As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats.

If you went shopping for a car this past year, the price tags probably made you hit the brakes.

Since the beginning of the pandemic, used car prices rose 39.8%, while new car prices rose 8.9%, according to the US Bureau of Labor Statistics.

“There’s just not a lot of cars out there, and if you go in and walk some lots, you’ll notice that it’s not there,” Jim Lyski, executive vice president and chief marketing officer for CarMax, told Fortune. “The consumer doesn’t really have their first pick right now, and so they’re going down to their second pick, third pick.”

With the high prices and shortage of supply, many consumers are waiting until 2022 to purchase a vehicle. Automakers are expecting pent-up demand, especially within the electric vehicle sector.

Even though many consumers have delayed their car purchases, the pent-up demand won’t be a solution for the ongoing labor, chip and, now, magnesium shortage. The chip shortage is expected to last into 2023.

Will consumers be able to keep putting off car purchases or will they swallow the higher prices?

Recovery in the automotive sector will be slow, but that doesn’t mean their marketing departments are pulling back. How much have the top automotive advertisers invested this past year, and where is the bulk of their spending going?

MediaRadar Insights

Overall Spending and Breakdown Across Formats

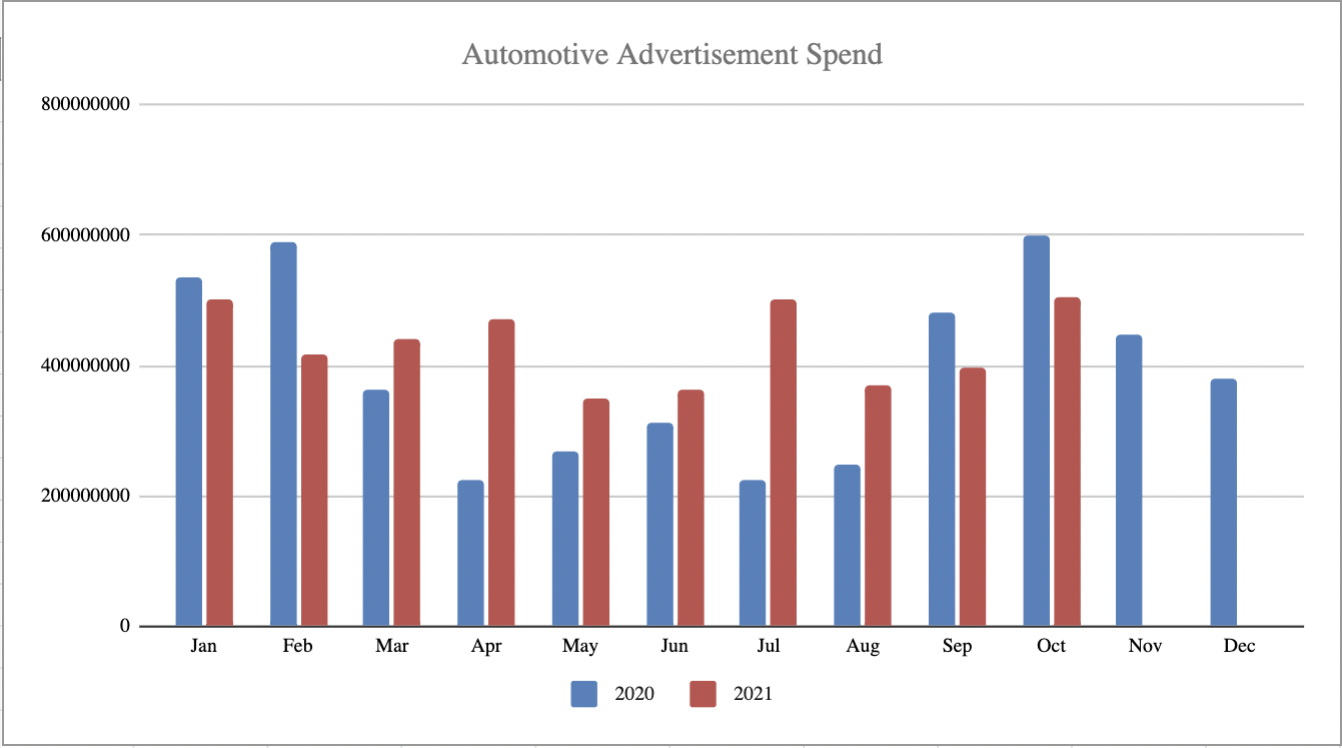

Though the automotive industry had a chaotic last two years, advertising spend has increased. Overall advertising spend in 2021 is up 12% year-over-year. In total, automotive advertisers invested more than $4.3 billion across formats.

We see the largest increase in digital spend, which grew 70% year-over-year. TV, the format that makes up most of the spending, grew 5% from $2.9 billion to $3.1 billion

Like many other industries during the pandemic, automotive companies shifted a significant amount of their budgets out of print. Print spend fell 27% from $276 million to $202 million.

Number of Advertisers

6.4 thousand advertisers spent $4.3 billion in 2021 compared to 6.3 thousand advertisers spending $3.8 billion in 2020.

Advertiser Retention and Shift in Top Advertisers

Of the top 22 advertisers from 2020, 7 advertisers remained top advertisers in the category.

New advertisers in the top 22 were specific models instead of automotive companies, these included: Ford F-Series, Chevrolet Silverado and Cadillac Lyriq.

In the overall category, automotive advertisers had a 62% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

