Summer 2020 undoubtedly looked much different around Europe due to the global impact of the COVID-19 pandemic. Fast forward to this year, and there was hope that the region’s effort toward a more “normal” summer would be successful.

On 1 July 2021, the EU Digital COVID Certificate Regulation entered into application, allowing fully vaccinated tourists to avoid tests or quarantines and broaden the list of European regions in which they could travel. July and August are historically two of Europe’s most important months for hotels with travellers spread across the continent on summer holidays, so have efforts like the aforementioned digital COVID certificate helped Europe’s hotels avoid another lost summer?

Occupancy & ADR recovery

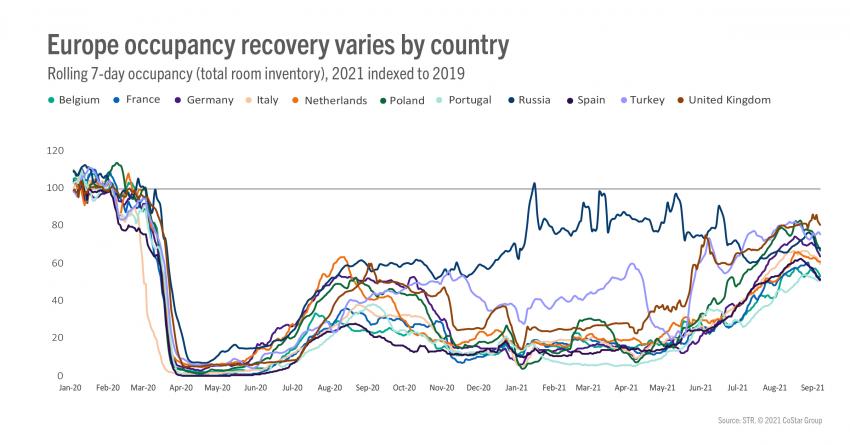

As noted in a previous article, the U.K. is still leading the way in occupancy recovery, and most recently for the week ending 5 September, sat at 77.0% of the comparable 2019 level. Turkey (72.7%) ranked second when indexed against 2019, while Russia (68.3%) was third.

Much lower on the list for that opening week of September, Belgium, France, Italy, Netherlands, Portugal, and Spain had only recovered between 50.2%-66.0% of 2019 levels.

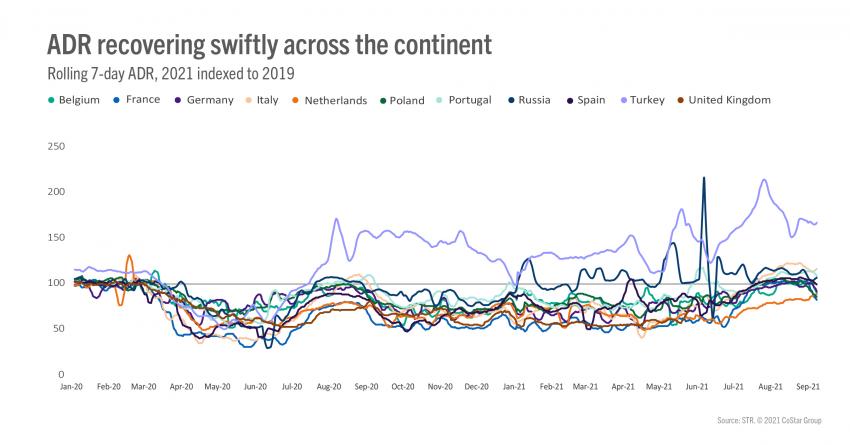

In terms of ADR, Europe has shown much stronger levels of recovery. For the week ending with 5 September, Italy posted ADR well above (116.3%) its 2019 level and followed closely by Portugal (108.6%) and Russia (106.7%).

Northern leisure destinations much further ahead

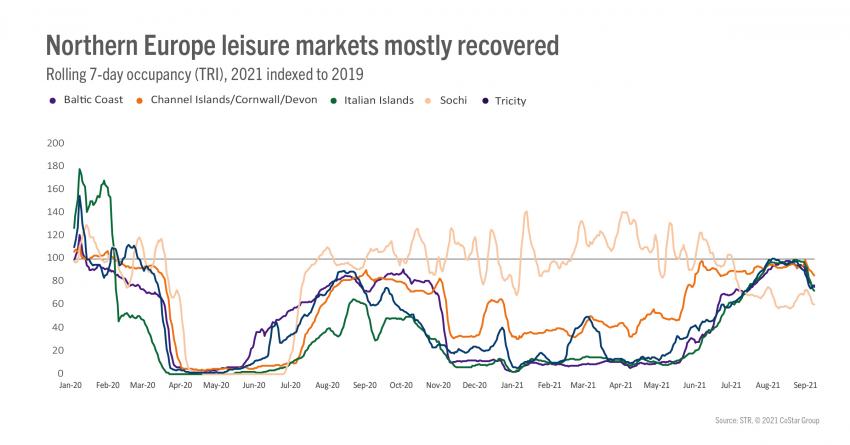

Northern Europe leisure markets saw strong performance during summer months driven by domestic demand.

For the week ending with 5 September, the STR-defined markets of Channel Islands, Cornwall and Devon in the U.K. recovered to 86.0% of 2019 occupancy levels. Tricity in Poland (77.0%) and the Baltic Coast in Germany (76.0%) also showed solid levels.

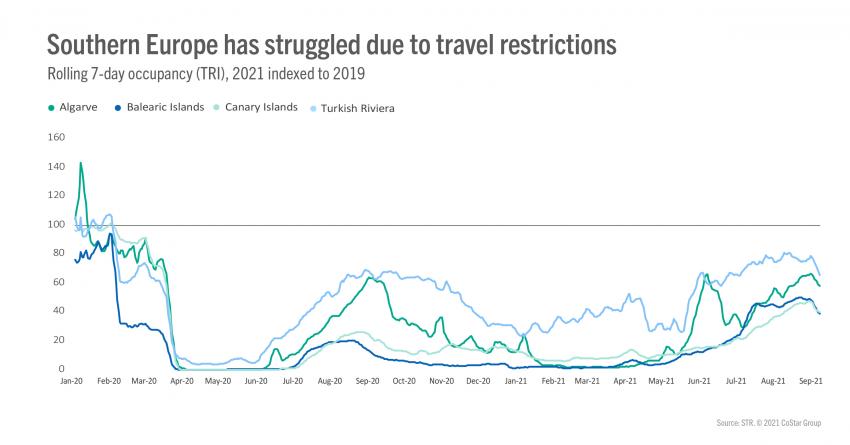

On the other hand, Southern Europe leisure markets have struggled. Travel restrictions, particularly from key outward-bound markets, like the U.K. and its traffic light system, has had a negative impact for this region.

The Turkish Riviera and Algarve posted levels that were 65.5% and 58.0% of 2019 levels, respectively, for the week ending with 5 September.

The Balearic and Canary Islands reached less than 40% occupancy of the 2019 comparable.

Conclusion

With more than 70% of adults in Europe fully vaccinated, the region’s recovery is underway with levels getting closer to 2019 comparables. Although these summer months could have not reached the highest expectations, they have been better than summer 2020.

On another positive note, leisure markets continue to drive performance for countries across the continent as consumers swap international breaks for staycation destinations.

The latest development with the U.K. removing international travel restrictions from 4 October is worth noting and may affect Europe’s recovery timeline.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.