In early January 2022, Mattress Firm filed for an IPO. The mattress company was taken private in late summer 2016 after about five years of trading on the NASDAQ. Consumer spending data shows that Mattress Firm’s sales have grown over the past two years, as average transaction values at the retailer have increased compared to before the pandemic.

Mattress Firm’s sales have exceeded pre-pandemic levels

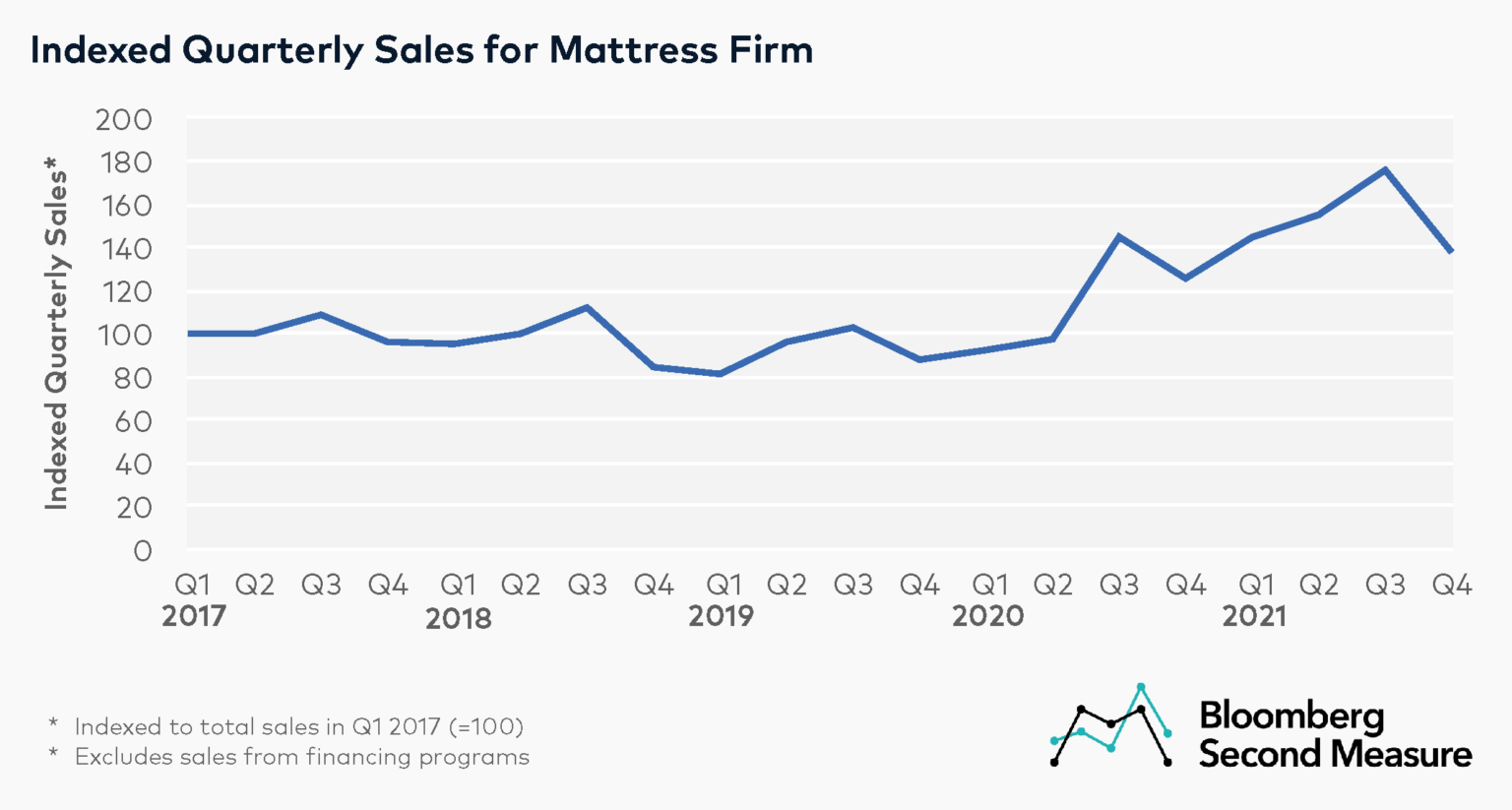

Mattress Firm has experienced increasing sales since early in the pandemic. Between Q2 and Q3 of 2020, sales grew 49 percent and have remained elevated through the end of 2021. Notably, Mattress Firm temporarily closed about 50 percent of its stores in March 2020, with most reopening by late May 2020.

Mattress Firm’s sales peaked in the third quarter of 2021, growing 21 percent year-over-year and 71 percent compared to the same quarter in 2019. Closing out the year, sales in Q4 2021 were 10 percent higher than in Q4 2020 and 57 percent higher than in Q4 2019.