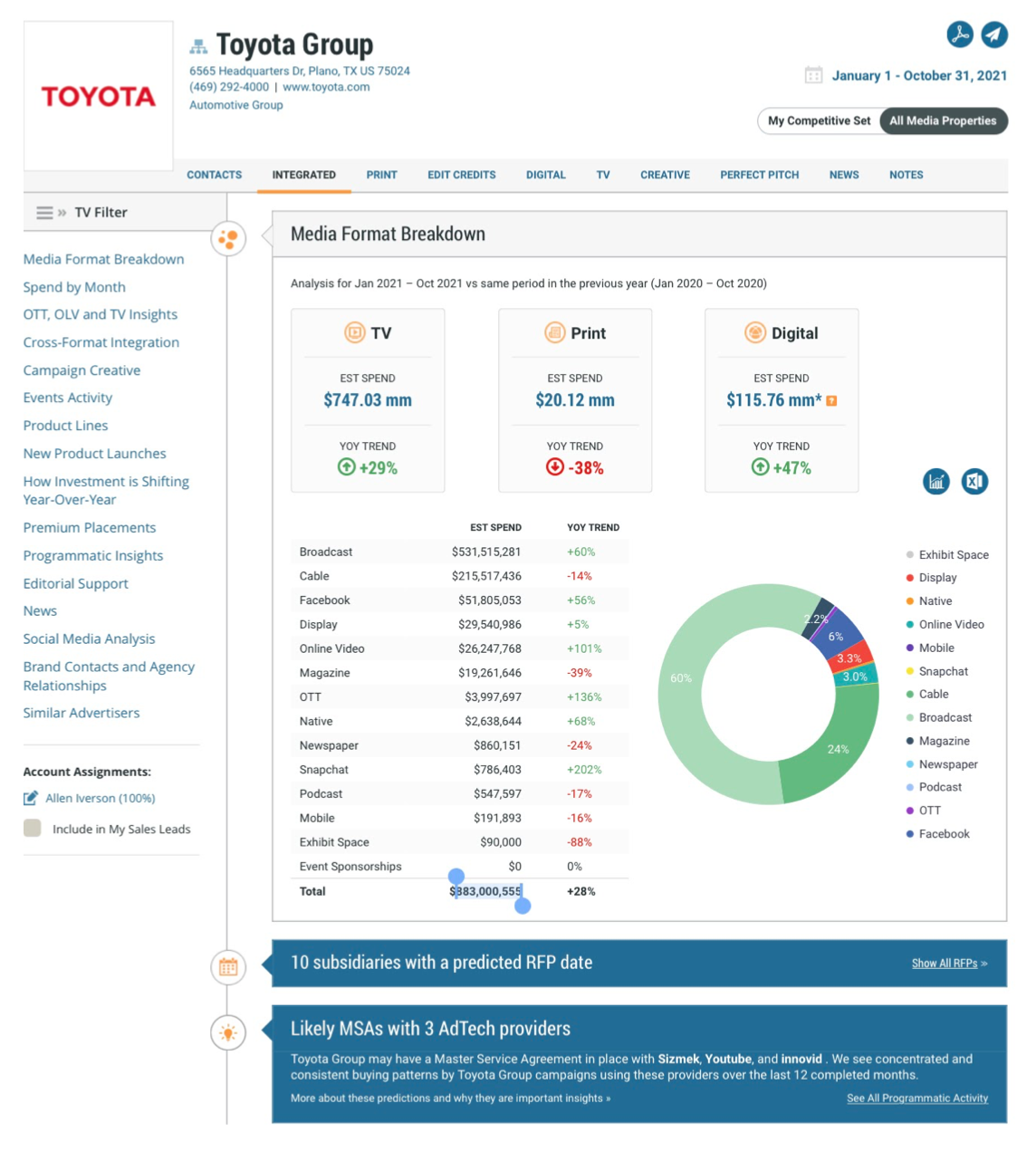

1. Toyota Group

The Toyota Group is arguably the top advertiser in the automotive industry, with 76% of their budget spent promoting their automotive products. Their advertising spend has increased by 28% since last year.

TV advertising makes up for 74% of all of their ad spend, the majority of which is allocated to broadcast ads. Toyota increased their investments in digital advertising by 47%. Online video, OTT, and Snapchat all saw investments increase by over 100%.

Below is a breakdown of The Toyota Group’s ad spend thus far in 2021. We predict they will likely have 10 upcoming RFPs issued. MediaRadar can help you connect with 68 key contacts at The Toyota Group.

