Despite chip shortages and factory closures, top consumer electronic producers had strong sales this year.

According to the latest report by Global Market Insights Inc., the market valuation of consumer electronics will cross $1.5 trillion by 2027.

Trends that will mark this sector next year include: a push for smart devices, more energy-efficient products, and investment in other sustainability practices.

With the steady growth in the electronics market, it’s a great time to pitch top brands who invest heavily in advertising.

MediaRadar Insights

Overall Spending and Breakdown Across Formats

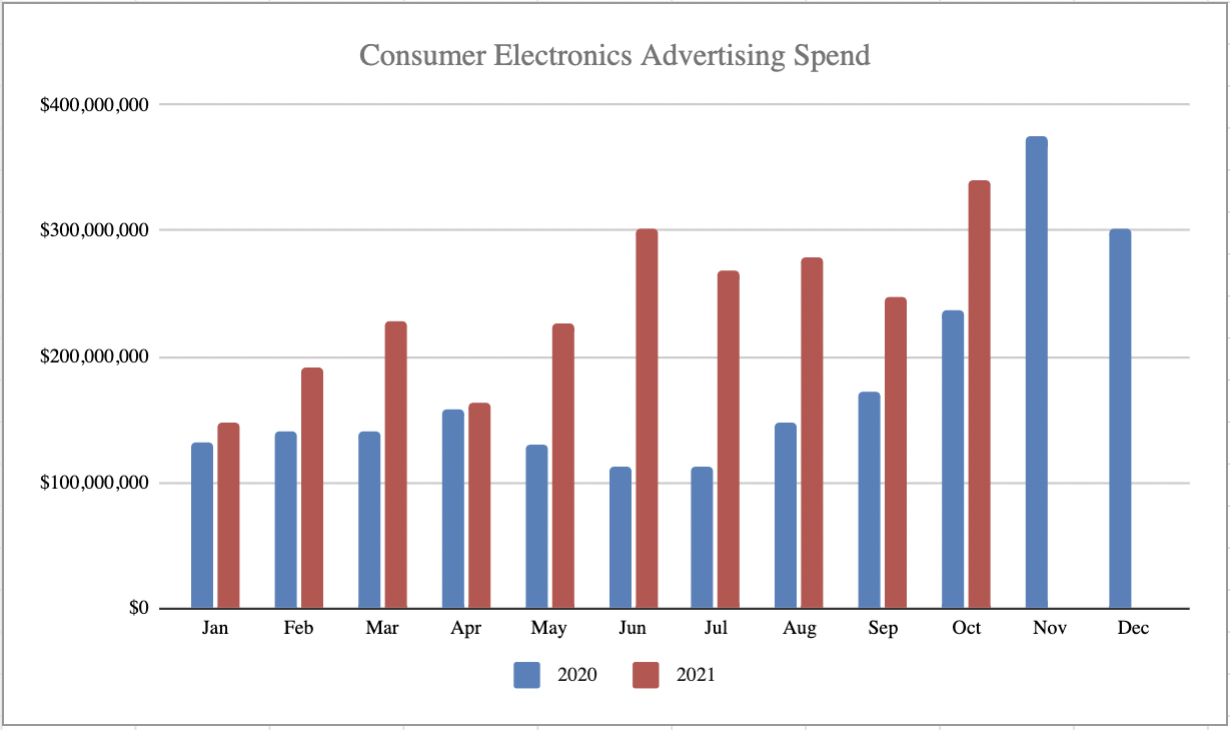

Overall, consumer electronics companies spent $2.4 billion through October 2021. This is an increase of 61% year-over-year.

$1.3 billion of this spending went to digital placements, which is up 65% from last year.

TV grew even more. Spending in this format increased by 80%, totalling $958.6 million.

Print also grew, even if at a slower pace. Print grew 19% year-over-year, with spending reaching $145.2 million.

Number of Advertisers

6,750 advertisers spent $2.4 billion in 2021 compared to 6,250 advertisers spending $1.5 billion in 2020.

Advertiser Retention

In the overall category, advertisers had a 56% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

1. Samsung Group

Samsung Group is a top advertiser in the consumer electronics market, with 85% of their overall budget on ads promoting their consumer electronics brands. Their ad spend is up 83% since last year.

Spending on TV advertisements has increased 125% year-over-year with a total spend of over $277 million, split between cable and broadcast platforms. Digital spending has seen an increase as well, with investments in Snapchat and OTT advertisements increasing by over 1000%.

Below is a breakdown of Samsung Group’s ad spend thus far in 2021. We predict they will likely have 9 upcoming RFPs issued. MediaRadar can help you connect with 66 key contacts at Samsung Group.

2. Apple, Inc.

Apple, Inc. is another major advertiser in the consumer electronics category, with $450 million, 54% of their overall budget, going to advertising their consumer electronic products. Apple’s ad spending has increased 35% since last year.

Over $257 million has been invested in TV advertising, a 28% increase year-over-year. $183 million is allocated to broadcast ads and nearly $74 million to cable ads.

