This year’s back-to-school season was different in a lot of ways for many children, but not much changed in retailers’ pursuit of their parents’ spend. In this week’s Insight Flash, we use our unique ability to cut our data by households with children to see where back-to-school growth was strongest. We examine average ticket growth by subindustry, changes in channel trends, and which brands are most exposed to households with children.

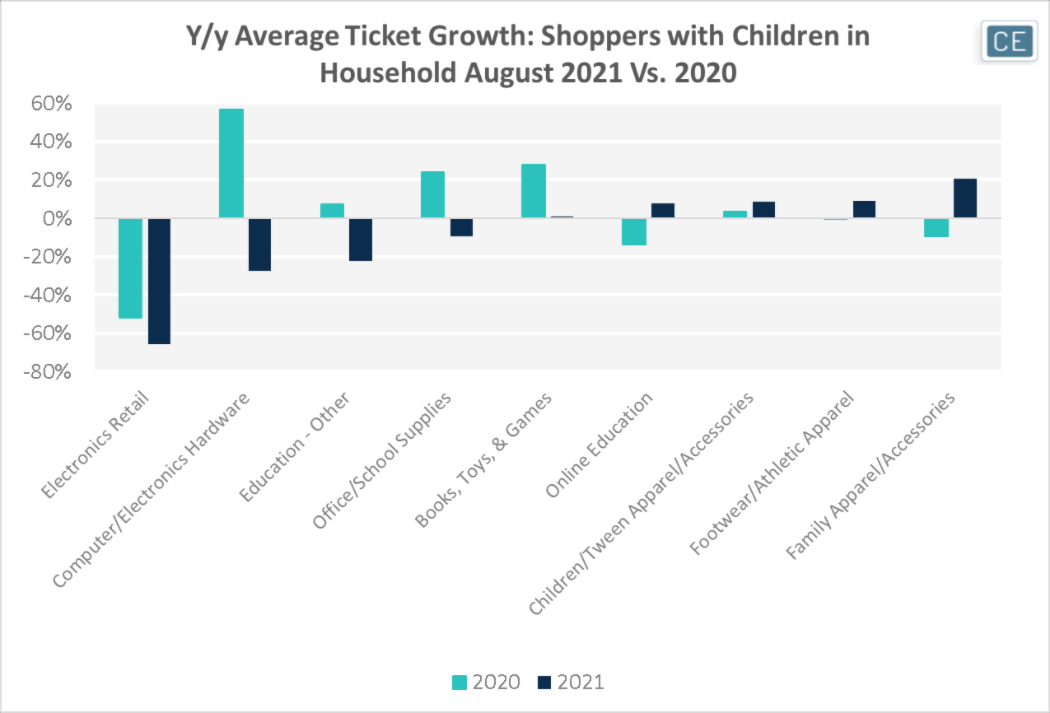

Since last year some brick-and-mortar stores were closed, especially in popular back-to-school venues like malls, average ticket growth by subindustry can control for number of transactions as an indicator of where spend might be growing. One thing the data indicates is pent-up demand for in-person outfits. The average ticket for Family Apparel/Accessories grew 20.5% y/y among households with children, while ticket for Footwear/Athletic Apparel grew 8.9% and ticket for Children/Tween Apparel/Accessories grew 8.7%. Meanwhile, electronics spend was down after last year’s purchases of at-home classroom devices.

