As this second pandemic year wraps up, we dove into foot traffic for leading gyms to understand how the offline fitness sector performed in 2021 and where it’s headed in 2022.

Nationwide Trends

Gyms suffered a heavy blow over the pandemic. Safety concerns, lingering restrictions and even the challenge of exercising while abiding by indoor mask requirements kept many people away from gyms long after the initial closures. Meanwhile, a large number of fitness consumers claimed that they were not planning on ever renewing their membership after discovering the cost and convenience advantages of home exercise.

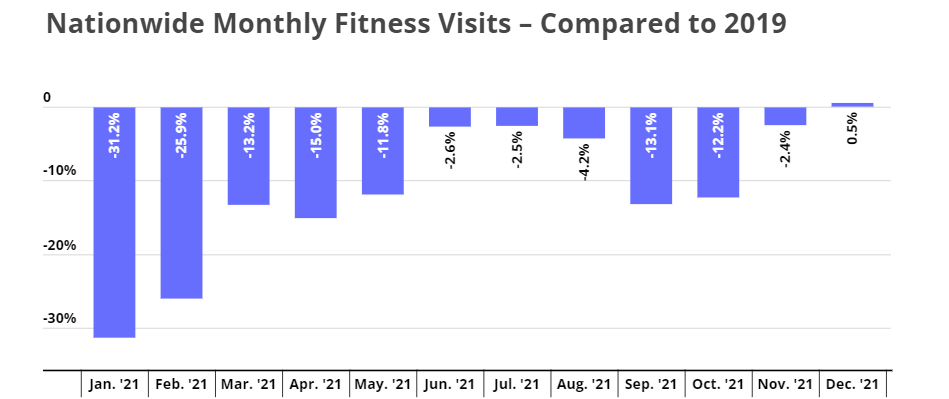

But despite the dire prognosis in early 2021, fitness year-over-two-year (Yo2Y) visits began to climb already in the spring along with vaccination rates. By July, nationwide fitness visits were only 2.5% lower than they had been two year prior – a clear testament to the enduring appeal of gyms, since the pandemic was still far from over. And even though visits dipped back down again in October and November – likely due to the rise of the Delta variant – visits bounced right back up in November, with December even seeing 0.5% growth in foot traffic compared to December 2019.

January Slump?

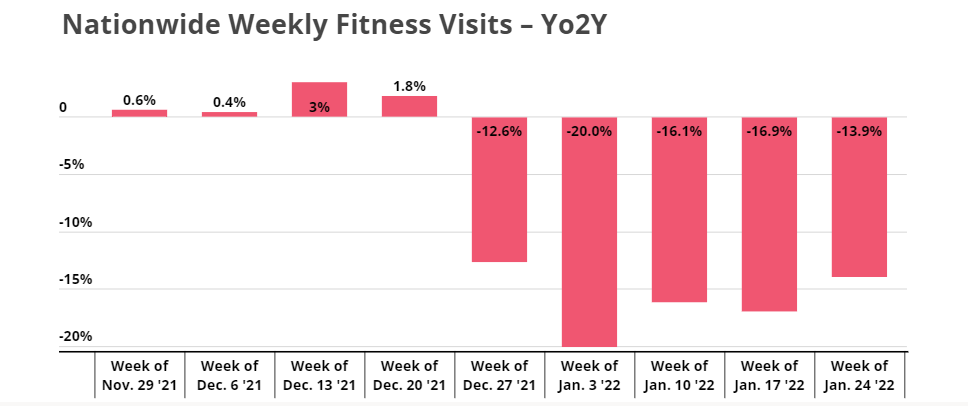

January is the month of new year’s resolutions, and since the most common new year’s resolution in the United States is to exercise more, the fitness sector consistently sees one of its strongest visit rates that month. As gyms ended the year on a high note, many looked to January to push the category into full-fledged growth. Instead, weekly fitness visits this January were down by double digits every week compared to January 2020.

