In-person dining at national restaurants began returning to pre-pandemic levels once people received their vaccinations.

According to the NPD Group, online and physical visits to fast casual restaurants were up 8% year-over-year by August, reaching levels similar to 2019.

“Fast casual restaurants have capitalized on the lessons they learned during the pandemic,” says David Portalatin, NPD food industry advisor and author of Eating Patterns in America. “Their customers are happy to return because so many fast casual restaurants have built a strong clientele based on their innovation and ability to deliver a quality customer experience.”

Curious about which brands are ready to spend big to bring more customers back in 2022? These are the top spenders from 2021.

MediaRadar Insights

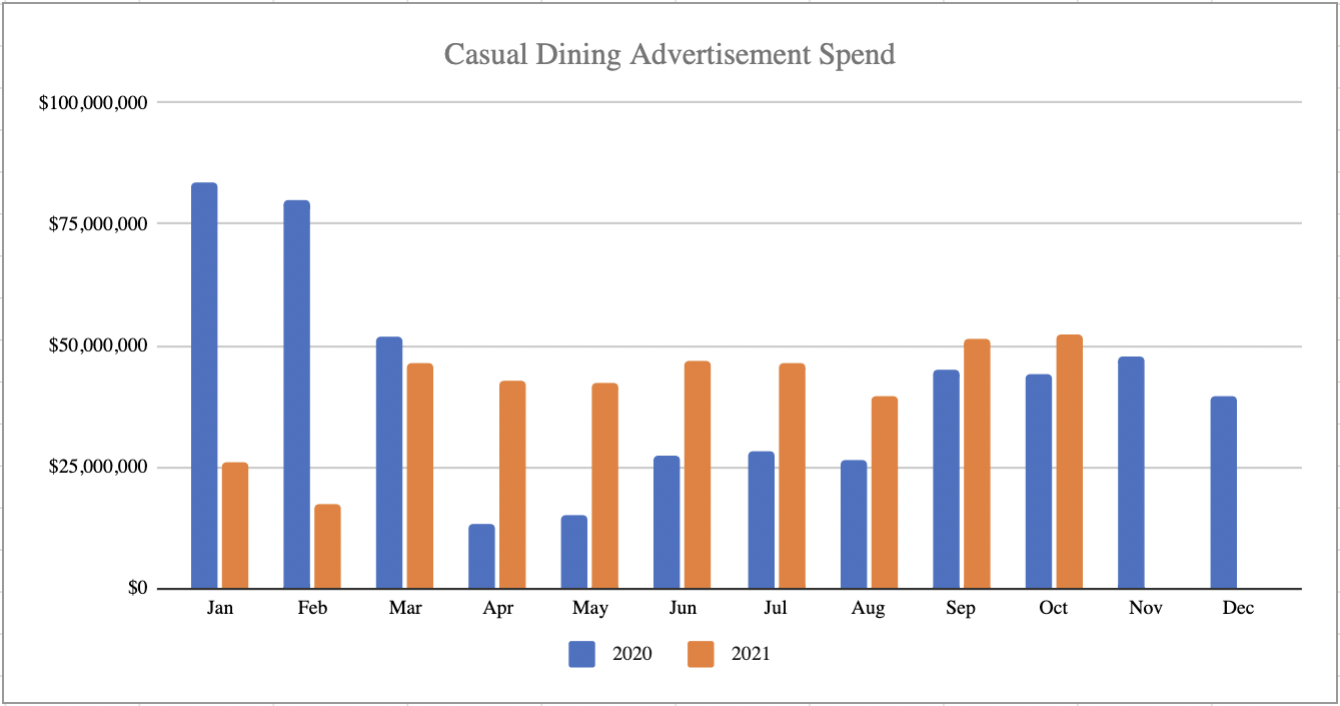

Overall Spending and Breakdown Across Formats

Overall, casual dining restaurants spent $412.2 million through October 2021. This is similar to last year, but it is down 1%.

Advertisers invested most in TV. However, at the same time, this is the format shrinking the quickest. Brands spent $248.9 million across the format, which is 19% less than last year.

Brands are shifting their TV and Print dollars into Digital. Digital grew 71% in 2021, reaching $145.5 million (through October.)

Print fell 16%. Advertisers spent $17.6 million in this format through October 2021.

Number of Advertisers

4.8 thousand advertisers spent $412.2 million in 2021 compared to 4 thousand advertisers spending $415.4 million in 2020.