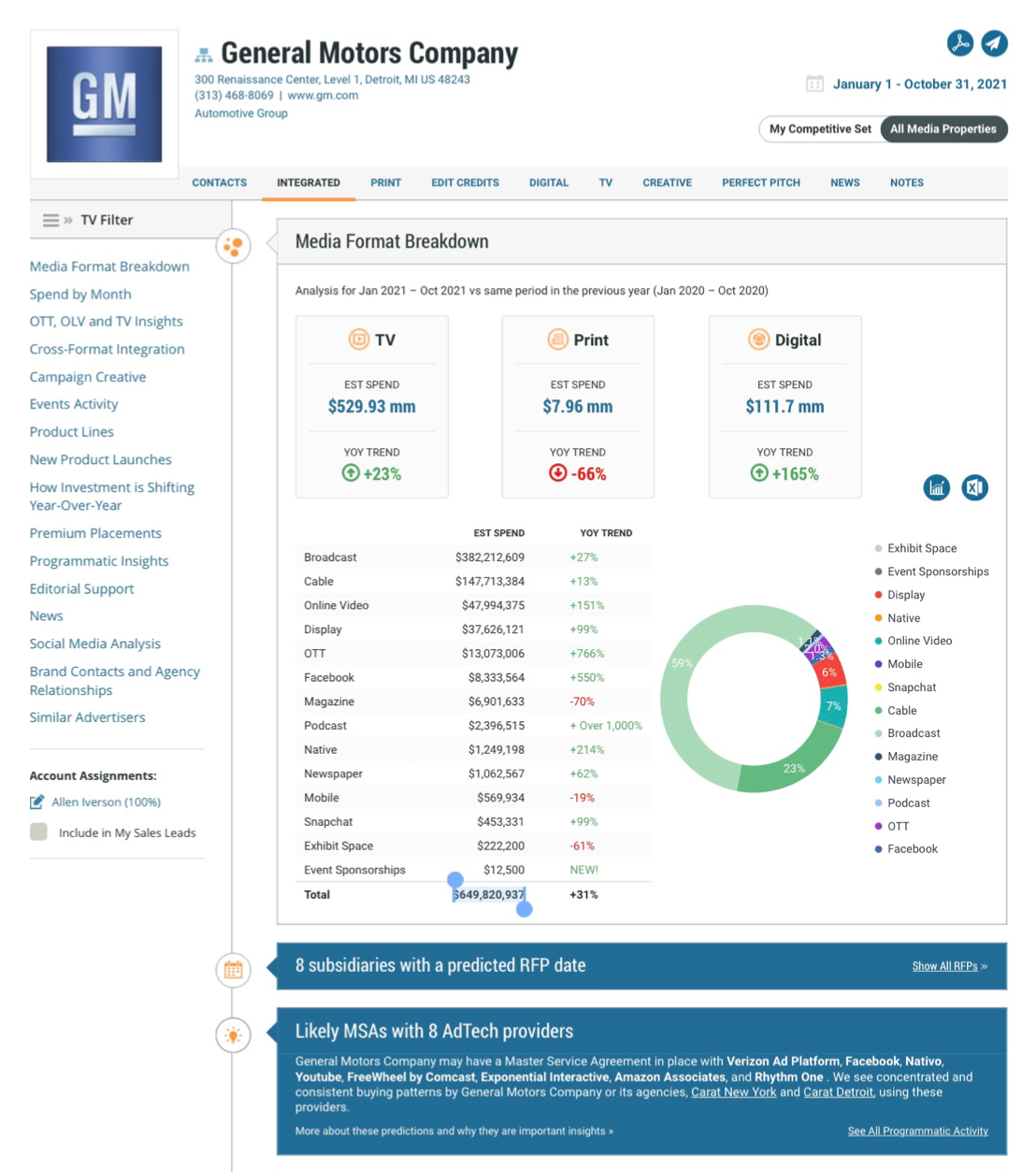

2. General Motors Company

General Motors Company is another big advertiser in the automotive industry, with 91% of their overall budget going to promoting their automotive products.

Spending on digital advertising has gone up 164% since last year, with investments in online video, OTT, Facebook, and native advertising increasing by over 100%. Podcasting ads went up by over 1000%

Below is a breakdown of General Motors Company’s ad spend thus far in 2021. We predict they will likely have 8 upcoming RFPs issued. MediaRadar can help you connect with 96 key contacts at General Motors Company.

