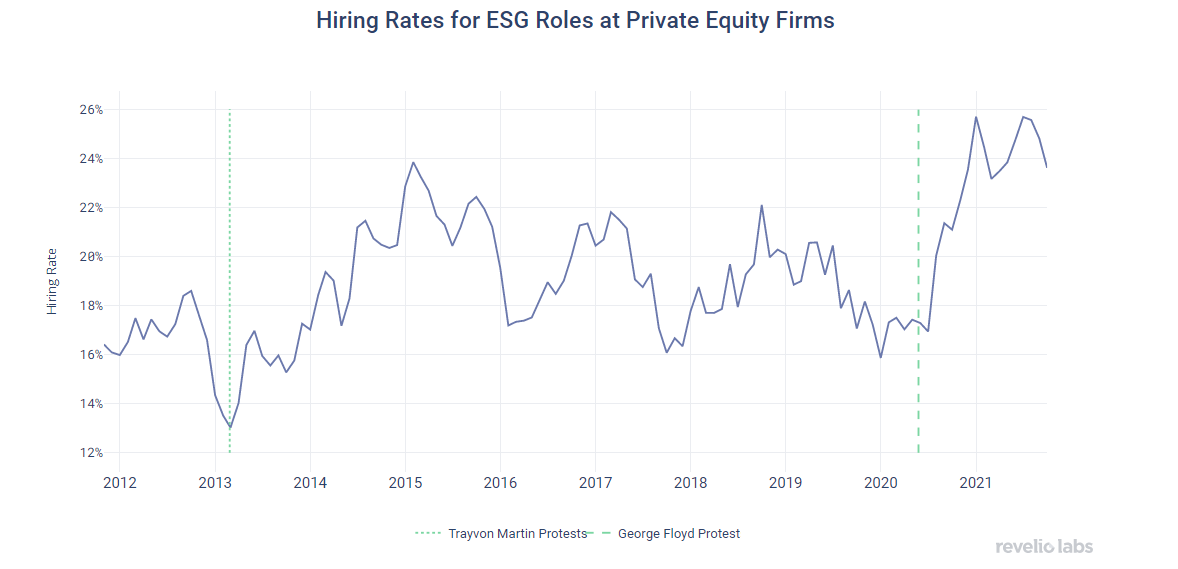

The financial industry is increasingly concerned with social sustainability, which has resulted in huge interest in Environmental, Social, and Corporate Governance (ESG) roles in this sector. And these positions have been growing most within private equity, where ESG has outpaced growth of other roles since 2020.

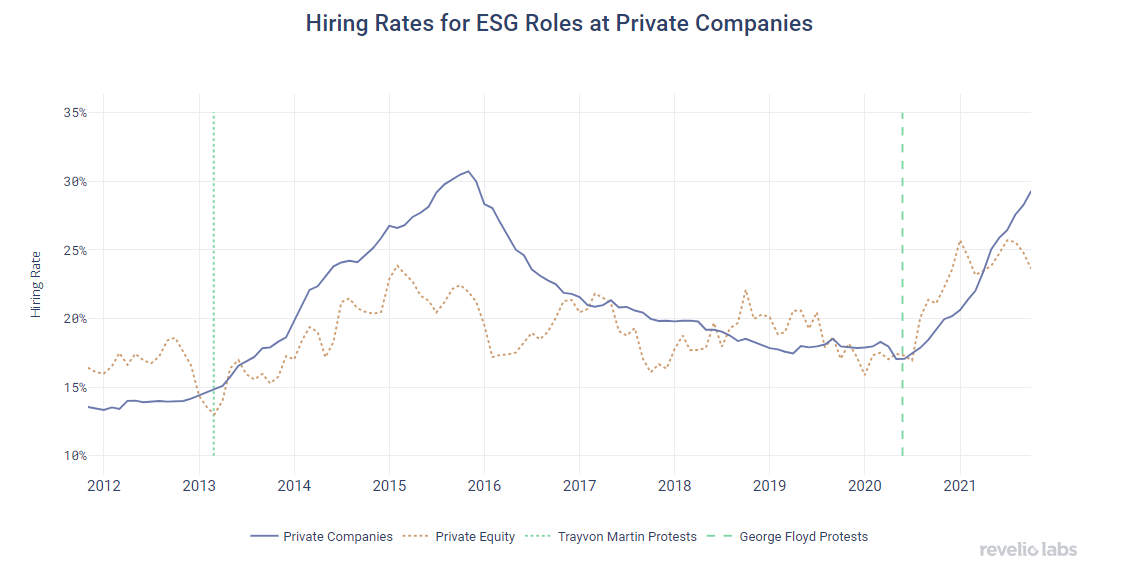

ESG Hiring Rates have been growing steadily in the last decade. Most notably, hiring rates appear to spike in the aftermath of major social movements.

Looking at the portfolio companies of these PE firms, we see that they are also hiring more ESG experts, though with some lag.

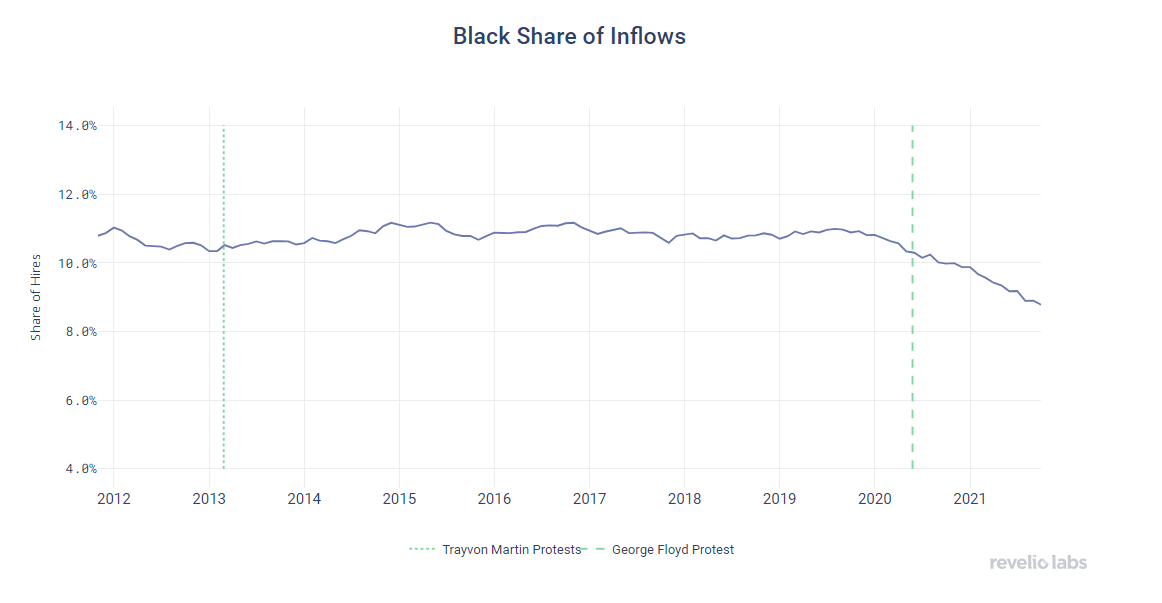

But aside from these new ESG roles themselves, do these positions actually lead to better ESG outcomes?

By looking at the share of new Black hires at these investment firms, we unfortunately see that this trend of increased ESG roles is ineffective at changing the overall composition of these companies. If anything, since the start of the pandemic, we see a decrease in diverse hiring.

Key Takeaways:

To learn more about the data behind this article and what Revelio Labs has to offer, visit https://www.reveliolabs.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.