Key takeaways for retail ranking: Black Friday and Cyber Monday 2021

Earnest Research First Choice Retailer Methodology

The Earnest First Choice Retailer Rankings are based on the credit and debit card spend of millions of de-identified U.S. consumers. Earnest identifies each shopper’s First Choice Retailer by comparing their spend across 1000 retailers between Thanksgiving and Cyber Monday. For example, if Shopper A spent $70 at Amazon, $50 at Walmart, and $30 at Target, their First Choice Retailer would be Amazon. Below, Amazon’s number one ranking means more customers spent the largest percentage of their retail wallet at Amazon during the holiday shopping period between Black Friday and Cyber Monday in 2021 than at any other merchant.

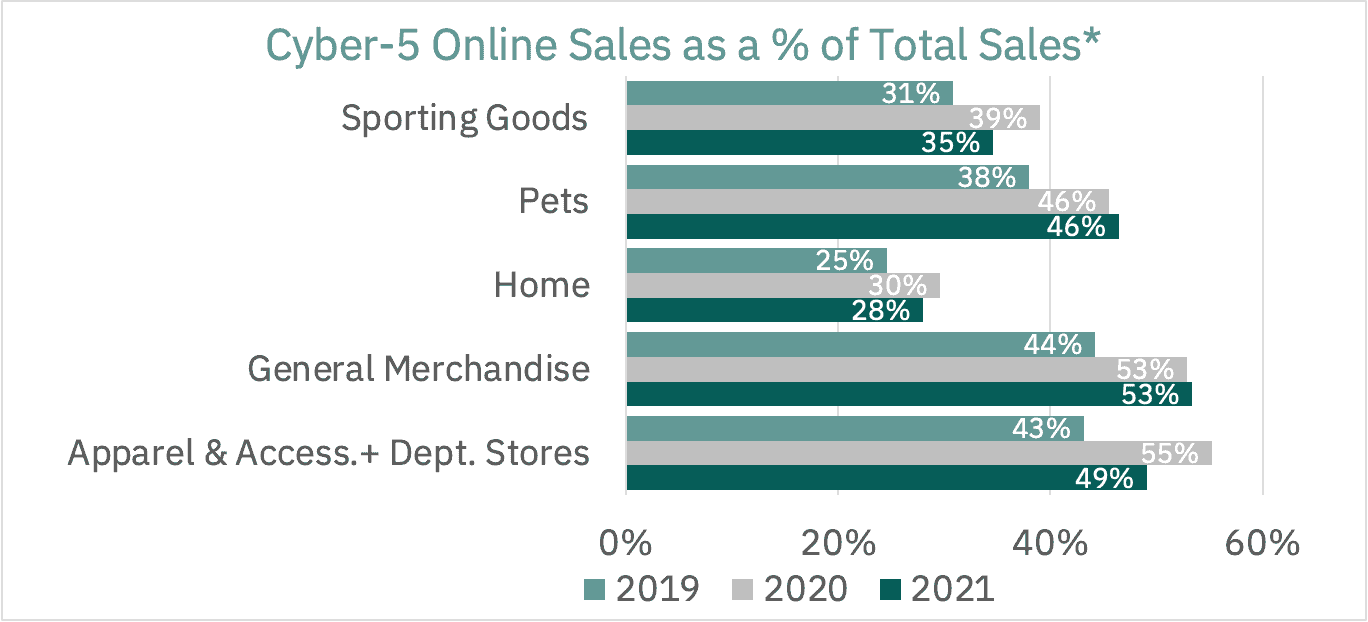

Substantial shift to online holiday sales continued

More than half of all sales in the General Merchandise and Apparel and Accessories and Department Stores categories occurred online during the Cyber-5 period in 2020, a record high. Online sales penetration in some categories such as Sporting goods, Home, and Apparel and Accessories and Department Stores retreated from those 2020 highs. The share of online sales at General Merchandise brands (like Amazon and Walmart) and Pets retailers exceeded 2020 levels, suggesting 2020 online sales levels reflected the new normal more than a one-off event in those categories. Online sales share for all major categories was higher than pre-pandemic.

