Introduction

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through August 2021.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The report is published monthly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes transition rates between states of delinquency and separate breakouts for 120+ day delinquency.

“The decline in the overall delinquency rate to its lowest since the onset of the pandemic is good news, but it masks the serious financial challenges that some of the borrower population has experienced. In the months prior to the pandemic, only one-in-five delinquent loans had missed six or more payments. This August, one-in-two borrowers with missed payments were behind six-or-more monthly installments, even though the overall delinquency rate had declined to the lowest level since March 2020.”

– Dr. Frank Nothaft

Chief Economist for CoreLogic

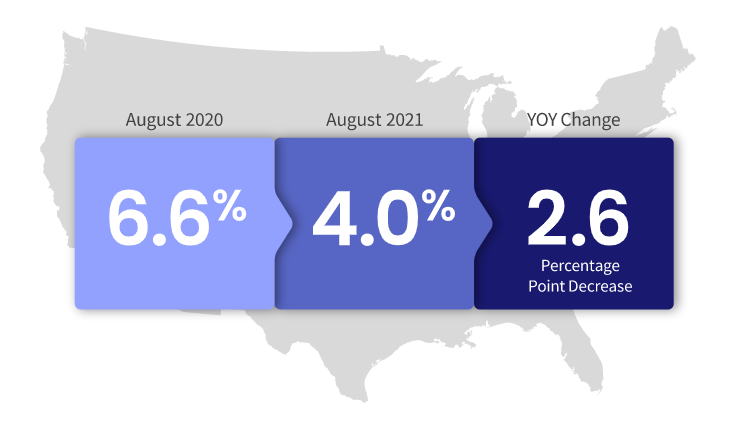

30 Days or More Delinquent – National

In August 2021, 4% of mortgages were delinquent by at least 30 days or more including those in foreclosure.

This represents a 2.6-percentage point decrease in the overall delinquency rate compared with August 2020.

Financial Challenges Persist

Facing slower than anticipated employment growth — August saw an increase of only 235,000 new jobs compared to the expected 720,000 — households have found creative ways to cut back on spending to prioritize mortgage payments. In a recent CoreLogic survey, over 30% of respondents said they would cut back on both entertainment and travel to focus on repaying outstanding debt. Income growth and a continued buildup in home-equity wealth will be important parts of financial recovery for borrowers hit hardest by the pandemic.

“The unprecedented fiscal and monetary stimuli that have been implemented to combat the pandemic are pushing housing prices and home equity to record levels. This phenomenon is driving down delinquencies and fueling a boom in cash-out refinancing transactions.”

– Frank Martell

President and CEO of CoreLogic

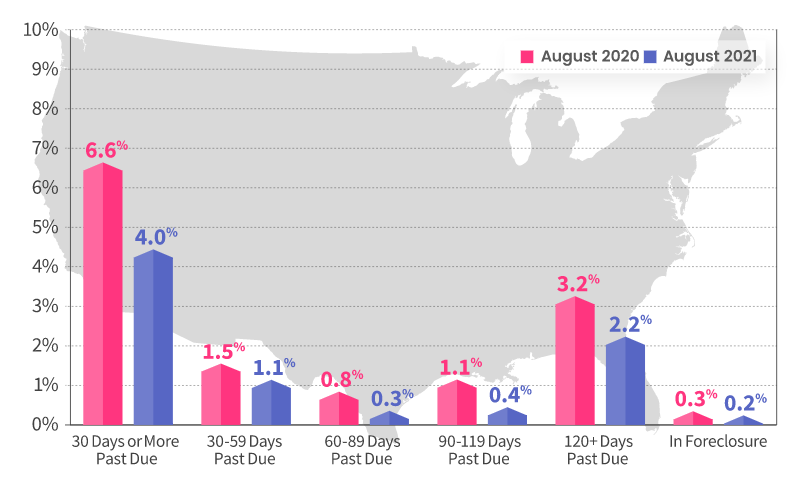

Loan Performance – National

CoreLogic examines all stages of delinquency to more comprehensively monitor mortgage performance.

The nation’s overall delinquency rate for July was 4%. The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.1% in August 2021, down from 1.5% in August 2020. The share of mortgages 60 to 89 days past due was 0.3%, down from 0.8% in August 2020. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 2.6%, down from 4.3% in August 2020.

As of August 2021, the foreclosure inventory rate was 0.2%, down from 0.3% in August 2020.

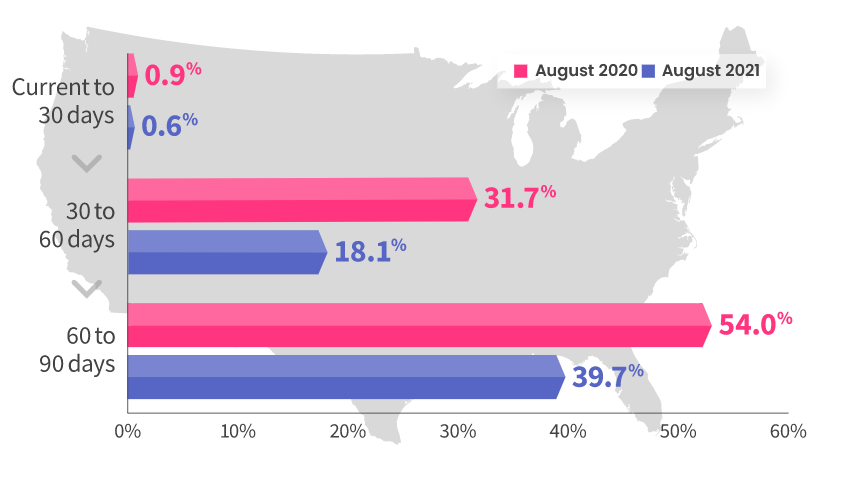

Transition Rates – National

CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The share of mortgages that transitioned from current to 30-days past due was 0.6%, down from 0.9% in August 2020.

