ATTOM’s newly released Q3 2021 Vacant Property and Zombie Foreclosure Report found that 1.3 million residential properties in the U.S. sit vacant, representing 1.4 percent, or one in 74 homes, across the nation.

According to ATTOM’s latest vacant properties analysis, while the number of properties in the process of foreclosure in Q3 2021, is down 3.7 percent from Q2 2021 and down 0.2 percent from Q3 2020, among those pre-foreclosure properties, the number of those sitting vacant in Q3 2021 is down quarterly by 6.7 percent and annually by 5.3 percent.

ATTOM’s Q3 2021 vacant property and zombie foreclosure report noted that the portion of pre-foreclosure properties that have been abandoned into zombie status dropped slightly, from 3.6 percent in Q2 2021 to 3.5 percent in Q3 2021. The report also noted that among the nation’s total stock of 98.4 million residential properties, the portion represented by zombie foreclosures is just one of every 13,060 homes. That number is down from one in 12,256 in Q2 2021 and from one in 12,486 in Q3 2020.

ATTOM’s latest vacant properties analysis reported that on the state-level, among those with at least 50 zombie foreclosures in Q3 2021, those with the biggest decreases in zombie foreclosures from Q2 to Q3 2021 included Maryland (zombie foreclosures down 39 percent, from 151 to 92), Massachusetts (down 26 percent, from 89 to 66), New Mexico (down 24 percent, from 85 to 65), Connecticut (down 12 percent from 75 to 66), Florida (down 11 percent, from 1,021 to 912) and Maine (down 11 percent, from 66 to 59).

The Q3 2021 report mentioned that New York continues to have the highest number of zombie properties in Q3 2021 (2,053), followed by Ohio (939), Florida (912), Illinois (805) and Pennsylvania (366).

In terms of zombie foreclosure rates, among the metro areas included in the latest analysis – those with at least 100,000 residential properties and at least 100 properties facing possible foreclosure – the highest zombie rates in Q3 2021 are in Portland, OR (13.7 percent of properties in the foreclosure process are vacant); Fort Wayne, IN (12.9 percent); Detroit, MI (11.9 percent); Cleveland, OH (11.8 percent); and Honolulu, HI (11.3 percent).

ATTOM’s Q3 2021 vacant property and zombie foreclosure analysis also found that the highest zombie-foreclosure rates among counties with at least 500 properties in the foreclosure process Q3 2021 are in Cuyahoga County (Cleveland), OH (13.3 percent of pre-foreclosure homes are empty); Broome County (Binghamton), NY (11.9 percent); Pinellas County (Clearwater), FL (11.4 percent); Onondaga County (Syracuse), NY (10.6 percent) and St. Clair County, IL (outside St. Louis, MO) (9 percent).