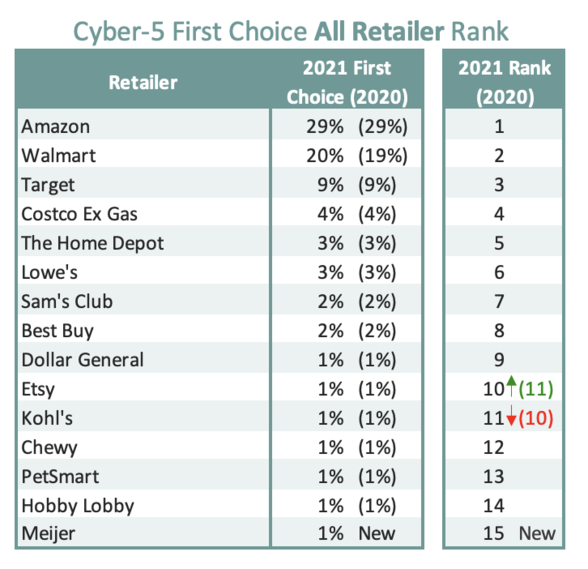

Marketplaces soared: Amazon and Etsy consolidated consumer leads

Amazon first topped Walmart as the First Choice Retailer among US consumers during the Thanksgiving to Cyber Monday shopping period in 2019. Since then, Amazon grew its share to nearly a third of all consumers, while Walmart lost its top position with some consumers. Online marketplace Etsy rose to tenth place, besting traditional department store Kohl’s, in keeping with broader sales growth on the Etsy platform and its acquisition of fashion reseller Depop.

Midwestern big box retailer and grocer Meijer was the only addition to the top 15 All Retailer list in 2021, reflecting a broader trend of consolidation at the top of the first place wallet share rankings.

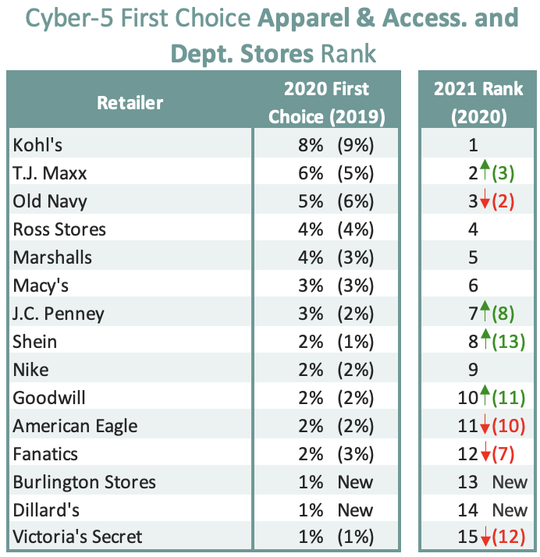

Apparel & Accessories and Department Stores: Shein leapt ahead

Relative newcomer Shein rose five rankings in 2021, riding a wave of growth based on new customer acquisition that catapulted the brand into the lead of the US Fast Fashion market earlier in 2021. Perennial leader on the list, Kohl’s, retained its number one spot despite losing some customers’ first place rank. Discounter T.J. Maxx displaced mall stalwart Old Navy. New to the list in 2021 are department stores Dillard’s and Burlington Stores. In keeping with rising interest in fashion resale, Goodwill rose in the ranks, displacing American Eagle.

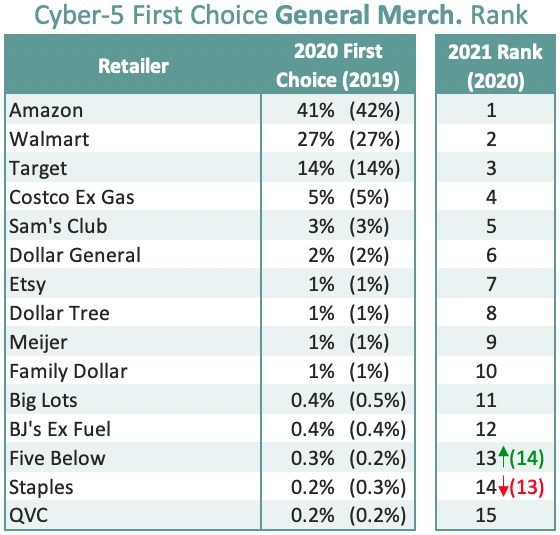

General Merchandise: Amazon increased lead

The number of General Merchandise consumers who spent their largest share of wallet at Amazon during the 2021 Cyber-5 period increased, solidifying its top spot among General Merchandise retailers. Amazon went into the holiday shopping weekend with a strong lead after record setting sales earlier in the year, and having successfully fended off Walmart and Target during their annual Prime Day sale. Walmart retained most of its first choice shoppers during the period, after growing sales YoY in the preliminary holiday period from November 1st-10th. Most changes in the General Merchandise rankings were otherwise minimal this holiday shopping weekend.