Digital advertisements saw an increase of 48% year-over-year, with a spend of over $186 million, $135 million of which went into online video ads.

Below is a breakdown of Apple, Inc’s ad spend thus far in 2021. We predict they will likely have 3 upcoming RFPs issued. MediaRadar can help you connect with 38 key contacts at Apple, Inc.

3. Denali Holding Inc.

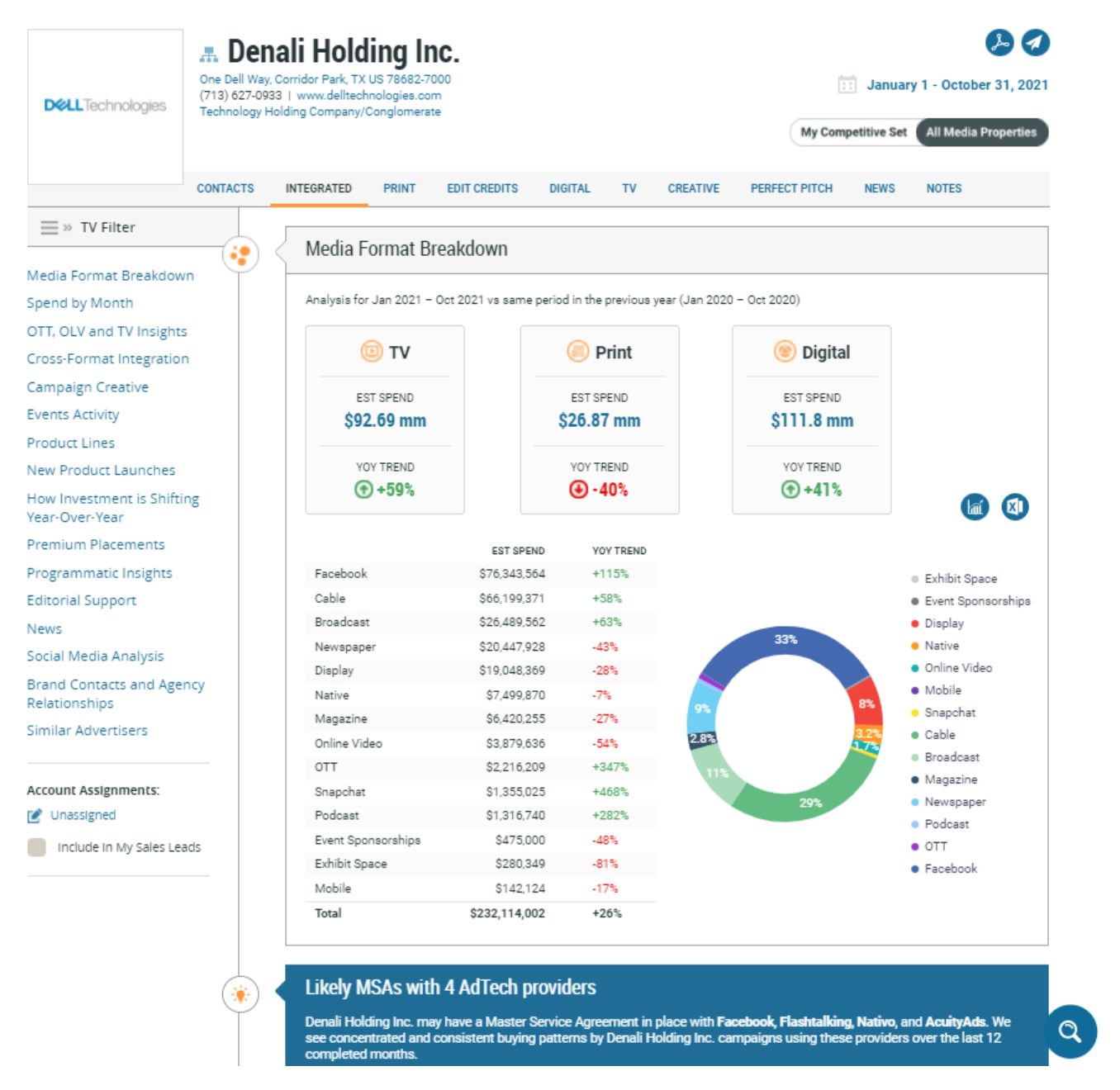

Denali Holding Inc is also a major advertiser in the consumer electronics market, with 76% of their overall budget going towards promoting their consumer electronic products. They saw an increase in spending of 26%.

Spending on digital advertisements increased by 41% this year, with Facebook, OTT, Snapchat, and Podcast ads seeing spending increase by over 100%. TV spending increased by 59% year-over-year, with $66 million going towards cable ads and $26 million going to broadcast ads.

Below is a breakdown of Denali Holding Inc ad spend thus far in 2021. MediaRadar can help you connect with 33 key contacts at Denali Holding Inc.

4. Alphabet, Inc.

Alphabet, Inc is another top advertiser in consumer electronics, with a spend of nearly $490 million promoting their consumer electronic products, an increase of 75% year-over-year.

Print advertising saw a spend increase of 145%, with Newspaper and Magazine ads seeing an increase of 171% and 121% respectively.