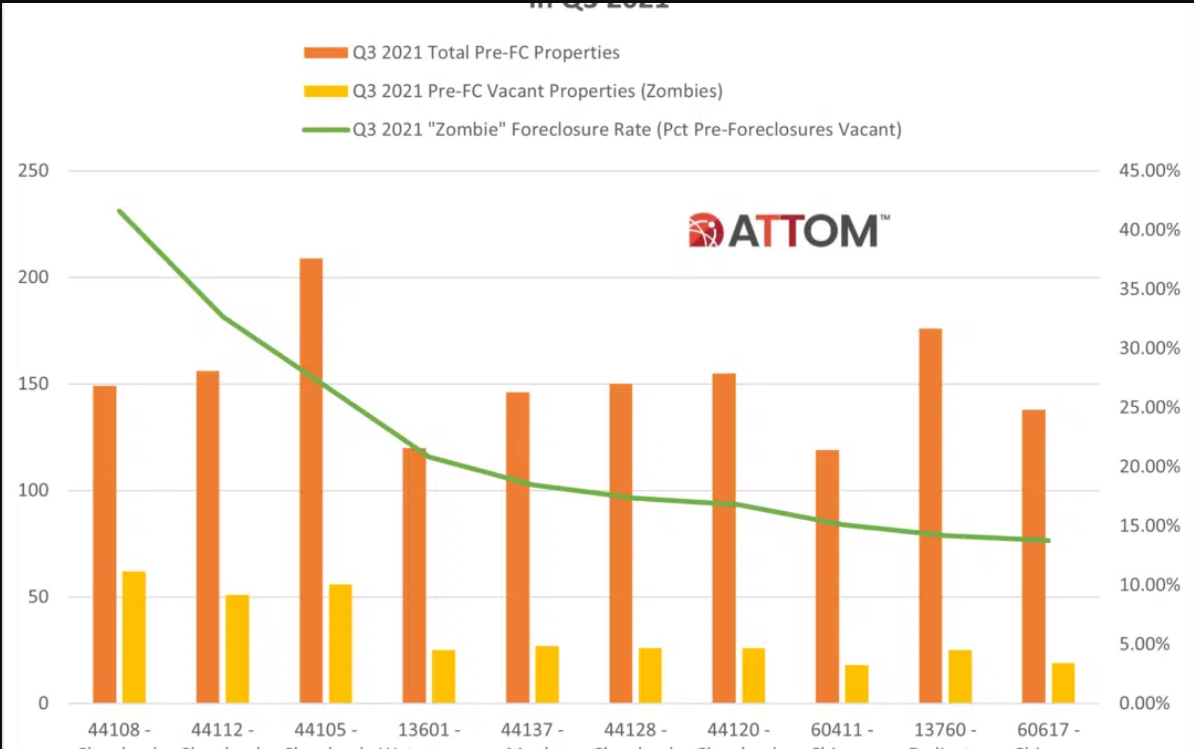

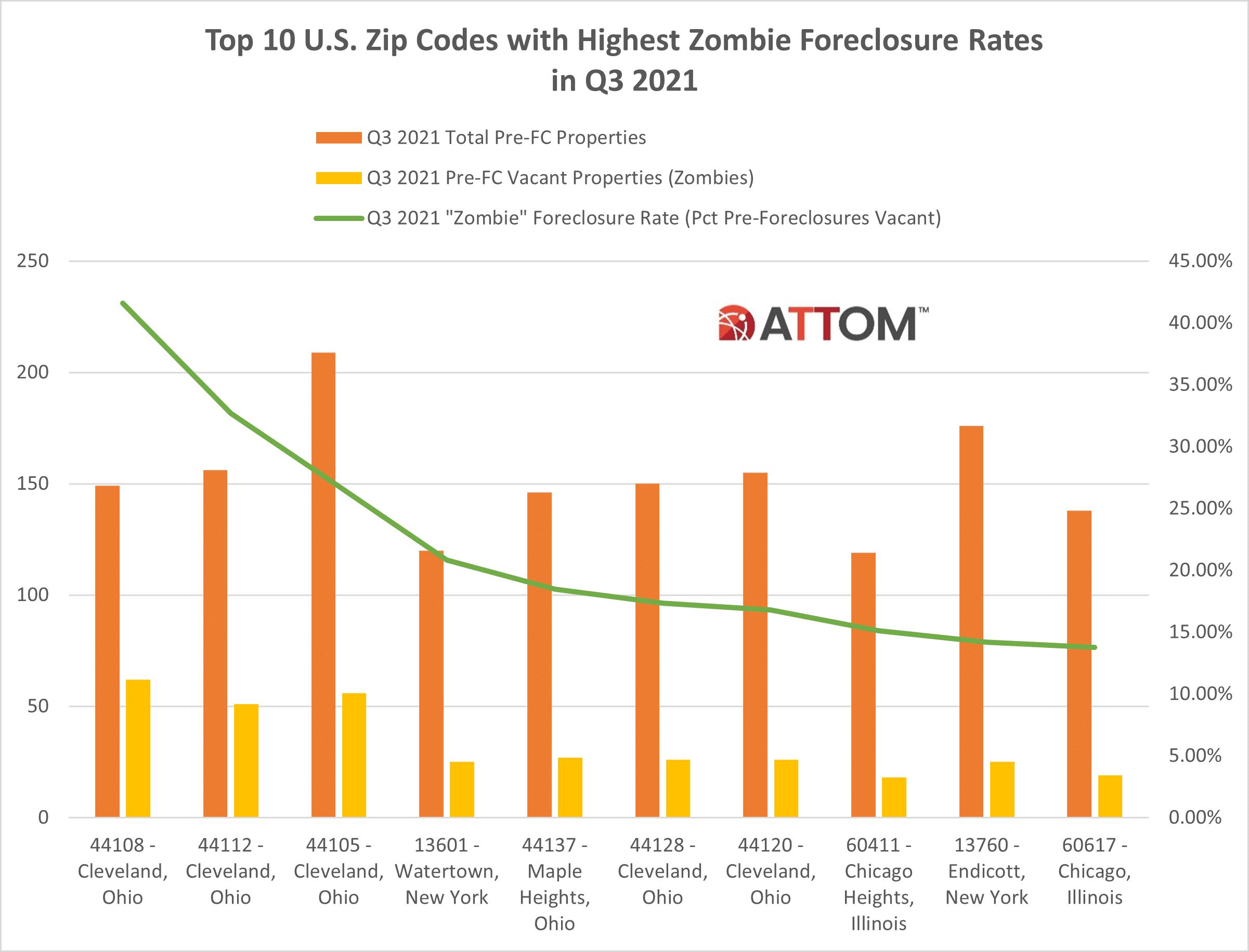

In this post, we take a deep dive into the data to uncover the top 10 U.S. zip codes with the highest zombie foreclosure rates among those zip codes with at least 100 properties in foreclosure. Those zips include: 44108 – Cleveland, OH (41.61 percent); 44112 – Cleveland, OH (32.69 percent); 44105 – Cleveland, OH (26.79 percent); 13601 – Watertown, NY (20.83 percent); 44137 – Maple Heights, OH (18.49 percent); 44128 – Cleveland, OH (17.33 percent); 44120 – Cleveland, OH (16.77 percent); 60411 – Chicago Heights, IL (15.13 percent); 13760 – Endicott, NY (14.20 percent); and 60617 – Chicago, IL (13.77 percent).

ATTOM’s Q3 2021 vacant properties report also noted that vacancy rates for all residential properties in the U.S. declined to 1.35 percent in Q3 2021 (one in 74 properties), from 1.42 percent in Q2 2021 (one in 70) and 1.58 percent in Q3 2020 (one in 63). The report noted the states with the biggest quarterly decreases in overall vacancy rates are Oregon (down from 1.8 percent of all homes in the second quarter of 2021 to 1.3 percent in the third quarter), Maryland (down from 1.7 percent to 1.1 percent), Wisconsin (down from 1.4 percent to 1 percent), Mississippi (down from 2.2 percent to 1.9 percent) and Minnesota (down from 1.5 percent to 1.2 percent).

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.