But the weak January numbers are not necessarily cause for concern. First, the Omicron variant that is currently sweeping the nation may be pushing some fitness consumers to put off visiting gyms until the current wave subsides. And just as visits bounced back up in November and December once the Delta wave dwindled, visits will likely rise back up once this fifth wave is behind us.

A second, more unexpected reason for the January slump is that people are making fewer new year’s resolutions this year. As The Atlantic puts in, “Resolutions Are Not the Vibe for 2022.” Nearly two years into a global pandemic, many people feel that the sheer unpredictability of life under COVID makes formulating new year’s resolutions a little pointless. And some are just worn out by everything that has unfolded since March 2020 and have decided to give themselves a break this year.

Since January visits tend to be sky-high, even a minor dip in visits this year can look like a major drop when compared to January 2020, when visits followed the typical January pattern. But the fact that the weekly visit gap has already narrowed from 20.0% for the week of January 3rd to 13.9% for the week of January 24 may indicate that the slump really is due to these unique challenges and the comparisons to early January 2020 – and so the fitness recovery is still very much on track.

Anytime Fitness leads Fitness Leaders’ Recovery

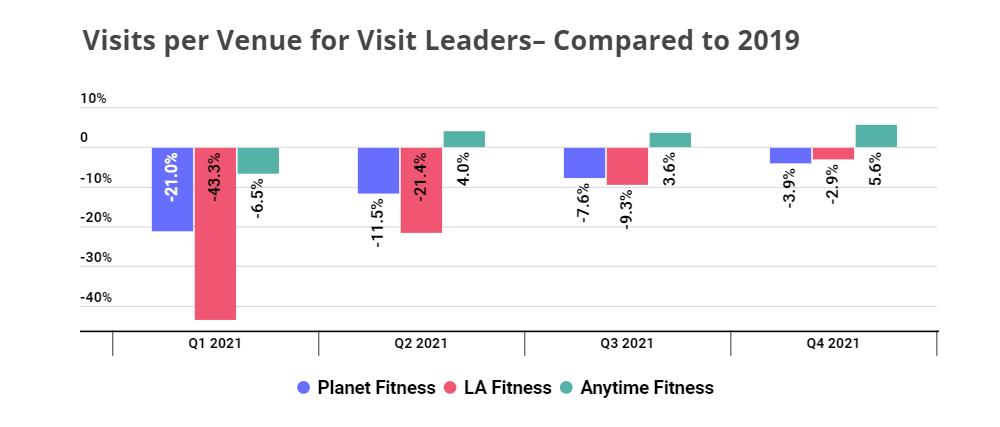

Planet Fitness, LA Fitness, and Anytime Fitness are three of the largest fitness chains in the United States by foot traffic, and visit trends for these visit leaders reveal a lot about the state of the fitness recovery.

As the graph below shows, visits per venue to all three fitness leaders have been steadily recovering since the beginning of the year. Planet Fitness, LA Fitness, and Anytime Fitness started the year with a 21.0%, 43.3%, and 6.5% Yo2Y visit gap, respectively, in Q1 – and ended the year with only a 3.9% and 2.9% Yo2Y visit gap for Planet Fitness and LA Fitness, and a 5.6% Yo2Y visit surplus for Anytime Fitness. The consistent recovery of these fitness visit leaders despite the onslaught of new COVID variants clearly shows that gyms – like malls, brick and mortar stores, and other retail tenants who’s demise has already been prematurely mourned – are still very much alive and well.

