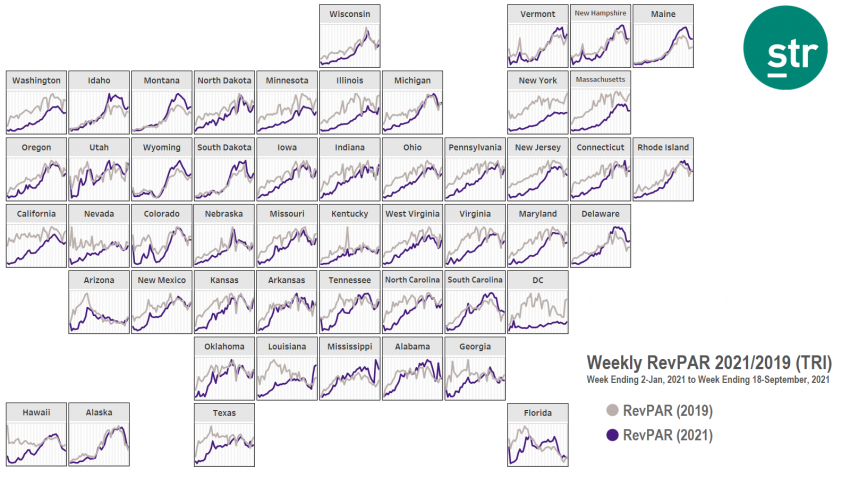

STR’s monthly 51-chart map focusing on revenue per available room (RevPAR) on a total-room-inventory basis shows a variety of recent national/regional market trends as well as the general pace of the industry’s continued recovery from the pandemic.

With Labor Day marking the unofficial end of the summer leisure-oriented travel season, recent weeks have produced a dip from summer peaks in many markets with ground lost from 2019 RevPAR levels. This expected seasonal slowing in U.S. hotel business is evidenced in most states’ performance.

At the same time for the four weeks ending with 18 September, 21 states outperformed their comparable 2019 average RevPAR, led by Maine (index score of 143 or 43% above 2019 levels) and Mississippi (142). A range of leisure-oriented regions, such as upper New England and the northwestern mountain states, continued to report strong RevPAR surpluses. Likewise, hurricanes along the Gulf coast also contributed to major surges in room demand (and subsequent RevPAR) for Louisiana (123), Mississippi and Alabama (114).

Washington D.C continues to sit well behind 2019 levels (RevPAR index score of 41, down from last month’s score of 51). Its recent four-week average RevPAR was US$69 compared with 2019’s US$168. Sizable shortfalls also continue in New York state (64, 2 points down from last month’s report), Illinois (74) and Massachusetts (74).

Fortunately, as reported in our latest Market Recovery Monitor, early indications for the fall season have shown signs that business travel and group demand are improving amid “conference season.”

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.