Our Q4 Retail Quarterly Index Reports analyze the performance of five key retail sectors – grocery, home improvement, fitness, superstores, and apparel – from a location analytics perspective. The reports provide insights into the quarterly performance of each category by diving into foot traffic patterns in the sectors as a whole and evaluating visit metrics for leading brands. You can check out the full reports in The Square.

Grocery

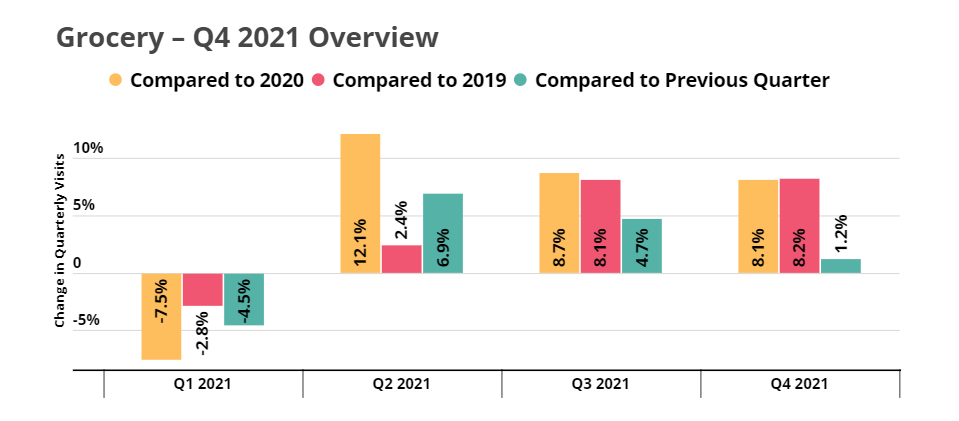

Pandemic shopping behaviors gave the grocery sector a major visit boost in 2020 – and Q4 data confirms that the trend continued in 2021. Over the last three quarters of 2021, grocery store foot traffic was up compared to both 2019 and 2020, indicating the category’s success in transforming a circumstantial surge into a long-term strength.

The fact that grocery visits have continued to grow quarter over quarter is even more impressive – and shows that the strong performance of the past two years might only be the beginning.

Home Improvement

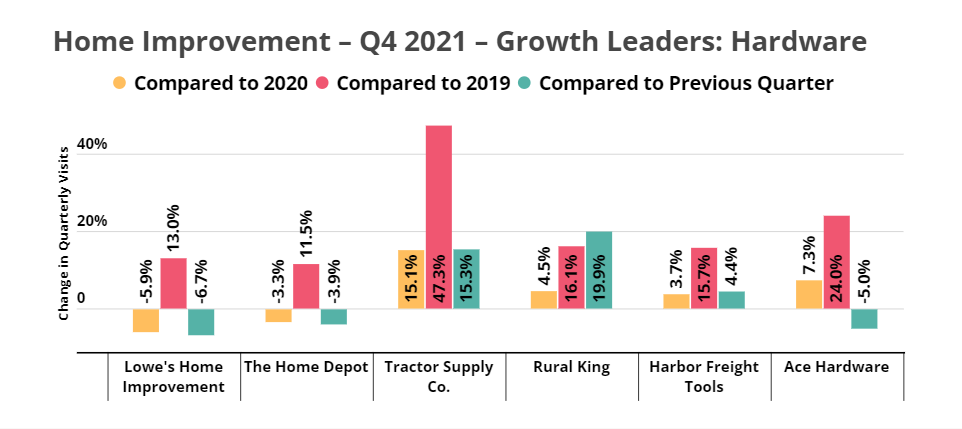

The biggest Q4 2021 home improvement Yo2Y visit growth belongs to Tractor Supply, but other smaller home improvement brands such as Rural Kings, Harbor Freight Tools, and Ace Hardware have seen both massive Yo2Y jumps and YoY foot traffic increases.

However, last year’s home improvement craze also brought a long-term boost to visit leaders Lowe’s Home Improvement and Home Depot, who have both seen their Q4 ‘21 rise by double-digits compared to Q4 ‘19 – so it would be a mistake to write off these brands’ impressive growth by focusing solely on YoY comparisons.

