At the beginning of the pandemic, the automotive (OEM) category pulled the emergency brake and endured a long, uphill battle against supply chain shortages, operational hurdles, and disruptions to long-term development strategies. By April 2020, car sales in the U.S. plummeted by 47%. As we turn the corner to a new year, many of these consequences have since resolved themselves but have left permanent scars on the automotive industry.

Today, we’ll analyze the top four advertisers in the auto category within each major market (U.S., Europe, Korea, Japan) during the height of the pandemic. These top players include Toyota, Hyundai, Ford, and Volvo. We’ll review their spending habits and creative strategy during this period to glean how these brands adapted to shifting consumer needs and demands in a fast-changing world.

Toyota focuses on fostering community

Toyota is the best-selling car manufacturer in the U.S. and the number one car brand advertiser from May 2020 to May 2021, spending just over $118M and earning 14B paid impressions from their digital campaigns. In addition to claiming the top advertiser spot, Toyota also pushed an impressive volume of creative (17,421). For comparison, Hyundai, the second-place spender, promoted 8,741 ads during the same period.

Despite the pandemic, winter storms and an ongoing chip shortage, Toyota ramped up spending in February ($13.7M) to push the newly redesigned and high-margin Toyota Sienna. Other top ads include Facebook campaigns promoting their dedicated fan page. Amid COVID-19 lockdowns, people found solace in online groups and communities to stay connected, while social distancing kept them apart from friends and loved ones. So it’s no surprise that when car sales took a hit, Toyota opted to help their customers cultivate community to keep the Toyota love going while the company, and the world at large, struggled to navigate the new normal.