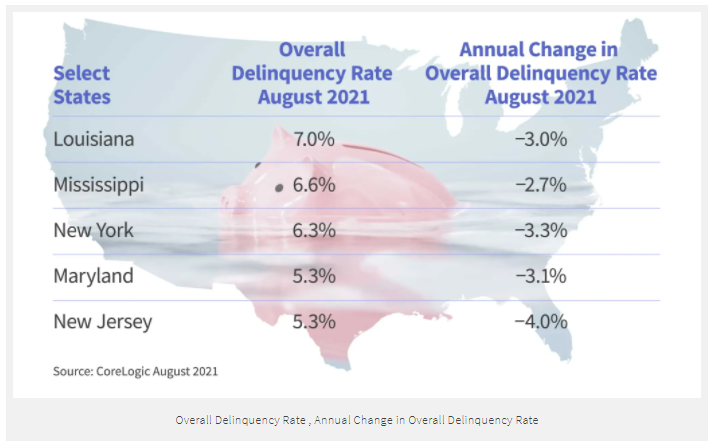

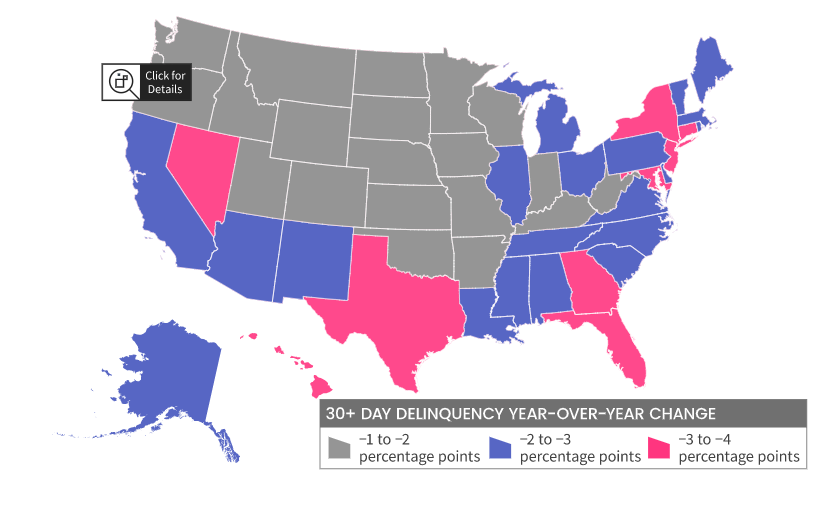

Overall Delinquency – State

Overall delinquency is defined as 30-days or more past due, including those in foreclosure.

In August 2021, all states saw year over year declines in their overall delinquency rate. New Jersey (down 4.0 percentage points); Florida (down 3.8 percentage points); and Nevada (down 3.6 percentage points), saw the largest year over year declines. All other states experienced decreases between -1.3 and -3.3 percentage points.

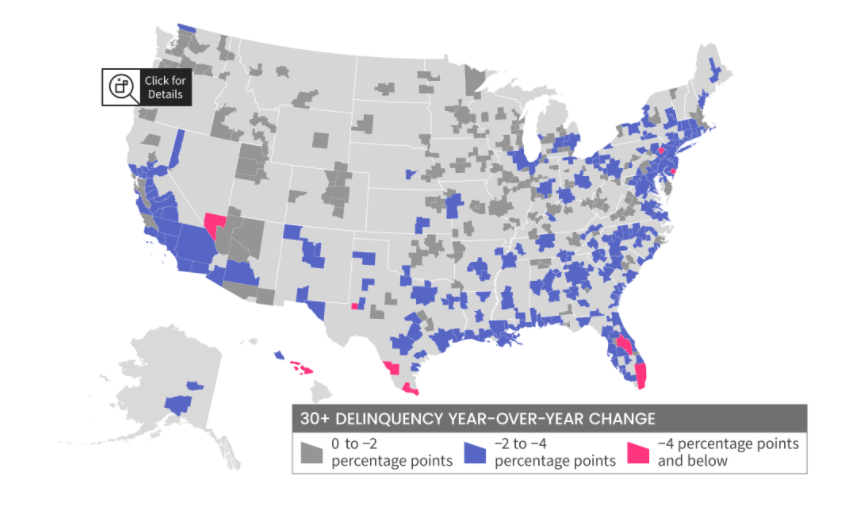

Serious Delinquency – Metropolitan Areas

Serious delinquency is defined as 90 days or more past due including loans in foreclosure.

There were 0 metropolitan areas where the Serious Delinquency Rate increased.

There were 384 metropolitan areas where the Serious Delinquency Rate remained the same or decreased.

Summary

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.