Last year’s Halloween was essentially cancelled by COVID as the United States entered its third COVID wave. This year, the holiday overlapped with the waning of the fourth wave, so we looked into the foot traffic data to find out – did 2020’s pent-up demand lead to a spike in halloween-related retail visits?

Uneven Performance Across the Sector

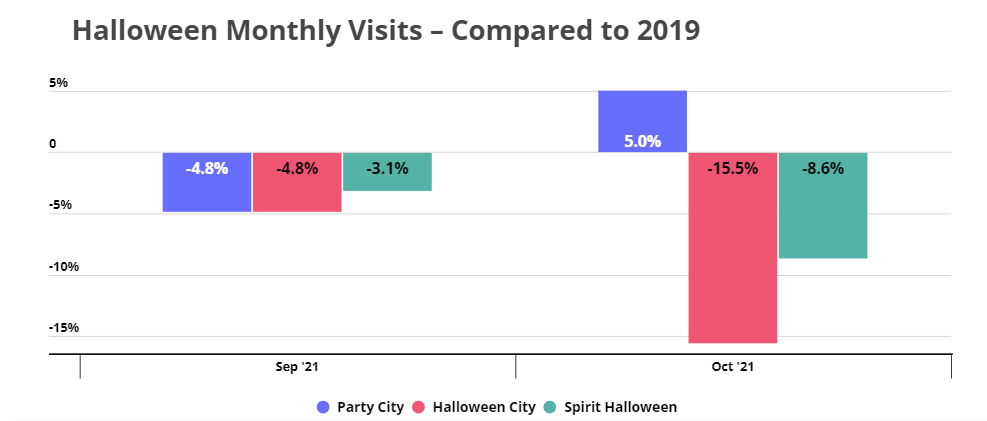

Although all three brands analyzed still had year-over-two-year visit deficits in September, Party City managed to close the gap in October to exhibit a 5.0% increase in visits compared to 2019. But visits to Party City’s Halloween-themed pop-up, Halloween City, took a plunge as the holiday approached, and ended up with a 15.5% decrease in visits compared to October 2019. Spirit Halloween, the one chain dedicated exclusively to selling Halloween paraphernalia, also saw visits down 8.6%.

Critically though, these numbers are being compared to the peak period for visits for these chains in 2019 – and COVID cases did have an impact on traffic, especially early in the month. The relatively minor gaps speak to an impressive revival for these chains as they operated in an especially difficult environment.

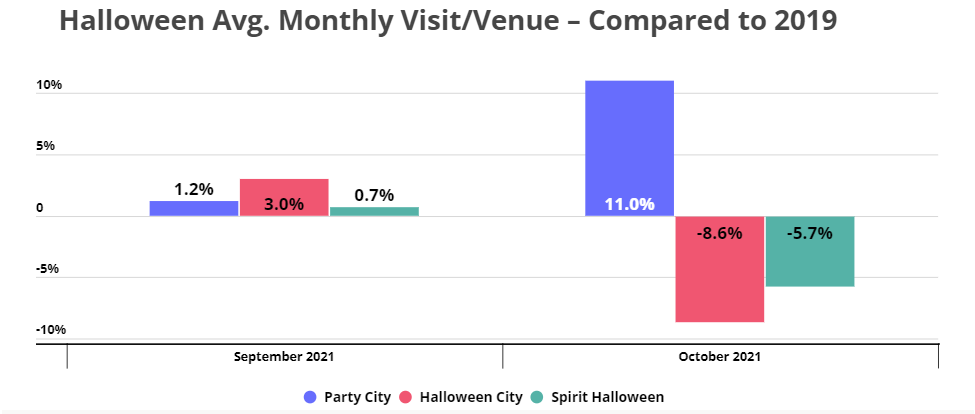

And some of the visit loss can be attributed to a reduction in stores. Party City permanently closed over twenty stores in 2020, which could explain why the October year-over-two-year increase in visits-per-venue was almost double the increase in overall foot traffic to the brand. Focusing on year-over-two-year visits-per-venue numbers instead of overall change in foot traffic also yields a much smaller visit gap for Halloween City, with year-over-two-year visits-per-venue down only 8.6% compared to the 15.5% decrease in overall visits. Spirit Halloween also performed better on the visits per venue metric than on the overall visit metric, with year-over-two-year average visits per venue down only 5.7%.

Interestingly, year-over-two-year visits per venue were up in September for all the brands analyzed. This may mean that consumers started shopping for Halloween early this year. After missing the opportunity to dress up and prepare their home for trick-or-treaters last year, people may have been extra excited about this year’s holiday and eager to get a jump start.

Will Party City visits continue to increase over the holiday season?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.