Rise of the Value Brands

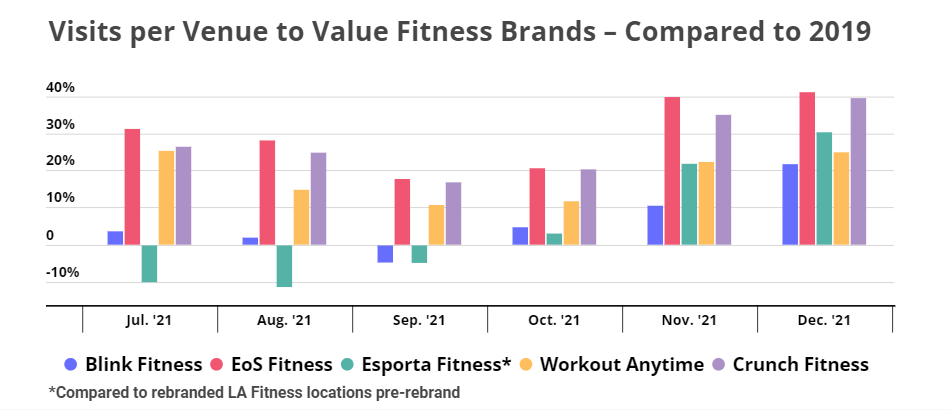

Before the pandemic, the default for Americans wanting to stay in shape was to pay to join a gym, and fitness consumers then had to decide which gym to join based on various factors such as price point and amenities. But COVID changed the default, and for over a year, the normal way to stay in shape was to engage in regular home workouts. And now that gyms have opened up again, fitness consumers are no longer making the choice between which gym to join – they are choosing whether to join at all or to continue working out at home.

This partially explains the rise in popularity of low-cost fitness brands. While Blink Fitness, EōS Fitness, and others may also offer a premium membership tier, these brands all advertise membership options that cost significantly less than the $37.7 per month an average gym membership costs in the United States. And in December alone, despite the Omicron surge, Blink, EōS, Esporta, Workout Anytime, and Crunch showed a visit per venue increase of 21.7%, 41.1%, 30.3%, 24.9%, and 39.5%, respectively.

Introducing lower price points can help fitness brands that are still working on closing their visit gap regain some of the customers they may have lost over the past two years. There are many ways to jump on the low-cost bandwagon, such as adding lower-cost membership tiers to existing brands or establishing new low-cost fitness concepts and rebranding select venues, like LA Fitness did with Esporta. Fitness chains that are still struggling to recover from the pandemic’s impact should take note. This also enables visitors to continue to leverage their at home routines or other memberships as part of a more holistic approach to fitness services.

Still Space for Premium Brands

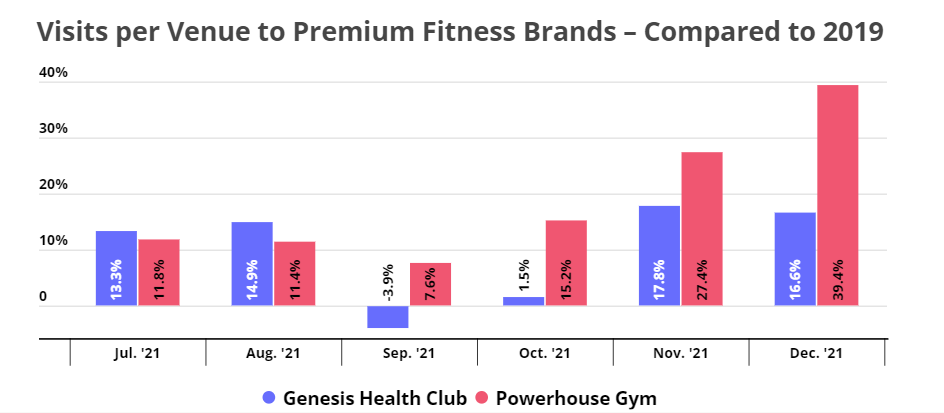

While many low-cost fitness chains are thriving, foot traffic data indicates that there is still room for premium fitness success. Genesis Health Club and Powerhouse Gym both charge above the national average for memberships, and like their low-cost peers, these brands have seen their visits per venue skyrocket over the past couple of months. But both Powerhouse and Genesis also offer amenities that go far beyond the standard gym services, such as child care and tanning.

The success of these clubs shows that some fitness consumers are still willing to pay a premium for gym membership – as long as they get premium services in return. It seems that the days of asking for $40/month in exchange for the use of space and a couple pieces of equipment are over. The pandemic has changed people’s value-for-fitness membership equation, and sports clubs that don’t adapt to today’s fitness consumers’ expectations risk being left behind.

Want to keep tabs on the fitness recovery in the United States?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.