Last month, Netflix raised the price of its US subscription plans for the third time since 2019. Are the increased fees just keeping up with inflation, or will Netflix see a dip in subscribers in a saturated marketplace? In today’s Insight Flash, we provide a sneak preview of our soon-to-launch Subscription Spend dashboard to answer this question, including retention over time, cohort behavior surrounding the last price increase, and new customer metrics. Consumer Edge US Transact Subscribers can use these dashboards to continue to track these metrics in reaction to the most recent increase.

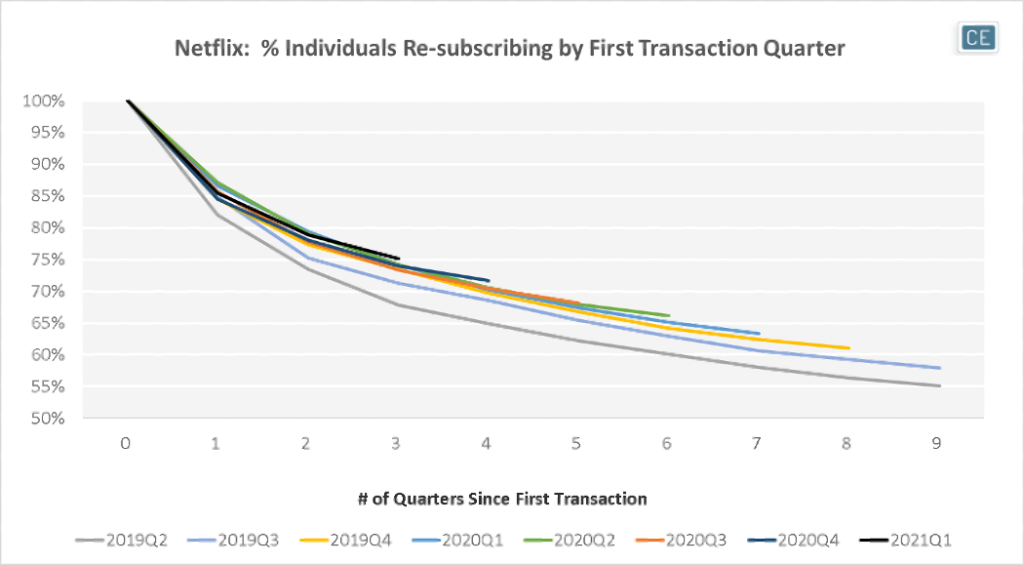

One thing that may provide some shield to Netflix is the fact that more recent cohorts of new subscribers appear to be more loyal. Those whose first transaction with the service was during the pandemic have seen higher repeat subscription rates than previous cohorts as long as seven quarters after their first sign-up. And this is not purely a phenomenon of subscribers stuck at home. Over the longer term, those who first subscribed in 2019Q4 have shown higher repeat rates than those who first subscribed in 2019Q3, who have shown higher repeat rates than those who first subscribed in 2019Q2.

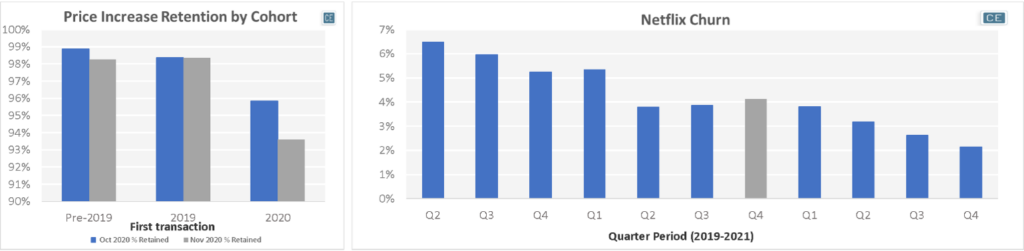

Digging specifically into the impact of Netflix’s last US price increase in October 2020, this pattern does appear to reverse itself slightly. Of those who were subscribed to Netflix at the beginning of our cohort data history, 99% of September 2020 subscribers were still active in October and 98% were still active in November. Of those who first subscribed in 2019, 98% of September 2020 subscribers were still active in October and November. It was only new 2020 subscribers who saw a falloff, with only 96% of September subscribers staying to October and only 94% staying to November. However, the sticker shock didn’t appear to last long – although 2020Q4 churn increased to 4.1% from 3.9% the quarter prior, by 2021Q1 it was back down to 3.8%.

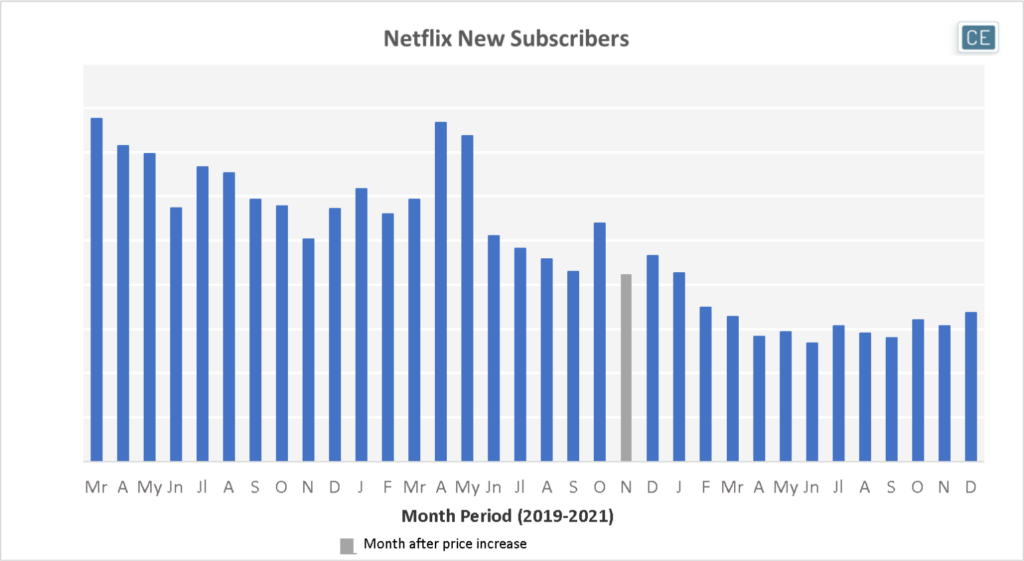

The largest impact for Netflix may not be in customers dropping because of the price raise, but in new customers being put off. The October 2020 price increase was followed by a drop in November new subscribers. Although the beginning of the holiday season has historically led to a decline in new subscribers in that month, the 2020 decline appears to have been exacerbated by the price hike. However, a jump in new subscribers in October 2020 may indicate a pull-forward as rumors of the increase started to circulate and customers hoped any price change would grandfather in old subscribers for a period. If this were the case, it could be argued that there was minimal net effect on new subscriptions due to the October 2020 price raise.

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.