The Revolving Door, the movement of public sector employees to private sector companies, is a heavily scrutinized Washington D.C. phenomenon. The movement between regulators and the companies they regulate can be problematic: when lobbyists turn into regulators, and vice versa, the transparency and fairness of regulatory policy is potentially jeopardized.

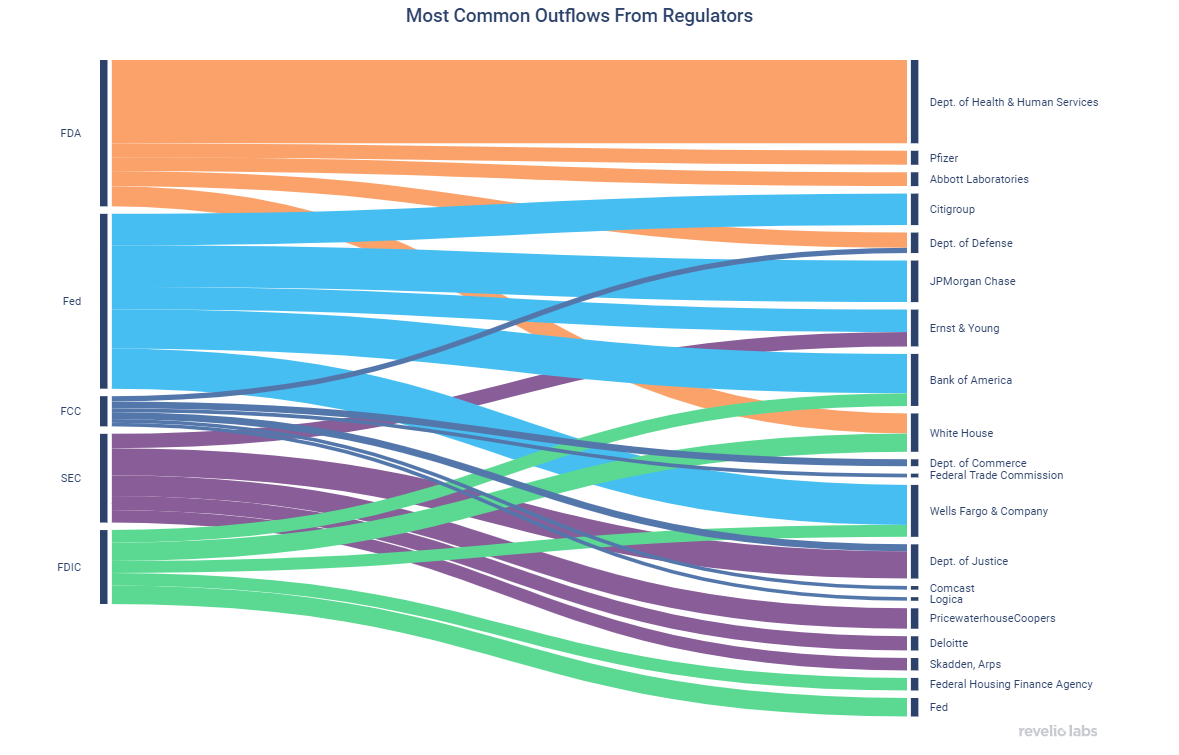

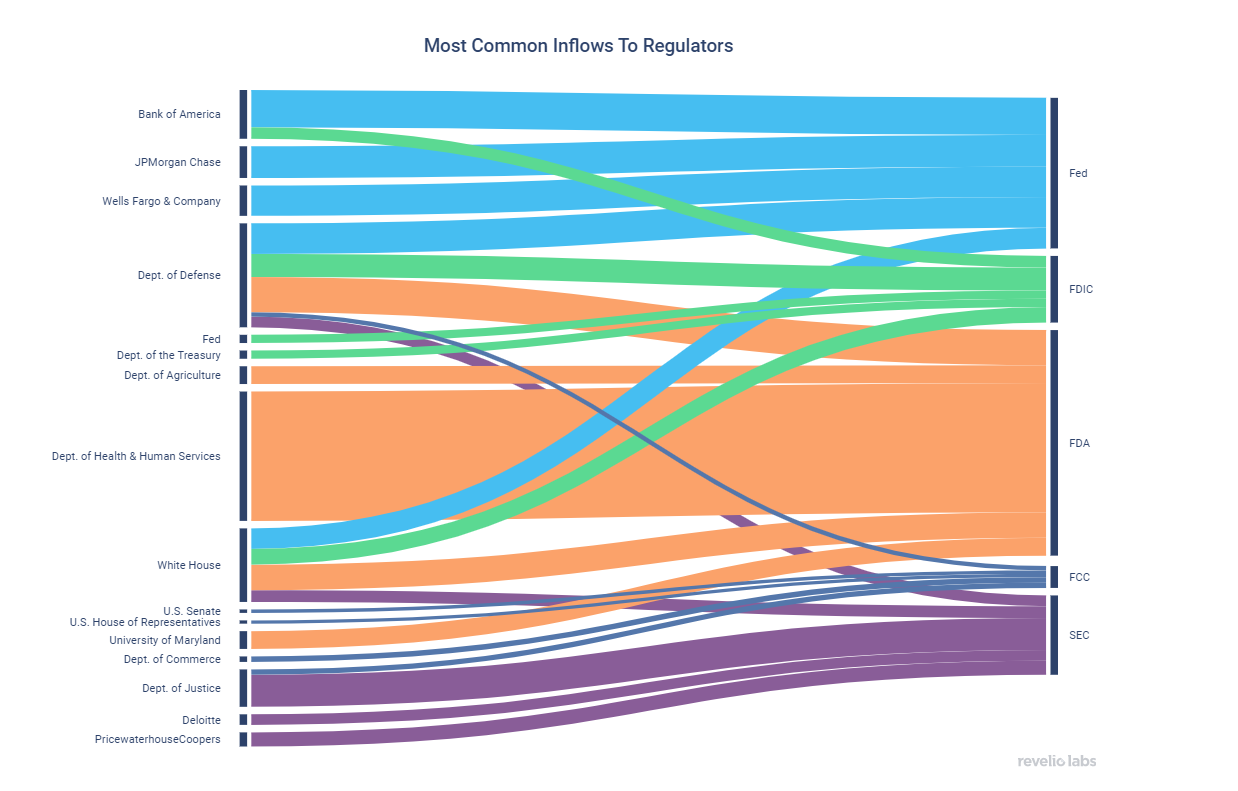

With our data spanning hundreds of millions of careers, we detect the inflows and outflows of regulators. The charts below show the most frequent transitions out of and into the largest regulatory bodies in the US.

