Podcasting is still one of the youngest forms of media—but that doesn’t mean it’s not a great advertising investment.

The number of podcasts is growing quickly, and people are taking notice. In 2006, only 22 percent of the adult population in the United States knew of podcasting, according to Statista. Last year, that number climbed to 78 percent.

And it’s no surprise—listeners with any niche hobby or learning interest can find something to enjoy.

This is great news for advertisers because it translates to a higher engagement rate, more loyalty between the listener and the podcast host and a less intrusive way to get a brand’s message across.

We’ve been tracking podcasting advertising data since 2020. To give you insights on the state of podcast advertising going into 2022, we’ve pulled together data on:

Podcasting is becoming more of a priority for brands. See how your potential clients and their competitors could be investing in podcasting and use these insights to guide your media planning in 2022.

Top Podcasting Advertising Trends

As the number of active podcasts and listeners increase, the ad numbers surge. Advertisers spent nearly $590 million on the format last year, which is a 21% increase from the year before.

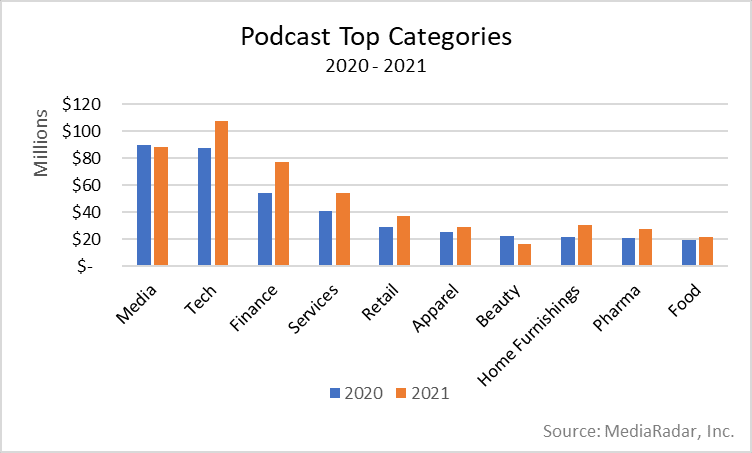

But even as the ledgers see big changes—the top spending categories are remaining stable.

The only slight shift was between Media and Tech.

Tech advertisers spent 23% more in 2021 than they did in 2020, moving into the top spending category position.

Finance advertisers increased their spending more than any other category—by 43%. Services also jumped a noticeable 33%.

Pharma and Retail categories both jumped up by 30%, but their spending is much less than other top categories.

The only major spending category to see a significant drop was Beauty, which decreased by 28%.

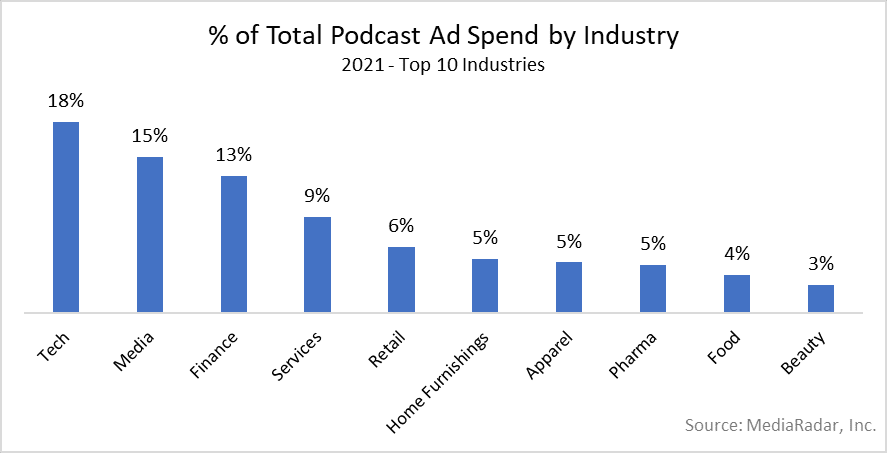

Another way to understand these categories’ spending is by looking at how much they make up total podcasing ad spend.

In 2021, the top categories made up 83% of total 2021 ad buys. The remaining 17% of advertising dollars come from smaller categories.

