The sales mix for club stores online can be very different than in-store. In today’s Insight Flash, we use our CE Receipt data to dig into individual online transactions for Costco and BJ’s. Although Costco is generally more likely to be thought of as a destination for higher-end goods like wine and jewelry, we dig into how the item mix really differs versus BJ’s and what role seasonality plays.

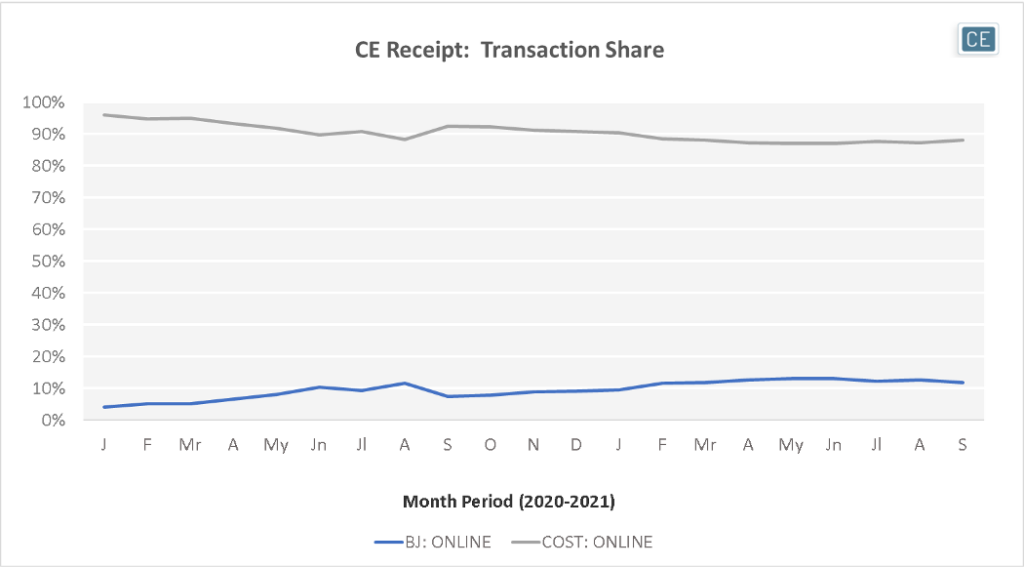

Although Costco online sees substantially more transactions than BJ’s online, BJ’s was chipping away at that share in the beginning of 2020. Share doubled from 4% in January to 8% in May. Although 2020 share peaked at 12% in August before declining back to single digits, it climbed back to 12% in February 2021 and went as high at 13% in May and June of that year.

Transaction Share

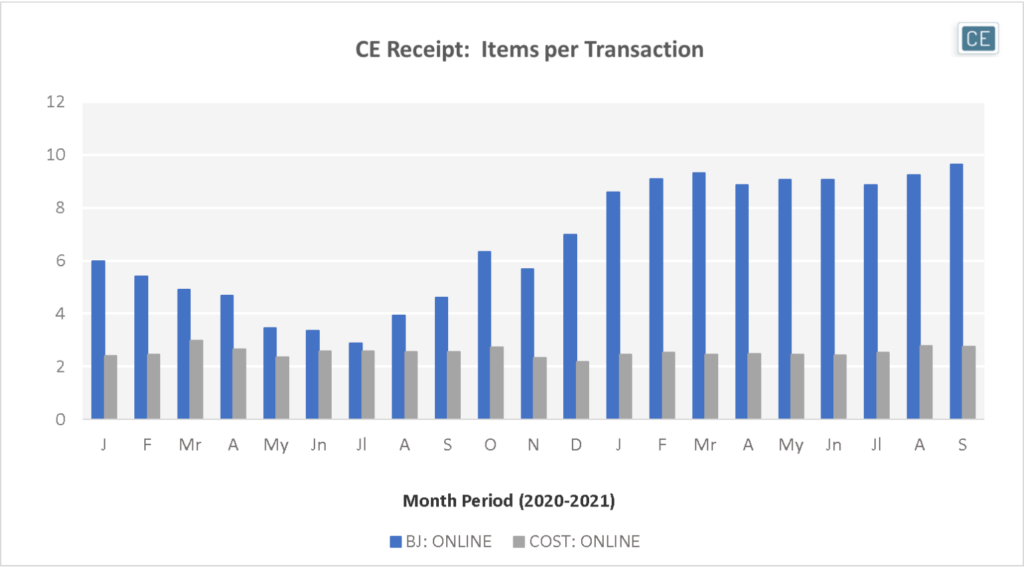

Inside the BJ’s online basket, shoppers purchase substantially more items than at Costco. Items per transaction ramped up substantially in 2021 at eight to ten items per transaction each month. In contrast, Costco transactions contained about 2.5 items per transaction for most of the year, increasing to 3.7 in October but dropping to 3.5 in November and 3.0 in December.

Items per Online Transaction

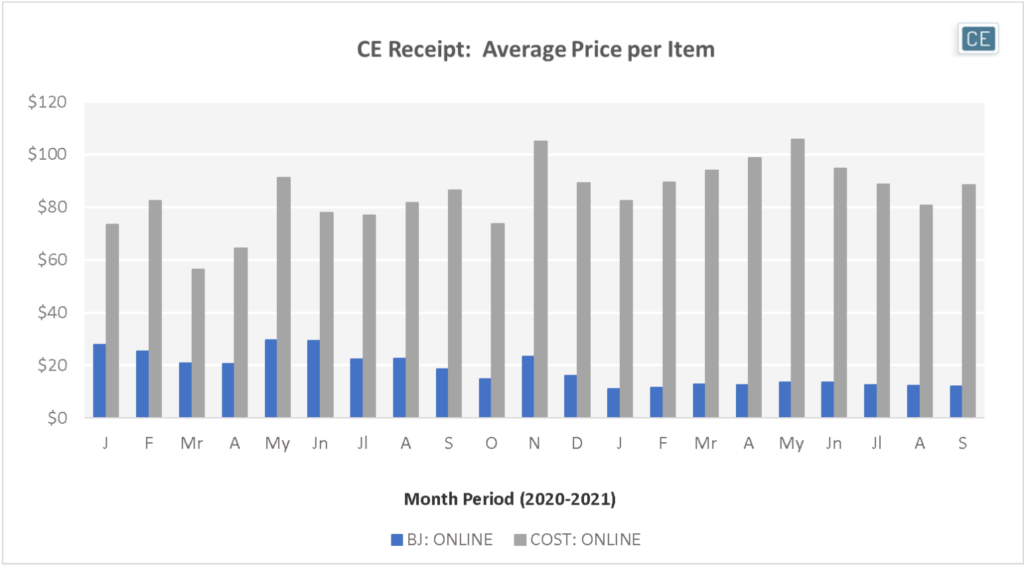

However, part of the reason Costco lags in items per transaction is because so many purchases contain higher-ticket items. Costco’s average price per items has ranged from $50-105 in the last 24 months. And while November and December of 2020 saw among the highest spend per item of the year, holiday spend per item in 2021 was almost a third lower. While BJ’s average price per item was only 15% or lower of the Costco figure for most of the year, it did swing to over 20% of the average price throughout the fall. While the price per item for BJ’s was also less in this period than in 2020, it appears the company did close some of the still-wide gap versus Costco price per item.

Online Average Price per Item

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.