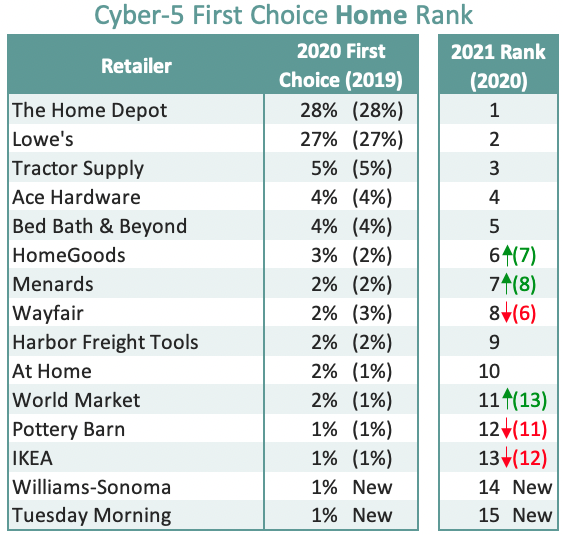

Home: Furniture fell while accessories and decor gained

2020 was a record year for consumers spending in the Home category as households stocked up on office supplies and furniture to make working from home during quarantine closures more tolerable. Home Furnishings (including Wayfair and Ikea) was already weakening headed into the holidays while lapping that prior year surge. Both retailers lost ground to brands focused on smaller home accessories and decor this Cyber-5, including HomeGoods and World Market. New to the list are Williams-Sonoma and Tuesday Morning, which also largely focus on decor and kitchen accessories, not furniture. The home improvement brands Home Depot and Lowes remained at the top of the list, likely due to consumers spending on high ticket appliances and materials at those stores.

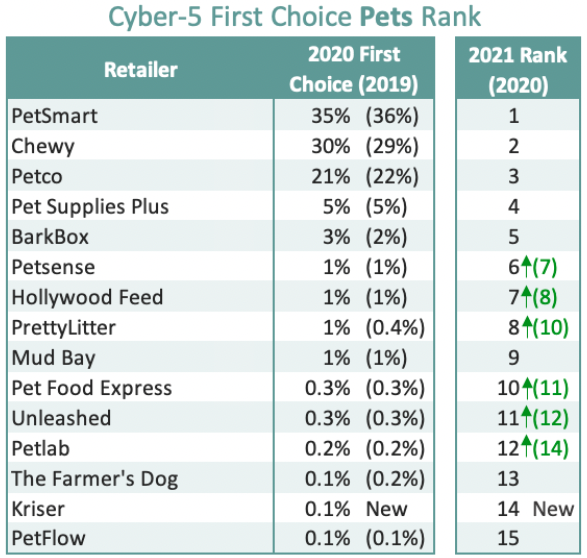

Pets: Petsmart and Chewy stayed on top

Traditional pet mass retail brands Petsmart, Chewy, and Petco kept their top spots among consumers in the Pets category despite Petsmart and Petco both losing some share of consumers’ top spend to Chewy and other smaller retailers. The closure of hundreds of Pet Valu locations made way for several smaller brands to move up in the rankings in 2021. Specialty pet food retailers such as Hollywood Feed, Pet Food Express, and Petlab all gained on the list. Eco conscious litter brand PrettyLitter also gained several spots during the holiday.

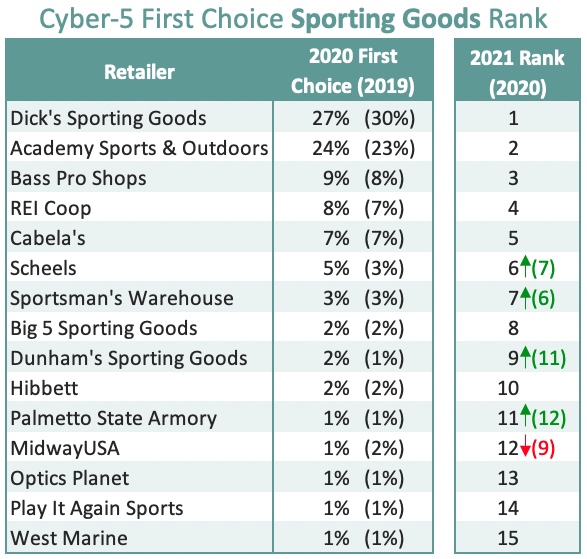

Sporting Goods: Dick’s lead remained despite losing share

Dick’s Sporting Goods retained their top rank in 2021 despite losing several points of top wallet consumer share. Major competitors Academy Sports & Outdoors, Bass Pro Shops, and REI Coop all gained top wallet consumer share. Notable movers included Dunham’s Sporting Goods, which gained 2 rankings while ammunition and firearm retailer MidwayUSA fell several spots.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.