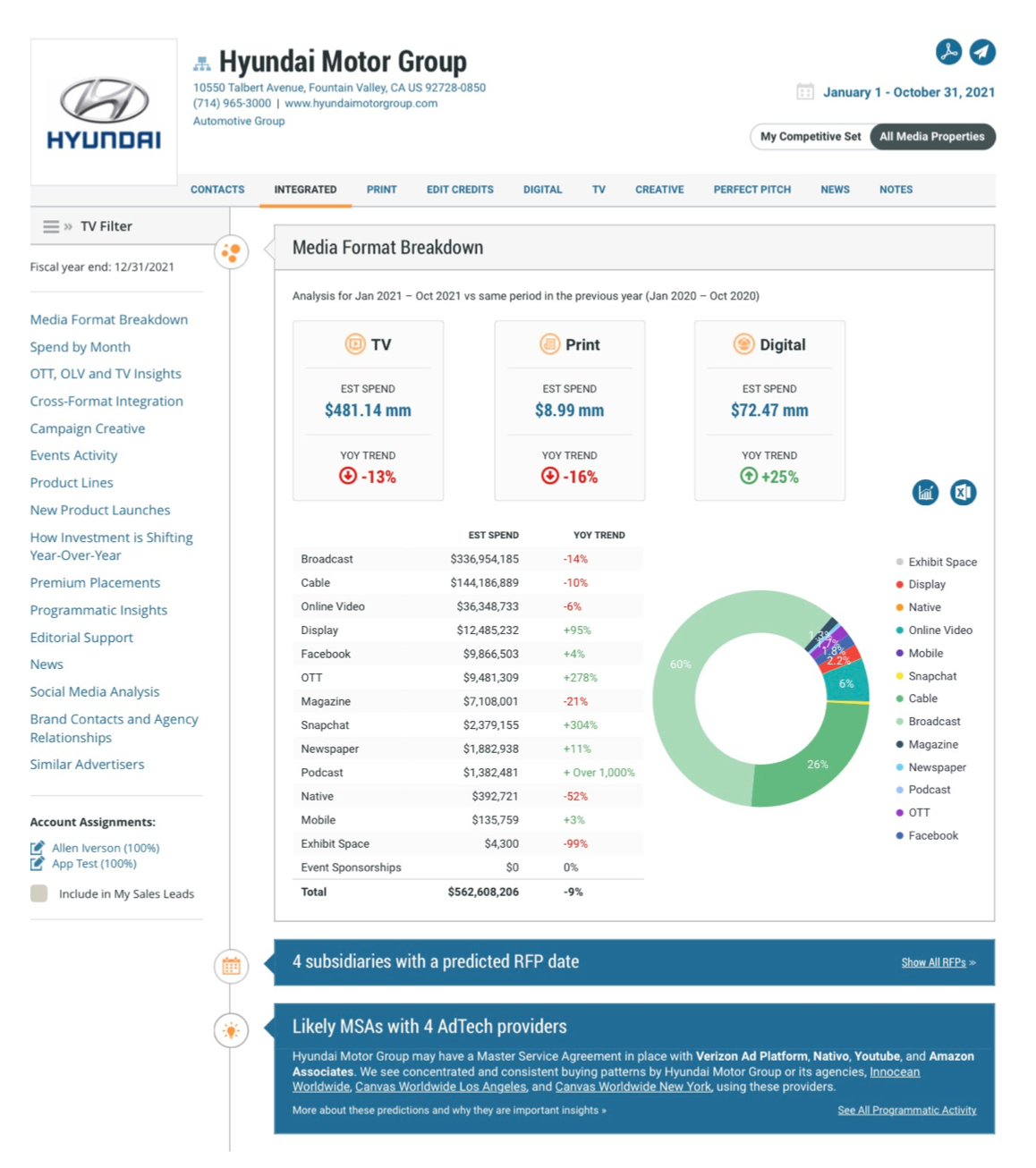

3. Hyundai Motor Group

Hyundai Motor Group is another top advertise, with 86% of their spending going to promoting their automotive products. While their spend is down 9% since last year, they’ve increased their investments in digital advertising 25% YOY.

Display, OTT, and Snapchat ads all saw increased investment by 94%, 278%, and 304% respectively. Podcast advertisements saw an increase of over 1000%.

Below is a breakdown of Hyundai Motor Group’s ad spend thus far in 2021. We predict they will likely have 4 upcoming RFPs issued. MediaRadar can help you connect with 44 key contacts at Hyundai Motor Group.

