Dating app industry growth has been a hot topic throughout the COVID-19 pandemic, as social distancing drove many U.S. consumers to virtual platforms to find love and make new friends. As in-person meetups are resuming, a number of dating apps have also rolled out features to help users filter potential matches by vaccination status. An analysis of a select group of companies in the online dating industry reveals that Bumble experienced the strongest increases in paid subscribers early on in the pandemic, as well as a second boost during the summer of 2021. However, industry veteran eHarmony earns the distinction of having the highest average lifetime sales per customer.

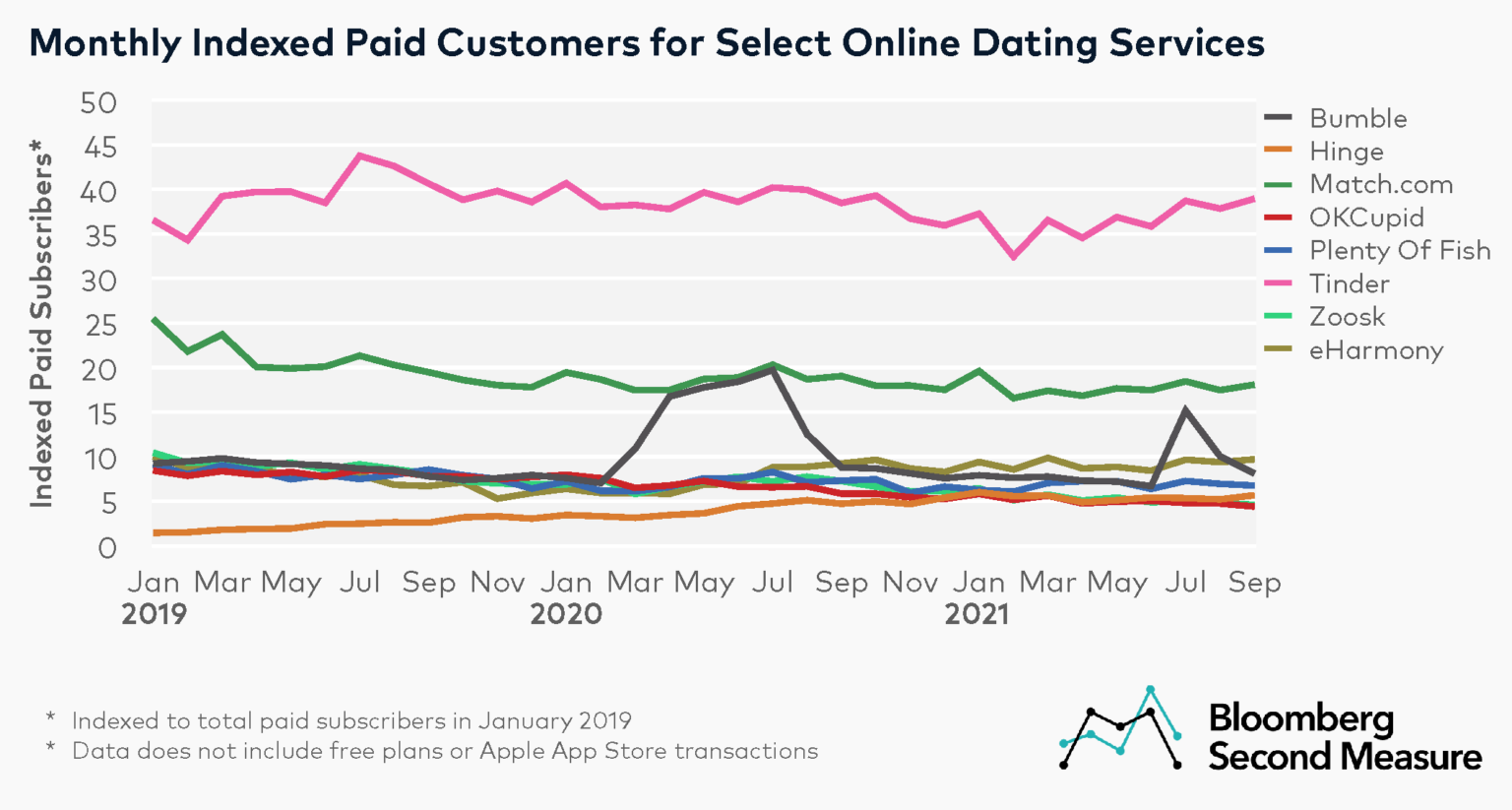

Tinder has the most paid subscribers among the online dating companies in our analysis

When looking at online dating industry trends, some of the main competitors include dating apps like Tinder, Bumble, and Hinge, in addition to online services that predated the smartphone era, like Match.com, eHarmony, Plenty Of Fish, OKCupid, and Zoosk. Among the competitive set, Tinder led the pack for the highest number of paid subscribers, followed by Match.com. Both Tinder and Match.com fall under the Match Group parent company, which also includes Hinge, OKCupid, and Plenty Of Fish. It is also worth noting that Bloomberg Second Measure data does not include users who have free plans, nor does it observe transactions made through the Apple App Store.

