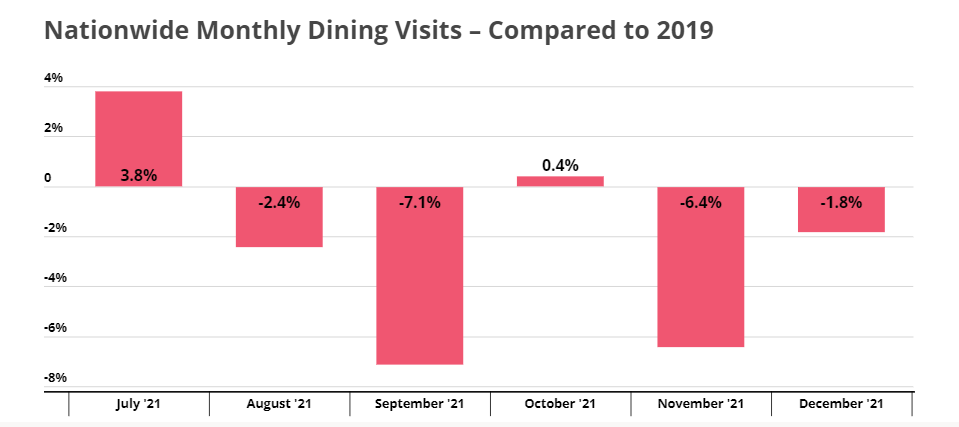

After recovering from Delta’s effects in October, nationwide dining visits promptly fell once more as the Omicron variant gained ground. Yet, it looks like the impact of each successive wave becomes more and more short-lived, because by December 2021 – as the United States continues to battle its fifth COVID wave – dining foot traffic rose once again to near-2019 levels.

So, how are the dining fluctuations affecting QSR visits? We dove into the data for major burger and chicken fast-food chains to find out.

Burger Leaders

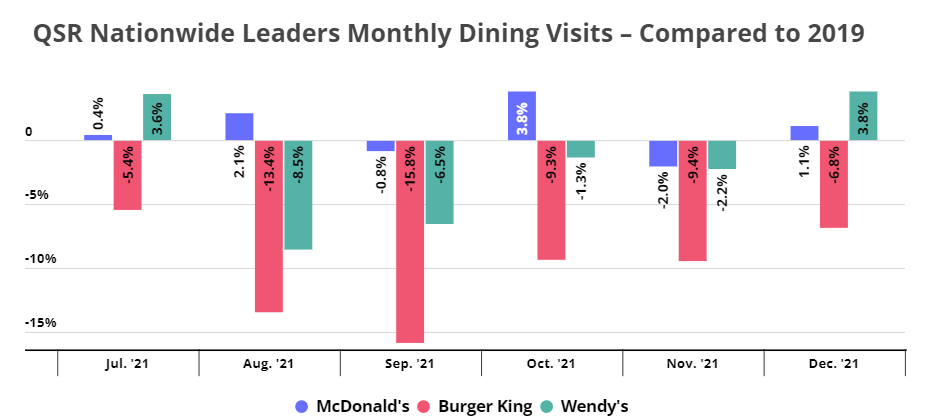

Despite the COVID-related challenges, McDonald’s remained the undisputed king of QSR in 2021. According to our Brand Dominance Map, McDonald’s led the burger category in every state in December, receiving a 43% share of nationwide visits to major burger chains, followed by Wendy’s with 12% and Burger King with 10% of nationwide burger visits.

McDonald’s has also succeeded in weathering the fourth and fifth COVID waves with relatively little damage. For the past six months, the brand’s visits have remained on-par with 2019 numbers, with August, October, and December even seeing Yo2Y visit growths of 2.1%, 3.8%, and 1.1%, respectively.

Wendy’s offline visits look almost equally as strong – despite a relatively rough August and September. The Ohio-based brand succeeded in nearly closing its Yo2Y visit gap in October and November before capping off the year with a 3.8% Yo2Y increase in foot traffic in December. And Burger King, which closed over 300 locations in 2020, still managed to slash its Yo2Y visit gap by more than half over the past four months, from 15.8% in September to 6.8% in December – indicating the potential for a strong visit§ comeback in 2022.