The Revolving Door is particularly striking at the Federal Reserve, where the most common transitions are with large commercial banks. At other regulators, the most common transitions are intragovernmental.

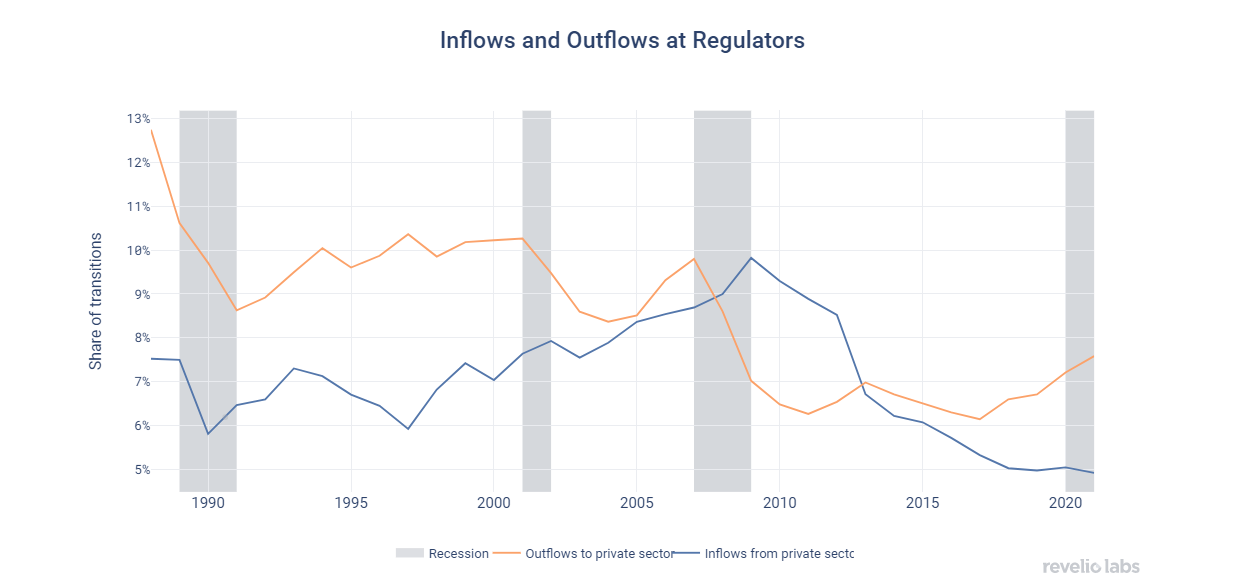

Inflows and outflows tend to move in opposite directions along the business cycle. During recessions, outflows from regulators to related private sector companies decrease, while inflows from related industry to regulators increase. As the public has become more aware of the Revolving Door phenomenon, it has declined over the last few decades.

Key Takeaways:

To learn more about the data behind this article and what Revelio Labs has to offer, visit https://www.reveliolabs.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.