When it comes to analyzing holiday sales, Consumer Edge data can be extremely helpful in tracking what has happened holiday-to-date. It becomes even more powerful when users take advantage of data on last year’s sales trajectory to forecast how the rest of the season may play out. In today’s Insight Flash, we compare holiday sales trends in the US and the UK in 2019 and 2020 to understand which subindustries are most levered to this time of year and how much holiday shopping will have already been included when our Black Friday data should become available for the majority of US retailers tomorrow. As a bonus, we also take a peek into an upcoming Insight Flash to show how our CE Receipt dataset can provide an even earlier glimpse into online orders.

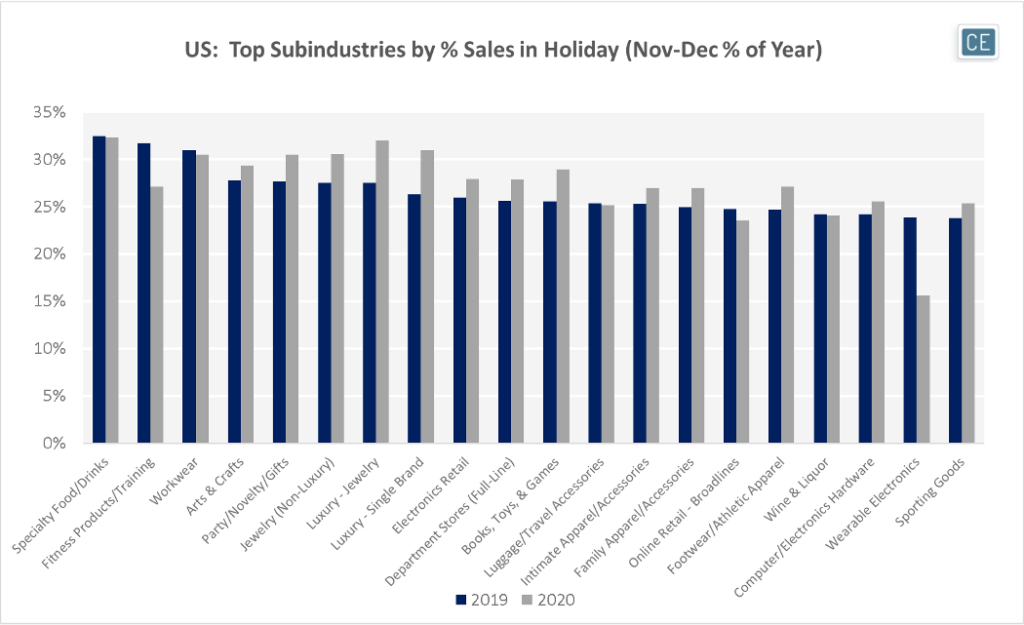

In the US in 2019, Specialty Food/Drinks, Fitness Products/Training, and Workwear saw the largest percentage of their sales in November/December – all over 30%. It is interesting to see that the holiday shopping season can be about both loading friends and families up with calories as well as helping them work those calories off. The high percentage of workwear sales may be more due to seasonal employment trends, especially at retail, than gifting though. In 2020, with in-store purchases even more shifted to the end of the year due to the COVID-19 pandemic, Luxury Jewelry and Single Brand Luxury as well as Non-Luxury Jewelry saw spend shift more into the holiday season at over 30% of total year spend.

