CVS recently announced its plans to close approximately 900 stores over the next three years, while Walgreens has been expanding and diversifying its store fleet – but both brands have been investing heavily in developing their healthcare offerings. We dove into the foot traffic data to better understand these pharmacy leaders’ pivot into healthcare and to see how location analytics can inform which CVS store closures.

Both Brands Strong

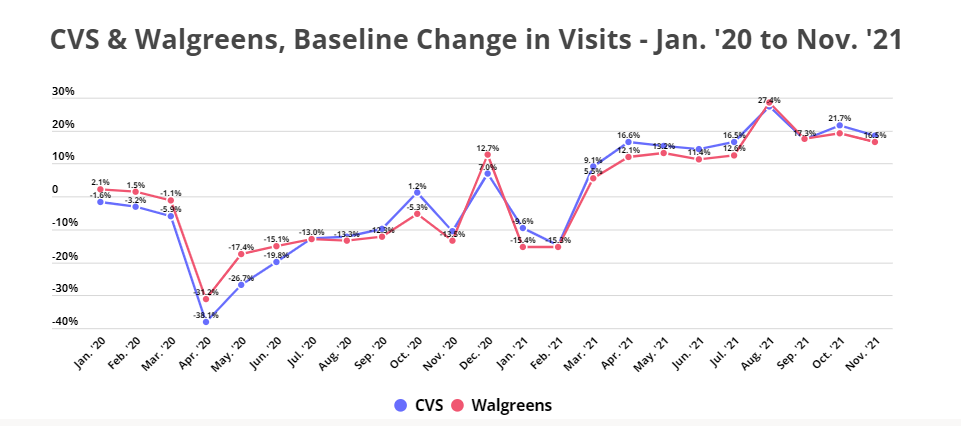

During the first year of the pandemic, visits to the pharmacy leaders took an initial hit (aside from the seasonal December foot traffic spike). But since March 2021, both Walgreens and CVS have seen their foot traffic skyrocket amidst the COVID vaccination drives and rising demand for health and wellness products alongside their wider range of offerings.

But while Walgreens seems to be expanding and diversifying its brick and mortar channels by opening new small-format pharmacy-focused stores and at least 600 primary care practices by 2025, CVS recently made headlines when it announced in November that it “will close approximately 900 stores over the next three years to reduce store density and ensure it has the right kinds of stores in the right locations for consumers and for the business.”

It is clear that CVS is operating from a position of strength. The announced store closings does not stem from any financial need to downsize its store fleet. Instead, the move should be viewed in the context of “right-sizing” to optimize its store fleet and execute its strategy of enhancing “omnichannel health services to meet the needs of consumers when and where they want it.”

CVS and Walgreens’ Pivot to Healthcare in Light of Heavy Cross-Shopping

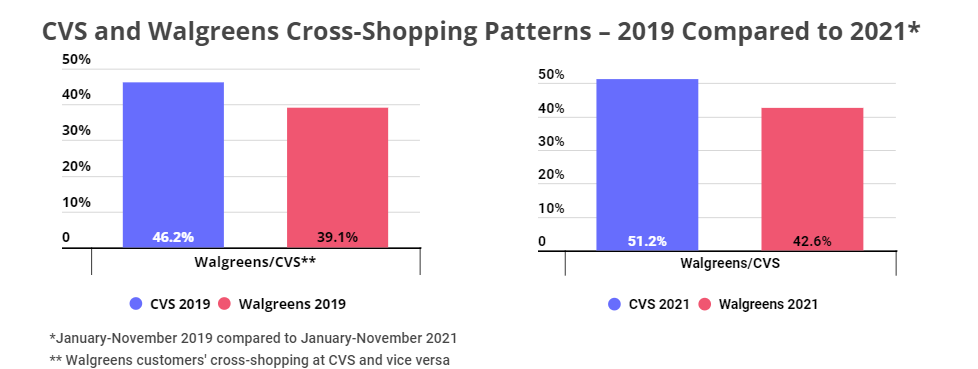

Many Walgreens customers also shop at CVS, and many CVS customers also shop at Walgreens. The large shares of cross-shopping combined with the success both brands have been seeing shows that there is room at the top for two pharmacy leaders.

At the same time, the large and increasing cross-shopping numbers may indicate that a significant number of consumers do not currently see substantial differences between the two brands. In this light, the brands’ respective move into the healthcare provider space will do more than just create an additional revenue channel – it will also likely increase customer loyalty, as patients who are being treated and monitored by Walgreens or CVS medical practitioners will now have a reason to choose one brand over the other.

