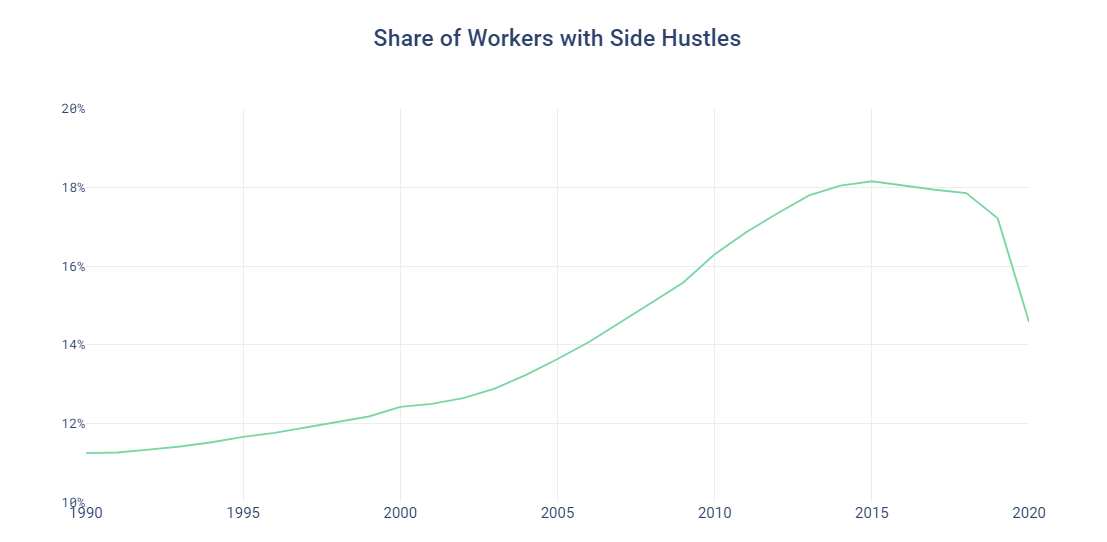

When Dolly Parton spun her classic 9-to-5 into an ode to side hustles for Super Bowl commercials, it sparked controversy as to whether hustle culture is the new norm. But is this really a ‘whole new way to make a livin’? By looking at online profiles who list more than one concurrent position, we can track the rise and fall of hustle culture in the American economy:

Between 1990 and 2015, side hustles became increasingly prevalent. At the peak of hustle culture, 18% of workers had a secondary job. As conversations on work-life balance and mental health became more audible, this trend took a downward turn.

