The days before and after Thanksgiving are some of the busiest travel days of the year – so we took the opportunity to check back in and give an update on the travel and hospitality recovery as 2021 draws to a close.

Slow and Steady Recovery for Yo2Y Airport Foot Traffic

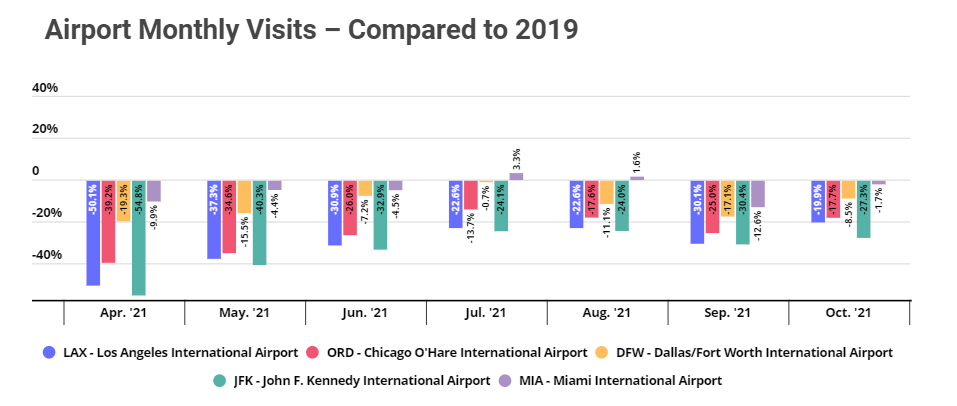

From April to July, the year-over-two-year (Yo2Y) monthly visit gap had been slowly but surely shrinking. But when we last checked in with the travel sector in late August, the summer season seemed to have ended abruptly, as the United States entered its fourth COVID wave. And since – Thanksgiving aside – fall is not typically a high-travel month, there was concern that the early end of the summer travel season would significantly hamper the sector’s recovery.

But the travel industry, which proved its resilience over the past 21 months, has again demonstrated its capacity to bounce back. Although visits to five of the nation’s leading airports did take a major hit in September, the Yo2Y visit gap narrowed significantly already in the following month. October foot traffic to LAX, O’hare, DFW, JFK, and Miami International was down by 19.9%, 17.7%, 8.5%, 27.3%, and 1.7%, respectively, compared to 2019 – which means that four out of the five airports analyzed were further along in their recovery in October than they were in June.

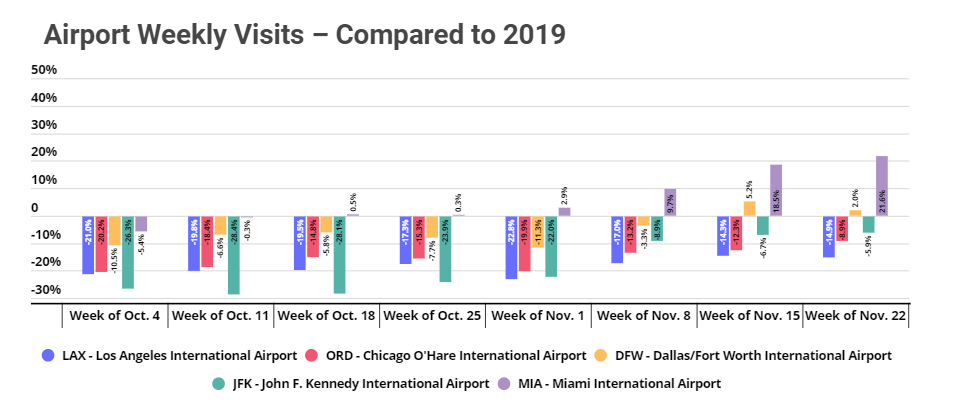

Zooming into weekly visits in October-November confirms that air travel is coming back. All the airports analyzed were in a significantly better position by mid November than they were at the beginning of October, with visits the week of November 15-21 only down by 14.3%, 12.3%, and 6.7% for LAX, O’hare, and JFK, and up by 5.2% and 18.5% for DFW and Miami International.

Interestingly, the week of Thanksgiving didn’t give the air travel recovery a major bump. While some airports did see their visit gap shrink slightly and Miami saw its visit surplus rise, these changes seem in line with the slow and steady recovery that the airports have been experiencing throughout the fall.

But the fact that the Yo2Y visit gap didn’t see any major change the week of November 22nd does not mean that Thanksgiving travel was not significant this year. It’s important to remember that the week of November 22nd 2021 is being compared to November 25th 2019 – in other words, Thanksgiving week 2021 is being compared to Thanksgiving 2019. So the reason the recovery rate held more or less steady throughout November is because this year’s Thanksgiving week also saw surges in air travel. In other words, Thanksgiving week 2021 airport visit numbers were relatively comparable to the 2019 numbers within the context of each year’s overall air travel.