Rising Stars

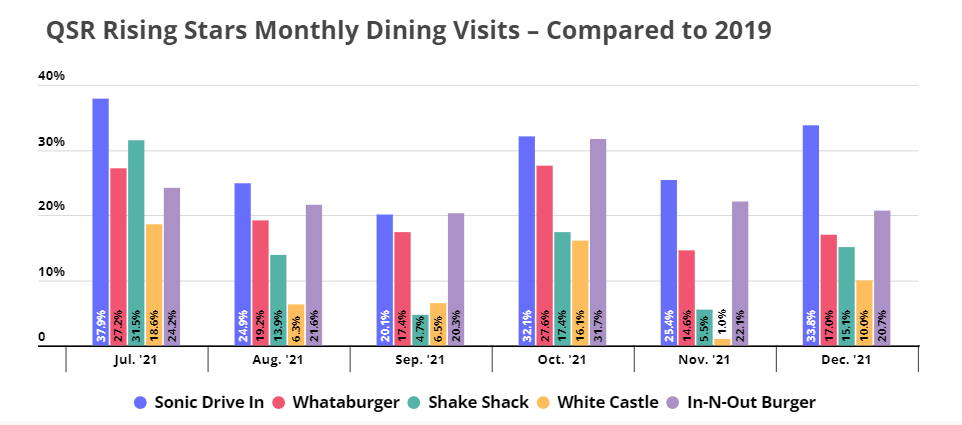

While legacy chains are focusing on holding on to what they have, certain QSR rising stars are forging ahead. Despite the general dining downturn, visits to Sonic Drive-In, Whataburger, Shake Shack, White Castle, and In-N-Out increased by 33.8%, 17.0%, 15.1%, 10.0%, and 20.7% compared to 2019. These are impressive Yo2Y growth numbers under any circumstances, and all the more so when the past two years have been under the shadow of a global pandemic.

And these rising stars are not resting on their laurels. Sonic Drive-in has been opening new locations and stepping out of its comfort zone and into the CPG space with its recently launched hard seltzer product line. Whataburger is also expanding. Shake Shack, which recently announced a Q4 increase in same-store sales, has been expanding nationally and internationally while adding new items to keep its menu current. In-N-Out is also testing a possible international expansion while – you guessed it – adding new US locations.

And White Castle, in a move out of Starbucks’ marketing playbook of releasing time-sensitive products to draw customers in during slower times, recently announced new menu items available only for the next month.

The Chicken Space

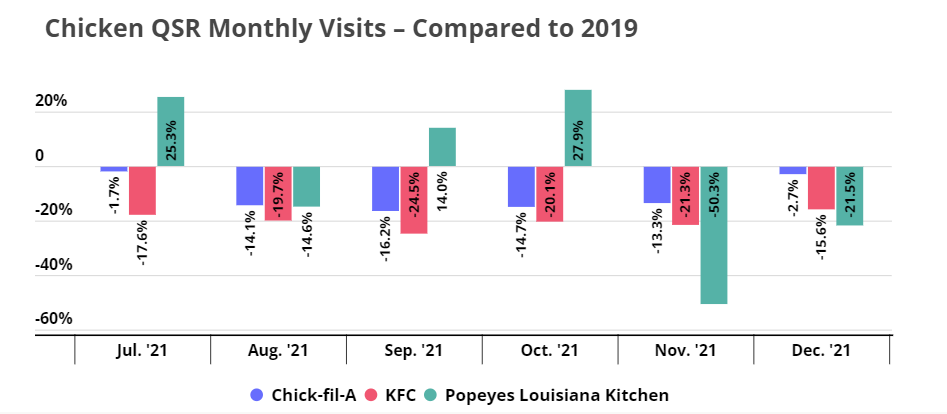

As of the end of 2021, Chick-Fil-A is still the dominant chicken QSR brand, taking 40% of all nationwide chicken QSR visits in December. Although the company that put the fried chicken sandwich on the map saw a Yo2Y decline in foot traffic in August through November, visits were almost back to 2019 levels by December 2021 – positioning the Georgia-based brand for a strong 2022. KFC has seen its Yo2Y foot traffic drop, likely due to permanent store closures and the company’s decision to focus on drive-thrus, but its May 2021 announcement of intent to triple its global store count shows that the fall in US foot traffic is not necessarily a reflection of the company’s overall health.

Popeyes, which was doing quite well earlier this year with October visits up 27.9% Yo2Y, took a massive hit in November from which it has yet to fully recover – and the reason seems quite unrelated to COVID. In the fall of 2019, Popeyes relaunched its chicken sandwich after having run out in August, causing a massive surge in foot traffic. Visits the first full week of 2019 rose 242% compared to the first full week of October ‘19, and stayed strong throughout the season. So while this year’s November-December numbers look weak, the drop should actually be attributed to the brand’s exceptional success two years ago rather than to any real drop in demand now.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.