The rise of the Omicron variant coincided with the start of the 2021 holiday travel season, and many worried that the rise in cases would throw a wrench into Americans’ much anticipated travel plans. We dove into the foot traffic data to find out – how did the current COVID wave affect holiday travel?

Hotels Fully Recovered Despite Circumstances

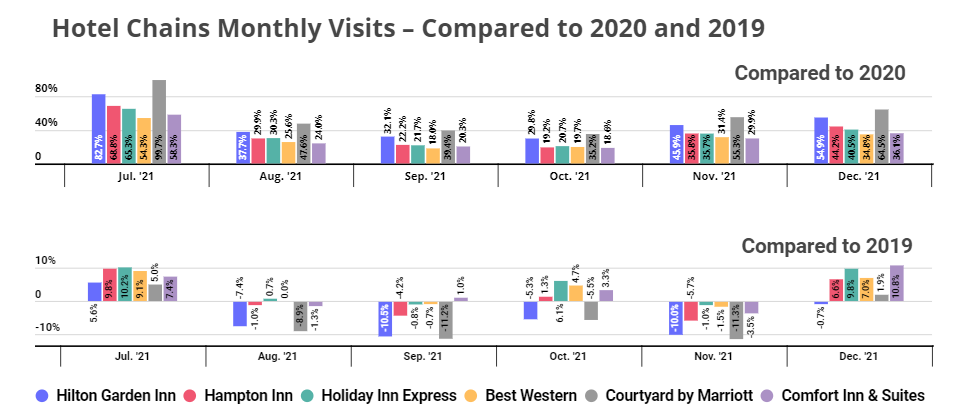

Despite the fourth and fifth COVID waves, location analytics data shows that the hotel industry has been on the path to recovery for quite some time. In July, at the height of the summer travel season, all the hotel chains analyzed showed impressive year-over-two-year (Yo2Y) growth in visits. The loss of international travel appears to have driven a boost to domestic travel.

The Delta wave could have yielded a serious blow to the industry – but foot traffic data shows that it did not reopen the visit gaps for most chains. Instead, Hampton Inn, Holiday Inn Express, Best Western, and Comfort Inn & Suites merely returned to 2019 visit levels in August and September and were back to growth by October 2021. And although these chains took a slight Yo2Y dip in November – most likely due to the downturn in Thanksgiving travel – all were back to posting solid Yo2Y visit increases by December, with visits to Hampton Inn, Holiday Inn Express, Best Western, and Comfort Inn & Suites, up by 6.6%, 9.8%, 7.0%, and 10.8%, respectively, compared to 2019.

Hilton Garden Inn and Courtyard by Mariott are recovering slightly slower, but these chains are still on a clear upward trajectory. In December, Hilton Garden Inn visits were only 0.7% lower than they had been in December 2019, while foot traffic to Courtyard by Marriott hotels was up 1.9% Yo2Y.

Strong Yo2Y Growth in Weekly Visits – Except for the Week of Christmas

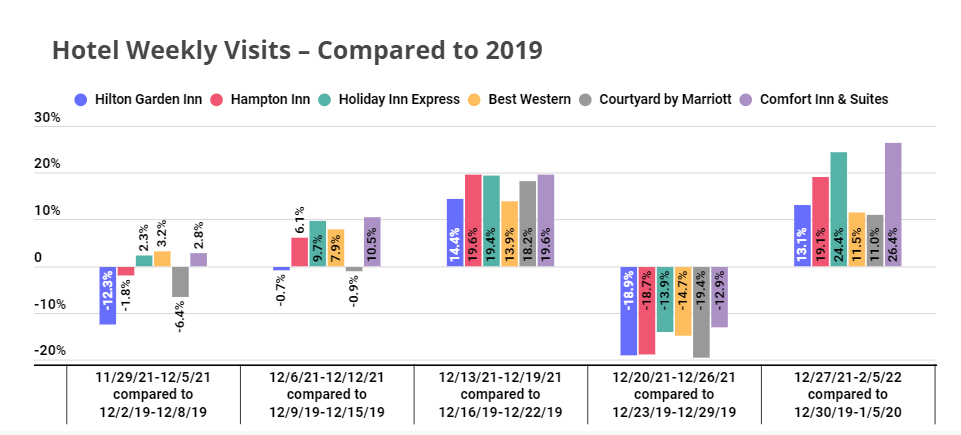

Diving into the weekly visit growth for December uncovers an interesting pattern: all six chains analyzed experienced strong Yo2Y growth in weekly visits the week before Christmas as well as the week following, but Yo2Y hotel foot traffic was significantly down for the week of the holiday itself.

This could mean several things. Maybe Americans actually enjoyed celebrating last year’s holidays with their local friends and family, and so opted to stay close to home for the holiday itself this year as well – and made up for it by travelling more intensely the weeks before and after. It could also mean that after missing their extended family during last year’s holiday, people who did travel this year chose to stay in their relatives’ homes – whereas they had previously stayed in hotels – to get a little more family time in.