Advertiser Retention

In the overall category, advertisers had a 35% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

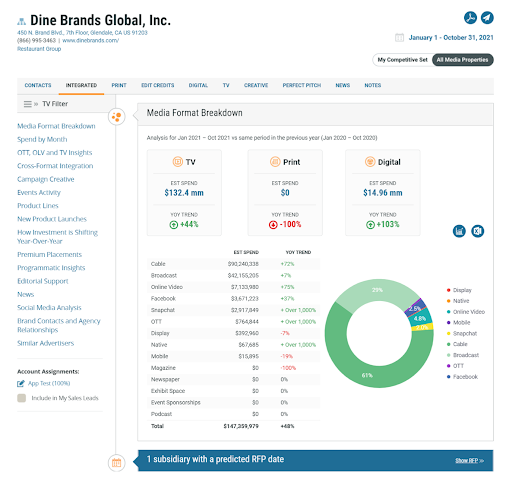

1. Dine Brands Global, Inc.

Dine Brands is a top advertiser in this category with 77% of their spend invested promoting their restaurants. Overall, their ad spend is up 48%, reaching more than $147mm.

Their spend in digital has increased 103%. Their TV spend is up 44%. Dine Brands is making considerable investment in Snapchat and OTT, with spending up 1000% in each.

Below is a breakdown of Dine Brand’s ad spend thus far in 2021. We predict they will likely have 1 RFP issued, MediaRadar can help you connect with 16 key contacts at Dine Brands.

2. Roark Capital Group

Roark Capital Group has been increasing their spend this year. Their spending is up 35% overall year-over-year with a spend of over $588 million, with 13% of its ad spend in this category.

Overall their TV, print and digital spend are all up. TV is up 31%, Print is up 13% and Digital is up 55%.

Their spend in online video is up over 118% year-over-year, while their OTT spend is up 206%.\

Below is a breakdown of Roark Capital Group’s ad spend thus far in 2021. We predict they will likely have 8 RFPs issued, MediaRadar can help you connect with 101 key contacts at Roark Capital Group.

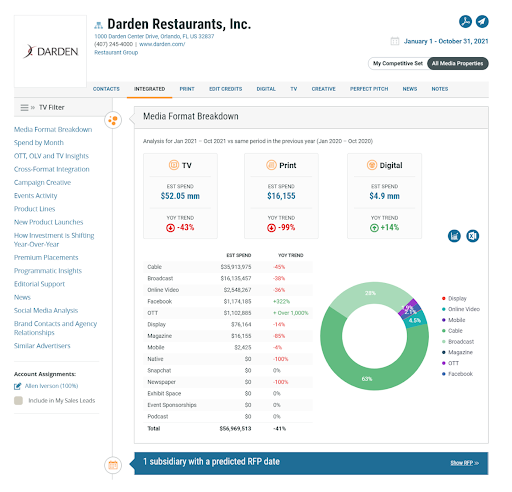

3. Darden Restaurants, Inc.

Darden Restaurants is a top brand in this category 100% of the ad spend budget promoting their restaurants. Notably their digital spend is up 14%.

Spend is up 1000% in OTT. Their Facebook investment is up 322%. Darden is spending much less in Print this year than last, down 99% year-over-year. On TV, their spending is down 43%.

Below is a detailed summary of Darden’s ad spend thus far in 2021. We predict they will likely have 1 RFP issued, MediaRadar can help you connect with 21 key contacts at Darden.

4. Denny’s Corporation

Denny’s is a top spender in this category with 88% of their total spending invested in this category. Overall, their ad spend is up 14% year-over-year.

They’re spending heavily across Digital and TV.

In digital they’re spending approx $2.3 million which is an increase of 815% over last year. Some formats that are growing for Darden include: Online Video & Magazines – both up 1000% year-over-year. They’re new to Facebook advertising this year.

Their spend in TV is nearly $18 million, which is down 1% from last year.

Below you’ll see a detailed breakdown of Denny’s Corporation’s spending. Always be ready to pitch with MediaRadar. We have 11 media buying contacts at Denny’s and their agencies.

5. CBOCS Properties Inc.

CBOCS is a top spending in the category, with 100% of spend invested in casual dining.

Overall, they’re spending heavily in digital and TV. Both are up. TV is up 109%, while digital is up 153%. They’re new to print, OTT, Snapchat and Magazine formats.

Below is a breakdown of CBOCS Properties’ ad spend. MediaRadar predicts that there is one likely RFP and and can connect with 4 media buyers at CBOCS Properties and their agencies.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.