Average Ticket Growth in Back-to-School Subindustries

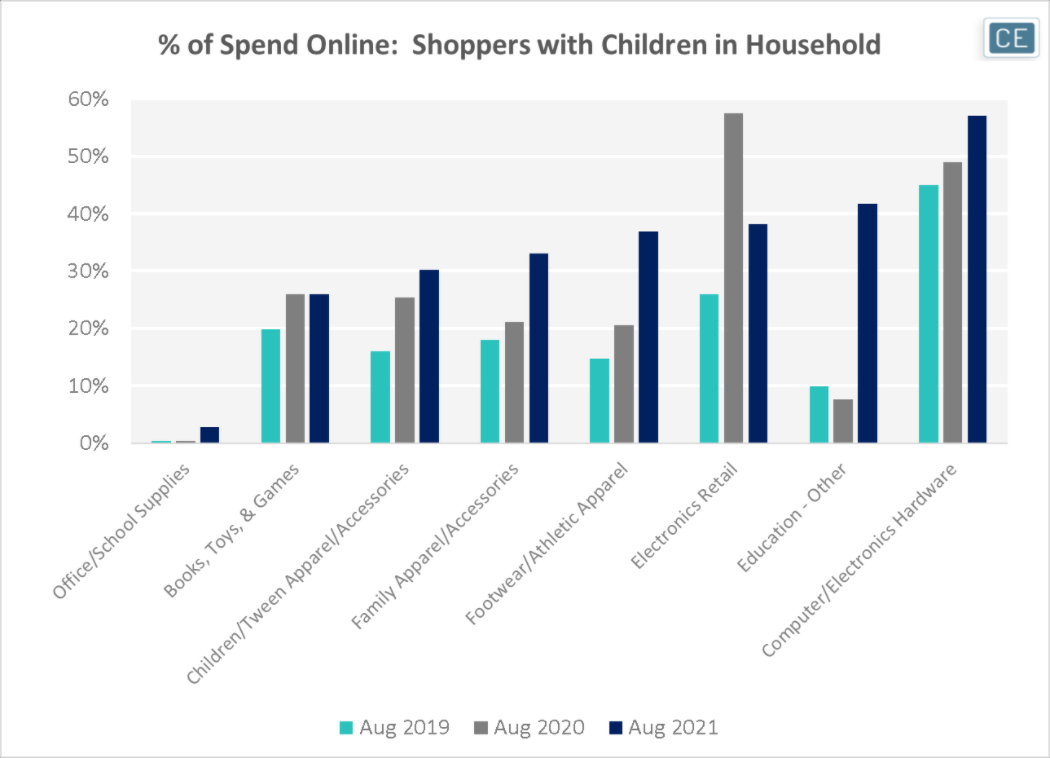

One back-to-school surprise is that even with more in-person shopping open, the % of spend online is still higher in 2021 than it was in 2020. With the exception of Electronics Retail, every single other Back-to-School subindustry is showing a higher share of spend online this year versus last year. Among these, it’s notable that Footwear and Family Apparel both had a double-digit delta rise in share of spend online in August 2021.

Online Spend in Back-to-School Subindustries

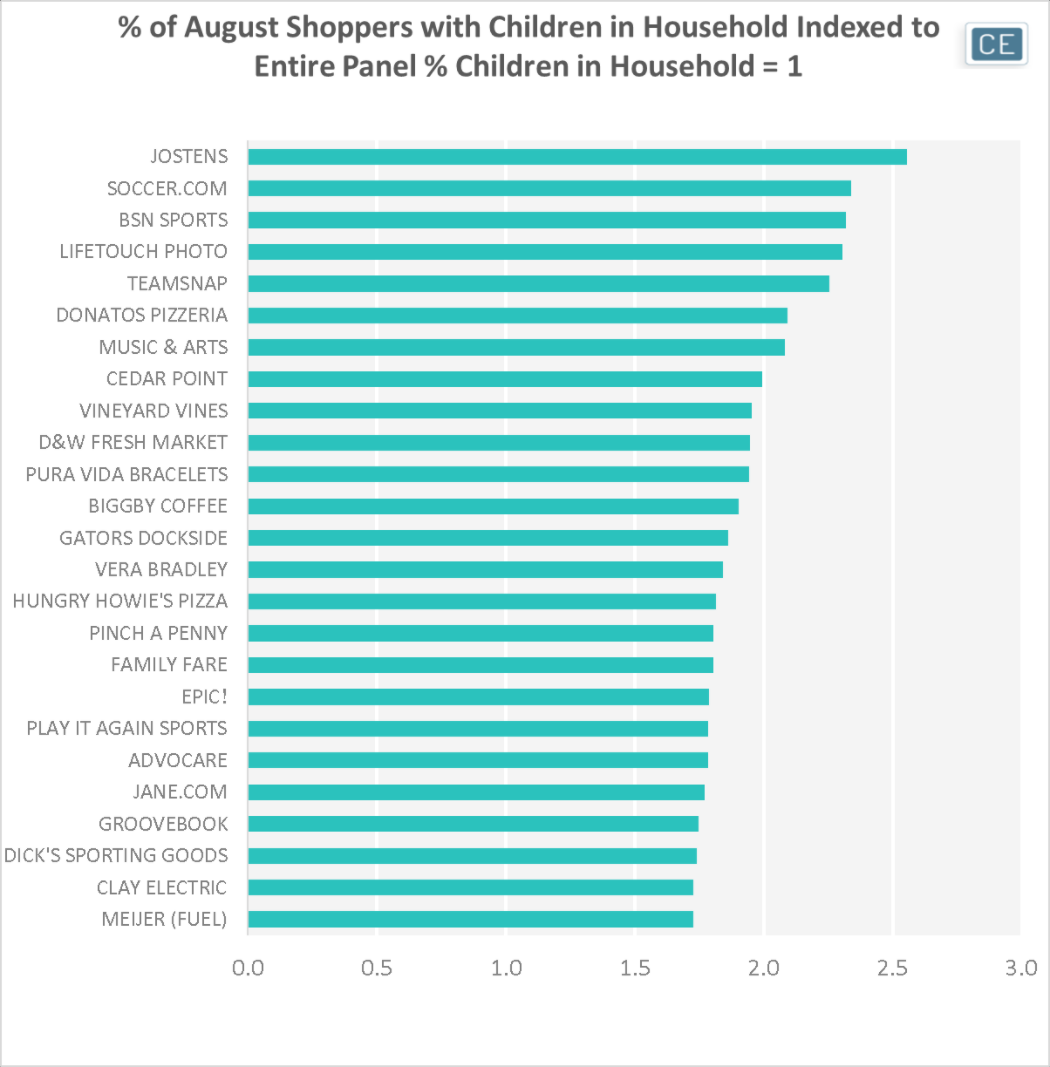

Among the brands most likely to be shopped by families with children in the household (relative to the percentage of our panel with children in the household) are Jostens and sports brands such as Soccer.com, BSN Sports, and TeamSnap. Among Back-to-School subindustries, some notable brands that are highly exposed to Back-to-School trends include Vineyard Vines, Pura Vida Bracelets, and Vera Bradley.

Back-to-School Exposure

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.