US Holiday Concentration by Subindustry

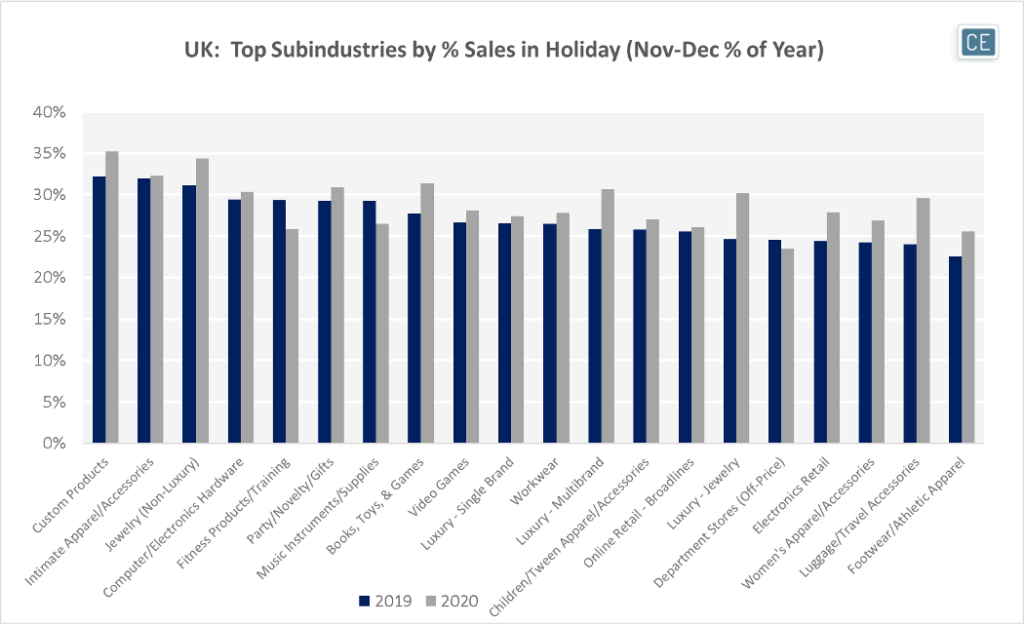

In the UK in 2019, pre-COVID gifting tended to be more personal with Custom Products, Intimate Apparel/Accessories, and Non-Luxury Jewelry showing the highest holiday spend concentration above 30%. 2020 saw less of a shift than in the US with the same subindustries showing the highest November/December percentage of spend. But they were joined by Books, Toys, & Games, Party/Novelty/Gifts, and Multibrand Luxury which also passed 30% of spend in those months.

