After a difficult winter, Brazil’s hotel occupancy is once again on the rise, reaching 44% in August 2021, or about 74% of the 2019 comparable. While occupancy recovery has been slow, the country’s rebound in average daily rate (ADR) has been strong, with monthly rates even exceeding 2019 levels earlier this year. August ADR reached BRL295.05, which was just 3.4% below 2019, as shifts in demand and supply have helped drive impressive ADR performance.

Domestic demand

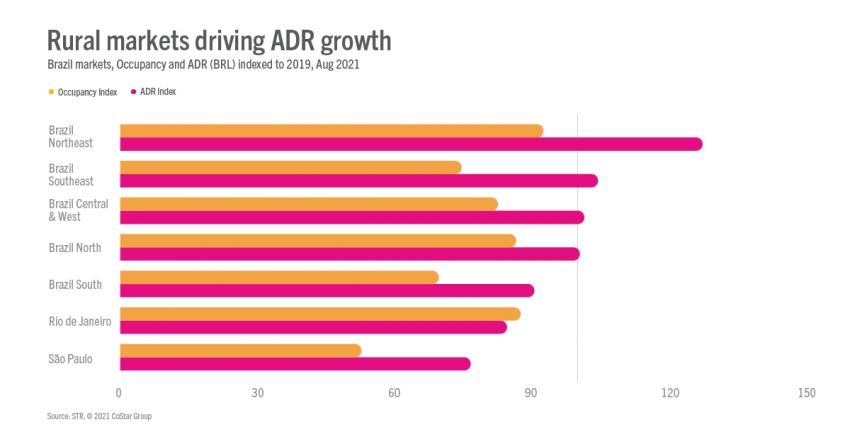

With international travel difficult at best, impossible at worst, Brazil’s hoteliers have relied almost entirely on domestic demand. This has led to strong performance in popular domestic vacation destinations outside of the country’s major markets.

While domestic destinations should anticipate continued strong performance in the short-term, it is likely that ADR will soften over time as international outbound travel resumes. Attracting international arrivals will help to offset the loss of domestic demand when that happens.

Temporary closures

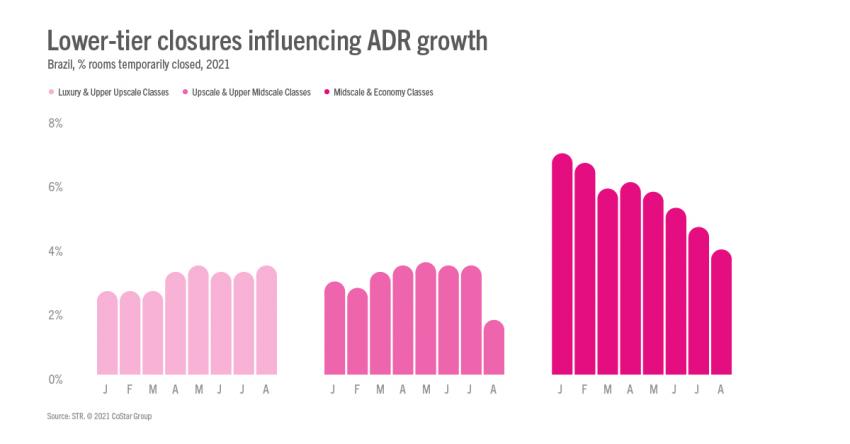

Temporary hotel closures have also played a role in strengthening rates this year. Midscale and Economy class hotels continue to show the highest temporary closure rates, which has played a role in pushing the country’s 2021 ADR in comparison with 2019.

Nationally, ADR should decline as lower-priced hotels reopen. This wouldn’t necessarily represent a decline in pricing power, but rather reflect a shift in market makeup.

Land of leisure

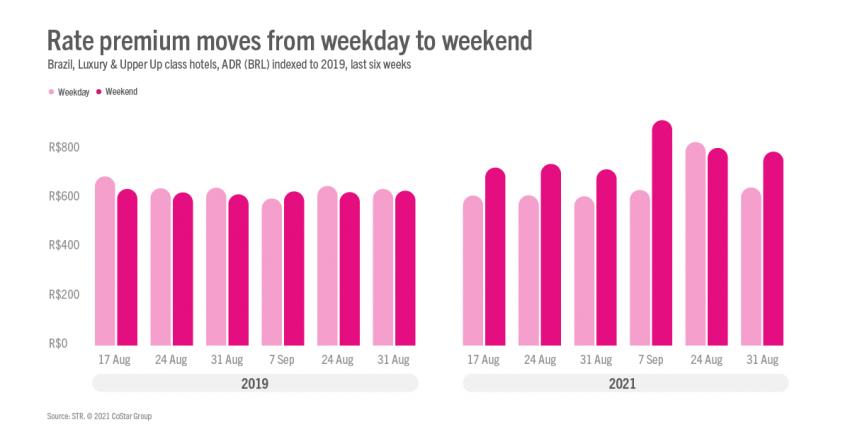

Similar to Europe and the U.S., Brazil’s high-end hotels have maintained the most pricing power, with Luxury and Upper Upscale class ADR exceeding 2019 levels for four consecutive months this year.

Part of that growth can be attributed to shifts in demand segments. While in 2019 weekday ADR outpaced weekend ADR, the opposite is true this year, and the premium between day-of-week ADR has increased.

Weekend-based leisure travel has recovered much more rapidly than weekday-based business demand. Risk aversion, work-from-home policies, and cost-cutting measures have significantly dampened business travel, and those factors will continue to depress weekday rates through the end of the year.

Conclusion

While August ADR fell just short of 2019 levels, August and September are typically some of the weakest ADR months in Brazil. Additionally, summer 2020 rates were extremely strong, despite the lack of vaccines available at the time, leading to increasing optimism for the warm months ahead. For Brazil, hitting 2019 rates during high season won’t be problematic; rather, hoteliers will be looking to sustain summer success this time around.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.