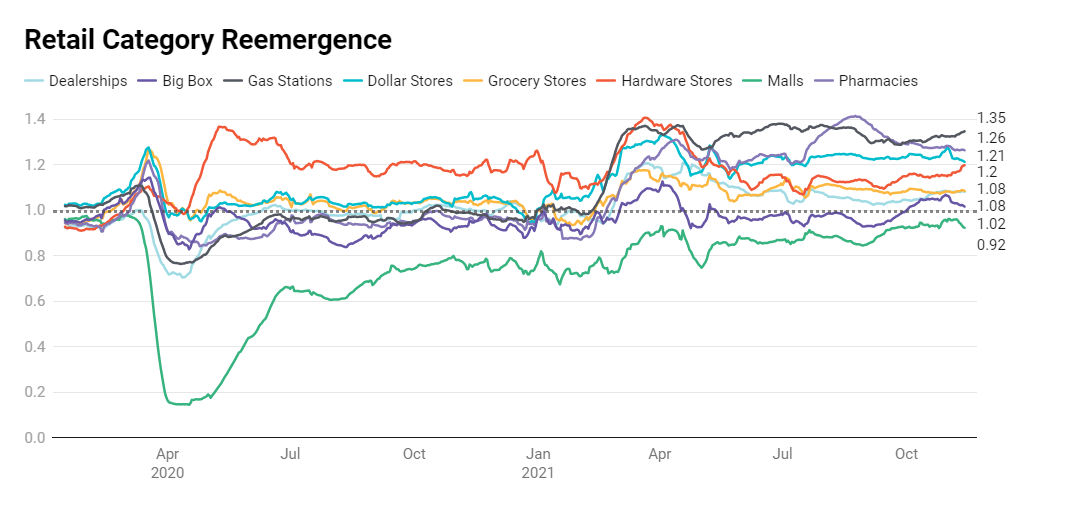

Foot traffic has been relatively up and stable since the decline of our initial Delta case wave and the conclusion of the back-to-school season. From October onward, things are pretty flat.

**

**

Despite the relative stability, we can spot a couple storylines unfolding here:

Grocery is the category we want to discuss today – that yellow line in the middle of the pack. It nicely encapsulates the complex mix of behaviors in the market right now, as some people return to their old behaviors, others stick with their new ones, and the remainder find a happy middleground.

This dynamic – the presence of old normals, new normals, and hybrid normals all at once – is showing up in every category we track. Understanding and serving this dynamic is key to winning this holiday season and beyond.

For a look at how your category traffic is reemerging compared to norms, check out our free live Retail, Travel and Dining dashboards.

We are gratified to see our analyses being included in various reports, since it is our goal to contribute to the #dataforgood effort. If you choose to re-use one of our analysis, all we ask is that you attribute the analysis or content to PlaceIQ. Thank you!

The Mixed Up World of Grocery Shopping

Since the pandemic arrived there’s been countless conversations regarding “New Normals” and “Old Normals”. Today I want to encourage you to stop thinking about the new and old normal as a binary; that one or the other will ultimately win and the other will lose. Instead, think about them as occurring and persisting at the same time.

Let’s use grocery stores to illustrate the point.

After COVID arrived, many of us shifted to a New Normal for groceries. We began ordering them online, whereupon they would be delivered to our door or dropped in our trunk via click-and-collect services. We saw this clearly in our data, as the average duration of visits plummeted as people stayed in their cars and stopped browsing the aisles. Grocery corporations themselves confirmed the change. For instance, Kroger reported their delivery business grew by 150% in 2020 compared to the prior year.

