As uncertainty and new cases of the Omicron variant increase across the globe, some countries have reimplemented restrictions around travel.

New restrictions obviously mean potential challenges for the hotel industry, and as we have seen throughout the pandemic, every class of hotel can be affected differently. In this latest piece, we look at how Luxury class hotels have performed around the globe, especially in more recent months.

ADR recovery

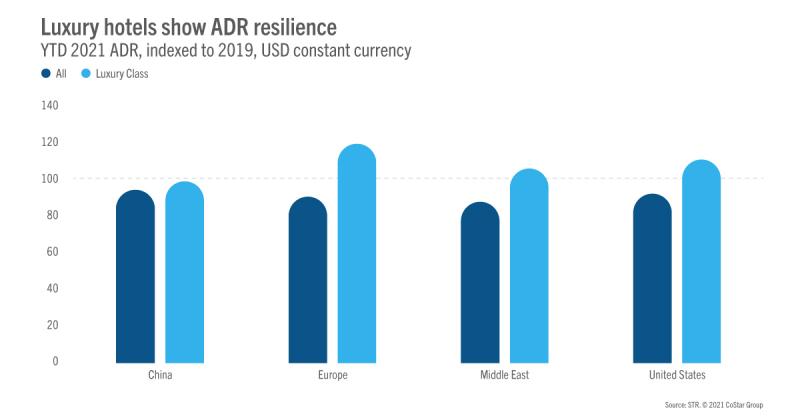

In 2020, luxury hotels saw global occupancy lower than all other classes combined. China luxury hotels, for example, recovered 66.9% of their 2019 levels, which was 4.9% percentage points lower than the combined recovery of all other classes (71.8%). Luxury hotels in the Middle East recovered more than 50% of the market’s 2019 comparable, while the recovery for all other classes was 7.3% percentage points higher. However, luxury hotels showed greater resilience in recovering average daily rate (ADR). Although slightly lower than 2019 levels, luxury hotels across all regions recovered between 93.0%- 96.6% of pre-pandemic ADR levels. A good example was in Europe, where luxury hotels recovered 96.6% of 2019 levels. For comparison, the rest of the hotel classes in Europe recovered 82.5% of the 2019 benchmark.

Fast-forward to 2021, luxury hotels in all regions have approached or even surpassed their 2019 levels in ADR. And different from 2020, luxury ADR recovery came in at higher levels than all other classes. In Europe and the Middle East, specifically, ADR reached 119.7% and 106.1% of 2019 comparables, respectively.

Supply: Return to…normal?

Although the uncertainty around the pandemic has affected a considerable amount of pipeline projects around the globe, new luxury hotels are still attractive among investors.

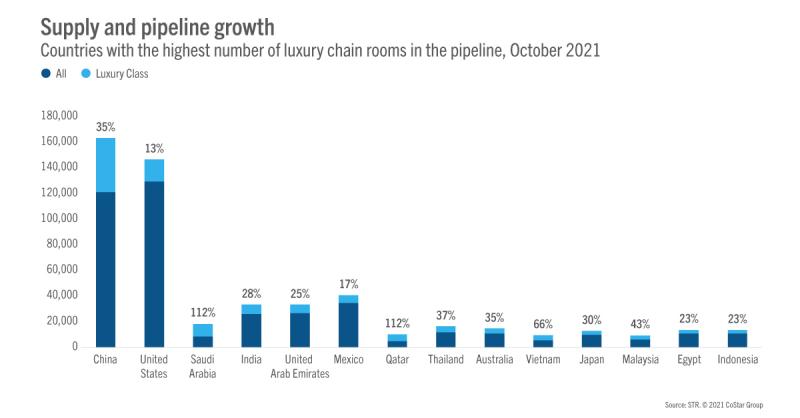

With 200,000 luxury hotels rooms in the pipeline across the planning, final planning and construction phases, the global luxury segment is projected for a 17% increase in room supply if all projects are completed over the next two to three years. Such growth is a testament to the resilience of the industry.

Although China and the U.S. show the largest number of luxury chain rooms in the pipeline, the Middle East and Asia Pacific (excluding China) are experiencing supply percentage growth above the global average. China shows 42,055 luxury chain rooms under development, a number that would produce a 35% supply increase in the market if all those rooms are completed. The U.S. shows 17,199 luxury chain rooms – 13% growth if all projects under development are completed.