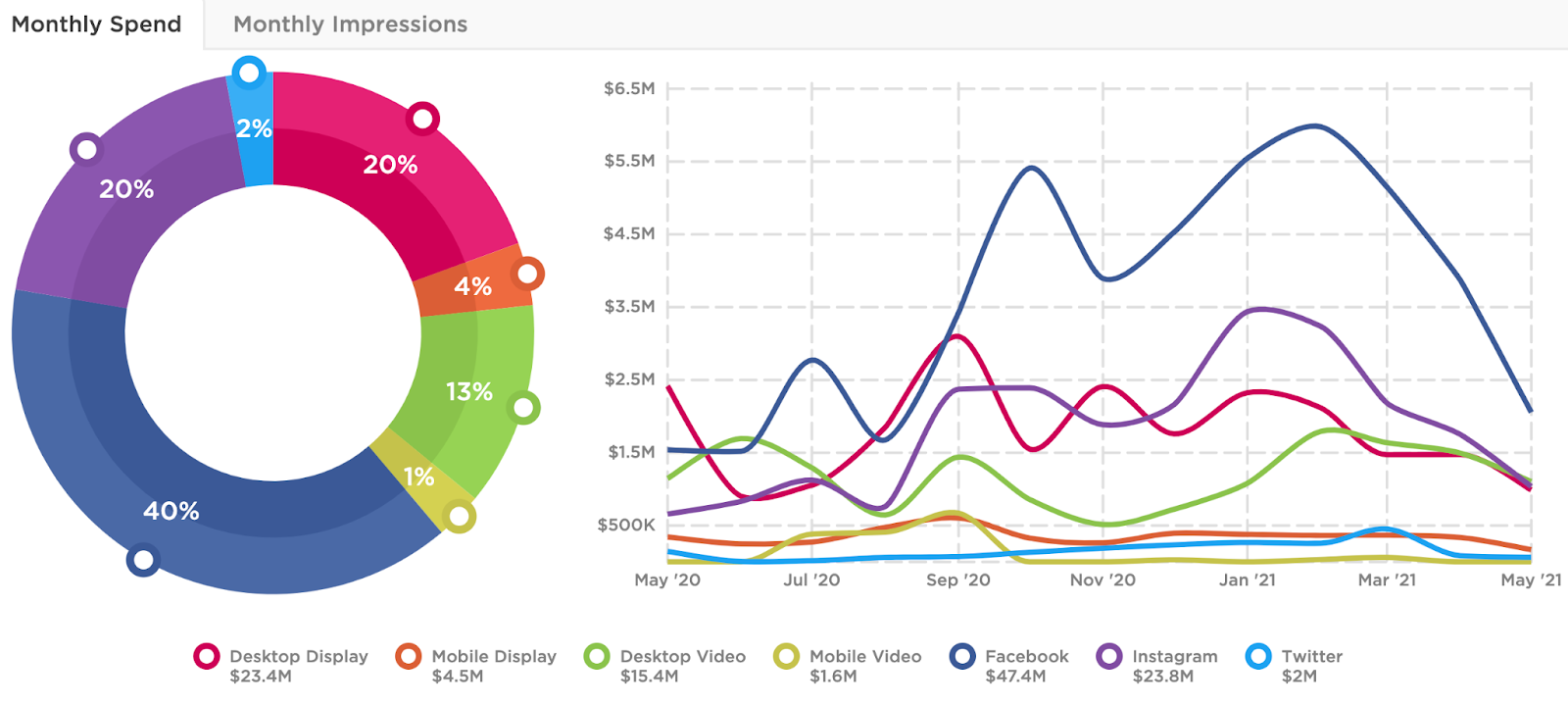

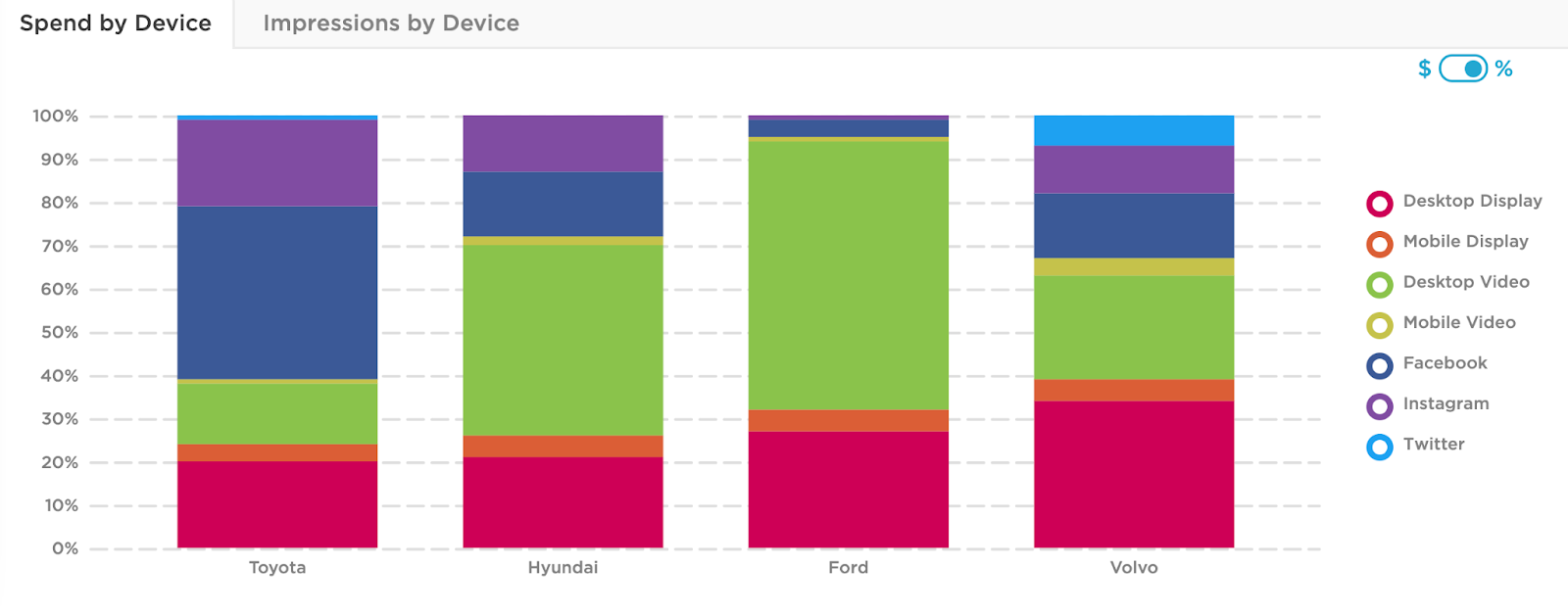

The lion’s share of Toyota’s ad budget was funneled into Facebook (40%), followed by Instagram (20%) that tied with Desktop Display at 20% spend share. Out of the top four advertisers, Toyota invested the most in Instagram, a smart move when you consider that Toyota is the most accessible and affordable car brand for new, young car buyers on this list.

28% of Toyota’s impressions came from Desktop Display ads it ran on Amazon in May 2020, yielding 1.4B impressions. Amazon Vehicles helps customers get the information they need when shopping for vehicles, parts and accessories. Yet another strategic play on Toyota’s end since many people use Amazon to discover, learn about and compare products. Consumers trust Amazon to help them make car purchase decisions, especially when factors such as affordability and vehicle reliability are top of mind.

Hyundai profits by embracing what they do best

During the Recession, Hyundai managed to perform well and emerged strong. When COVID-19 hit, Hyundai’s sales performed 50% better YOY than the industry average, and by the end of 2020, the brand’s market share increased by half a percentage point. The Korean car brand invested $97.2M in digital ads from May 2020 to May 2021, yielding 9.1B total impressions from over 8,000 creatives.

Affordability and fuel efficiency are important considerations to consumers shopping for a non-luxury vehicle. Hyundai has been hustling to improve its affordability and fuel efficiency across its product line for years while leaving a history of sub-par quality vehicles in the dust. When the pandemic hit, Hyundai adapted to the times and pivoted their digital strategy. Their top creative during this period reflect the company’s approach to promoting affordability with Hyundai’s Assurance Program, Payment Deferment, and APR/Cash Specials, in addition to highlighting their top-sellers fuel efficiency and newly added safety features.