Top podcast advertisers in 2021

The following top ten companies account for 15.9% of the overall 2021 spending:

The data suggests that podcast advertising is effective. Once brands become podcast advertisers, they tend to stay the format. 79% of podcast advertisers from 2020 continued buying in the format in 2021. The top spenders were some of the most steady advertisers, as we’ll see when dig deeper into Q4.

How are podcasts inserting ads into their episodes?

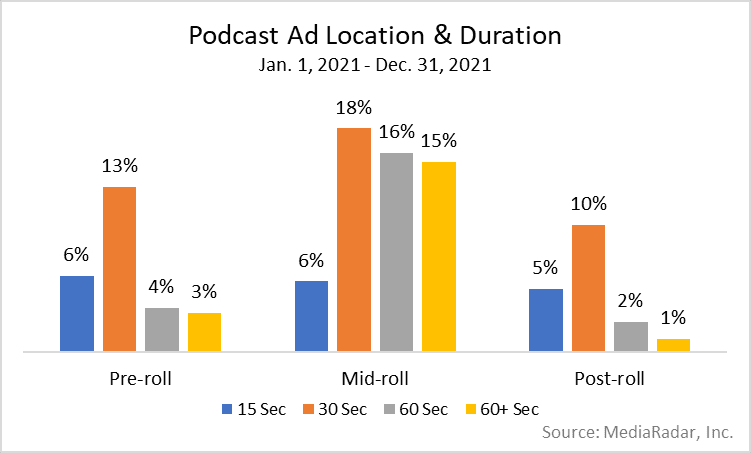

When you are purchasing your ads, you might be curious about how your competitors are behaving. By looking at the data, we can see which placements are most common.

The bulk of ads (42%) are 30 seconds in length. And most are placed in the middle of the podcast or at the beginning, when they’re less likely to be skipped. The exact breakdown is as follows:

Quarterly Podcast spend 2020-2021

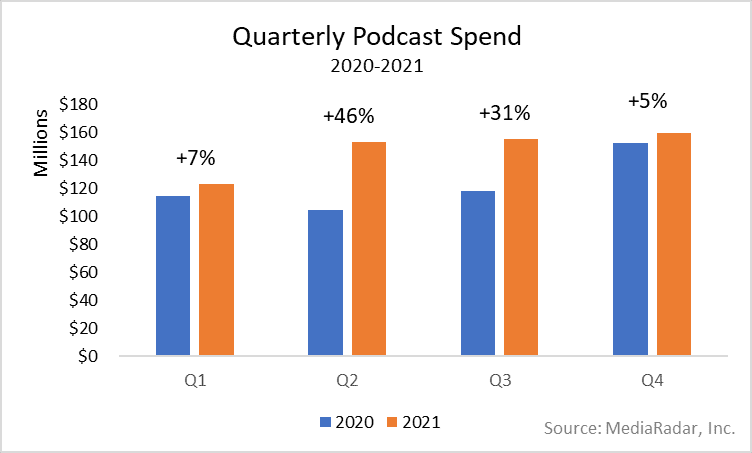

In 2021, most of the growth in spending took place in the middle of the year. But this year-over-year growth seems to be related to a mixture of depressed COVID-related spending and a better overall year in 2021. Spending in 2021 was rather stable from Q2 on out.

The largest year-over-year increase took place in Q2 2021 and Q3 2021. By Q2 2021, podcast spending had significantly climbed past spending during pre-COVID times.

Even though big spenders are steady and faithful advertisers, much of this increased spend actually came from a surge in new, smaller brands.

Using Q4 to Shed Light on 2022 Podcast Advertising

Podcast advertising seems to be in a steady state. There were only minor differences between Q4 and the previous time periods in 2021.

Nearly $160 million in Q4 2021. If trends remain similar to those of the last three quarters, we expect to see similar spending in Q1 of 2022.

Top podcast advertisers in Q4 2021

The top ten podcast advertisers spent over $26 million in the last three months of the year.

They top spending brands include:

The two differences between the top advertisers in Q4 and the previous quarters were the swapping out of Coors and Progressive for Bank of America and State Farm. Otherwise, the list features the same top spenders.

When it comes to category spending, the top categories looked very similar to earlier in the year. However, beauty continued on its downward spending trend and no longer made the top spending list.

Public service advertisers contributed more to overall podcast advertising than beauty brands by the end of the year.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.