Athleisure – and workleisure – are having a moment. After the long months of shelter-in-place, many consumers are looking for clothes that make them look presentable without sacrificing the comfort they got used to during the lockdowns. But is the surge in athleisure translating to offline success for bona fide sportswear brands? We dove into visit trends at Nike and Under Armour to find out.

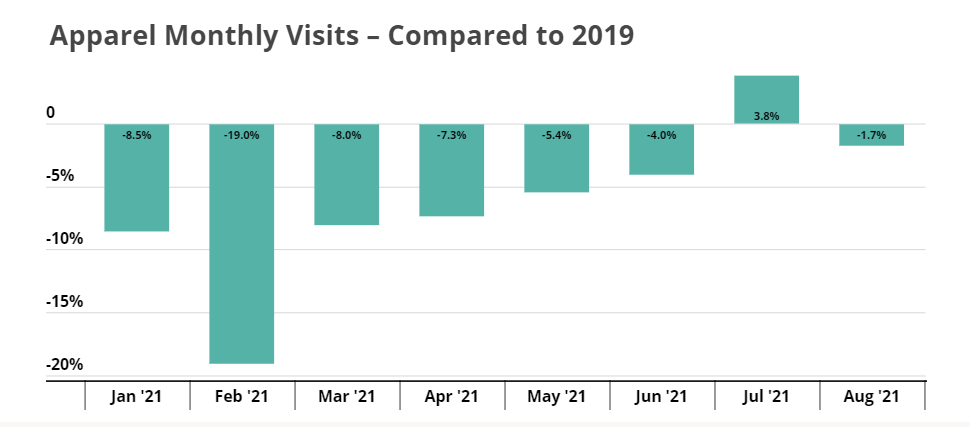

Slow Overall Apparel Recovery

The nationwide apparel recovery as a whole has been slower than in other industries. July is the only month this year where the sector managed to reach visit growth compared to 2019, and foot traffic dropped again in August amidst renewed COVID concerns. Maybe apparel visits dropped because more consumers are buying clothes online; or perhaps shoppers are still excited to wear their existing items that have been gathering dust in their closets for the past year and a half.

Brand recoveries should be understood within the context of a slow return to 2019 visit levels across many leading clothing brands.

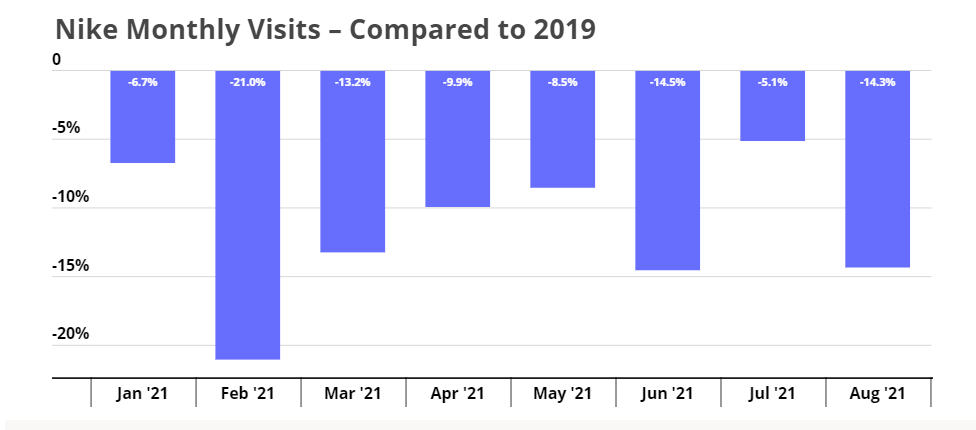

Nike’s Slow Offline Recovery

Nike has been open about its belief that “digital is the new normal” and has been investing in its website and mobile apps – so it’s important to remember that the brand’s brick-and-mortar locations is just one component of its overall business model. Still, the athletic wear giant has been experiencing a steady offline recovery. Visits in July were just -5.1% lower than they had been in July 2019, a strong result considering that season was a particularly successful one. But in August, as visits dipped again in the face of rising COVID cases, traffic dropped back to -14.3% below August 2019 levels.

