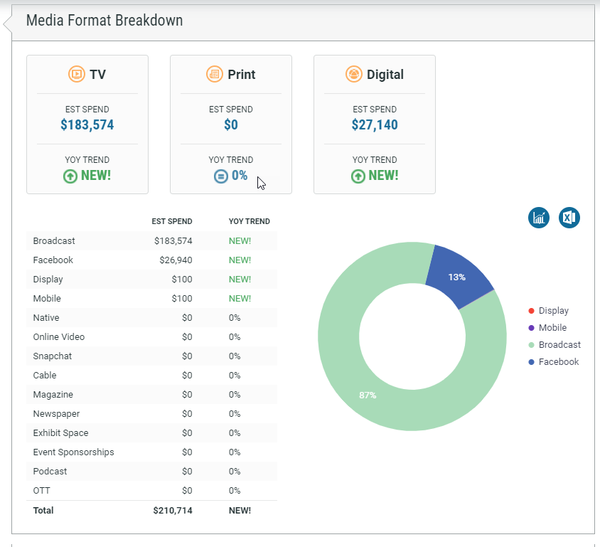

Of the examples on this list, Gong is younger, which may contribute to its smaller and nascent advertising spend. It may seem surprising to see such a fresh startup spending 87% of its budget on broadcast. But there is an explanation: Gong took out a 30 second Super Bowl ad, which we all know that even a few seconds of this format can sometimes require an entire marketing budget (we see you Reddit).

But this doesn’t mean that Gong doesn’t spend on marketing—they are marketing pro’s. But up until recently, they’ve dominated the conversation using excellent branding efforts.

4. Drift

Drift is often thought of as the first Conversational Marketing and Conversational Sales platform. Though other companies provide chat automation tools, Drift has high performing focus on enabling B2B businesses to develop relationships with customers.

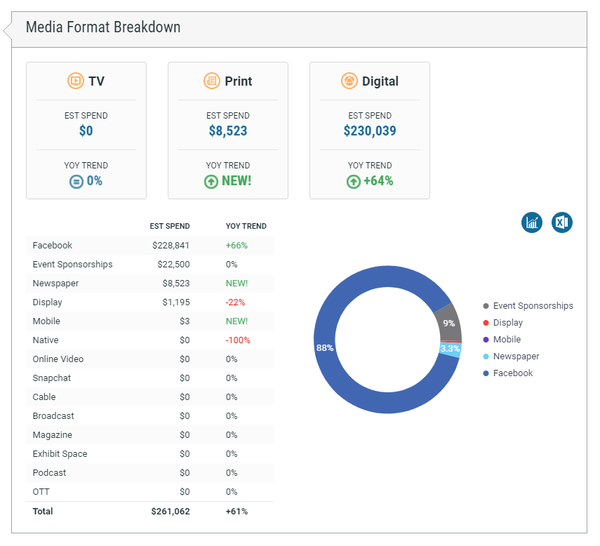

Like Hubspot, Drift spends nearly 90% of its advertising budget on Facebook. And they’ve recently begun to invest in newspaper. Like the other companies, events only make up a small amount of the company’s budget for the time being.

B2B software companies that create new categories are likely to be spending mostly in digital, just like the consumer sector. Within the last year, all of these brands have recently experimented with at least one new format. And Gong even went for the Super Bowl.

Without events, B2B brands are still willing to experiment, testing formats that were typically reserved for consumer brands.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.