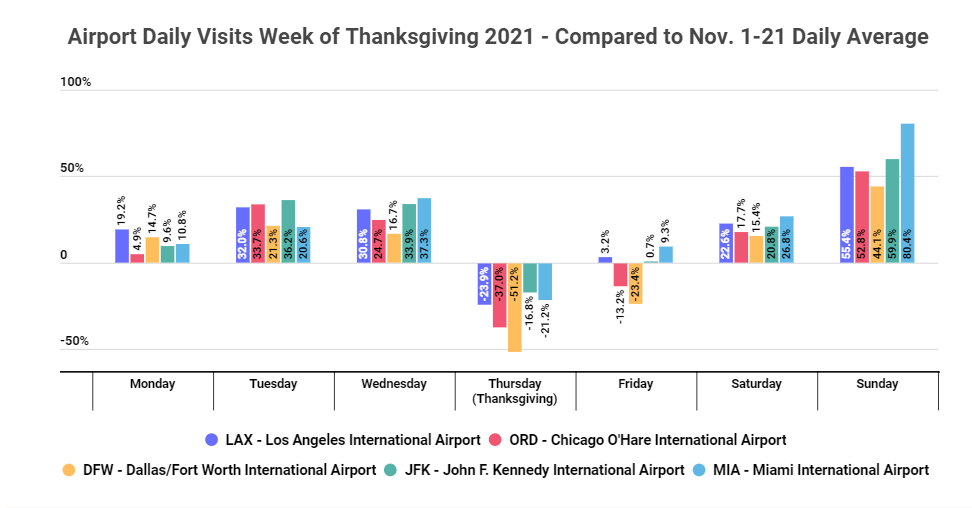

Thanksgiving Travel

Comparing airport visits over the week of November 22nd to the average daily foot traffic for November 1-21 (the three weeks preceding Thanksgiving) show just how significant Thanksgiving travel was this year. While we usually think of the Wednesday before Thanksgiving as one of the busiest travel days of the year, it seems that many people actually preferred to travel on Tuesday this year – airport visits were higher on Tuesday than on Wednesday for all the airports analyzed except Miami. But the busiest travel day was neither Tuesday nor Wednesday, but Sunday, as many travellers stayed at their destination as long as possible, journeying back just in time to be back at work on Monday.

Hotel Recovery

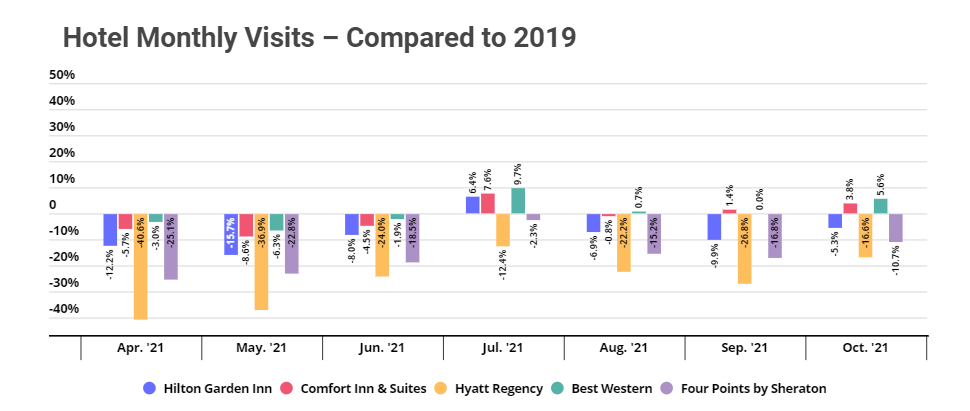

The hotel recovery has not been uniform across chains. Some brands have essentially recovered from the COVID blow – Comfort Inn & Suites and Best Western saw a respective 3.8% and 5.6% increase in Yo2Y October visits. Others, such as Hilton Garden Inn, Hyatt Regency, and Four Points by Sheraton which had 5.3%, 16.6%, and 10.7% respective decreases in Yo2Y October visits, are still working on closing the visit gap.

But unlike airport visits – where the Yo2Y figures for November 22-28 were in line with the Yo2Y visit comparisons for November as a whole across the board – some hotel chains did get a relative boost the week of Thanksgiving.

Four Points by Sheraton managed to decrease its Yo2Y visit gap by almost a third compared to the week before, to reach a Yo2Y visit gap of 10.8% the week of Thanksgiving. Hyatt Regency, which has been struggling with a double digit Yo2Y visit gap since the start of the pandemic, saw a Yo2Y visit increase of 4.2% the week of Thanksgiving.

Hilton Garden Inn, meanwhile, which had seen its Yo2Y visit gap narrow again in October, saw Yo2Y foot traffic fall again in November, with visits the week of Thanksgiving down 9.8% compared to 2019. And Comfort Inn & Suites and Best Western, where Yo2Y foot traffic had already recovered prior to Thanksgiving, saw their Yo2Y numbers drop slightly– 3.8% and 6.9% increase, respectively, for Comfort Inn & Suites and Best Western, compared to 8.8% and 10.1% increases the week before. The slight decrease in Yo2Y visits the week of November 22nd could be because these chains cater largely to business travellers.

Will the current COVID concerns disrupt the airport and hotel recovery?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.