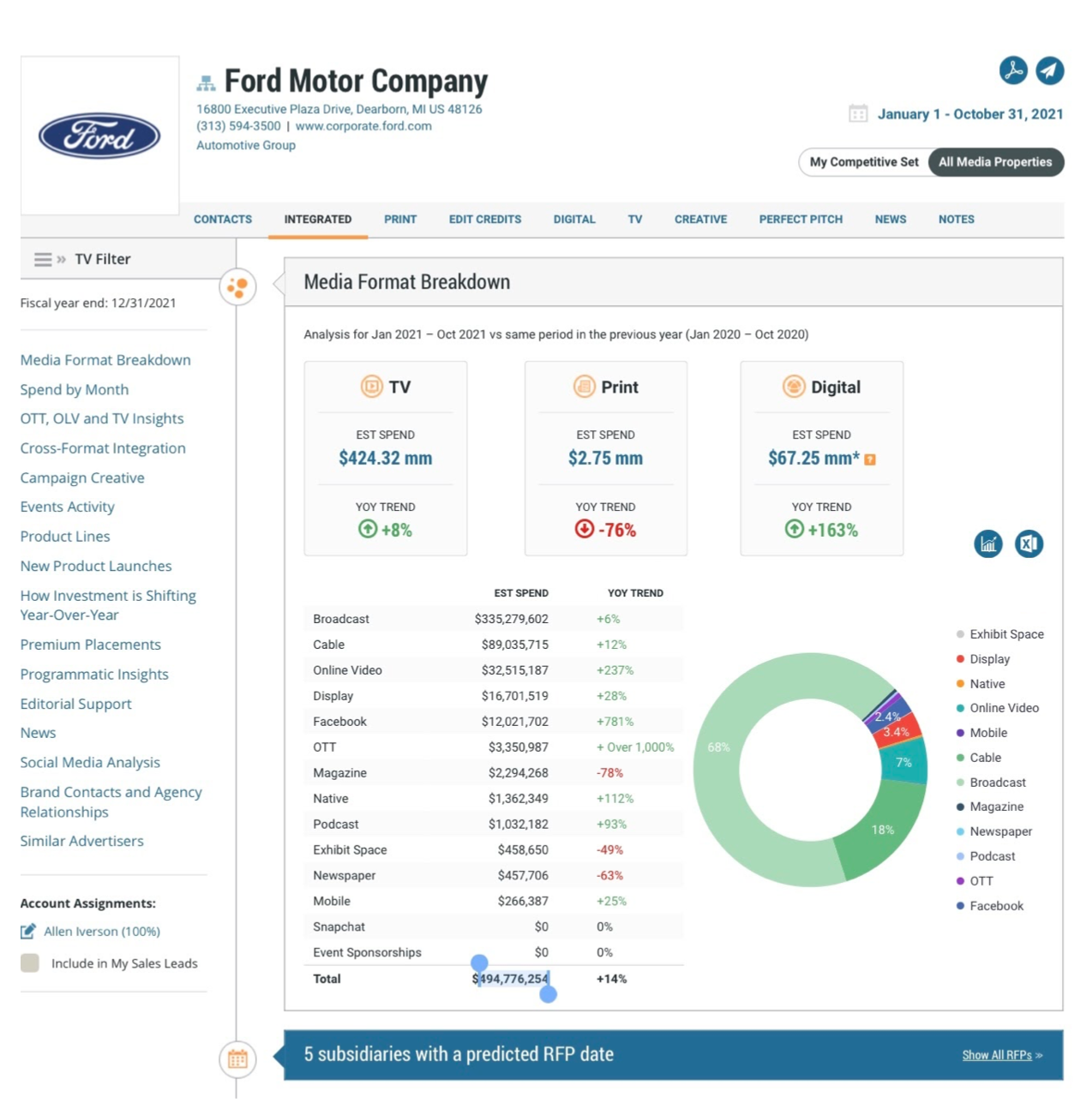

4. Ford Motor Company

Ford Motor Company is another returning top advertiser, with 90% of their spending going to promoting their automotive products. Their spend is up 14% since last year, and they’ve increased their investments in digital advertising 163% YOY.

Display, OTT, and Snapchat ads all saw increased investment by 94%, 278%, and 304% respectively. Podcast advertisements saw an increase of over 1000%.

Below is a breakdown of Ford Motor Company’s ad spend thus far in 2021. We predict they will likely have 5 upcoming RFPs issued. MediaRadar can help you connect with 65 key contacts at Ford Motor Company.