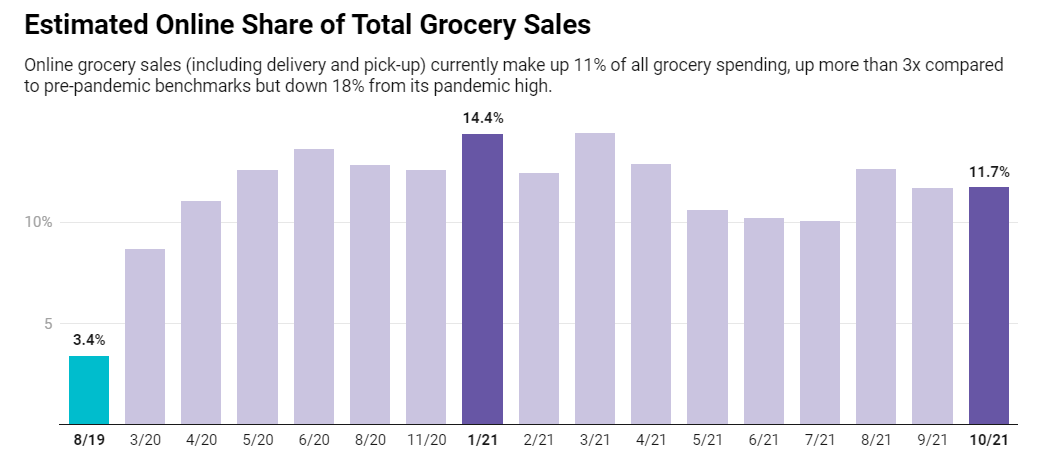

But as COVID’s threat lessened and/or our tolerance for risk increased, many of us started to revert to old habits. At the grocery store, the click-and-collect parking spots were no longer overflowing. But not everyone snapped back to Old Normal, and many of us settled somewhere in between. A report on October grocery purchasing published by Brick Meets Click, a grocery industry strategist, paints a complex picture:

It’s quite the ride:

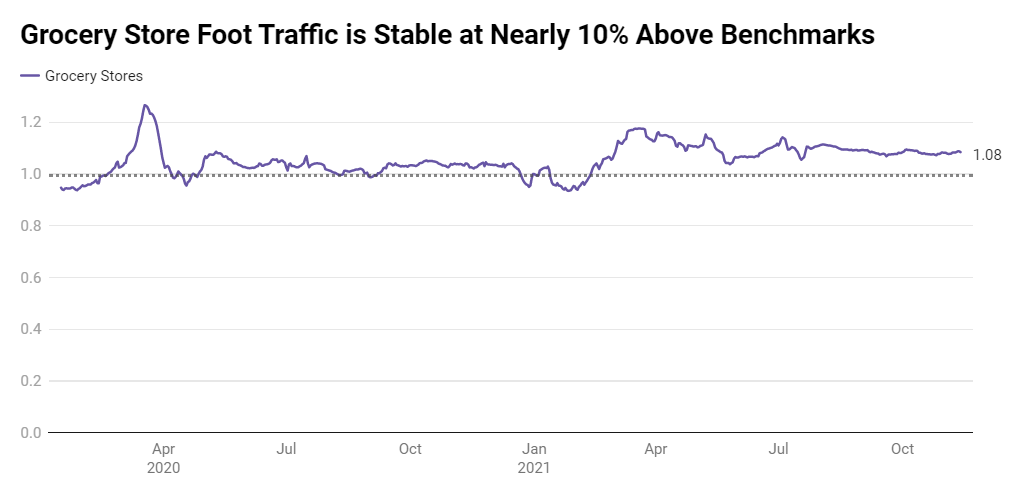

But while the online share of grocery sales holds stable at more than 3x its pre-pandemic norm, foot traffic to grocery stores remains 10% higher than its 2019 benchmark:

Online orders and foot traffic are both consistently up, at the same time! This is another great example of Old Normal and New Normal occurring simultaneously (which we explored with different categories in June).

It would be easier for marketers if Old and New Normals were binaries. If customers stuck with one or the other we’d know where to allocate our efforts. But with Old and New Normal occurring at once our existing market segmentation is undermined. We need more data to understand who’s sticking with the New Normal, who’s reverting to Old, and who’s somewhere in-between.