Air Travel Slower to Recover

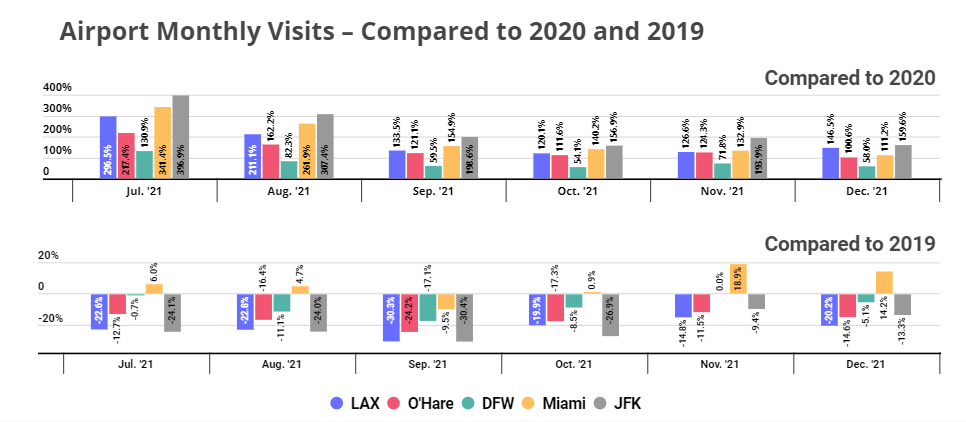

The hotel industry’s impressive recovery does not seem to be spilling over to airport foot traffic. With the exception of Miami International Airport, which registered a 14.2% Yo2Y growth in December visits and has been leading the pack in terms of visit recoveries all year, other major airports analyzed are still lagging behind their 2019 foot traffic performance. Los Angeles International Airport (LAX), Chicago O’Hare, Dallas/Fort Worth (DFW), and John F. Kennedy International Airport (JFK) experienced Yo2Y visit decreases of 20.2%, 14.6%, 5.1%, and 13.3%, respectively, compared to December 2019.

But just because the airport recovery is moving at a slower pace than the hospitality rebound does not mean that predictions for airports’ 2022 performance should be pessimistic. The strong YoY foot traffic numbers show the demand for air travel has risen sharply in the past year despite the circumstances and offers hope for a comeback.

Little Correlation Between Airport and Hotel Recovery

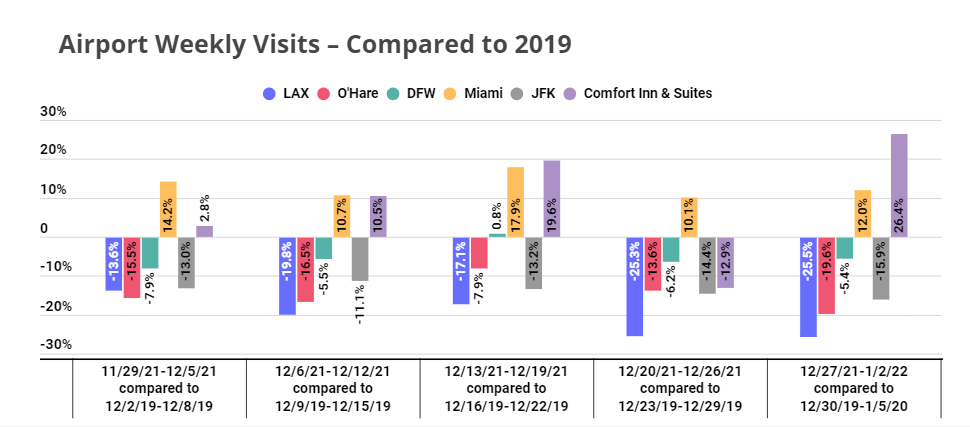

The Yo2Y weekly airport foot traffic data doesn’t show one clear pattern in the same way as the Yo2Y weekly hotel numbers did – but this lack of correlation is itself revealing. Indeed, location analytics show that the significant rise in hotel visits during the weeks before and after Christmas did not have any substantial impact on airport weekly visits.

The lack of correlation between these two data sets means that even those Americans who are travelling seem to be avoiding airports. And since visits to train stations throughout the country are also down, the conclusion must be that more Americans are choosing to travel by car – likely because personal vehicles are the least risky options during these times of pandemic. And since it is unclear what impact this increase in road trips will have on domestic air travel long-term, now may be an opportunity for rest stop operators and other highway retailers to try out new strategies and diversify their product offerings as they try to win the loyalty of new types of customers who might not have been on the road pre-pandemic.

Will the hotel recovery remain steady? Will air travel return to pre-pandemic levels in 2022?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.