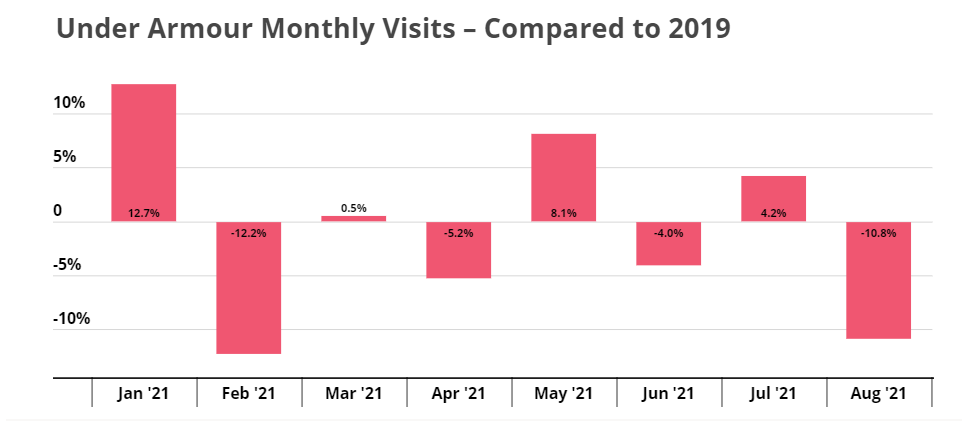

Under Armour’s Mixed Performance

Like Nike, Under Armour has been investing in digitization over the pandemic, but the brand’s offline performance is also benefiting from a renewed focus on owned retail. Year-over-two-year monthly visits have been equal to or higher than the nationwide apparel average every month this year except for August, with July visits up 4.2% when compared to July 2019.

And while the brand seems to have had a particularly difficult August, the low visit numbers are not necessarily cause for concern, especially with the wider sector seeing a visit decline later in the month as well.

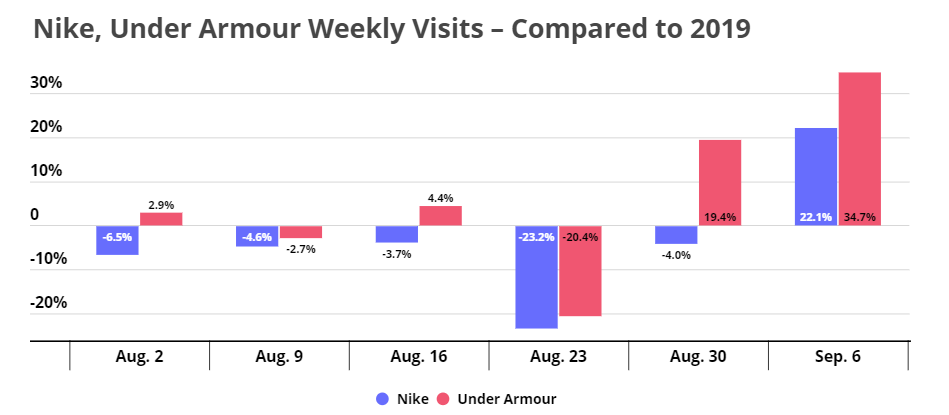

The Best is Yet to Come

And, indeed, early September data reveals that Under Armour and Nike visits have been rebounding strongly since the beginning of September. Weekly visits for the week beginning September 6th were up significantly for both brands – a 22.1% increase for Nike and a 34.7% increase for Under Armour compared to the equivalent week in 2019.

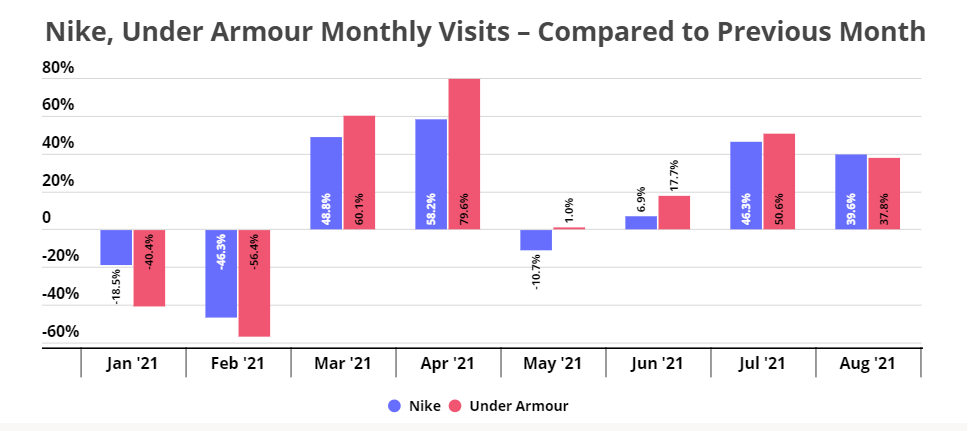

Both brands have also been experiencing a consistent month-over-month growth in visits for the past three months. June visits compared to May were 6.9% and 17.7% higher for Nike and Under Armour, respectively; visits in July to Nike and Under Armour stores were up 46.3% and 50.6%, respectively, compared to June; and August visits in comparison with July were up 39.6% for Nike and 37.8% for Under Armour.

If the monthly growth in visits is any indication – the best is yet to come for these sportswear leaders.

Will Under Armour return to year-over-two-year visit growth in September? Will Nike make a full offline recovery by the end of 2021?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.