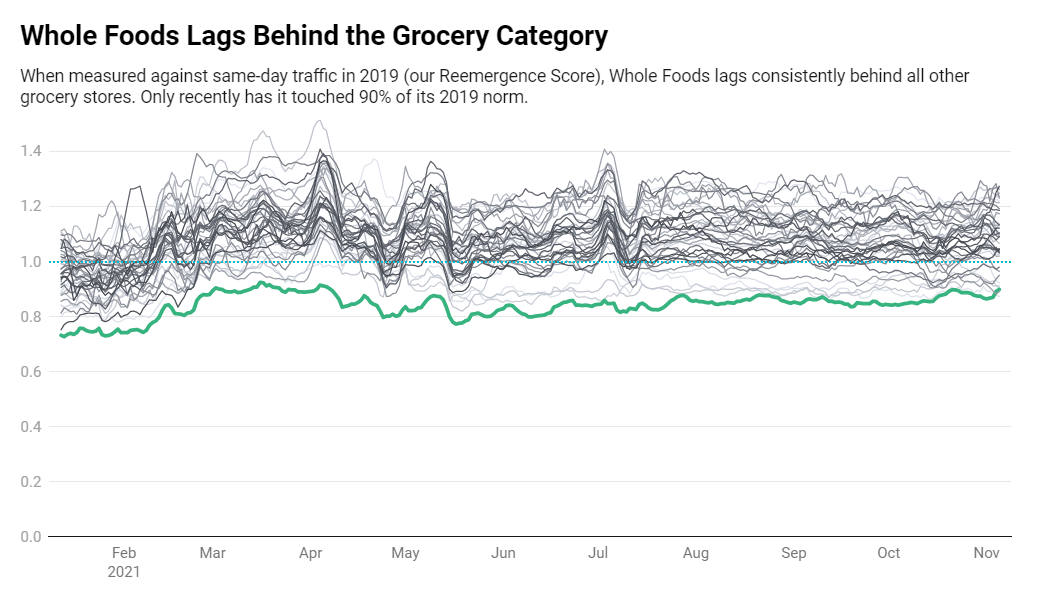

Thankfully when it comes to grocery we have some solid leads. If we break foot traffic out by brand, a certain store sticks out like a sore thumb:

Whole Foods has lagged behind every other grocery brand for all of 2021. While the category as a whole is up 10% compared to 2019, Whole Foods has barely touched 90% of the same benchmark.

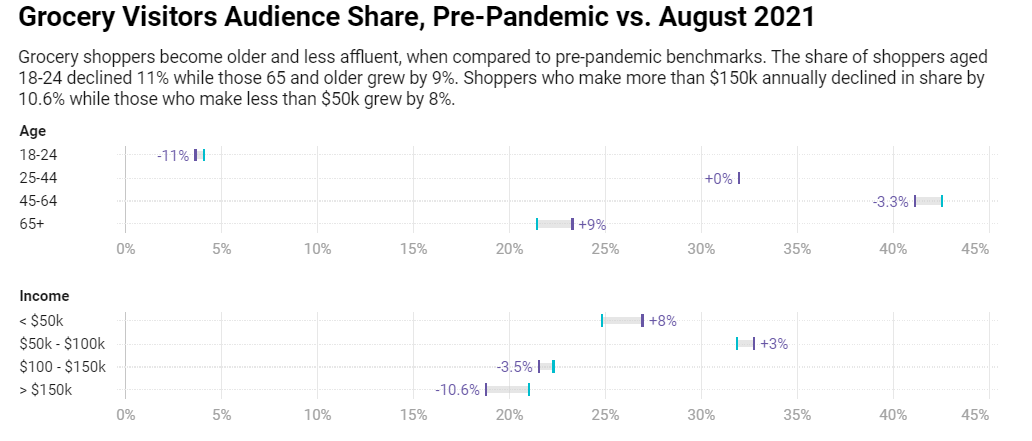

Breaking down traffic by time of day and urban context reveals that part of this softness is due to Whole Foods missing out on the office lunch foot traffic it used to enjoy. However, the chief driver for the lagging foot traffic has to do with the changing demographics of grocery store shoppers:**

**

**

The share of shoppers making more than $150k in household income has declined by an incredible 10.6%. This nicely corresponds with Whole Foods’ younger and affluent core audience. Foot traffic isn’t recovering because this brand’s customers are more likely to stick with the New Normal.

As the threat of the pandemic fades, we’re living in an era where old behaviors and new behaviors are occurring at once. All marketers need to account for this diversity by identifying and isolating new and old normal shoppers in order to adjust their calls to actions and match each segment with the right point of purchase, product, or service. Failure to do so will significantly undermine the efficiency of their efforts.

To learn more about the data behind this article and what PlaceIQ has to offer, visit https://www.placeiq.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.