Bumble–which went public in February 2021 and is a Tinder competitor that differentiates itself by only allowing women to initiate conversations after a match–experienced the highest bump in paid subscribers during certain periods of the pandemic, notably March through July of 2020 and again in July 2021. Between February and March of 2020, Bumble’s paid subscribers increased 54 percent, while the majority of the other companies experienced a month-over-month decrease in paid subscribers. One potential factor is that Bumble was an early adopter of built-in video for its app, a useful feature during the shelter-in-place period that has since been offered by competitors such as Tinder and Match.com.

Bumble’s paid subscribers grew 125 percent between June and July of 2021, while the average month-over-month increase for all competitors in this period was only 13 percent. Around this time, Bumble announced its plans to open a retail cafe in New York, as an in-person complement to its online matchmaking service.

Hinge, one of the newer dating services in this analysis (founded in 2012), has consistently seen the highest year-over-year growth in paid subscribers during the pandemic. More specifically, Hinge was the only company in the analysis to experience positive year-over-year growth every month since January 2019.

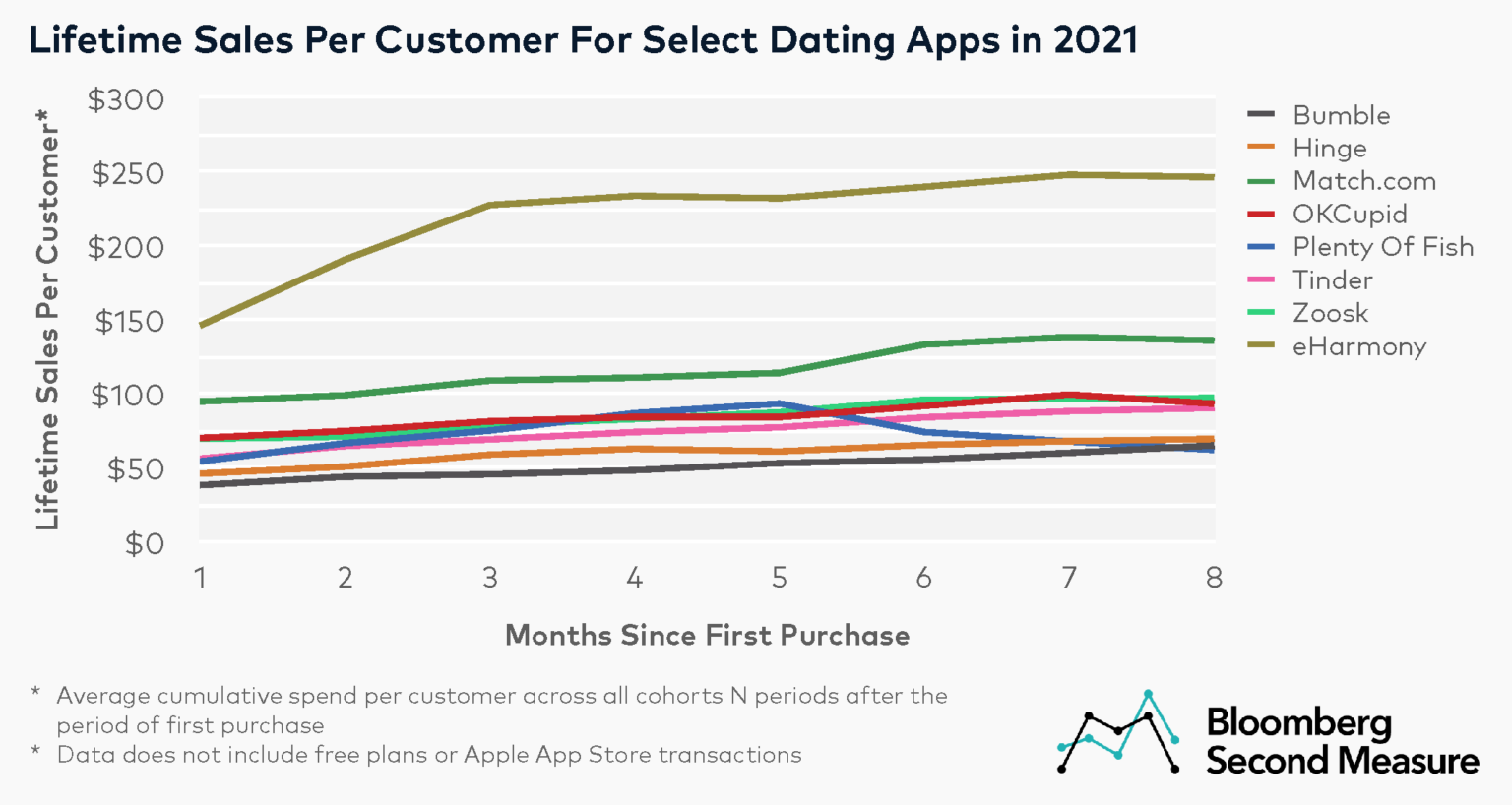

eHarmony has the highest average lifetime sales per customer year-to-date in 2021

Among the online dating services in the competitive set, eHarmony has the highest average lifetime sales per paid subscriber to date in 2021, with $247 after 8 months. Match.com came in second with an average lifetime sales per customer of $136. Plenty of Fish and Bumble had the lowest average lifetime sales per customer in this time frame, with $62 and $65, respectively.