UK Holiday Concentration by Subindustry

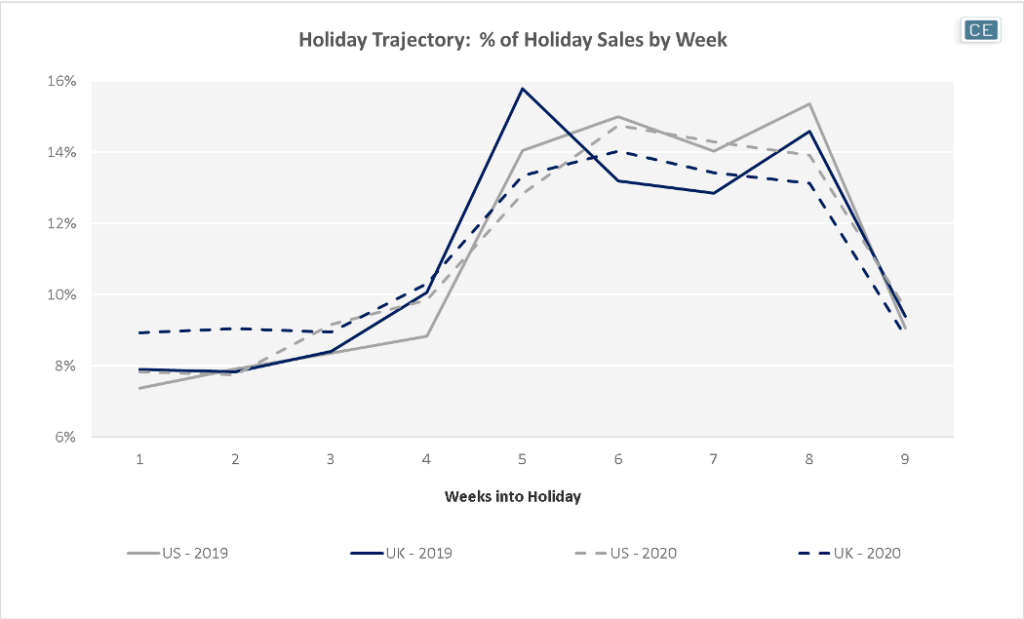

Although some US shoppers like to complain that holiday music starts playing earlier and earlier each year, in fact UK sales tend to be more heavily weighted to the first few weeks. In 2019, the top 20 most concentrated holiday spend subindustries had over a third of their sales by the fourth week of holiday shopping and half by the fifth week. This was 1.7% more in Week 4 and 3.4% more in Week 5 than in the US. In 2020, both geographies saw holiday sales ramp earlier, though the UK still had 2.6% more spend already completed four weeks into the holiday season and 3.2% more five weeks in.

Top Subindustry Weekly Cadence

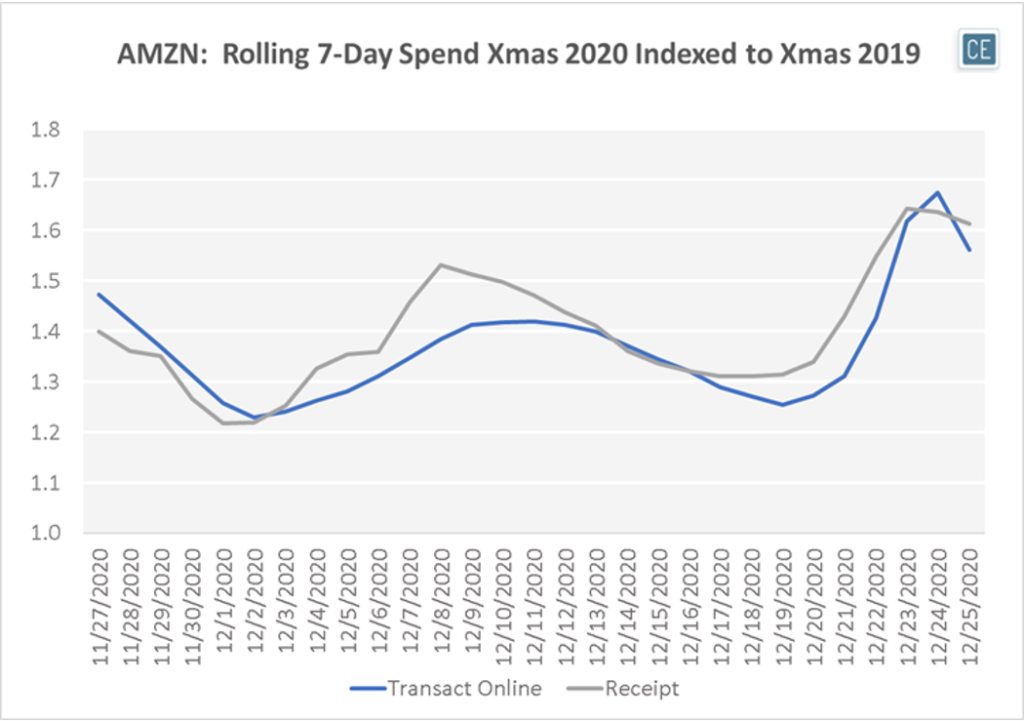

Flash Forward: As a reminder, all transaction datasets from payment card data capture when a purchase is charged to a credit card, which is usually when an item is shipped for online orders. Our CE Receipt data is uniquely able to capture when an online order is placed, which can be a leading indicator for recognized revenue and more closely mirror demand comp. Given the supply chain disruptions currently occurring in the economy, this data may prove even more important if companies start reporting gross orders in addition to recognized revenue. Stay tuned for a future Insight Flash with more details!

CE Receipt US Flash Forward

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.