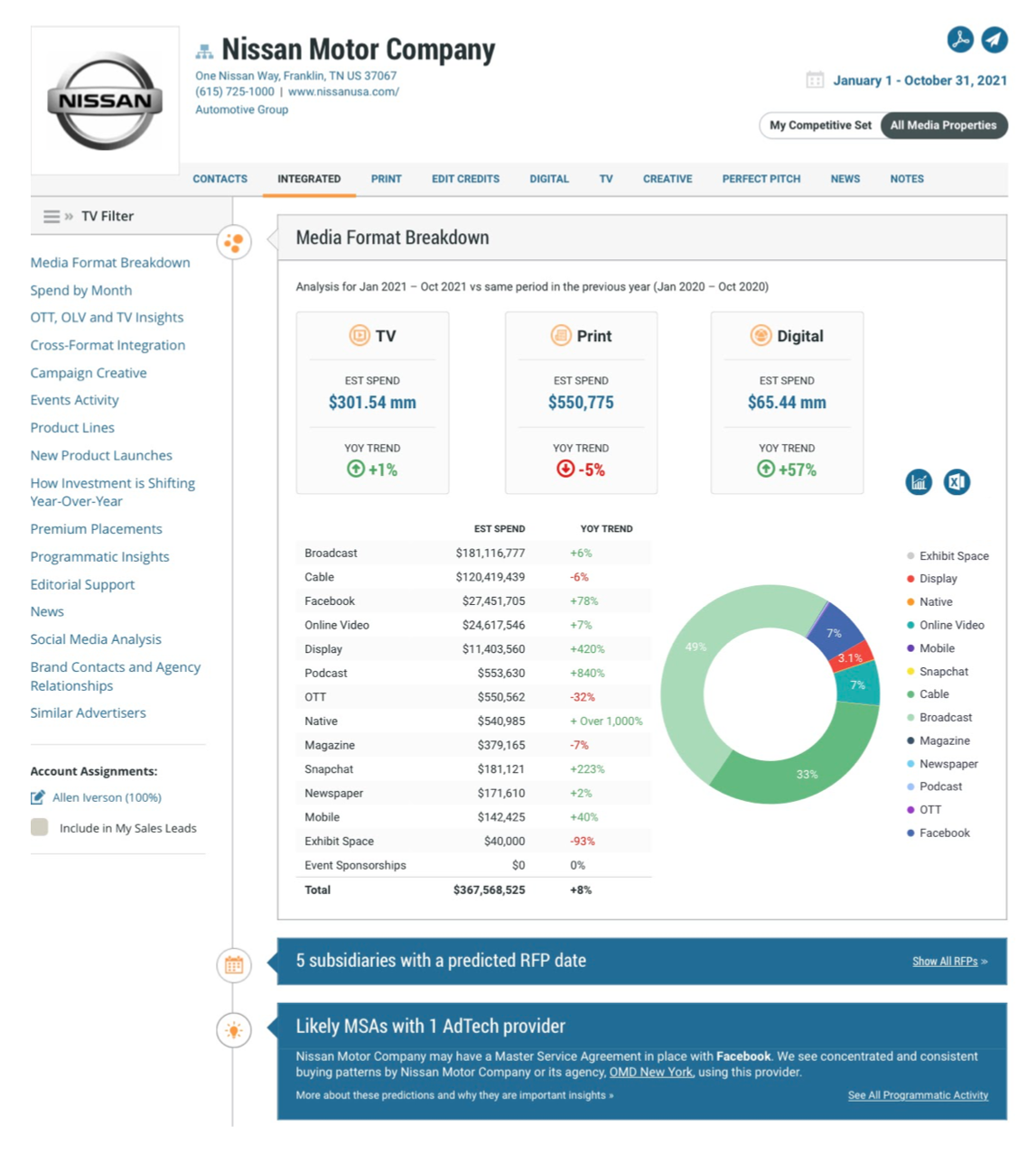

5. Nissan Motor Company

Nissan Motor Company is another key company to watch in 2022, with 98% of their spending going to promoting their automotive products. Their spending is up 8%.

82% of Nissan’s advertising spend is spent on TV advertisements, up 1% since last year. Spending on digital advertising is up 57% YOY. Display, Podcast, and Snapchat ads are up 420%, 840%, 223% respectively. Investment in native advertising increased over 1000%.

Below is a breakdown of Nissan Motor Company’s ad spend thus far in 2021. We predict they will likely have 4 upcoming RFPs issued. MediaRadar can help you connect with 22 key contacts at Nissan Motor Company.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.