Loan Performance Insights Report Highlights: October 2021

In October 2021, 3.8% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), which was a 2.3-percentage point decrease from October 2020 according to the latest CoreLogic Loan Performance Insights Report . Comparatively, the overall delinquency rate in October 2019 was 3.7%.

Overall Delinquency Rates

The share of mortgages that were 30 to 59 days past due — considered early-stage delinquencies — was 1.2% in October 2021, down from 1.4% in October 2020. The share of mortgages 60 to 89 days past due was 0.3% in October 2021, down from 0.6% in October 2020.

The serious delinquency rate — defined as 90 days or more past due, including loans in foreclosure — was 2.2% in October, down from 4.1% in October 2020. Forbearance programs have kept delinquencies from progressing to foreclosure and therefore the foreclosure inventory rate — the share of mortgages in some stage of the foreclosure process — was at a 22-and-a-half year low of 0.2% in October 2021. However, the share of borrowers behind on payments by six months or more was 1.6% in October — making up roughly 40% of the overall delinquency rate.

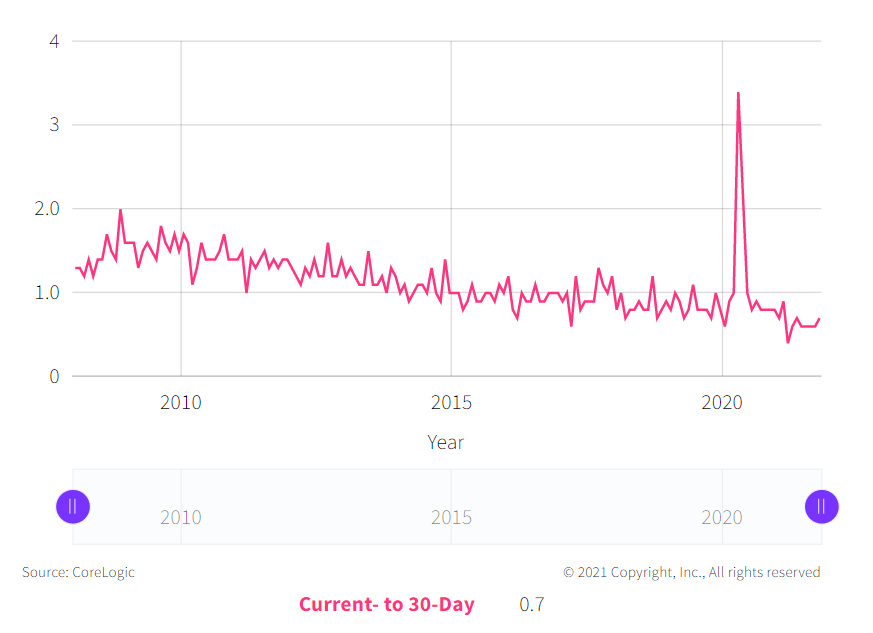

Figure 1: Current- to 30-Day Transition Rate Shows Sharp Decrease From Year Ago

October 2021

Stage of Delinquency: Rate of Transition

In addition to delinquency rates, CoreLogic tracks the rate at which mortgages transition from one stage of delinquency to the next, such as going from current to 30 days past due (Figure 1).

The share of mortgages that transitioned from current to 30 days past due was 0.7% in October 2021 — a decrease from 0.8% in October 2020. Low transition rates indicate that while the rate of mortgages in any stage of delinquency remained elevated, fewer borrowers slipped into delinquency than at the peak of delinquency rates in 2020.