Aside from the general increase in sales during the pandemic, Mattress Firm’s sales also follow a seasonal pattern, with an uptick in the third quarter followed by a decline in the fourth quarter of each year. One potential factor contributing to this trend is that Mattress Firm experiences a spike in weekly sales during its holiday weekend sales events, and its Fourth of July sale and Labor Day sale both take place in the third quarter.

Mattress Firm’s customer counts dropped in 2019 before growing again during the pandemic

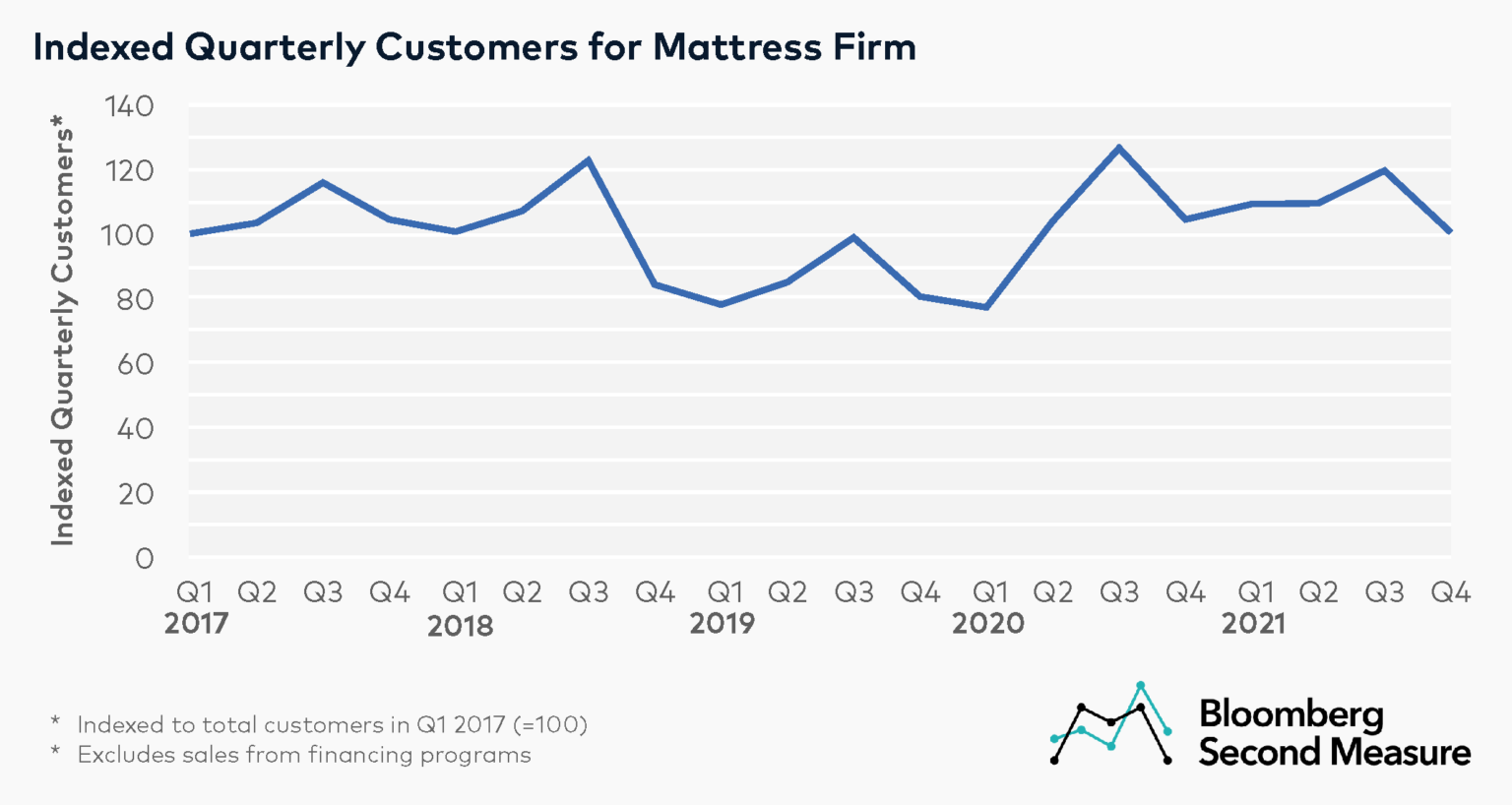

Looking at consumer spending data over the past five years, Mattress Firm’s customer counts were the lowest in 2019. Declining customer counts in 2019 may be partially attributed to the fact that Mattress Firm closed 700 stores after declaring bankruptcy in late 2018, thus dramatically reducing its retail footprint.

In 2020 and 2021, quarterly customer counts at Mattress Firm approached similar levels as they were before the bankruptcy. In Q4 2021, Mattress Firm’s customer counts exceeded those from the same quarter in 2018 and 2019, by 19 percent and 25 percent, respectively. Compared to Q4 2017, customer counts in Q4 2021 were 4 percent lower.

