Another holiday season has come and gone, but like the one experienced in 2020, 2021’s iteration was anything but ‘normal’. For many retailers, Thanksgiving was again removed from the mix and the wider season was dominated by concerns over supply chain challenges, labor shortages, and the omnipresent risk of rising COVID cases.

And, as perhaps should have been expected considering the 2021 experience, all of these effects were felt. Yet, the situation was hardly doom and gloom, with many retailers seeing exceptional traffic to locations throughout the holiday season.

So, what were the unique aspects of the 2021 season and which have the highest likelihood to continue to impact the sector in the coming years?

The Extended Season

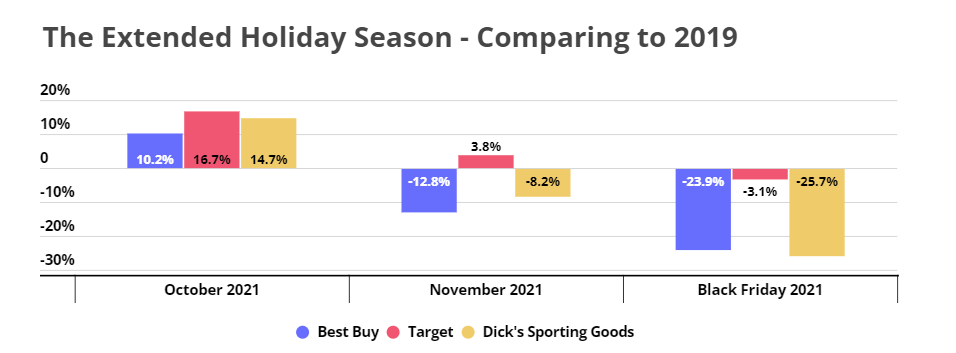

Because of the aforementioned concerns over supply chain and labor, many retailers made active pushes to drive visits earlier in the holiday season. And the result was clearly seen. Visits for many top retailers were up significantly in October as many visitors made an effort to get holiday shopping done early to ensure having their products on time.

Yet, the effort to extend the season also reduced the urgency for shopping on major days like Black Friday. As a result, many retailers saw significant reductions in visits on Black Friday itself – even when the wider season’s results were much stronger. Target saw a 3.1% decline on Black Friday even though November visits were up 3.8%. Best Buy, a brand that traditionally sees huge traffic increases on Black Friday, saw visits down 23.9% on the day, even though November visits were down just 12.8% and October visits were up 10.2%.

The shift to extend the season is important not just because it empowered retailers to succeed under difficult and unique circumstances. The shift is also critical because it signifies the ability of retailers to shape consumer behavior through effective communication and incentivization in order to create a win/win. Retailers wanted to ensure that customers had the products they wanted, and had them on time. By articulating the challenges and effectively incentivizing the change that would help overcome them, the wider retail sector was able to impact an existing consumer behavior for the better of all parties. This is an important lesson as both consumers and retailers continue to grapple with an environment that is still finding a new equilibrium post the disruption caused by COVID. Optimistically, it offers the hope that the future retail environment could be better for all parties involved.

Black Friday’s Relative Demise

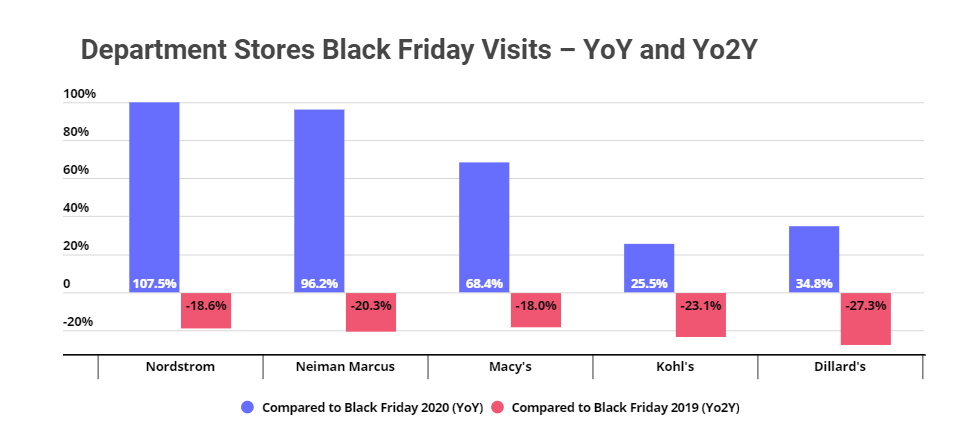

While the magnitude of the Black Friday decline will likely not be as severe in 2022, it is difficult to ignore the decline in the overall centrality of the day to the wider shopping season. Black Friday is not going anywhere, nor should we assume that 2021 metrics are an accurate reflection of the day’s continued weight. However, the ability of many brands to drive success over a more extended period without the same onslaught of visits will likely drive a continued push for an extended season in years to come.