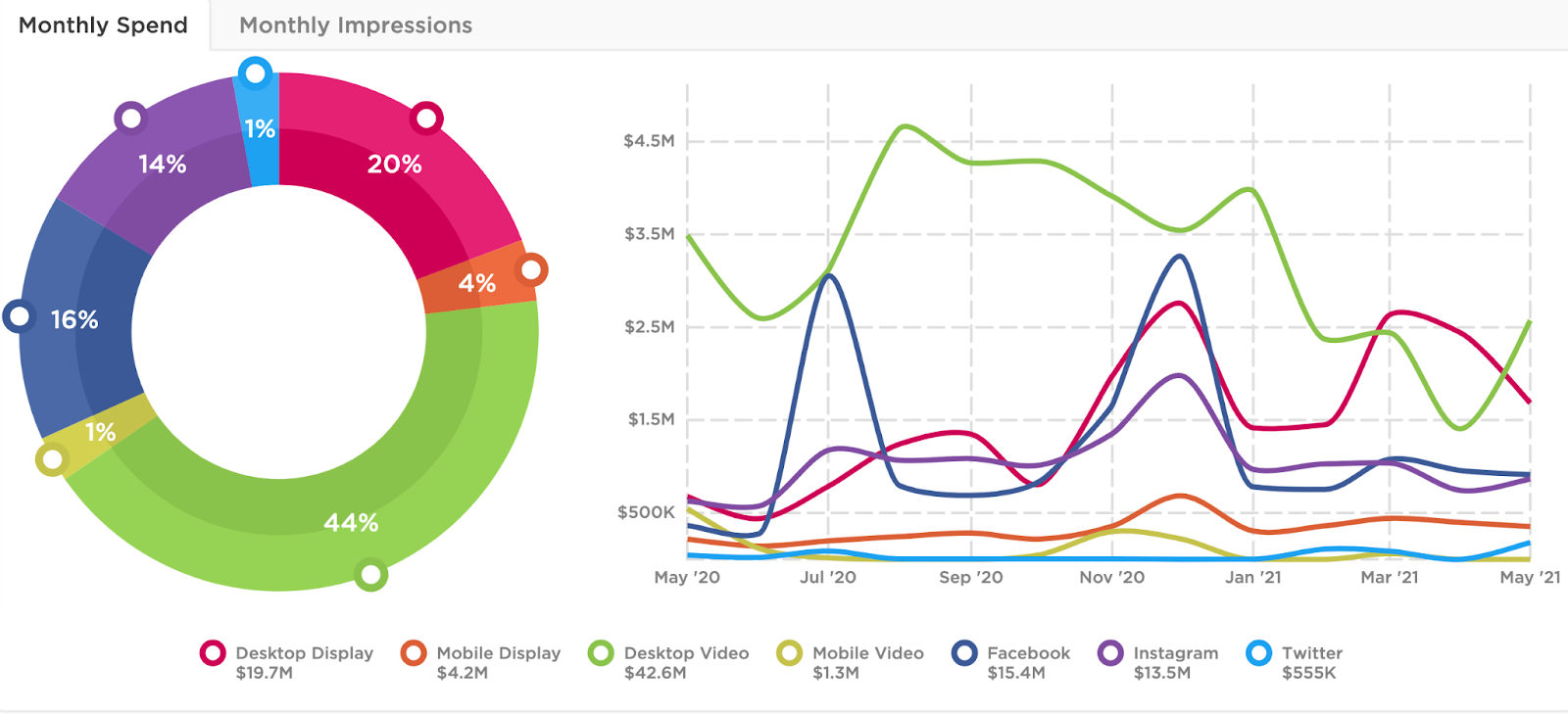

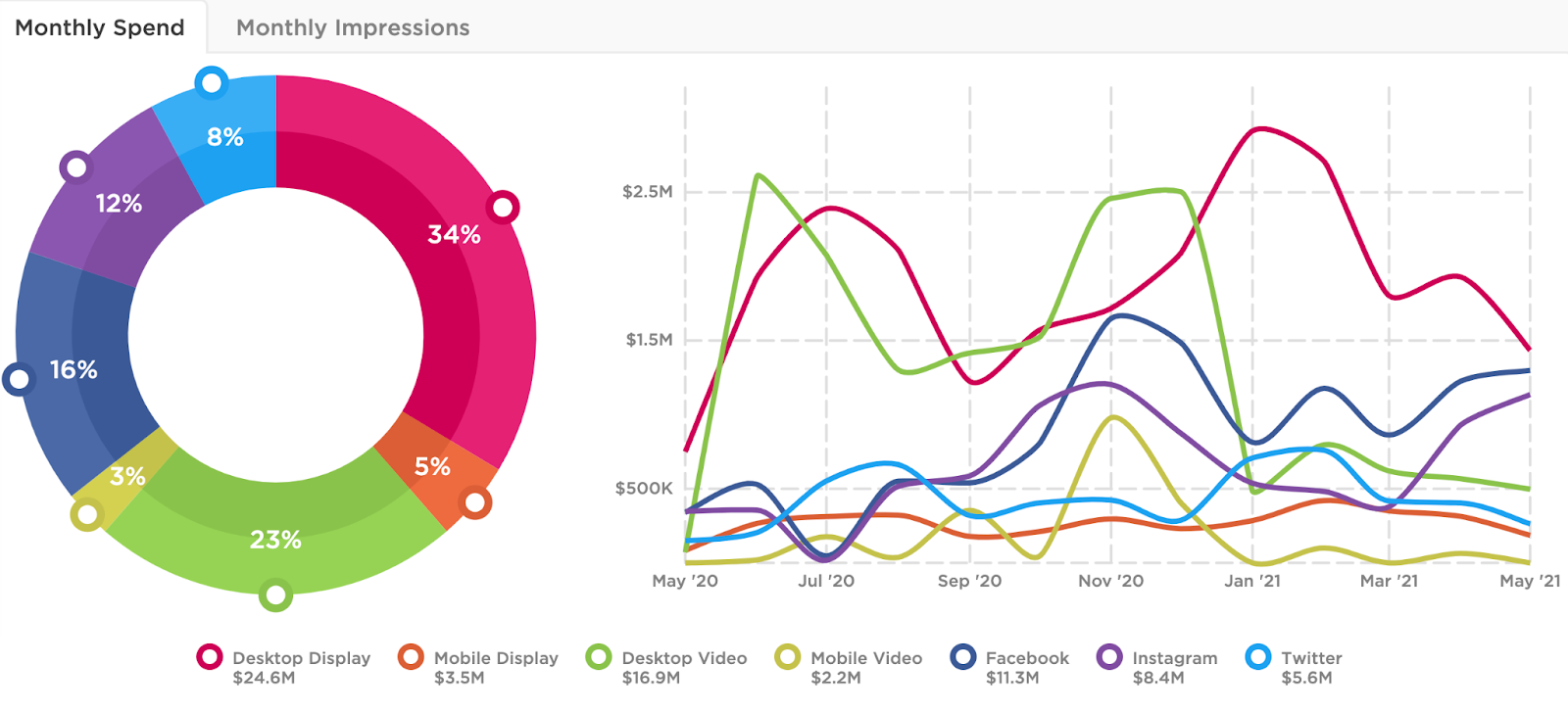

44% of Hyundai’s ad budget went to Desktop Video, followed by Desktop Display (20%), with Facebook coming in third at 16% spend share. We see more uniform distribution when looking at impression share, with 29% of total impressions coming from Desktop Video, 27% from Desktop Display, and 20% from Facebook.

Ford reinforces its corner on the emergency vehicle market

In February 2021, Ford Motor reported a YOY 14.1% decrease in sales. The American car company’s struggles were compounded by winter storms, the chip shortage, and a still-raging pandemic. At one point, the company assembled thousands of its high-margin F-150s without their essential chips, stowing them in a massive parking lot that could be seen from space.

Still, Ford emerged as one of the top advertisers in the automotive category during this period ($75M). Ford is the second-largest U.S. automaker and the largest seller of police vehicles. The company controls more than half the police vehicle market in the U.S. While fleet sales account for only a tiny share of the company’s total revenue, Ford invested substantial ad dollars into promoting this side of the business. However, emergency vehicle fleets provide a steady income for the automaker in an otherwise highly cyclical industry. As the country’s emergency health services continue to buckle under the strain of new outbreaks and variants, financial shot callers in the medical field would immediately think of Ford to meet their needs.

