Public equity investors use Apptopia’s app data estimates to identify leading indicators and trend shifts in tickers six to eight weeks ahead of consensus. Apptopia’s data is quite literally a clairvoyance in equity trading (we won’t haunt your house though).

Apptopia’s Director of Equity Research, Tom Grant, recently chatted with Neudata to discuss travel industry trends as COVID-19 continues to shape the sector. Car rental companies, like everyone else in the industry, have taken a hit from COVID. However, as people continue to prefer isolated travel to that of public transportation, car marketplace apps, parking apps, and car rental apps have seen periods of strong growth this calendar year.

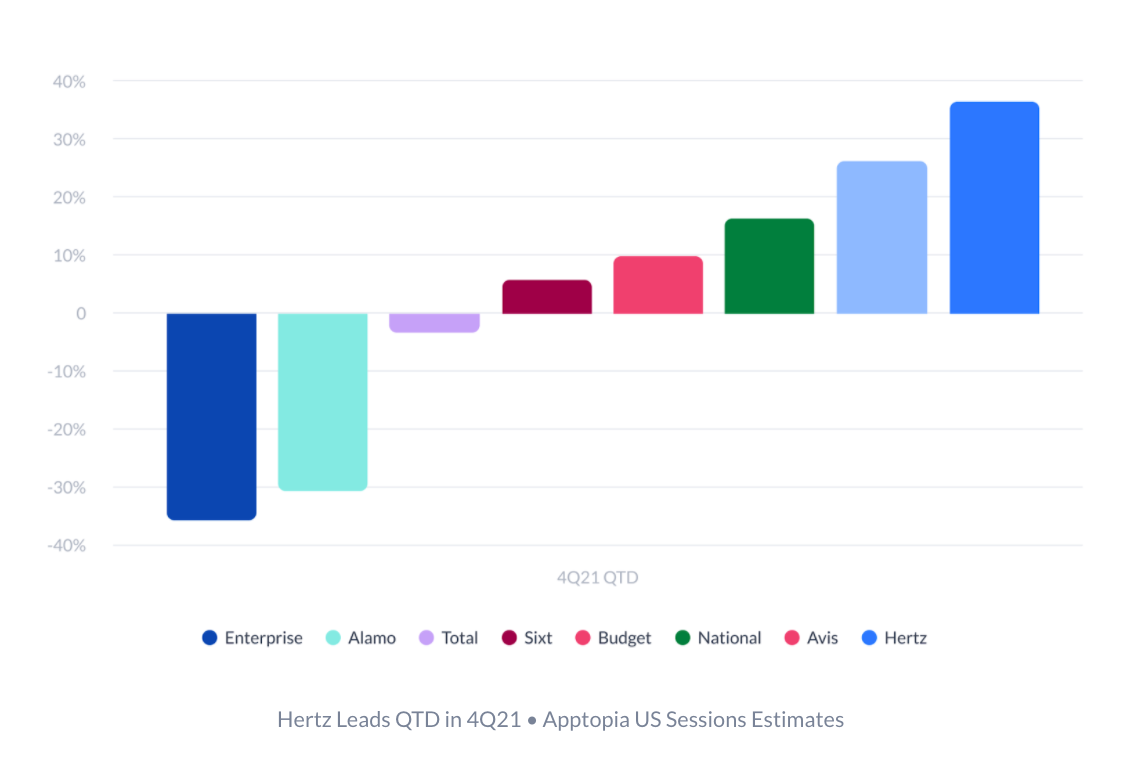

In terms of mobile app activity, car rental apps turned negative by 2% collectively, in 4Q21. This decline was driven by Enterprise’s US Sessions Estimates being down more than 30%. Alamo, which Enterprise owns, is also down significantly.

That being said, there is one exception. Hertz’s (NASDAQ: HTZWW) US Sessions Estimates were up over 30%. This can be attributed mostly to its deal with Tesla, where they pledged to purchase 100,000 vehicles from the electric car manufacturer. Whether or not Hertz is equipped to handle the growth associated with this acquisition will be determined in the coming months.

Another important consideration for Hertz moving forward is cost. Typically, rented cars are low end, affordable models, keeping rental prices low. The cost of a Tesla starts around $50k. Will this jack up Hertz’s rental prices? Will people want to pay this premium to rent a Tesla on top of their other travel expenses? Judging by app activity, it appears people are at least curious. Personally, I would say absolutely not. I love a good deal. Give me that cost-effective Nissan Versa and I am perfectly happy.

The one thing backing up Hertz’s jump is its market share. In the mobile sphere, Hertz now takes up a sizable 16% of all car rental app sessions in the US.

Hertz’s dance with Tesla certainly gives the public a glimpse into what renting a car could be like in the near future. For now, how will Hertz remain competitive with this costly acquisition? Could a competitor undercut Hertz and send it back to its all time lows where it was just a few months ago?

To learn more about the data behind this article and what Apptopia has to offer, please reach out to Connor Emmel at cemmel@apptopia.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.