Fitness

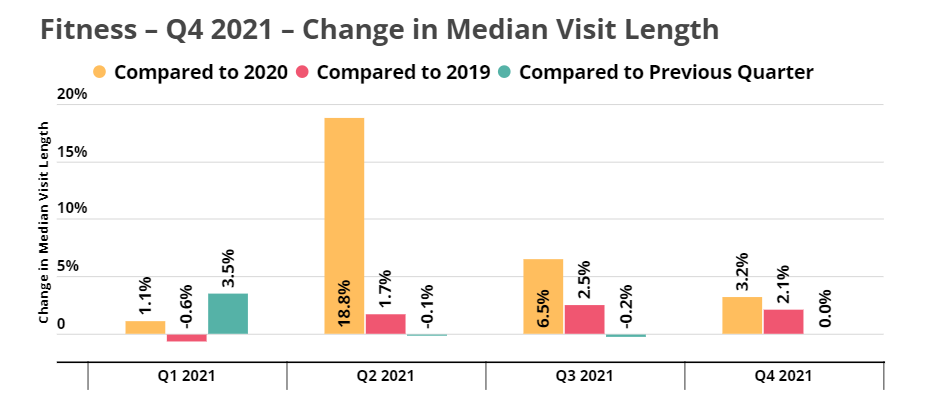

Although the sector is still recovering in terms of visit numbers, median visit length exceeded 2019 levels already in Q2 – and has remained relatively steady since. This means that while the number of gym goers is still fluctuating, those visitors who have decided to head back to fitness centers are committed to getting in a full workout, which highlights how important gyms still are to many people’s fitness routines.

Apparel

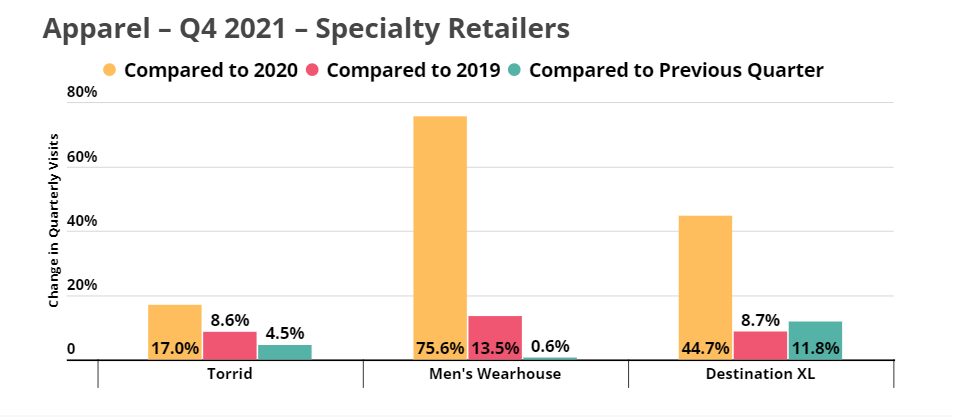

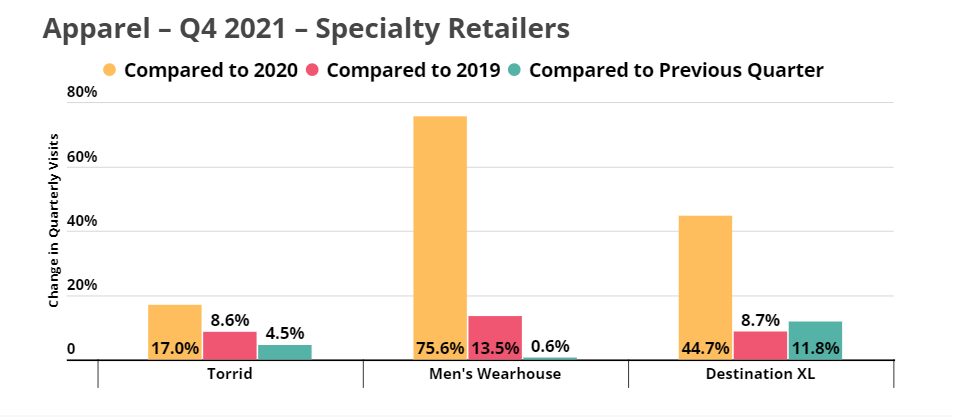

Specialty retailers, such as plus-size retailers Torrid and Destination XL and menswear brand Men’s Wearhouse surpassed their Q4 2019 foot traffic numbers despite the overall downturn in the sector.

These retailers’ unique offerings may be driving the visit surge: consumers may be keen to try these types of clothes on for fit and feel before making a purchase, which is harder to do online.

Superstores

Like in other retail sectors, weekday visits in Q4 saw the biggest increase YoY, Yo2Y, and QoQ. This surge in weekday visits reflects the fact that the pandemic and its extensive disruption to daily and weekly routines will likely have a long-term impact on consumer behavior – including the shift to more weekday errands in order to keep the weekend free for leisure or family time.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.