The pandemic precipitated a rush in home improvement projects as well as a hot housing market, which may have increased consumer demand for mattresses and other home furniture. The shift to working from home—with some workers preferring to sit on their bed rather than at a desk—may also be a contributing factor to Mattress Firm’s growing customer base amid the pandemic.

Mattress Firm’s average transaction values also rose in 2021

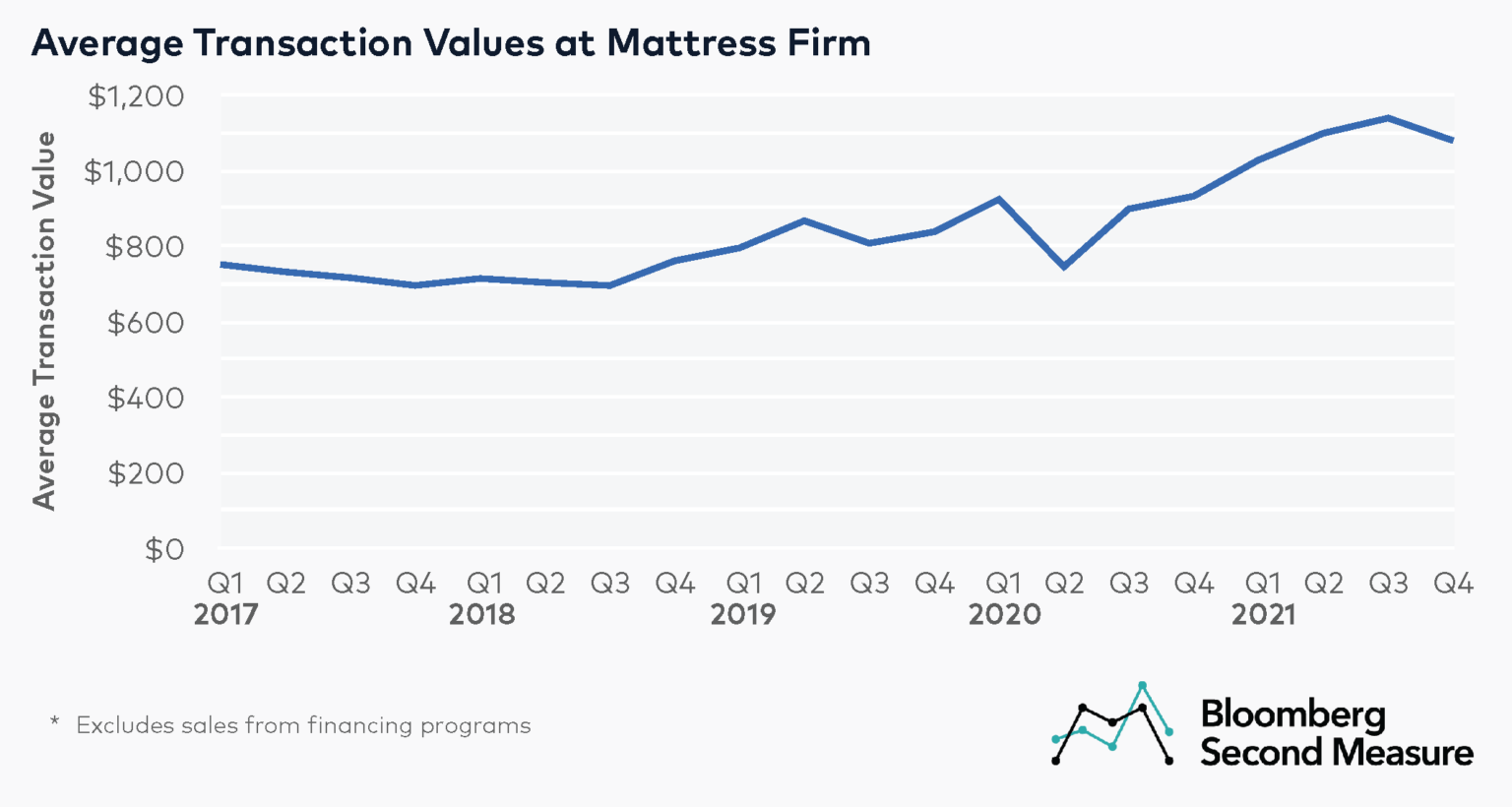

Consumer spending data also shows that rising transaction values corresponded with Mattress Firm’s higher sales in 2021. For every quarter in 2021, the average transaction value was higher than the same quarter in the previous four years. Supply chain challenges and the cost of labor and materials have contributed to rising prices at mattress retailers over the past year.

In the most recently completed quarter, Q4 2021, the average transaction value at Mattress Firm was $1,078, which was 16 percent higher than the same quarter in 2020 and 29 percent higher than the same quarter in 2019. Notably, Bloomberg Second Measure data excludes transactions made from financing programs. Average transaction values would likely be lower if financing payments were included. Over the past five years, the third quarter of 2021 had the highest transaction value, at $1,138.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.