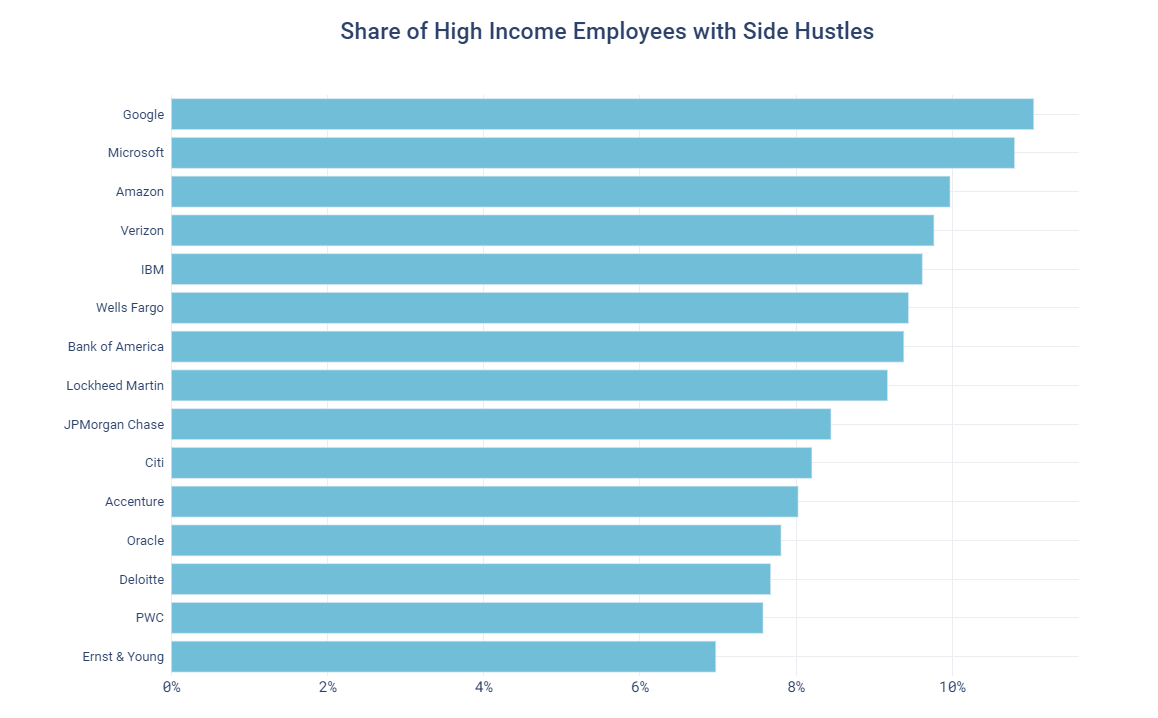

An important distinction to make in this context is between a secondary job necessary for a living wage, versus a passion project. Below are the companies with the highest shares of employees with side hustles, when their primary position earns above-median salaries:

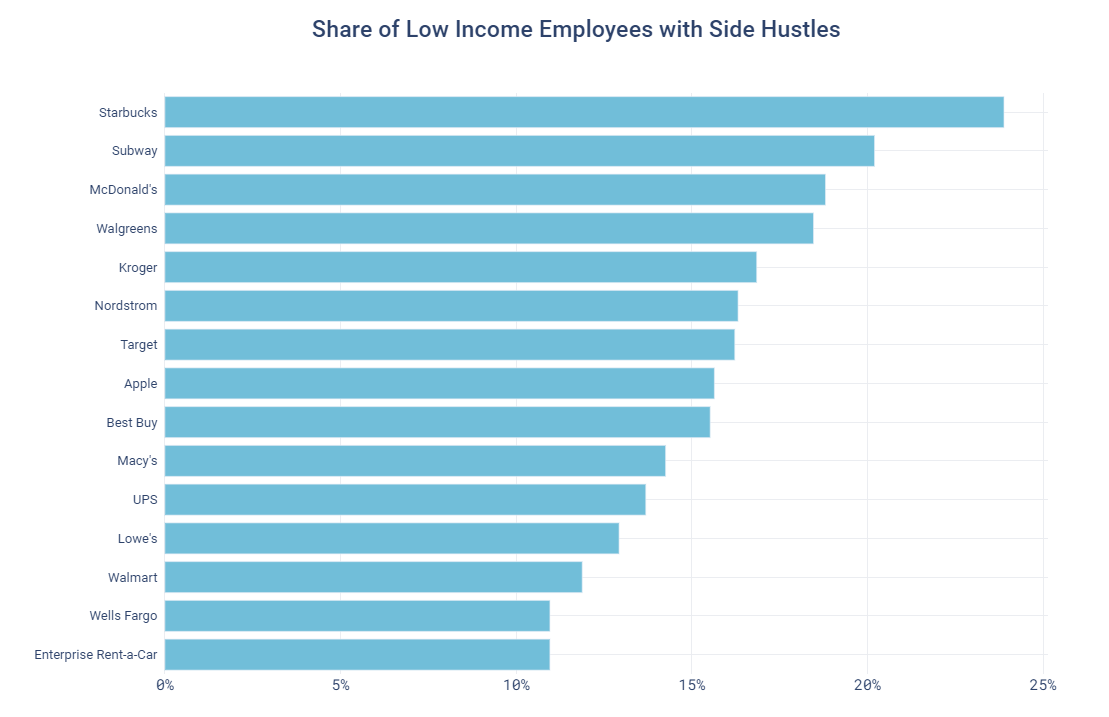

And below are the companies with the highest shares of employees with side hustles, when their primary position earns below-median salaries.

Key Takeaways:

To learn more about the data behind this article and what Revelio Labs has to offer, visit https://www.reveliolabs.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.