TV spending, which increased by 72% year-over-year, saw $186 million allocated to broadcast ads and $146 million to cable ads.

Alphabet also increased their digital ad spend by 56% year-over-year.

Below is a breakdown of Alphabet, Inc’s ad spend thus far in 2021. We predict they will likely have 7 upcoming RFPs issued. MediaRadar can help you connect with 129 key contacts at Alphabet, Inc.

5. Amazon.com, Inc.

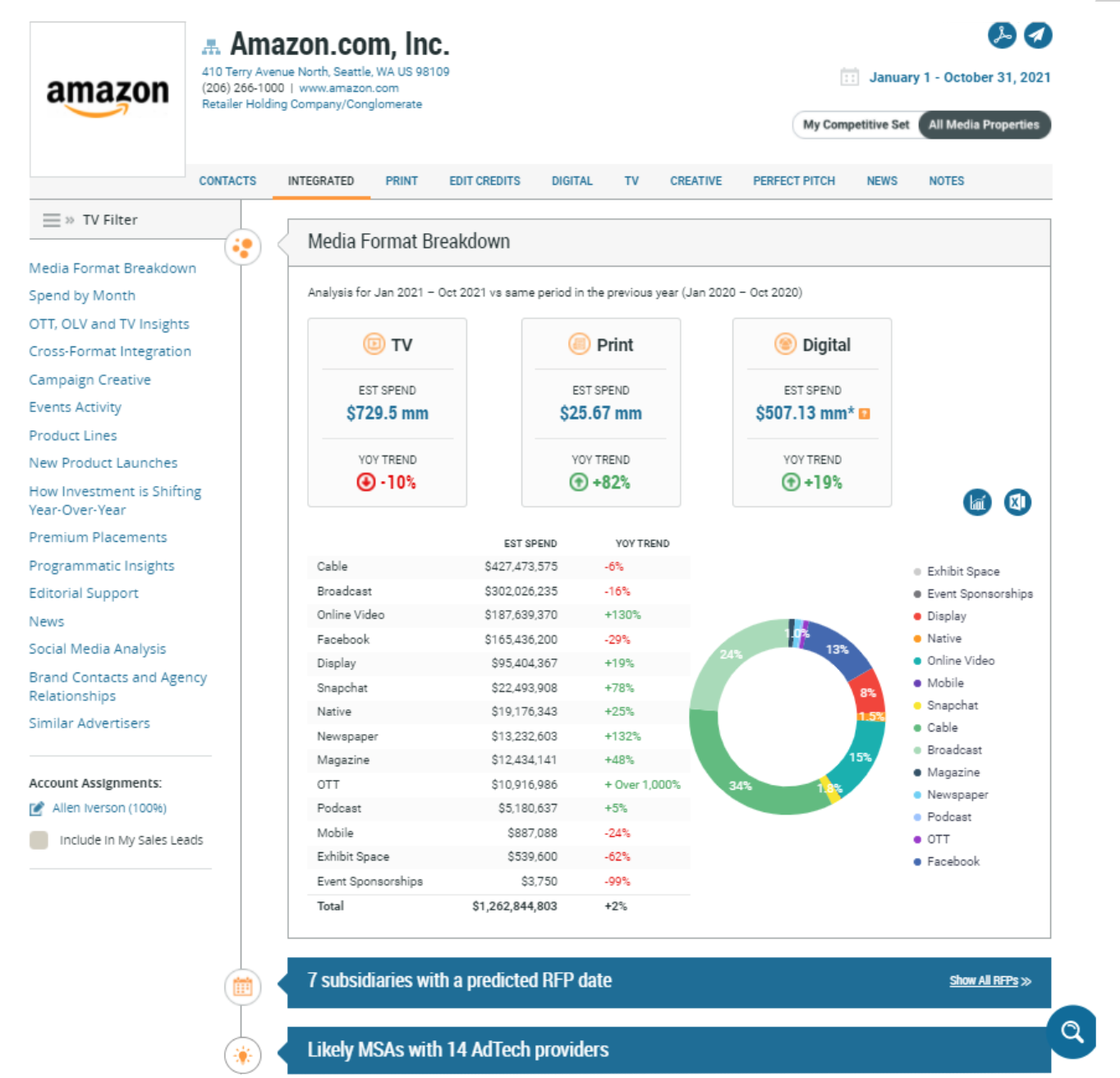

Amazon.com, Inc. is one of the biggest advertisers of consumer electronics, with a total estimated spend of nearly $1.3 billion, an increase of 2% year-over-year.

Digital and Print advertisements both saw increased spending, with investments in online video, social media, and OTT platforms.

Amazon spent nearly $730 million on TV advertisements, with $427 million allocated to cable ads and $302 million to broadcast spots, accounting for 34% and 24% of the overall spend respectively.

Below is a breakdown of Amazon.com, Inc’s ad spend thus far in 2021. We predict they will likely have 7 upcoming RFPs issued. MediaRadar can help you connect with 134 key contacts at Amazon.com, Inc.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.