Paid options differ by dating service and may account for variations in average lifetime sales. For example, eHarmony’s premium service offers 6-month, 9-month, and 12-month subscriptions, which can be paid upfront or over up to 4 payment periods. Tinder offers three subscription tiers (Plus, Gold, and Platinum) and Bumble also offers multiple paid plans as well as single-use paid features. All companies in the analysis also offer free plans with limited features. Free plans are not included in Bloomberg Second Measure’s dataset.

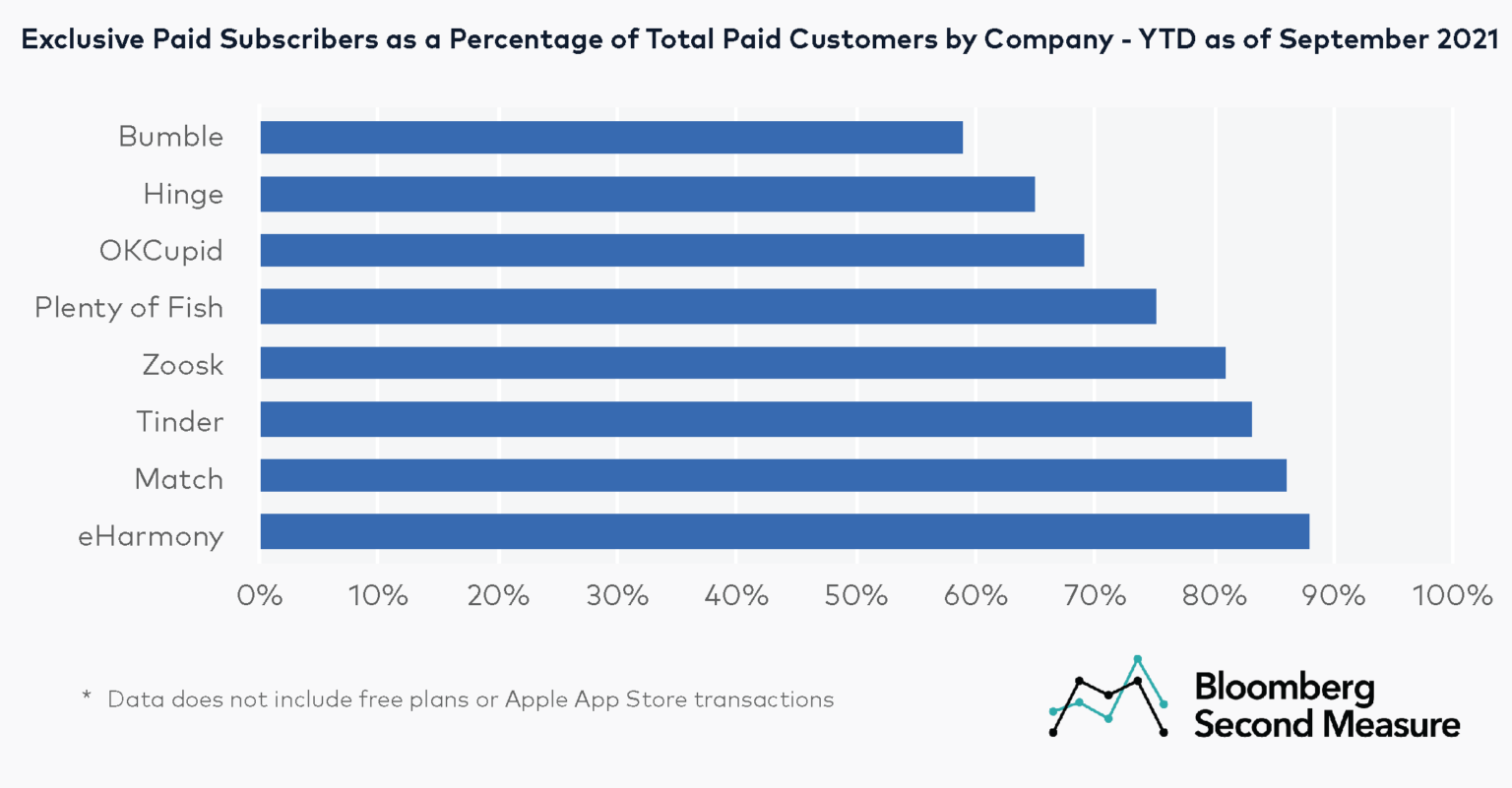

Are users paying for multiple online dating services?

When it comes to paid subscriptions, consumers tend to be loyal to one company. Among the online dating services in our analysis, eHarmony had the highest percentage of exclusive paid customers, with 88 percent purchasing only from eHarmony and not any of the other services year-to-date in 2021. Match.com was second highest in terms of customer loyalty, with 86 percent exclusively paying for Match. Bumble had the lowest percentage of exclusive paid customers, with only 59 percent.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.