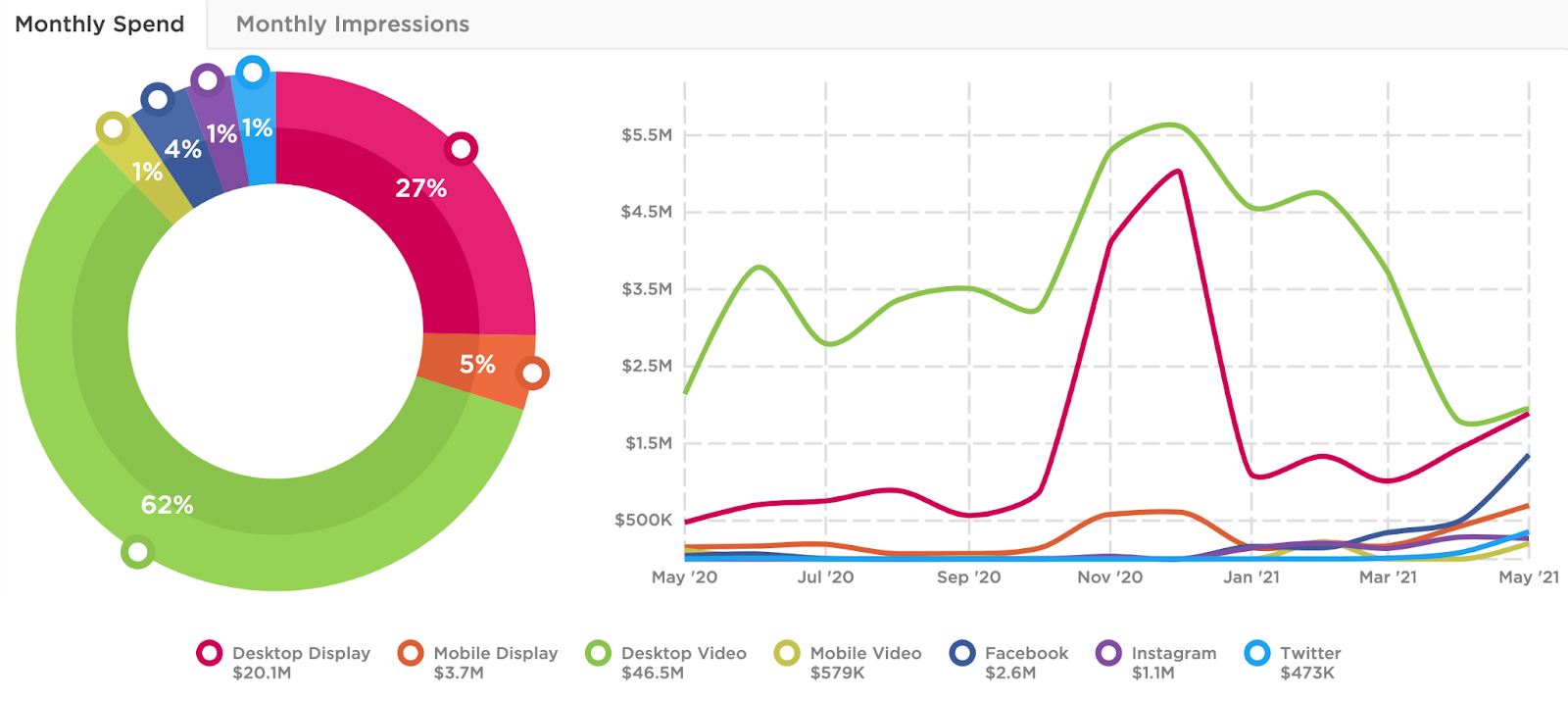

Ford invested 62% of its total ad budget in Desktop Video, the highest spend share of any auto brand on this list. 44% of their total budget was funneled into Youtube campaigns.

Volvo spends big on Desktop Display

Swedish-owned Volvo was also not exempt from the global chip shortage, which caused a major delay in manufacturing activity and forced several Volvo production plants to close for brief periods. Volvo invested $72.4M into its digital campaigns. Interestingly, the Swedish car company spent $20M less than second-place advertiser Hyundai ($97.2M) but pulled in nearly 1 billion more impressions (9.9B) than their Korean-based competitor.

Volvo cars carry a track record of having one of the highest safety ratings on the road. Volvo’s creative strategy leaned into the brand’s commitment to safety and acknowledging the turbulent financial climate affecting their target audience. The company’s top video spot promoted Volvo’s Summer Savings Event, offering 0% financing for up to 5 years, with online buying and home delivery options available. Like Hyundai, Volvo played to its strengths and promoted campaigns that placed safety and vehicle reliability at the center of its message.

Among the top advertisers, Volvo invested the most in Desktop Display ads (34%), earning 47% of total paid impressions from the channel. The company funneled $6.9M (9%) of their ad budget into Yahoo, a sensible choice considering Yahoo and Yahoo Finance skew towards an older and more affluent demographic that can afford their vehicles.

The last year has presented numerous roadblocks for the automotive industry. Brands will need to continue to adapt to shifting consumer needs while dealing with the ripple effects of supply chain shortages and pandemic-related limitations. These brands adapted to the new normal by offering their customers community, financial incentives and support, and reinforcing brand preference through emotionally-driven creative that leaned into safety and accessibility. The auto industry is making a comeback, and we’re confident it’s revving up its engines for a stellar 2022.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.