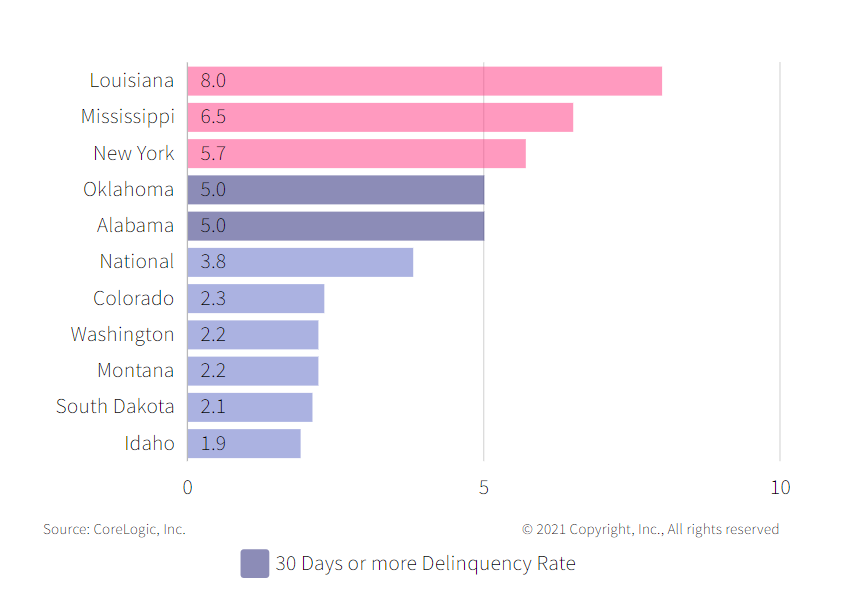

Figure 2: States With the Highest and Lowest Rate of Mortgages At Least 30 Days Past Due

October 2021

State and Metro Level Delinquencies

All states posted annual decreases in their overall delinquency rates in October 2021 as the employment picture improved across the country compared to a year earlier. Figure 2 shows the states with the highest and lowest share of mortgages 30 days or more delinquent. In October 2021, that rate was highest in Louisiana at 8% and lowest in Idaho at 1.9%. Idaho has had one of the strongest job recoveries in the U.S. and Louisiana has had one of the weakest. As of October 2021, Idaho had recovered all the jobs lost in March and April 2020 while Louisiana had only recovered 52% of jobs lost.

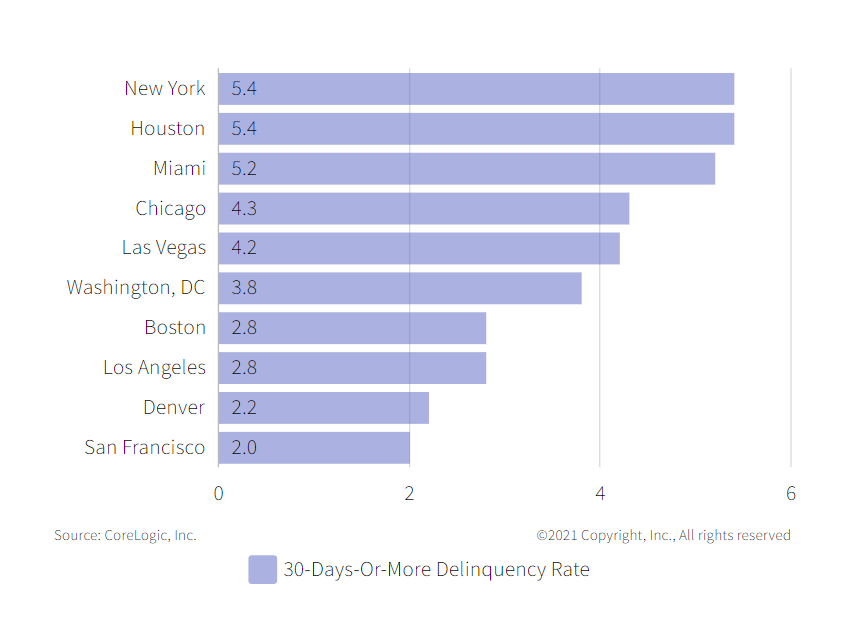

Figure 3: Percentage of Mortgages At Least 30 Days Past Due For the Ten Largest Metropolitan Areas

October 2021

Figure 3 shows the 30-plus-day past-due rate for October 2021 for 10 large metropolitan areas. New York and Houston had the highest rates at 5.4%, and San Francisco had the lowest rate at 2%. Miami’s rate decreased 5.2 percentage points from a year earlier. Outside of the largest 10, all but two metros recorded a decrease in the overall delinquency rate. Nevertheless, elevated overall delinquency rates remain in some metros, including Houma-Thibodaux, Louisiana (13.5%); Odessa, Texas (10.2%); Hammond, Louisiana (9.7%) and Laredo, Texas (9.6%).

After over a year of trying conditions for borrowers, delinquency rates have improved. Data from the Bureau of Labor Statistics shows that by October 2021 an estimated 82% of the jobs lost in March and April 2020 were recovered, which translates to roughly 18.2 million Americans back at work. The combination of significant job market improvement, home quity increases and federal assistance programs have helped overall delinquency rates decline to 3.8%, which is close to the October 2019 rate of 3.7%.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.