Saudi Arabia and Qatar are each projected to increase their luxury hotel supply by 112% upon completion of all projects. This is not surprising news, as we’ve noted in a previous analysis that Saudi Arabia’s leading hotel supply growth, along with the strength of other Middle East hospitality markets, is further validation that the region is quickly rising as a global tourist destination.

Winter is coming

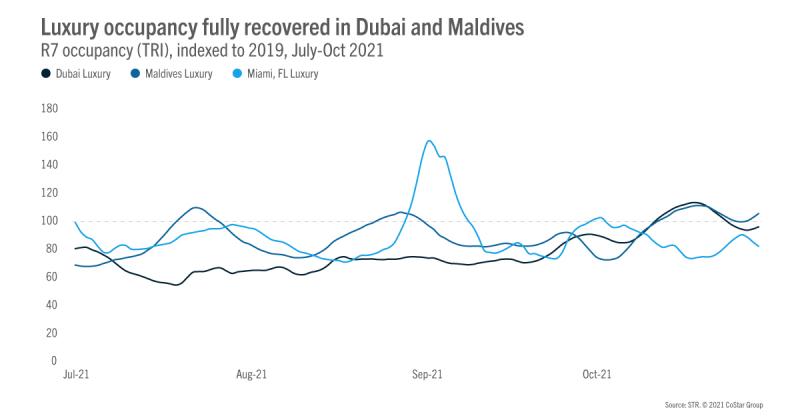

Winter is approaching in many parts of the world, which benefits popular “winter sun” destinations such as Dubai, Maldives and Miami.

Since their pandemic low points, Dubai and Maldives luxury hotels have slowly but surely recovered their 2019 occupancy levels. For the week ending with 31 October, for example, Maldives luxury class hotels posted occupancy that was 106.1% of the 2019 comparable. That same week, Dubai luxury hotels saw 96.7% of the market’s 2019 occupancy, while Miami’s luxury segment showed 82.8% of its 2019 level.

Then there is pricing, where luxury hotels have already posted ADR levels 20-40% ahead of 2019 comparables. Dubai’s luxury hotels are leading that ADR recovery at 140.8% of 2019 levels during the week ending with 31 October.

Groups, welcome!

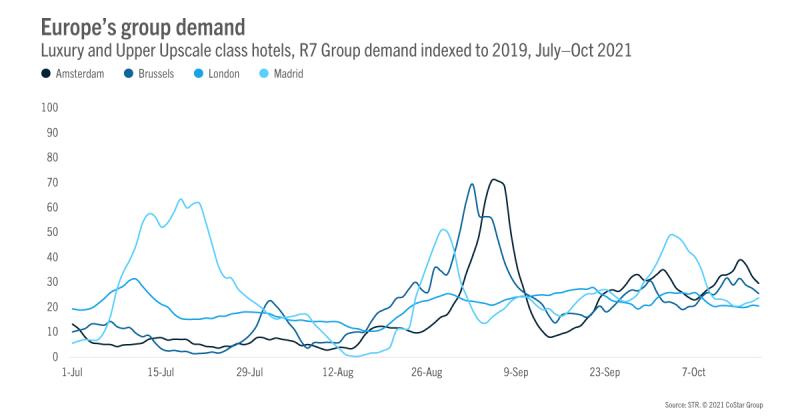

Undoubtedly, leisure travel has created the most cause for celebration since the recovery began from the global pandemic. However, to reach the next phase of performance recovery, the hotel industry needs business travel and groups to return in a big way.

While analyzing group demand, we’ve seen how groups start to return slowly to major cities. In Europe, however, group demand is still showing at a slower pace.

While looking at luxury and upper upscale class hotel occupancy for the week ending with 17 October, Amsterdam recovered 30% of its 2019 levels. Although those levels were low when compared with the 2019 benchmark, they could be deemed a moderate success considering the difficulties for group demand in the past year.

For comparison, although the U.K. removed international travel restrictions on 4 October, London’s luxury and upper upscale class hotels recovered just 21% of the 2019 comparable for the week ending with 17 October.

An uncertain future

Undoubtedly, the hotel industry has proved its resilience and will continue to attract guests and investment. However, success is not guaranteed in every market or every hotel type. The future remains uncertain with new variants such as Omicron spreading across the globe, but luxury hotels have shown their ability to navigate through the times.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.