That means that at least some visitors – if not a growing number – will likely choose to shop earlier or later in the season to avoid the rush of the pinnacle date for brick and mortar shopping. So, though Black Friday 2022 should surpass 2021 standards, it’s very likely that it will also fail to reach the standards set in 2019.

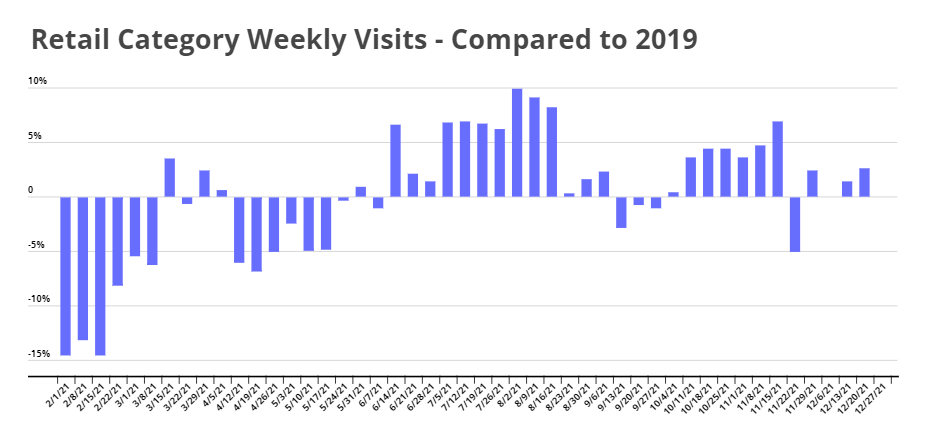

Perfect Storm, But Still Success

Retailers were simultaneously concerned that supply chain issues would lead to a lack of products in stores, labor shortages would limit professionals to staff those same locations and COVID would impact consumer demand for in-store visits. And while the effects of all of these issues were felt, overall retail visits still remained relatively close to – if not above – 2019 levels and far ahead of 2020 numbers.

The ability to drive success even in the face of a ‘perfect storm’ of challenges is a massive testament to the ongoing consumer demand for physical retail. While the sector is clearly evolving in a direction that demands greater omnichannel alignment, the continued centrality of the physical store received a major vote of confidence over the holiday retail season.

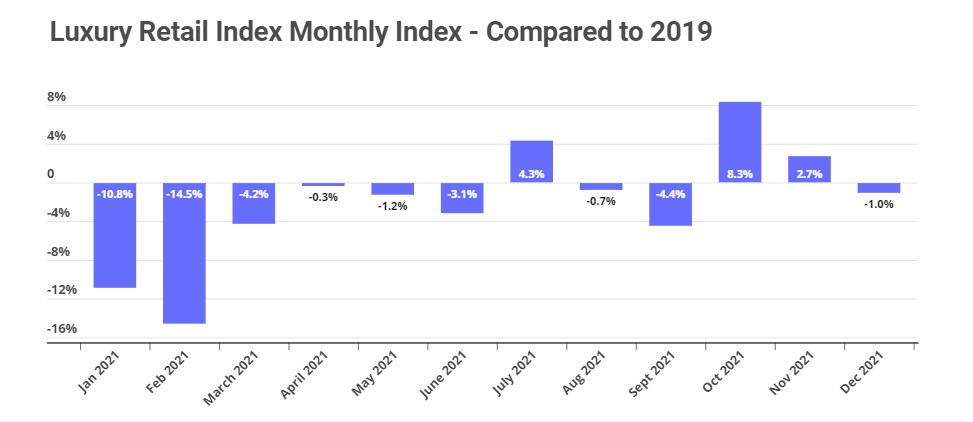

Luxury Reigns

Between government stimulus and an increased ability to save for high earning individuals, luxury retail saw a strong end to 2021. While visits were down 1.0% in December compared to the same month in 2019, the relatively minimal decline combined with Yo2Y growth in October and November all suggest a very strong holiday period for the luxury space.

This optimism is only reinforced by increased transaction sizes in this sector, the high level of conversions for in-store visits and the greater levels of disposable income key audiences for this segment have available. While a wider reopening of the economy should dilute some of the forces that drove the sector’s unique success, other factors, including the return of international travel, should help drive visits to brands in the space in the year to come.

Which holiday takeaways will provide the most impact?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.