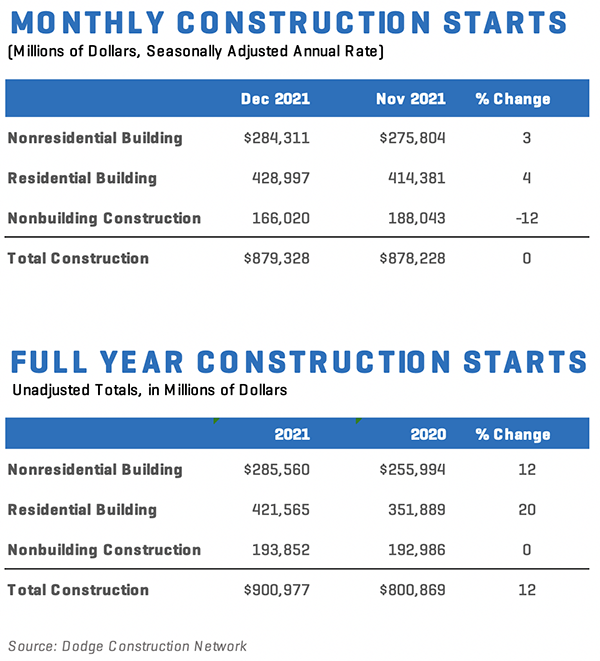

Total construction starts were flat in December with a seasonally adjusted annual rate of $879.3 billion, according to Dodge Construction Network. Residential construction starts gained 4% in December 2021, while nonresidential building starts improved by 3%. Nonbuilding starts, however, declined 12%.

Across 2021, total construction starts rose by 12% compared to 2020. Residential starts moved 20% higher, and nonresidential buildings increased 12%. Nonbuilding starts were flat in 2021.

“The increase in construction starts was impressive given the many challenges the industry faced during the year. Higher material prices, labor shortages, and multiple waves of COVID infections threatened to dampen the recovery,” stated Richard Branch, chief economist for Dodge Construction Network. “However, construction remained resilient and persistent throughout the year in the face of these difficult issues. While these challenges will remain in 2022, the industry is well-positioned to make further gains fed by a growing pipeline of nonresidential projects waiting to break ground and the infusion of money directed towards infrastructure.”

Below is the breakdown for construction starts:

Nonbuilding construction starts lost 12% in December to a seasonally adjusted annual rate of $166 billion. The only sector within nonbuilding to gain ground during the month was environmental public works, which gained 40%. Utilities/gas plants fell 79%, miscellaneous nonbuilding dropped 23%, and highway and bridge starts fell by less than 1%. For the full year, nonbuilding starts improved by 0.4% from 2020. Environmental public works rose 21% and utilities/gas plants moved 6% higher. However, miscellaneous nonbuilding starts were down 16% for the full year, and highway and bridge starts fell 6%.

The largest nonbuilding projects to break ground in December were the $1.3 billion East Side Coastal Resiliency project in New York, NY, the $305 million Kirkman Road extension in Orlando, FL, and the $177 million first phase of the Friant-Kern Canal Middle Reach project in Lindsay, CA.

Nonresidential building starts improved 3% in December to a seasonally adjusted annual rate of $284.3 billion. The commercial sector advanced 12% due to gains in retail, office, and hotel starts while parking structures lost ground. Institutional starts fell 17% in December as healthcare pulled back following a strong November. Manufacturing starts, meanwhile, posted a significant gain due to the start of a large project. For the full year, nonresidential building starts gained 12% from 2020. Commercial starts were up 8%, institutional starts improved 5%, and manufacturing starts rose 89% for the year.

The largest nonresidential building projects to break ground in December were the $700 million expansion of the Danimer Scientific manufacturing facility in Bainbridge, GA, the $650 million expansion of the Los Angeles County Museum of Art in Los Angeles, CA, and the $500 million renovation of the Fontainebleau Hotel in Las Vegas, NV.

Residential building starts rose 4% in December to a seasonally adjusted annual rate of $429.0 billion. Multifamily starts moved 5% higher, and single family starts gained 3%. For the full year, residential starts were 20% higher than in 2020; multifamily starts rose 25%, and single family starts increased 18%.

The largest multifamily structures to break ground in December were the $1.0 billion Southside Park mixed-use building in Miami, FL, the $398 million first phase of the Broadview at Purchase College senior living facility in Purchase, NY, and the $300 million 800 Broadway apartment tower in San Deigo, CA.

Regionally, total construction starts in December rose in the South Atlantic and Northeast regions, but fell in the Midwest, South Central, and West regions.

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.