What CVS stores should be closed?

Store closures are often seen as a cause for alarm, but when handled strategically, they can actually empower a brand to maintain its reach while increasing efficiency within its wider retail footprint. When approached like this, the impact of the closures can actually provide a net gain for the retailer. Potential store closures can be analyzed on a market-specific level, by identifying areas with large shares of underperforming stores that should be thinned out, or or on a property-specific level, by identifying redundant locations.

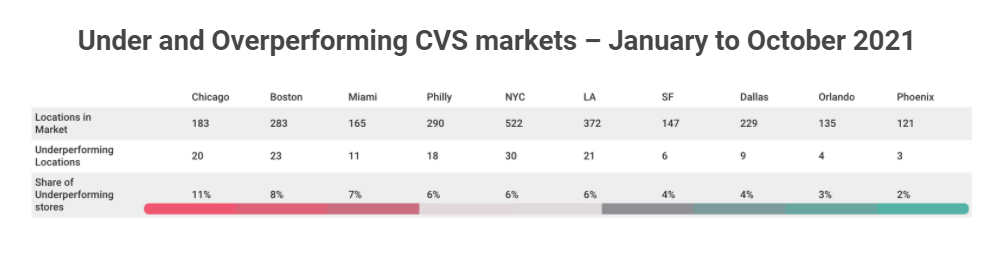

One way to identify markets where store density should be thinned out is to establish a baseline visit performance for a region and identify the standard deviation for each region, which can then be used to identify under and over performing markets. We used our location analytics data to characterize ten of CVS largest markets, and found that, on average, only 6% of CVS stores in a given market were “underperformers.” Several markets, however, including Chicago, Boston, and Miami, had a larger share of underperforming outliers than average.

Thus, it would not be surprising if these markets experienced a larger share of closures than markets such as Orlando or Phoenix that have a lower share of underperformers. This may also speak to areas that had been harder hit by COVID migration patterns and shifts in where and how people work.

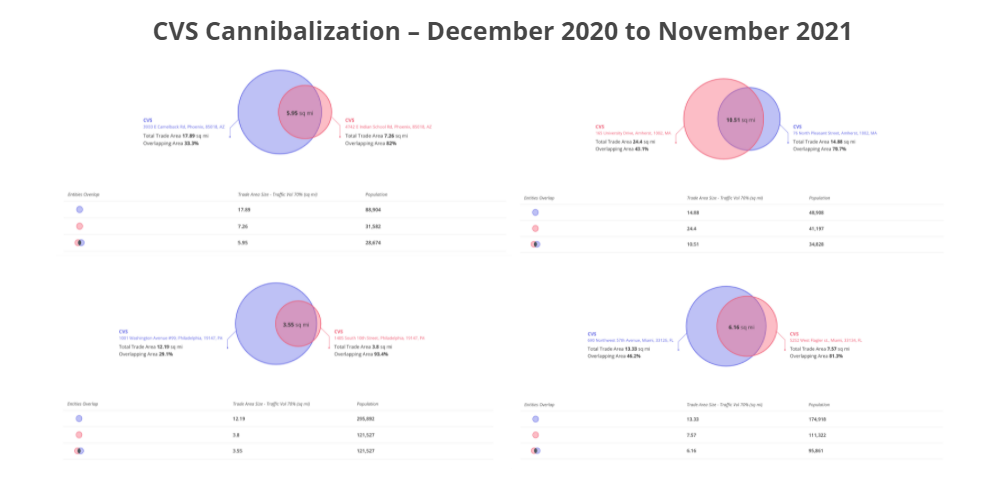

Another critical factor is accounting for cannibalization. CVS stores do not only have to compete with Walgreens – the current number and distribution of CVS stores means that these stores often end up competing with each other.

For example, the graph below shows four sets of nearby CVS stores, where the trade area of one CVS exhibits 70% or more overlap with the trade area of another nearby CVS. This means that the vast majority of customers of the cannibalized CVS also visit the nearby CVS. Closing these locations would not greatly inconvenience CVS’ existing customers – they can just continue to consume the company’s product and services at the nearby branch, which they already patronize. It would be likely, then, that CVS will close at least some of these cannibalized locations as part of its store fleet consolidation and optimization.

Should CVS leverage this rightsizing effort to better maximize the efficiency of its reach, the result could drive a far more effective impact on a per store basis.

Will Walgreens continue to expand its store fleet? Will CVS focus on closing cannibalized stores, underperforming stores, both, or neither?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.