Q2 2020 will go down in history as an unprecedented period for the mobile economy. People stayed home and downloaded a lot of apps. With gyms closed in many countries, health and fitness app downloads surged from 565 million to 811 million in that single quarter (Q2 2020). After that dramatic spike in the early days of lockdown, download volumes of health and fitness apps settled down last year.

Aside from the covid-induced anomaly year, the long term trend for the category was still growing as we head into 2022. According to App Annie’s State of Mobile 2022 Report, total downloads for 2019 stood at 1.97 billion. In 2021, they hit 2.48 billion.

It’s All in the Mind: The Meditation Sub-Category Reached New Heights

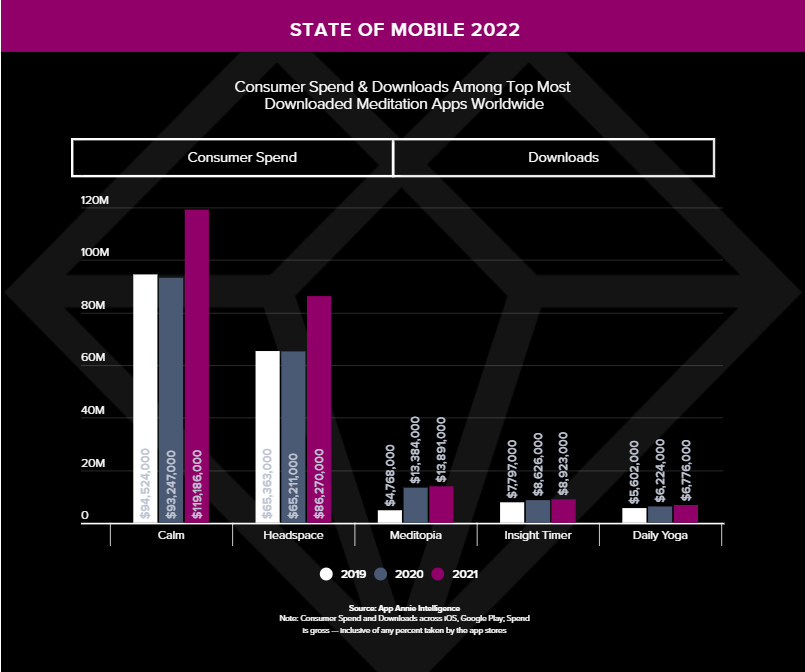

One of the biggest factors in the standout year for Health and Fitness was the success of meditation apps. During the pandemic there was a significant focus on mental health, which drove interest in products such as Calm, Headspace, Meditopia, and Insight Timer. The top three apps by downloads dominate the market, collectively attracting 37 million downloads in 2021, according to data from App Annie’s State of Mobile report.

In terms of usage, out of the top 10 meditation apps worldwide in 2021, Insight Timer users had the highest average sessions per user on Android phones, more than 40% higher than that of the next highest meditation app. In addition, they were also #1 in terms of average time spent in the app per user. This means that not only are people spending more time in Insight Timer, they are also using the app more frequently, on average, compared to other major players in the sub-category.

In terms of app store spend, the top 5 meditation apps achieved 25% growth YoY last year. The top 2 meditation apps by spend, Calm and Headspace, together generated $205 million in 2021. However, it is also important to note that this is not the only monetization pathway on mobile — some apps leverage in-app advertising, corporate partnerships, or complement with m-commerce.

That’s not all. These two companies are now focusing on the next phase in their growth. Calm has raised $217 million to fund its expansion while Headspace has already started spending – it acquired the AI-driven mental health and wellness company Sayana in January 2022.

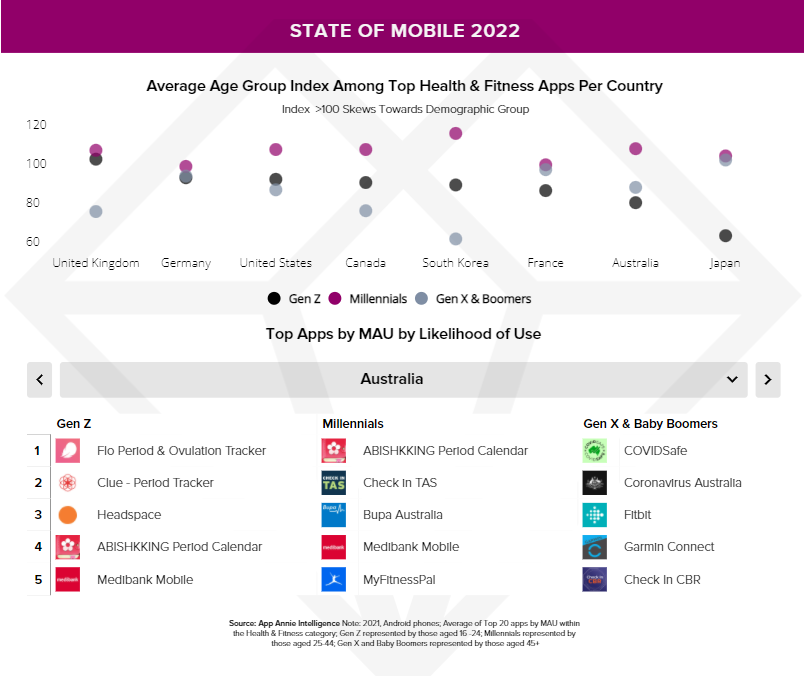

The Age Factor: Millennials Download More Health and Fitness Apps than Other Age Cohorts in Every Country

This year’s State of Mobile report reveals demographic differences in the health and fitness app space. Broadly speaking, this is a Millennial-centered category. They skewed the most towards health and fitness apps in 2021 compared to the overall population than Gen Z or Gen X & Baby Boomers across every region covered. For example, in the past year in South Korea, Millennials had an index of 120 among the average of the top 20 health and fitness apps by monthly active users. This means that in South Korea, Millennials on average were 20% more likely to use a health and fitness app compared to the overall population, at least among the top 20 apps by MAU observed.

In terms of product choices, Gen X & Baby Boomers reveal a preference for self-quantifying apps. They skew towards pedometers, dieting, walking, and hiking apps. At the other end of the age scale, Gen Z lean towards wellness and feminine health apps.

Indeed, if there is one product that stands out in the ‘femtech’ sub-category, it is Flo Period & Ovulation Tracker. The UK-developed app ranked #1 or #2 for Gen Z monthly active users in seven of the eight countries studied. This might be a contributing factor as to why the company is now valued at around €675 million.

Gen Z is a particularly interesting age group to pay attention to in the near future, as they seem more likely to try out new and innovative health and fitness app concepts such as Reflectly, an AI-powered journal app where feedback is curated based on what they write and how they are feeling on a particular day. They are the ones most likely to set the trend in the health and fitness sub-category in the years ahead.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.