As people return to the in-person experience of restaurant dining, you might expect mobile ordering to have tapered off. But food delivery apps like GrubHub, UberEats and DoorDash haven’t seen a slowdown in orders—even as they continue to make headlines for the wrong reasons.

“Food delivery app usage has not slowed down, even as consumers return to in-person dining more frequently,” Alisha Kapur of Similarweb told Reuters. Instead, the meal delivery market “is expected to turn to a phase of consolidation in the coming months as players look to adjust operations after the explosive boom in demand served up to them during the COVID-19 pandemic.”

The consolidation may also be an effective way for the biggest food delivery apps to fight against delivery fee caps, not to mention both expand and improve their relationships with local restaurants.

While there are dozens of delivery apps available, UberEats, DoorDash and GrubHub get the most attention (rightly so, with 96% of the market between them).

We wanted to know: while they’re fighting to reverse delivery cap fees in large cities and taking strides to repair relationships with local restaurants, how are these top delivery apps maintaining their advertising presence?

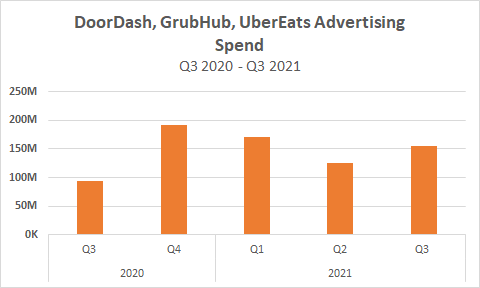

The biggest takeaway: advertising is speeding up, not slowing down—even compared to the companies’ ad spend in the second half of 2020, when consumers were assuaging their pandemic anxiety with tacos and poke bowls.

We’ll have to see how spending compares for Q4, but the first three quarters of this year tell a story of increased spending and experimentation with formats.

The headline: ad spend from GrubHub, Uber Eats, and DoorDash total $155.4M in Q3 this year.

This is up 24% from the previous quarter, and up 65% over Q3 ad spend last year. All three of the biggest food delivery apps are shifting where their ad dollars are going: DoorDash and UberEats have drastically increased their TV spend, while GrubHub is looking to stand out with digital advertising.

This year, DoorDash invested new ad dollars into events, sponsoring Home Delivery World, International Pizza Expo, and the National Restaurant Association Show. They’ve increased their TV presence by 97%, spending over $90M on their commercials in 2021.

GrubHub pulled some of their TV and most of their print ad spend this year, shifting it into their digital advertising (which is up 234%). But the biggest change is in doubling down their investments into social media (mostly Facebook and Snapchat)—spending on these platforms has increased by over 1,000% this year. The app’s podcast and native advertising has also heavily increased by 672%.

UberEats is also heavily increasing their TV spend this year, too. TV now makes up 90% of their budget, with over $50M invested in the format. The food delivery app has increased ad spend in all of their digital formats, with top spend allocated to Facebook, YouTube, OTT, and podcasting.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.